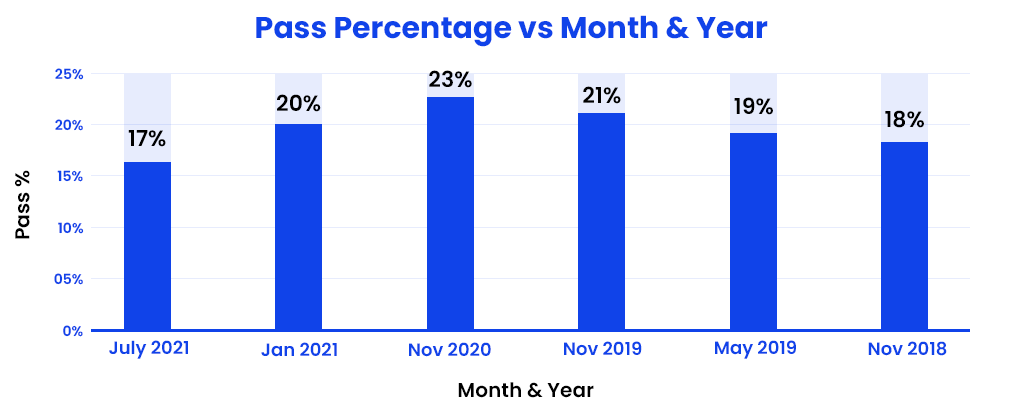

With the cut-throat competition in the Chartered Accountancy examination and high cutoffs, only 15 % percent of students qualify for the exam, and the rest 85 % of students are left with no choice but to prepare for the next attempt.

Since the eligibility criteria for the Chartered Accountant is only 10+2, most of the students start preparing for the CA exam without enrolling in Graduation.

After failing in a few attempts they realize that they should enroll themselves for Graduation to look for other options. A graduation degree serves as a backup option if they do not succeed in qualifying for the examination.

A graduation degree allows them to learn new things which can help them in their career and personality development.

Regular College or Correspondence/Online College Along with CA?

Students preparing for Chartered Accountancy examinations face several challenges while selecting the mode of learning for B.Com while pursuing a CA.

They reach out to different people to seek advice on choosing a regular college or correspondence and online mode. Every person he meets gives different advice increasing his confusion.

Most of the students who decide to pursue graduation while pursuing CA, give up this idea and decide to focus on CA only losing an opportunity to obtain a degree that can help them with personality development and comprehensive knowledge. Also Read | Top 10 Online Courses to Do Along with CA Course!

Since the Chartered Accountancy Exam is an arduous task due to its immense syllabus which requires considerable focus from the students, deciding to graduate while preparing for it is a courageous step.

The syllabus of Charter Accountancy incorporates both theoretical as well as practical aspects. Students are required to give substantial time to memorizing the concepts and practicing the numerical.

While deciding on the mode of learning for graduation, students must anticipate in which mode they would be able to manage their time for CA preparation. As the vast syllabus of CA itself demands significant attention and time, students must be able to manage their time while pursuing their graduation.

The second thing they must consider that if there are good colleges with the best accreditations and ratings available in their city or locality.

If good colleges with the best accreditations and rankings are available nearby and they can devote significant time for both preparation and gradation they must go for the regular college.

Regular college provides structured learning which can help in the development of discipline in the students. The regular colleges have fixed schedules, and classes, with deadlines for assignments and examinations, which help a lot in learning time management.

Students can interact with other students, discuss their doubts with professors and teachers, and participate in group studies which will enhance their understanding of concepts and relieve the pressure of preparation.

Students can participate in different extracurricular and co-curricular activities organized in the college which help in personality development. By participating in these events they discover their creative side.

They can build strong networks with peers and professors which will help them in their career prospects.

The majority of students do not have an option for good colleges and universities with the best accreditation and ranking that is available to their locality to pursue graduation and they think they cannot manage their graduation degree from regular college and CA preparation simultaneously.

For those students, a degree from correspondence or Online Universities is one of the best options. Prestigious and esteemed universities with great accreditations and rankings are providing bachelor's degrees in online and correspondence mode.

This mode of learning provides flexibility to the students to manage their time significantly for graduation and CA preparation.

Universities offering Online and Correspondence degrees offer the same facilities offered in regular mode with flexibility in learning.

The courses are supported by their highly experienced and skilled faculty who conduct live classes through the university’s well-developed Learning Management System.

Students can attend these classes live or can watch the recorded version after completing their CA preparation schedule.

This saves their crucial time of traveling to college and following their fixed schedule. In online and correspondence mode, students can structure their schedules according to their preparation.

Since the University Grants Commission has recognized online and correspondence degrees at par with regular degrees, there is no difference in the weightage of these degrees.

With quality education and an adaptable mode of learning, students develop self-discipline which inculcates self-motivation to achieve their goals detaching from all the distractions.

They get to build networks with peers, professionals, and industry leaders with the connect alumni feature of the university.

With sufficient flexibility and time management provided by online and correspondence modes, they can dedicate maximum time to their CA preparation and qualify for the exam as soon as possible.

Best Degree to Pursue with CA Preparation

Students preparing for CA can pursue any bachelor's degree depending on their interests and career prospects. It is advisable to pursue a degree whose nature and curriculum correlate with the CA syllabus.

Bachelor of Commerce (BCom) is one of the best graduation programs whose curriculum is identical to the CA syllabus.

This helps students in their preparation and if student focuses on either B.Com or CA preparation, it will prove to be beneficial for both things.

Since the students with B.Com degrees are exempted from the CA Foundation examination, they get this additional benefit if they pursue this program. With theory and accounting and taxation numerical, students are equipped with knowledge and skills relevant to CA preparation.

B.Com or B.Com (H)?

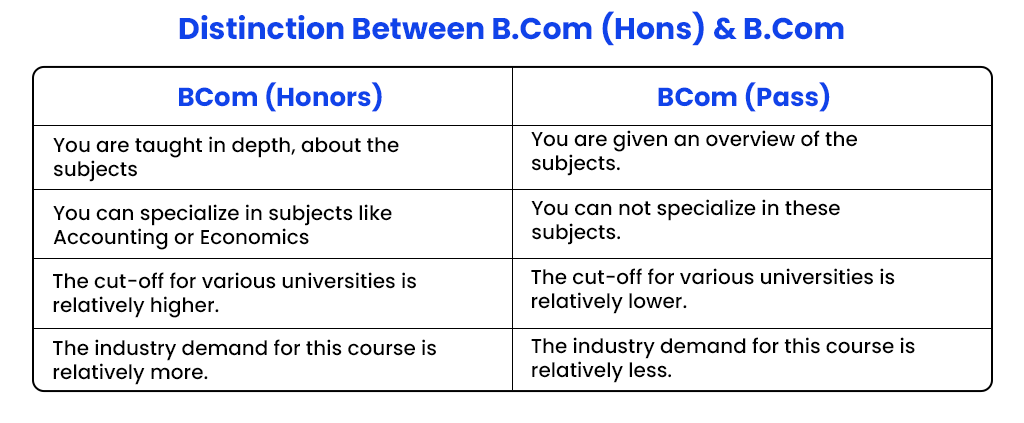

Bachelor of Commerce with Hons offers a great emphasis on specialization, in-depth study of the topics, and academic excellence than a normal B.Com which provides a general overview of the commerce-related subjects.

The knowledge offered in B.Com is very limited as compared to the B.Com with Hons. B.Com (Hons) offers specialization which provides broader perspective to the students.

Students who want in-depth expertise and skills with extensive theoretical and practical knowledge of commerce should opt for B.Com with Honors.

The duration of both the programs are same which is 3 years. Students preparing for the CA examination should opt for the B.Com Hons to enhance their knowledge with in-depth coverage of the subject which will ultimately facilitate them in their preparation and help in their all-round development.

Both courses are available in Online mode and are offered by some of the best universities in India. Pursuing these programs in online mode provides flexibility to the students which helps in managing the time for academic learning and CA preparation.

Articleship With Graduation

The Institute of Chartered Accountants of India (ICAI) does not permit students to join articleship after qualifying for their CA Intermediate Examination if they are pursuing their graduation from a regular college or University.

Students who are pursuing their graduation from correspondence or online mode can join the articleship with the permission of ICAI.

With the help of online and correspondence modes, students can join the articleship and pursue their graduation degree at the same time.

This mode provides great flexibility and time management to balance academic learning with CA articleship. This saves students from wasting their precious years.

In the regular mode either they have to leave the graduation degree or wait for it to complete to start the CA articleship. In either case, the student is at a loss.

So if he chooses to pursue graduation from online mode or correspondence mode, not only he will be able to manage his time for preparation and learning but also in Articleship without dropping out of college.

Reasons for pursuing Chartered Accountants?

In times when businesses are growing very rapidly and operating in multiple sectors, management of financial accounts and bookkeeping has become a challenging task.

To scrutinize every financial transaction and properly record them to determine the financial position of the organization, a skilled and knowledgeable professional is required.

To address these challenges faced by the organizations, the role of skilled and trained Chartered Accountants comes into effect.

Given the importance of the Chartered Accountant in the functioning and operations of the organization, it becomes one of the most promising career options one can opt for to achieve great heights in their career.

Chartered Accountant is one of the highly paid domains in the industry. A student opting for this program can build a great professional career.

Who is a Chartered Accountant?

A Chartered Accountant (CA) is a professional who has passed the Chartered Accountancy program offered by the Institute of Chartered Accountants of India (ICWAI). After completing the course, the person becomes a member of ICWAI.

CA is one of the most prestigious jobs in the field of finance and accounting. CA provides several services to business organizations auditing financial statements, preparing taxation estimates, assisting in investment policy, and mentoring businesses in their financial plans.

A valid member of ICWAI can only be called a CA. No other program or degree can offer this designation to anyone.

The CA program demands lots of commitment on the student's side due to which less than 10 percent only qualify this program every year. This program provides considerably great career opportunities to the individuals pursuing this course.

CA provides career options that are highly in demand in the industry with lucrative remuneration packages. CAs can work in multiple industries like finance, banking, services, and manufacturing sectors.

The program provides international recognition with great professional growth.

What are the duties and responsibilities of CA?

CAs are responsible for multiple for various tasks related to finance, audit, accounting, taxation, etc in the business organization. Some of the main duties of CAs are mentioned below-

- Financial Statements - CAs help in preparing and analyzing the financial statements, ensuring that they follow the accounting standards and regulations.

- Auditing - CAs conduct an audit of the financial statements to assure stakeholders of the firm or company that financial statements depict the true picture of the company and information provided is true.

- Tax Planning - Tax planning is one of the main duties of CAs. By offering tax return assistance and tax-saving suggestions, they support both individuals and corporations in adhering to tax laws. They ensure that enterprises abide by all tax-related laws and regulations.

- Financial Management - Budgeting, analysis, and financial planning are responsibilities that CAs may take on. They support businesses in managing risks, making well-informed financial decisions, and maximizing performance.

- Regulatory Compliance - Chartered Accountants make sure that their employers or clients abide by pertinent laws, rules, and accounting standards, including the Companies Act, SEBI regulations, and International Financial Reporting Standards (IFRS).

How to Become a CA?

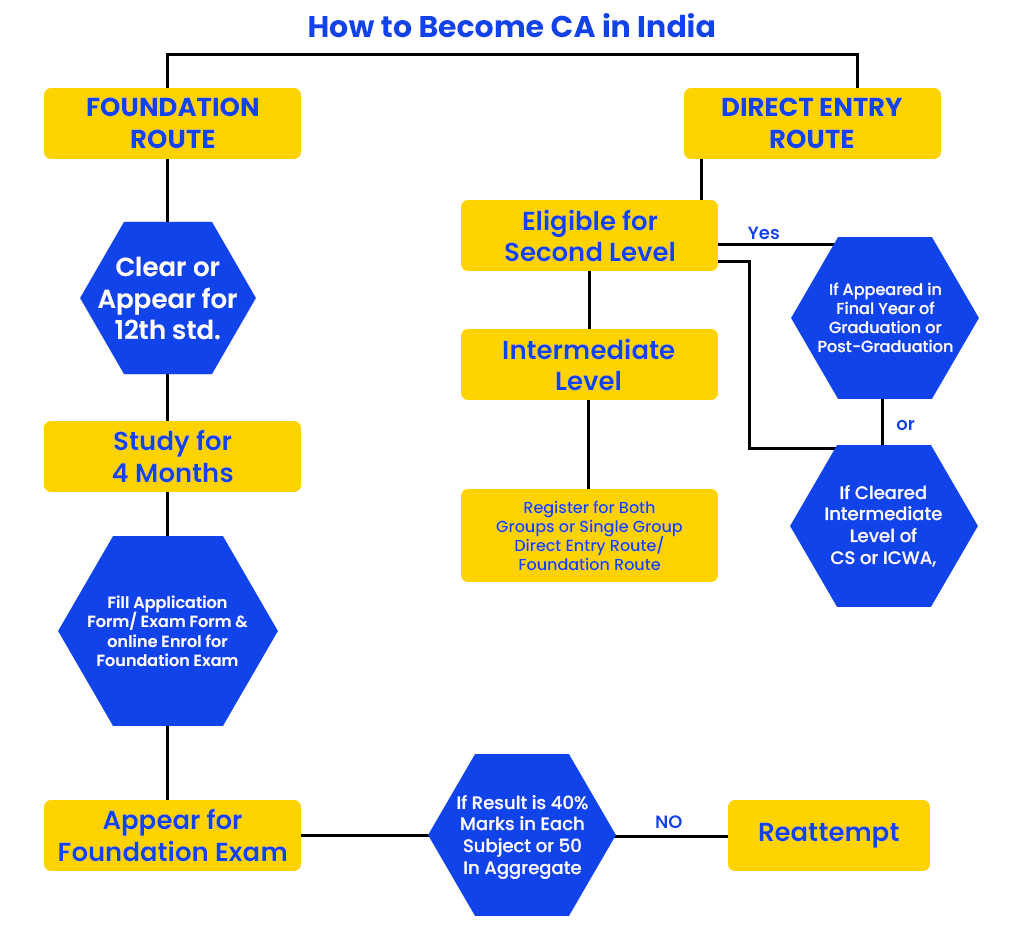

To become a certified Chartered Accountant in India, one has to go through several steps and examinations.The process is mentioned below -

CA Foundation

- Register with ICAI for the CA foundation program after passing the 10+2 examination from a recognized school board.

- A minimum of 4 months of study period is required after registration.

- Upon finishing the study period, appear for the CA Foundation exam.

CA Intermediate Course

- Register with ICAI for the CA Intermediate course once you have passed the CA foundation.

- Finish the compulsory 8-month study period.

- Once the study period is completed, appear for the CA Intermediate Examinations.

Articleship Training

- After qualifying for the CA Intermediate Exam, undergo a compulsory article ship training program under a certified Chartered Accountant.

- The period for articleship training is 3 years which is aimed to equip students with practical training.

- Finish an articleship training program under a certified chartered accountant for a predetermined amount of time.

- During the articleship term, finish both the orientation training (OT) and information technology training (ITT) simultaneously.

CA Final Course

- After qualifying for the CA foundation and CA intermediate examinations and completing compulsory articleship training, enroll with ICAI for the CA final course.

- Complete the compulsory 8 months of study.

- After completing the study period, appear for the CA final examination.

- Pass the CA Final Examination.

Membership

- After passing the CA Final Exam, conclude the GMCS ( General Management and Communication Skills) training.

- Apply for membership with ICAI to become its certified member and qualified Chartered Accountant.

Conclusion

In conclusion, after considering all the points mentioned above, it is undoubtedly clear that pursuing a B.Com (Hons) online mode while preparing for the CA exam is the best option. The curriculum of the B.Com (Hons) is very similar to the CA syllabus and offers specialization and in-depth knowledge in accounting, taxation, Statistics, and other topics. Online mode offers flexibility to the students in balancing academic learning and CA exam preparation.