Expert Interviews

- University Reviews

- Career Guide

Video Counseling

Video CounselingImportant Facts

- Ask any Question - CV Forum

Top 15 Primary Goals of Financial Management 2026

Isha Adhikari Jan 12, 2026 1.3K Reads

Technology enhancement hasn’t affected IT management, but some other industries or sectors have, in an appropriate way, such as financial management. Yes! You heard that right! As 2026 approaches, financial management has evolved so much from the aspects of technology, regulatory changes, market situations, etc. In this blog, you will explore more about financial management. It is also about the top 15 primary goals of financial management for the upcoming year, the importance of financial management, its benefits, key theories, modern approaches, and potential career opportunities within this field. So! Let’s get started.

Importance of Financial Management

Before, diving deeper into the primary objectives of financial management, it is better to know it from the basics. Start with the definition that financial management is to analyze, plan, organize, direct, and control an organization's financial activities. It refers to monitoring an organization's budget to execute a project or program. Forecasting about the financial decisions and risks of the company or business are also included in the financial management. An organization may face complexity in meeting financial goals, inefficient operations, poor decision-making, or maybe business failure without effective financial management.

In the upcoming year, the financial management is amplified due to these factors:

- Global Economical Shifts: In a few years, the world will become more effectively financially interconnected with each other. The introduction of digital cash and other global events—such as pandemics, geopolitical conflicts, and changes in international trade policies—can significantly impact financial stability. Hence, it is recommended that the business be more careful in terms of finance and economics.

- Technological Advancements: The landscape of financial management is reshaped due to modern financial technologies (FinTech) such as blockchain, artificial intelligence (AI), machine learning, and data analytics. With the help of these tools and technologies, you can make smarter, data-driven decisions, automate repetitive tasks, and streamline financial operations.

- Sustainability and ESG Concerns: Financial management also evolved so much with time. As individuals related to the financial sectors or industry such as Investors, regulators, and consumers are increasingly prioritizing environmental, social, and governance (ESG) factors in decision-making. Nowadays, Companies or businesses with financial management are more aware of sustainability metrics and ethical investing practices while delivering profitable outcomes.

- Complexity of Regulations: Domestic or international governments have introduced new tax policies, financial reporting standards, and compliance requirements. Financial managers need to stay updated with evolving regulations to ensure legal & financial compliance.

Benefits of Financial Management

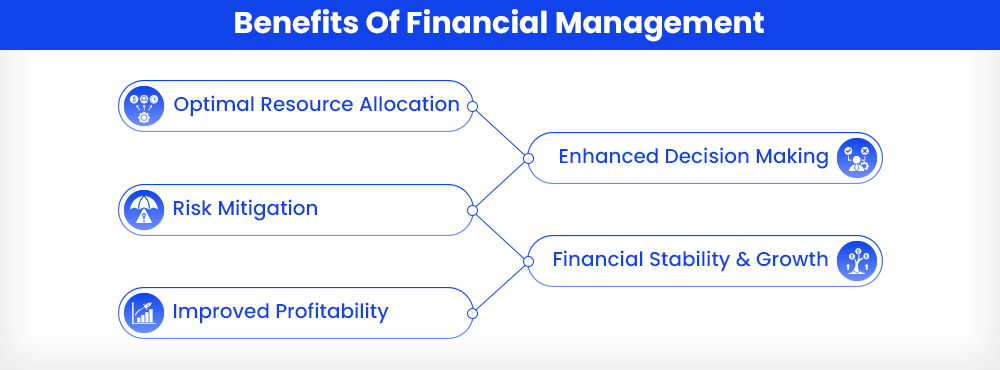

There is a diverse range of advantages of financial management that you can reap as an entity to grow your business or organization. Some of the key benefits of the financial management are as follows:

- Optimal Resource Allocation: Optimal resource allocation is one of the major benefits that you can reap from financial management as it helps you to keep an eye on the financial status of your business. You can efficiently manage the financial resources or allocate the capital to the sectors that will help the business to earn the best return from the investment. This can include a diverse range of things such as whether it's investing in new projects, expanding operations, or purchasing new technology.

- Enhanced Decision Making: With the accuracy of the financial status of the company, the higher authority can easily make informed decisions that will also assist the business firm financially. This process includes budgeting, forecasting, and strategic planning. Financial managers provide crucial insights into cash flow, profitability, and cost management.

- Risk Mitigation: Financial management helps businesses identify, assess, and manage financial risks. Whether it’s currency fluctuations, interest rate risks, or market downturns, having a solid risk management strategy is essential to safeguarding an organization’s financial health.

- Financial Stability & Growth: Financial management guides the business to analyze, identify, assess, and manage financial risks. It can be currency fluctuations, interest rate risks, or market downturns, therefore, it is important to have an effective solid risk management strategy to safeguard the organization’s financial health.

- Improved Profitability: Financial management assists you in controlling costs, optimizing pricing strategies, and streamlining operational efficiency, leading to higher profitability in the long run.

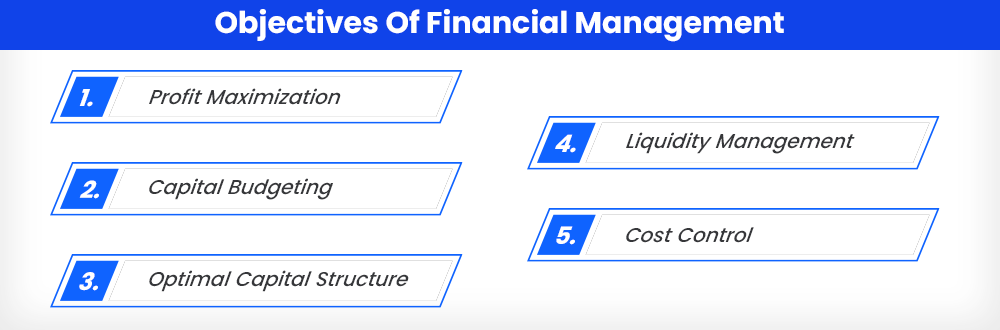

Primary Objectives of Financial Management

Financial management plays an important role in any organization. It serves several crucial purposes, each having its own aspects. In this section, you will cover the top 15 primary goals of financial management that help the business to grow efficiently and effectively in this ever-evolving and dynamic financial market. So, let’s get started.

- Profit Maximization: The main objective of financial management is to ensure the profit maximization of an organization. The increment rate of the company’s profit ensures that the company is doing great in terms of financial and economic growth. It helps the company to reinvest in itself, expand its business operations, and meet the expectations and needs of the clients and stakeholders. Companies can use modern technology to analyze and monitor the profit maximization of the business firm like advanced data analytics to identify the most profitable areas and investment opportunities.

- Wealth Maximization: The other goal of financial management is wealth maximization. Wealth maximization goes beyond profit maximization to focus on increasing the overall value of the organization. This takes into account the long-term growth in stock prices and shareholder value, with an emphasis on sustainable business practices.

- Optimal Capital Structure: Optimal capital structure is the other and one of the most important goals of financial management of a company. For any business firm, it is important to ensure the capital structure of the business firm. The organization must achieve debt and equity financing, by balancing the cost of capital, there would be very little chance of sudden risk and ensuring the optimal resources for expansion and operations. This remains a priority as interest rates and capital markets fluctuate.

- Liquidity Management: The other goal of financial management is to manage the liquidity of an organization. The management of the liquidity helps the company to meet its short-term obligations without affecting long-term growth. With market volatility and potential disruptions in the global supply chain, maintaining sufficient liquidity will be a priority for organizations.

- Risk Management: Risk management is one of the most important goals of financial management. It is the role of the financial risk manager to analyze, identify, assess, and manage financial risks. This is essential for almost every organization or business firm to safeguard themselves from sudden potential losses. Financial managers will need to create more robust risk management frameworks, factoring in global economic instability and digital security risks.

- Cost Control: Cost control is something that can work as the beacon of light for organizations in bad times. Efficiently controlling costs helps businesses maintain profitability even in times of financial strain. As global inflationary pressures may persist, businesses will need innovative strategies to reduce operating costs without compromising quality.

- Investment Decision-Making: The investment decision-making process plays an important role for an organization. Organizations need to make smart decisions related to investment. These things can help organizations in analyzing the potential returns against risks. Investment choices will rely heavily on data-driven insights, from stock and real estate investments to sustainable and green ventures.

- Financial Planning & Forecasting: Financial planning and forecasting is one of the most important goals of the financial management of an organization. The planning and forecasting of financial things of the organization can offer them a roadmap for the business firm to forecast and predict future financial outcomes. Companies can use different artificial intelligence tools and real-time data to develop more accurate forecasts to anticipate challenges and opportunities.

- Capital Budgeting: Capital budgeting involves evaluating major investments and long-term projects. This ensures that the company allocates resources efficiently, especially for expansion or new ventures. Technology and sustainability considerations will influence capital budgeting.

- Maintaining Stakeholder Confidence: Communication is the key to maintaining the stakeholder or clients’s relationships and confidence. Therefore, companies need to maintain strong and polite relationships with outsiders and customers. It is important to maintain good relations with investors, employees, customers, and other stakeholders and make them satisfied as it ensures the long-term growth of the companies.

- Economic Sustainability: Economic sustainability is very important for organizational growth. A focus on sustainability ensures that the company’s financial practices do not harm future generations. As environmental, social, and governance (ESG) concerns continue to grow in importance, integrating these practices into financial management will be central in every era.

- Credit Management: Credit Management is very important for an organization. Business firms must have a hold on the credit management system. Since it is important to manage the credits of the organization to prevent themselves from excessive debts. Organizations must incorporate advanced credit-score management systems to assess and manage any future credit things.

- Tax Optimization: For an organization, it is important to optimize its tax policies, liabilities, and other tax-related things to ensure that the business is in the cost savings and profit situation. In the upcoming years, with evolving tax regulations and global tax reforms, tax optimization strategies will need to be more agile and tech-driven. Since it will help in the long-term financial success of the organization.

- Dividend Policy: Making a positive and effective dividend policy for the organization is very crucial. It is the role of the financial managers to balance shareholder rewards with reinvested dividends. However, with changing investor preferences in the upcoming and ever-evolving years, understanding the trade-off between dividends and retained earnings will be critical.

- Capital Efficiency: Capital is the foundation of every business, therefore it is important to verify whether your capital is used in an efficient way or not. This includes all kinds of capital (capital invested in domestic and international businesses) to ensure the optimal returns of the capital. This means leveraging technology and data analytics to monitor capital allocation and ensuring that every penny spent contributes to growth.

Types of Financial Management Goals

Careers That You Can Explore In Financial Management

Besides the economic profit, financial management provides you with a wide range of professional careers that help you grasp high-profile jobs and high-priced salary packages. These are a few careers that you can explore for bright career paths. These are as follows:

- Financial Management Specialist: The financial management specialist is responsible for analyzing, planning, and monitoring the financial operations of a business firm. He/she is responsible for developing and optimizing the budgets, making financial decisions, preparing financial reports, and coordinating with the senior authority to ensure a positive and growing financial status of the company. There is an array of top universities, such as Banaras Hindu University and Punjab University Online, from where you can pursue your online MCom in Financial Management. After completing your online M.com degree in the finance field, you can easily apply for numerous job profiles in finance, such as financial analyst, financial management specialist, and many more. As a financial management specialist, you will get a salary package ranging from INR 6,50,000 to 11,00,000 per annum.

- Economist: The economist is an individual who analyzes and monitors market trends, economic data, and government financial policies and predicts the financial situation of an organization in advance. After pursuing an online MSc in applied finance, economists can assist organizations in understanding broader economic forces that could impact their business decisions. The role and responsibilities of an economist are to analyze the latest financial information and trends. To advise the companies on the macroeconomic factors affecting their business. Also, it provides strategic insights to mitigate economic risks. An economist can earn a high-salary package ranging from INR 9,00,000 to 25,00,000 per annum.

- Insurance Advisor: The Insurance Advisor is one of the best professions that you can opt for after pursuing an online MBA in financial management if you want to build your career in financial management. You can easily earn up to INR 3,00,000 to 5,00,000 per annum. The main role of an insurance advisor is to advise clients on the right and effective financial advice on topics such as investment, retirement planning, and sudden risk protection. Their other responsibilities are to review the companies' insurance policies and ensure they are still in use according to the customer's needs. They update and keep accurate records of clients' insurance. They need to maintain good and strong relationships with the clients and navigate the taxation on their investments.

- Financial Risk Manager: The Financial Risk Manager is also an exceptional career prospect that you can opt for if you are someone with a keen interest in financial management. The financial risk manager (FRM) is responsible for identifying, evaluating, and mitigating financial risks to an organization. It includes the analysis of financial markets and global financial environments to evaluate the financial risk factors, develop the financial legal impact of risks on the business, and communicate the risks to the higher authorities of the organization. If you are a financial insurance advisor in India, you can easily earn up to INR 6,00,000 to 25,00,000 per annum. There is an executive online program in finance available that can opt to grab a high-profile job in finance management.

- Senior Accountant: Preparing financial reports, financial statements analysis, reconciling balance sheets, general ledger accounts, bank reconciliations, and vendor ledgers and accounts payable. The role and responsibilities of the senior accountant are to provide assistance in the annual auditing preparations, perform audits, investigate, and resolve audit findings. They also create federal, state, local, and special tax returns, handling TDS, and TCS compliance. With the advancement in technology, accountants need to learn new and digital accounting systems, programs, procedures, and so on. Training of the interns and freshers' accountants maintaining their work reports and submitting them to the higher authorities are also included in their work responsibilities. To make a career as a senior accountant and earn an average salary package of up to INR 4,00,000 to 10,00,000 per annum, you can choose an online BBA in financial markets.

- Financial Planner: The financial planner is responsible for the analysis of the client's financial status, recommending investment strategies and financial products, assist the clients in planning for retirement and other life goals. To advise the tax-efficient strategies for the clients. Financial planners assist individuals and organizations in planning for their long-term financial goals. They provide guidance on investments, retirement planning, tax strategies, and estate planning. To be a successful financial planner in India, you can do an executive online PG diploma in finance and banking. After that, you can easily earn an average salary package of up to INR 4,00,000 to 10,00,000 per annum.

- Tax Analyst: As the name suggests, the tax analyst is responsible for monitoring and reviewing the tax policies and ensuring whether the companies are following the tax policies or not. They have to prepare and file corporate tax returns, tax liability optimization, and tax laws & regulations compliance. They are also responsible for making tax returns, identifying opportunities for tax savings, and tax-efficient strategies. Work with the external auditors and other financial & regulatory authorities to ensure the financial statements & compliance. They need to keep themselves up-to-date with financial and tax regulations and policies. If someone is a tax analyst, then he/she can easily earn an average salary package of up to INR 4,00,000 to 6,00,000 per annum.

Conclusion

Finance is one of the most important sectors of the economy. It works as a financial foundation of any organization, therefore, it is important to set some goals for financial management. It is also important to ensure that all the organizations are following all the financial norms and policies, leading the companies towards short and long-term success. In fact, with the advent in the technology sector, it will become even more crucial to incorporate advanced and digital technologies into the finance sector to maintain effective and efficient financial management. Through these practices such as ensuring liquidity, maximizing shareholder value, and promoting financial efficiency, businesses can navigate the increasingly complex financial environment with confidence. Embracing modern tools like AI, data analytics, and FinTech solutions will provide a competitive edge in a rapidly changing world.

FAQs (Frequently Asked Questions)

The primary goals of financial management are to ensure financial stability, optimize resource allocation, maximize shareholder wealth, manage risks, ensure compliance, and contribute to strategic decision-making that drives growth and profitability.

The three main goals of financial management are:

- Profit Maximization: Ensuring that the organization’s operations result in maximum profitability.

- Wealth Maximization: Increasing the value of the firm for its shareholders over time.

- Risk Minimization: Identifying and mitigating financial risks to ensure business stability and sustainability.

The scope of financial management encompasses a wide range of activities, including investment decisions, financing decisions, dividend decisions, risk management, financial planning, financial analysis, and capital budgeting. It also includes strategic financial decision-making and ensuring that financial resources are allocated in ways that optimize business performance.

Financial management is inherently strategic, focused on planning, controlling, and monitoring financial resources to achieve organizational objectives. It involves decision-making about capital structure, investment opportunities, budgeting, and risk management, all while aligning financial decisions with the overall goals of the business.

Several factors influence financial planning, including:

- Economic Conditions: Economic growth, inflation, interest rates, and market trends can affect financial projections.

- Regulatory Changes: New laws and tax policies can impact financial planning and reporting.

- Technological Advancements: Automation, artificial intelligence, and data analytics are transforming financial planning processes.

- Business Objectives: The financial plans must align with the organization’s strategic goals, such as expansion, mergers, or diversification.

- Market Risks and Uncertainties: Changes in consumer behavior, global markets, or industry disruptions can impact financial forecasts.

3 Years of Experience / Narrator

With 3 years of experience in content writing and copywriting and keen interest in voiceover and scripting, I, Isha Adhikari, am passionate about content creation and narration.

Every query is essential.

Our team of experts, or experienced individuals, will answer it within 24 hours.

Recommended for you

Tired of dealing with call centers!

Get a professional advisor for Career!

LIFETIME FREE

Rs.1499(Exclusive offer for today)

Pooja

MBA 7 yrs exp

Sarthak

M.Com 4 yrs exp

Kapil Gupta

MCA 5 yrs exp

or

Career Finder

(Career Suitability Test)

Explore and Find out your Most Suitable Career Path. Get Started with our Career Finder Tool Now!

ROI Calculator

Find out the expected salary, costs, and ROI of your chosen online university with our free calculator.