Expert Interviews

- University Reviews

- Career Guide

Video Counseling

Video CounselingImportant Facts

- Ask any Question - CV Forum

Top Government Jobs for Chartered Accountants (CAs) [2026]

Priyanshu Bhatt Jan 12, 2026 1.4K Reads

Chartered Accountancy is highly regarded and offers numerous opportunities in India. Even though working in private firms and creating their practices is traditional, more Chartered Accountants (CAs) are starting to look for government jobs that are stable, well-paying, and meaningful. The rise in transparency and regulation in the Indian economy has caused demand for skilled financial experts in public offices to grow significantly.

This website will explain the main government jobs for Chartered Accountants in India, their requirements, the tasks involved, the pay scale, and how they can develop.

Why Should CAs Consider Government Jobs?

It is useful to learn the advantages of a government job for Chartered Accountants before we list the top positions. Because financial governance is changing and more accountability is needed in public finances, the government is now a preferred and reliable career option for CAs. Thinking of joining government agencies can be a good reason for those who want to become Chartered Accountants.

1. Unmatched Job Stability

While work in the private sector may be tough and sometimes hard to predict, working for the government assures a higher level of job security. After they are selected, CAs usually remain employed long-term and are less likely to be terminated, which attracts people who want a stable and reliable profession.

2. Balanced Work-Life Environment

Many government jobs have regular work hours and offer their workers a lot of leave benefits. So, professionals have more opportunities to keep their professional and private lives separate and balanced.

3. Comprehensive Perks and Benefits

Besides earning a good income, employees in government positions are offered benefits such as pension plans, housing assistance, money for travel, subsidized health care, and many more. All these features considerably raise the total compensation and help workers secure their future finances.

4. Opportunity to Make a Public Impact

Chartered Accountants who work in government departments can help shape policy and growth within the country. From checking how the government spends money to making financial rules and regulations, CAs in government make sure governance and the economy remain solid.

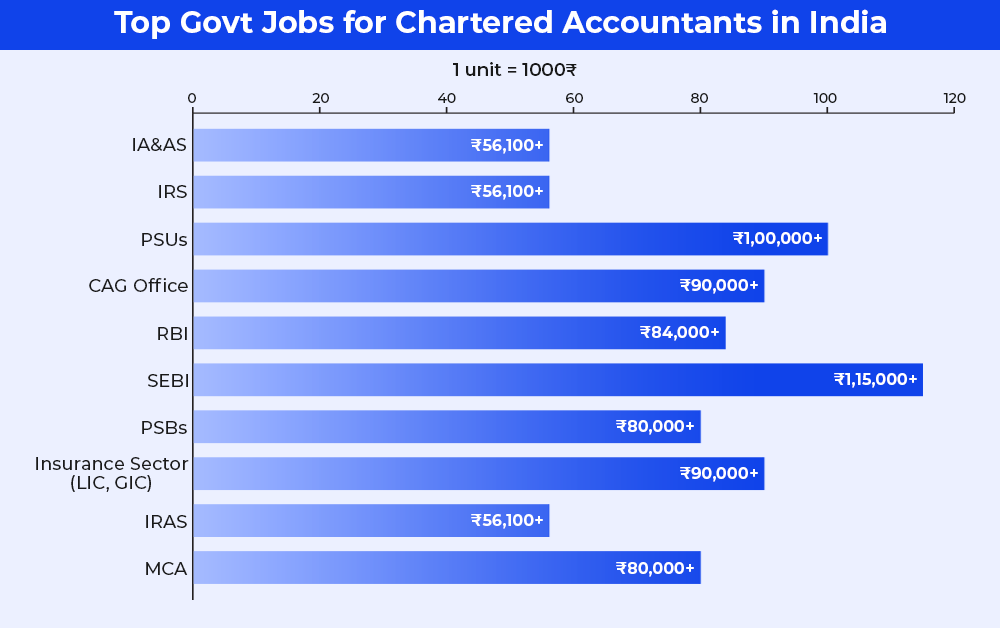

Top Government Jobs for Chartered Accountants in India

Chartered Accountants working in the government have experienced major changes in their career options over time. The opportunities for qualified CAs now exist in regulatory bodies, central services, public sector undertakings, and national institutions. A variety of government positions are available for Chartered Accountants in India, and they are included here with detailed explanations, necessary qualifications, what the role involves, payment, and the opportunity to advance.

1. Indian Audit and Accounts Service (IA&AS)

The Indian Audit and Accounts Service (IA&AS) is considered a top Group ‘A’ civil service, supervised by the Comptroller and Auditor General of India (CAG). The Public Accounts Committee helps by ensuring the public understands the use of funds by all central and state governments, as well as all public sector enterprises.

CAs who join IA&AS are assigned responsibilities to review government finances, prepare financial statements, and provide financial guidance to various government ministries. People enter IA&AS by succeeding in the tough UPSC Civil Services Examination.

At the entry level, officers get placed at ₹56,100 per month and other allowances like HRA, dearness allowance, and travel perks. As time passes, officers may be promoted to leadership roles like Director, Principal Director, and even Deputy CAG, so the position is suited to people looking for public administration and financial governance.

2. Indian Revenue Service (IRS)

Along with the IAS and IPS, the Indian Revenue Service (IRS) is one of the top-ranked Group ‘A’ services responsible for taxation. Working in either the Income Tax Department or the Customs and GST Departments, IRS staff are responsible for the administration of taxes.

As tax laws, compliance, and accounting standards are their main fields, Chartered Accountants are most suited for roles at the IRS. Businesses are managed by allocating taxes, pursuing illegal tax evaders, enforcing laws, and planning new policies. You need to pass the UPSC Civil Services Examination to become an IRS officer.

Starting salary is at ₹56,100 per month, but excludes any government-approved benefits. CAs working in the IRS may advance to important chief positions like Chief Commissioner of Income Tax or rise within the Central Board of Direct Taxes (CBDT), a major body in Indian tax policy decisions.

3. Public Sector Undertakings (PSUs)

Building the country’s infrastructure and industries depends greatly on Public Sector Undertakings (PSUs) like ONGC, GAIL, NTPC, SAIL, and BHEL. Such corporations encourage CAs to join them in charge of managing finance, accounts, audit, and taxation duties.

A lot of PSUs hire Chartered Accountants straightaway using their ICAI placement ranks or by conducting separate recruitment exercises. In PSUs, CAs take care of creating and managing the budget, carrying out internal audits, planning finances, handling taxes, and reducing costs.

Payment in PSUs can vary from ₹60,000 to ₹1,80,000 each month, depending on your position and years of experience. They supply many benefits apart from pay, for example, housing, bonuses, medical insurance, and discounts for travel. After building experience and dedication, Chartered Accountants may become leaders, such as a Chief Financial Officer (CFO) or Director (Finance, choosing the direction for the organization.

4. Comptroller and Auditor General (CAG) Office

The Comptroller and Auditor General (CAG) is responsible by law for auditing both the central and state government finances in India. In the CAG office, Chartered Accountants are responsible for auditing ministries, public projects, and departments to check the proper use of public funds.

The Staff Selection Commission (SSC) or the Union Public Service Commission (UPSC) is responsible for hiring people for positions in the CAG office, based on the requirements. Salaries for these jobs are between ₹50,000 and ₹1,50,000 according to the role and the project. Those with experience as CAs in the CAG office may rise to senior management roles of Director or Principal Accountant General and lead audits and government financial reporting.

5. Reserve Bank of India (RBI)

The central bank of India, known as the Reserve Bank of India (RBI), is in charge of setting monetary policy and monitoring financial institutions throughout the country. The RBI greatly appreciates Chartered Accountants who have skills in finance, complying with rules, banking audits, and analyzing the economy.

The Reserve Bank of India hires CAs mainly into Grade B Officer positions and also carries out special recruitment drives. They may be assigned to work in the RBI’s Internal Audit, Financial Markets, Risk Monitoring, and Supervision departments.

Approximately ₹84,000 is the monthly salary for a Grade B Officer, including all their allowances. Employees have access to housing, medical insurance, and retirement plans. As time goes on, CAs are often chosen to serve as General Manager, Executive Director, or Deputy Governor and help influence the country’s economic policies and financial structures.

6. Securities and Exchange Board of India (SEBI)

All regulation of India’s capital markets is covered by the Securities and Exchange Board of India (SEBI). It guarantees fairness in the stock market, looks after investors, and reviews listed companies.

Most Grade A (Assistant Manager) positions in Accounts, Legal, and General at CCI are reserved for Chartered Accountants. Their duties consist of examining public companies, looking into illegal financial activities, checking that rules cannot be broken, and preparing new policies.

SEBI sends a notification for recruitment, and the initial monthly pay is about ₹1,15,000, including benefits of a leased house, bonuses for good performance, and health insurance. As the years go by, some officers can progress to Grade B, then Grade C, or they may ultimately become Executive Director. Individuals joining the industry in the area of securities, investment regulation, and market integrity find SEBI to be a great option.

7. Public Sector Banks (PSBs)

These banks, such as the State Bank of India (SBI), Punjab National Bank (PNB), and Bank of Baroda, employ many CAs in their financial, auditing, and risk management departments. These jobs are given out by IBPS during the Specialist Officer (SO) exam or through direct recruitment.

At banks, Chartered Accountants handle internal audits, assessment of loans, management of risks, and financial projections. The salary varies widely, ranging from ₹60,000 and ₹1,00,000 every month based on the company and designation.

Key perks are housing, incentives linked to performance, pension advantages, and the ability to move forward in the company. CAs may progress, holding positions as General Managers, Chief Compliance Officers, and Executive Directors, leading many branches across the country.

8. Insurance Sector – LIC, GIC, NICL

Life Insurance Corporation (LIC), General Insurance Corporation (GIC), and National Insurance Company Limited (NICL) offer jobs to Chartered Accountants in finance, actuarial auditing, underwriting, and investment management departments.

They are generally filled by applying for specialized tests such as the LIC AAO (Chartered Accountant) exam. Responsibilities in this position are to examine financial reports, review audits of investments, review the underwriting process, and ensure that IRDAI’s regulations are followed.

An employee’s pay scales from ₹60,000 to ₹1,10,000 depending on their assigned role and level. People in the insurance sector with the CAs designation typically have secure employment, good health benefits, and can advance to the top positions of CFO or Senior Finance Officer.

9. Indian Railways Accounts Service (IRAS)

The Indian Railways Accounts Service (IRAS) is in charge of handling India’s most complicated financial system. Budgeting, reviewing, managing revenue, auditing, and planning finances for the Indian Railways are all handled by Chartered Accountants in IRAS.

The Main way to enter IRAS is through the UPSC Civil Services Examination. Being an IRAS officer in the Railway Department, a CA will look after fund distribution in each zone, supervise financial matters, and introduce improved accounting techniques.

At the beginning, you get ₹56,100 per month, plus benefits for accommodation, travel, and pension. Growth within the company is consistent, allowing an individual to become Principal Financial Adviser and then Financial Commissioner for Railways, which is one of the top finance roles in the country’s public infrastructure.

10. Ministry of Corporate Affairs (MCA)

Indian corporate laws and policies are managed by the Ministry of Corporate Affairs (MCA), with the MCA responsible for the Companies Act, LLPs, and corporate compliance standards. In chartered firms, Chartered Accountants take on the jobs as Financial Analysts, Company Prosecutors, and Compliance Auditors.

CAs ensure company laws are delivered, supervise investigative auditing, help set policy standards, and look into false financial reporting. The UPSC, SSC, or sometimes a simple contract are the ways recruitment happens for government jobs.

Pay varies from ₹60,000 to ₹1,20,000 a month based on your work profile. If someone performs well over time, they may become a Director or Joint Secretary, leading regulatory work for companies in the country.

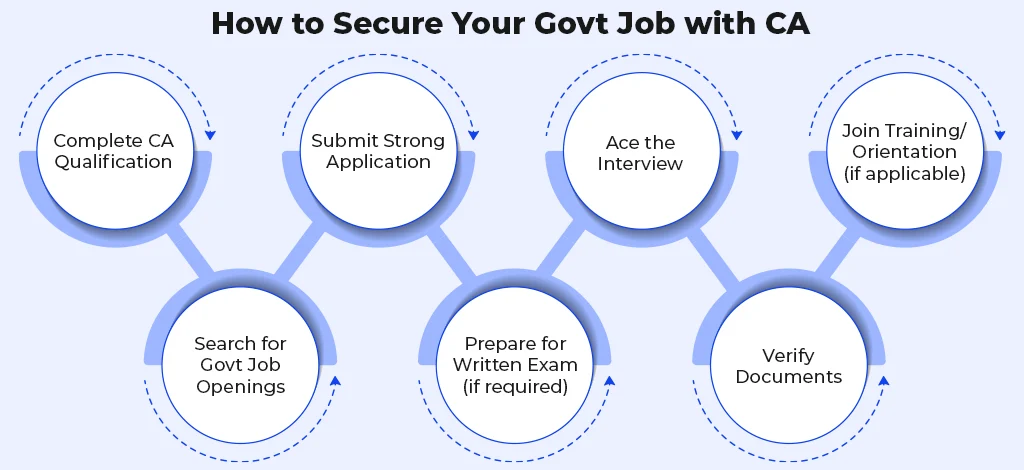

How to Secure Your Government Job with CA

Landing a government position as a Chartered Accountant involves a blend of academic credentials, skill development, and strategic preparation.

Follow this structured path to improve your chances:

- Attain Your CA Qualification

- Explore Job Vacancies

- Submit a Well-Prepared Application

- Prepare for the Written Exam (if applicable)

- Excel in the Interview Stage

- Complete Document Verification

- Attend Training (if required)

Government Job Application Tips for CA Graduates

Preparing and planning carefully is necessary if you are applying for a government position as a CA (Chartered Accountant) graduate. Because there is a lot of competition for such jobs in India, people must be attentive and well-prepared to get hired. Here are specific guidelines meant for CA graduates interested in working in the government sector:

1. Stay Proactively Informed About Job Openings

It is a good idea to watch the official websites of government bodies, PSUs, as well as UPSC, SSC, and IBPS, for the news about open positions. Getting email notifications or joining special forums can help you not miss any important opportunities.

2. Thoroughly Understand Eligibility Requirements

Make sure to carefully read the requirements listed in the job adverts prior to applying. Some of the standards are the age required, the education level, the needed experience, and certifications or skills. Following these criteria will reduce the risk of getting eliminated before the project ends.

3. Strategically Prepare for Competitive Examinations

In order to get selected for various government positions, one has to pass exams like those hosted by UPSC, SSC, and other recruitment bodies. The subjects accountants should focus on after they graduate from CA are accounting, finance, economics, and general knowledge. Prepare a proper study schedule, use your time efficiently, and sign up for extra courses if they might help.

4. Stay Updated with Current Affairs and Economic Developments

Hiring processes and testing usually include questions about recent events in economics and finance. Keep yourself updated by reading newspapers, financial journals, and reputable online news to help you express your views during evaluations.

5. Engage in Regular Practice with Previous Years’ Question Papers

Practicing past exams gives you an idea of the types of questions, their pattern, and the level of difficulty. Maybe most importantly, this strategy sharpens your thinking speed and also gives you more confidence with the structure of the test.

6. Refine Your Interview and Communication Skills

Passing the written examination is only one of the steps to getting selected. An interview aims to examine your personality traits and your skills in communication, and whether you fit the job description. Work on being interviewed, try to get advice from others, and focus on speaking and thinking confidently. Responding to interview questions according to what the job requires can bring you great success.

7. Leverage Specialized Resources and Study Environments

Preparing for exams at libraries or study centers can be very helpful. Also, the e-Library named after Bharat Ratna Atal Bihari Vajpayee in Nagpur is making a difference by helping students who want to prepare for competitive exams, giving access to reading rooms, computers, and valuable study material.

8. Maintain Consistency and Manage Stress Effectively

Applying for and getting a government job may require a lot of time and effort. A good study habit, reachable goals, and relaxing with exercise, meditation, or your favorite activities can help a lot. Having a positive attitude and perseverance will help you get past any challenges you meet.

Study Online, Work Towards Government Goals

Securing a good government job demands a complete blend of dedicated preparation and academic qualifications. For CA Aspirations, enrolling in an online degree program can be the best decision, as you can learn from anywhere and at any time. Just one thing you have to keep in mind is that the degree you pursue is from an approved and accredited university. That’s why we have mentioned some of the top online universities from where you can pursue your degree online, and what's the best part, you can convert your fees into easy monthly emi options.

Sounds great? Yes, it is! However, there are a lot of online universities. First, check out these online institutions, then continue with your research.

|

Top Online Institutions For UG |

|

Top Online Institutions For PG

|

Top Online Institutions For PG |

|

Conclusion

In India, Chartered Accountants (CAs) find a very lucrative career option in government jobs that are full of stability, dignity, and meaning. Although the private sector might offer high financial returns, public sector jobs enable CAs to play significant roles in country development, policy formulation, and financial management. Be it the assignment with the best of the institutions like the RBI, SEBI, Indian Railways, or serving the nation by ensuring transparency in government finances with agencies like the CAG or IA&AS, the assignments offer long-term growth, attractive remuneration, and a balanced life.

FAQs (Frequently Asked Questions)

Some of the best options include the Indian Audit and Accounts Service (IA&AS), the Indian Revenue Service (IRS), Public Sector Undertakings (PSUs), RBI, SEBI, CAG Office, Public Sector Banks, Insurance Companies, IRAS, and the Ministry of Corporate Affairs.

Yes, many top government jobs require passing exams like the UPSC Civil Services Exam, SSC, IBPS SO, or specialized PSU recruitment tests.

Yes, most government roles offer regular work hours, generous leave policies, and a structured work environment, leading to a better work-life balance.

Salaries typically range from ₹56,000 to ₹1,80,000 per month, depending on the department and position, along with additional perks like housing, medical benefits, and pensions.

CAs can apply through official notifications on PSU websites, ICAI campus placements, and recruitment portals for RBI, SEBI, etc., which conduct their exams and interviews.

Yes, CAs can advance to senior roles such as CFO, Executive Director, Principal Director, or even Deputy CAG, depending on the department and performance.

Many government roles accept freshly qualified CAs, especially in PSUs and through entry-level recruitment exams. Some higher positions may require experience.

Strong knowledge of taxation, auditing, compliance, communication skills, current affairs awareness, and analytical ability is crucial for success in exams and roles.

Yes, especially in roles like IRS, IA&AS, and RBI, CAs contribute to tax policy, financial regulation, public audits, and economic development strategies.

They should regularly check official portals like UPSC, SSC, IBPS, PSU career pages, and subscribe to alerts from ICAI and job forums to stay informed.

3 Years of Experience | Content Specialist I Copywriter

Writing what Google loves, and students need.

Every query is essential.

Our team of experts, or experienced individuals, will answer it within 24 hours.

Recommended for you

Tired of dealing with call centers!

Get a professional advisor for Career!

LIFETIME FREE

Rs.1499(Exclusive offer for today)

Pooja

MBA 7 yrs exp

Sarthak

M.Com 4 yrs exp

Kapil Gupta

MCA 5 yrs exp

or

Career Finder

(Career Suitability Test)

Explore and Find out your Most Suitable Career Path. Get Started with our Career Finder Tool Now!

ROI Calculator

Find out the expected salary, costs, and ROI of your chosen online university with our free calculator.