Expert Interviews

- University Reviews

- Career Guide

Video Counseling

Video CounselingImportant Facts

- Ask any Question - CV Forum

How To Become a Financial Analyst In 2025: A Complete Career Guide

College Vidya Team Apr 11, 2025 1.1K Reads

With companies, organizations, and individuals expanding their financial assets and business potential, the effective management of finances and ensuring financial health has become increasingly important. The job role of a financial analyst becomes central in this regard as they look after the analysis of various types of financial data to guide financial decisions, and investments, mitigate risks, and so on.

Individuals and aspirants looking to develop a career in the financial sector can consider this domain as a viable and lucrative option. In this blog, we take a deep dive into the career of financial analysis and explore how to kickstart one's career as a financial analyst.

Why Choose a Career in Financial Analysis?

Like most career options in finance and the BFSI sector, the role of a financial analyst is also quite lucrative and scope in India. Mentioned herein are a few of the key benefits associated with pursuing this career.

- Lucrative Compensation: The field of financial analysis is lucrative and offers appealing salary packages to students and aspirants right off the start of their careers. The scope for financial growth in the field is also lucrative through the years.

- Diverse & Dynamic Working Environment: There are a number of domains within the field of financial analysis, including market research, risk assessment, investment planning, and so on. The work environment for the field is also dynamic and fast-paced in nature allowing for significant exposure and skill development during one’s career.

- High Demand Across Industries: Formally trained financial analysts are highly in demand across a number of industries including those like banking, investments, the healthcare sector,s etc. They are also regularly employed by corporates for financial and asset planning and so on.

- Opportunity to Contribute to Strategic Decisions: Since financial analysts are involved in the identification of key financial trends and insights, they play a central role in strategic decision-making in any organization. Resultantly, right from the start of one’s career, a financial analyst can play a central role in impacting strategic decisions.

- Global Career Scope: The scope of financial analysis is wide and prospective, with a number of appealing opportunities available across the globe with lucrative growth potential and exposure.

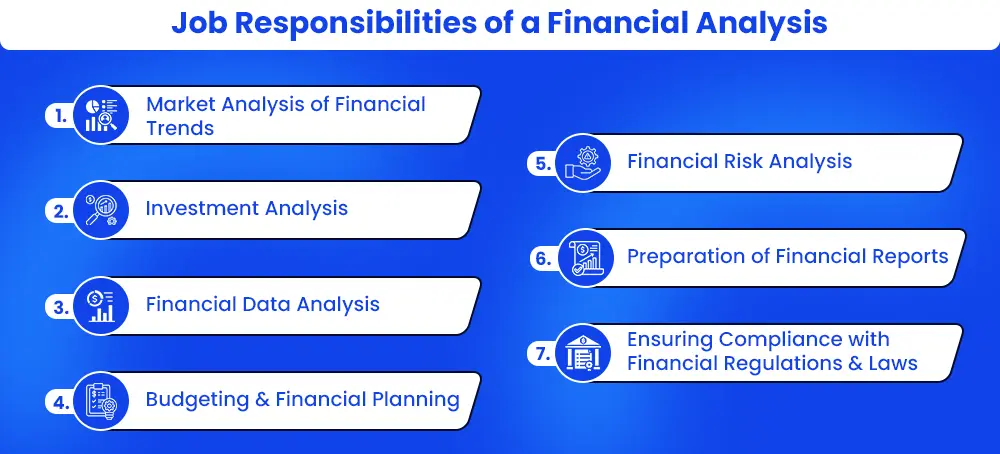

Roles & Responsibilities of a Financial Analyst

Financial analysts play a holistic role in enhancing the financial health of organizations and thus, their role encompasses a variety of financial functions including those like market analysis through requisite research, investment analysis and identification of investment opportunities, risk analysis, and mitigation from a financial standpoint as well as aspects like budgeting analysis. Detailed below are the various responsibility areas of a financial analyst.

Key Skills Needed for Financial Analysis

A financial analyst must possess a host of technical or functional as well as soft skills so as to succeed in the role. These functional skills relate to areas of financial management and analysis as well as technological literacy and competence. Similarly, soft skills include those like a general analytical orientation as well as interpersonal skills to succeed in the role. Further details are elaborated upon below.

1. Technical Skills & Knowledge to Succeed as a Financial Analyst

The functional and technical skills related to finance as well as a strong knowledge of the foundations of finance and economic markets form the core of the desirable skill repertoire for this role. Certain critical skill areas that are needed to succeed in the role of a financial analyst are elaborated upon below.

|

Key Skills |

Specifications |

|

Financial Modelling |

Being proficient in the development of robust financial models that allow accurate forecasting and predictions of revenues, expenses, projected profits, etc. |

|

Financial Risk Analysis |

The ability to identify potential financial risks upon due market research and identify mitigation strategies for the same using financial software and predictive analytics. |

|

Usage of Financial Tools & Software |

Being proficient in operating with financial software such as Anaplan, Sage Intacct, Vena, Cube,etc. to perform necessary operations related to financial analysis. |

|

Knowledge of Economic Markets |

Having sound knowledge and awareness of financial markets, economic trends,and developments, industrial patterns, factors impacting the market,t and so on. |

|

Accounting |

Being proficient in functions related to accounting, auditing, banking,g and related domains of financial management for seamless management of tasks. |

|

Investment Analysis |

Being able to evaluate and analyze portfolios, stocks, bonds, etc. to identify investment opportunities and provide consultations based upon the risk-return trade-offs. |

2. Soft Skills to Succeed as a Financial Analyst

Soft skills and interpersonal skills are also essential for financial analysts to possess considering they are required to regularly interact with key stakeholders in cross-functional domains to convey key financial insights and strategize financial plans. The details of the required soft skills for financial analysts are mentioned below.

|

Key Skills |

Specifications |

|

Attention to Detail |

Having a keen eye for detail and maintaining a thorough and detailed approach to one’s tasks, enabling easy identification of errors, patterns and trends. |

|

Time Management |

Being able to manage multiple projects and priorities effectively within determined deadlines so as to attain effective task completion. |

|

Communication Skills |

Being able to articulate one's ideas and opinions in a clear, comprehensible and simultaneously convincing manner so as to create the desired influence and get buy-ins from relevant stakeholders. |

|

Analytical Aptitude |

Having an analytical approach at work enables the interpretation of complex financial data thoroughly and effectively. |

|

Critical Thinking |

The ability to understand financial data from a critical lens including the identification of potential impacts and implications of certain financial decisions on an individual or the firm. |

|

Ethical Integrity |

Having a strong and clear ethical standing guiding all financial decisions and analysis, allowing for due compliance and confidentiality to clients. |

What are the Career Opportunities for Financial Analysis (Types of Options available in Financial Analysis)

While the role of a financial analyst in itself is a potent and hopeful one, once trained in financial analysis, a professional can venture into a number of related fields including those like risk analyst and consultant, financial manager, investment banker, or investment consultant, equity research and so on. These fields are lucratively compensated from fresher roles and provide the professional with diverse exposure.

A few of the relevant career options that a financial analyst can explore, along with their recent compensation based on the latest statistics, are provided below.

|

Career Option |

Average Salary (Per Annum) |

|

Financial Analyst |

INR 6.5 LPA |

|

Financial Manager |

INR 14 LPA |

|

Financial Risk Analyst |

INR 8 LPA |

|

Investment Consultant |

INR 25 LPA |

|

Portfolio Manager |

INR 13.21 LPA |

|

Wealth Manager |

INR 5 LPA |

|

Investment Banker |

INR 11 LPA |

|

Equity Research Analyst |

INR 7 LPA |

|

Private Equity Analyst |

INR 7 LPA |

|

Financial Auditor |

INR 6.5 LPA |

Career Analysis: Scope of Financial Analysis

Having understood the nature of the career of a financial analyst, let us now delve into the prospects of a career in financial analysis, including the understanding of the industry trends, and financial investments required to start this career and its growth trajectory.

Demand for Financial Analysts: Industry Trends

Some key trends and insights related to the field of financial analysis have been provided below.

- The major organizations where financial analysts are hired include private and public banks, multinational banks, stockbroking firms, insurance firms, financial consultancies, etc.

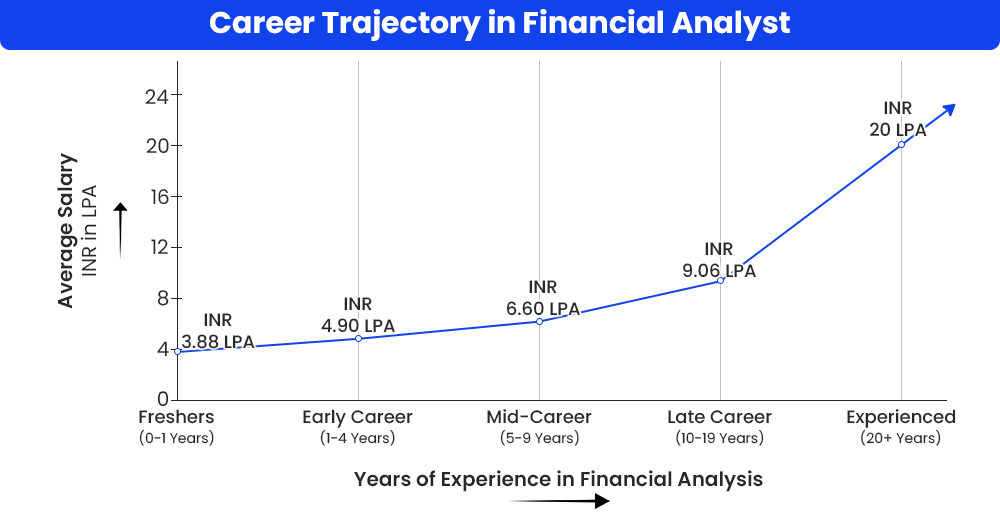

- The potential earning range for a fresher in financial analysis is about INR 4 LPA to INR 5 LPA. with years of experience, this grows to an average of INR 9 LPA.

- Financial modeling is coming up as a key domain of financial analysis, accompanied by a widespread use of data analytical techniques, making it a core skill in financial analysis.

- Like a majority of other fields, automation is leading to a digital transformation of the domain of financial analysis as well. As a result, AI integration is enhancing the efficiency and accuracy of decision-making and analytics in the domain.

- Proficiency with digital software for financial analysis has also become a central skill desirable for the role.

Fees & Costs Involved in Becoming a Financial Analysis

In addition to the course of a Chartered Financial Analyst (CFA), there are a number of UG and PG course options that can enable an aspirant to start a career in financial analysis. These include UG degrees like a B.Com, a BBA in banking/finance/accounting/finance, etc., as well as PG options such as an M.Com, an MBA, or PG programs (PGP) in financial analysis. A majority of these options are available for students to pursue in the regular, distance, and online learning (OL) modes at their convenience. Based on the institute, the mode of the course as well the duration of the course, the required tuition fee is liable to vary.

Mentioned below are a few of the prospective courses that one can pursue to begin their financial analysis career. The approximate course fee is enlisted alongside. Please note, the exact fee structure and amount might vary from one institution to another.

|

Financial Analysis Courses |

Approximate Course Fees |

|

Bachelor of Commerce (Specialisations: Accounting & Finance, Banking & Finance, Auditing & Finance |

INR 2,50,000 |

|

INR 4,00,000 |

|

|

INR 1,50,000 |

|

|

INR 20,000 |

|

|

INR 1,50,000 |

|

|

INR 1,62,000 |

|

|

INR 2,00,000 |

|

|

INR 5,00,000 |

|

|

INR 4,50,000 |

|

|

INR 4,50,000 |

|

|

INR 3,00,000 |

|

|

INR 2,50,000 |

|

|

Chartered Financial Analyst (CFA) |

INR 1,00,000 |

|

PG Financial Analysis Program |

INR 2,00,000 |

Career Growth Trajectory of Financial Analysis

Financial analysis is a lucrative career domain in India. Being a role in the BFSI sector, major financial consulting firms, private and public banks, and financial firms hire financial analysts at lucrative compensation. While freshers may start out with moderately high packages, the compensation offered escalates exponentially with years of experience added to one’s profile. The overall growth trajectory for a financial analyst has been represented below.

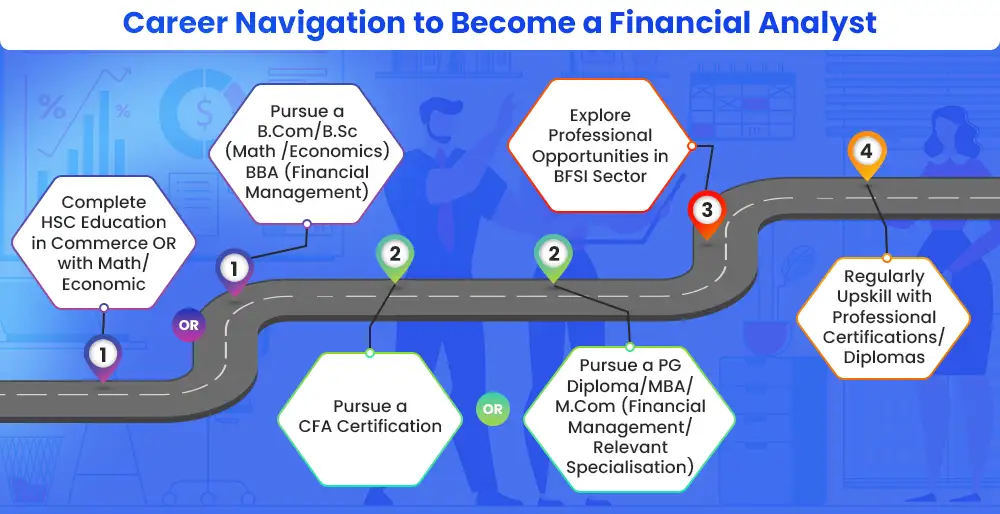

Career Navigator: What Course to Pursue for a Career in Financial Analysis?

To practice as a financial analyst in India, one must at least possess a relevant Bachelor’s degree. Upon completing HSc (grade 12 or equivalent) education in the commerce stream (or at least with economics/mathematics as a subject), one can pursue a relevant UG degree like a B.Com, a BBA (specialization such as financial management, banking, and accounting,g, etc.) or a B.Sc (in specializations like Mathematics or Economics). A fresher can begin looking out for professional opportunities such as internships or entry-level roles in financial firms or can further pursue a PG-level course such as an MBA (finance/accounting and banking/other relevant specialization), an M.Com, or a PG diploma/certification in financial analysis.

Consequently, one can also pursue a CFA certification offered by the CFA Institute, which can be taken up by a student upon completing a Bachelor's education and securing at least 4000 working hours in a professional capacity. The overall career navigation to become a financial analyst has been outlined below.

Some of the top institutions in India which are recognized for their elite education in the domains of finance, financial management and financial analysis have been represented below. These include a number of private and public institutions which offer these courses.

Conclusion

Financial analysis is a booming career of the BFSI sector which is currently growing in demand across industries and can be a potent option for an aspirant interested in developing skills in multiple finance domains. The compensation, the diverse career opportunities, the dynamic nature of the field, and its global demand make it an option worth considering.

FAQs (Frequently Asked Questions)

There are several channels to become a financial analyst in India. After completing one's grade 12 education in commerce stream or with mathematics/statistics as a subject, one can take up a UG degree course such as a BBA, B.Com, or B.Sc (Economics/Mathematics). Additionally, they can further upskill by pursuing a PG degree/diploma in financial management/analysis and start exploring professional opportunities in the BFSI sector. Conversely, one can also prepare and pursue the Chartered Financial Analyst (CFA) course and start practicing as a financial analyst.

On average, a fresher in financial analysis can earn anywhere between INR 4 LPA to INR 5 LPA, and with further years of experience, a mid-level financial analyst can easily earn up to INR 9 LPA.

Some of the top organizations that hire financial analysts include those like Wipro, KPMG, Accenture, Deloitte, Amazon, JP Morgan Chase, etc.

At the undergraduate level, one can take up degrees like B.Com, B.Sc (in Mathematics or Economics), and BBA (in financial management or related specialization) to pursue financial analysis in the future. At the PG level, one can take up an MBA (in financial management or related specialization)/M.Com/ M.Sc (Economics/Mathematics). The Chartered Financial Analyst or CFA course is another relevant qualification to practice as a financial analyst in India. Lastly, one can also consider professional qualifications like certifications and short-term diplomas to upskill oneself as a financial analyst and start practicing professionally.

Yes, you may still pursue a career in financial analysis if you do not have a commerce background at the grade 12 level. However, you must have studied mathematics or economics at the higher secondary level to pursue financial analysis.

Yes, in India, a number of eminent institutions and universities offer their courses in financial analysis and management in the fully online (or OL) mode upon receiving the due accreditation from UGC-DEB. These courses which are from accredited colleges and universities are completely valid and recognized as possessing equivalent value as regular courses in finance.

Idea Alchemist / Concept Creator / Insight Generator

We are an online education platform where users can compare 100+ online universities on 30+ X-factors in just 2 minutes. With an active CV community, we have transformed online learning to quite an extent. With the CV Subsidy scheme, we contributing to GER in India while helping our learners with their finances in their “Chuno Apna Sahi” journey!

Every query is essential.

Our team of experts, or experienced individuals, will answer it within 24 hours.

Recommended for you

Tired of dealing with call centers!

Get a professional advisor for Career!

LIFETIME FREE

Rs.1499(Exclusive offer for today)

Pooja

MBA 7 yrs exp

Sarthak

M.Com 4 yrs exp

Kapil Gupta

MCA 5 yrs exp

or

Career Finder

(Career Suitability Test)

Explore and Find out your Most Suitable Career Path. Get Started with our Career Finder Tool Now!

ROI Calculator

Find out the expected salary, costs, and ROI of your chosen online university with our free calculator.