Expert Interviews

- University Reviews

- Career Guide

Video Counseling

Video CounselingImportant Facts

- Ask any Question - CV Forum

How to Become A Cost Accountant (Step by Step Guide 2026)

College Vidya Team Jan 23, 2026 1.1K Reads

Cost accounting is a crucial career field in the domain of the BFSI sector, which revolves around the optimization of costs for enterprises and organisations through recording costs, analyzing them, and identifying channels of cost control and optimization. As a career domain, it is one of the most lucrative ones in India in the financial sector, and offers opportunities across several industries, including those like healthcare, IT, consulting, FMCG, public sector units, and so on.

Given this context, many aspirants and professionals turn to the career of a cost accountant in India by taking up relevant courses. In this blog, we provide an outline of how to become a cost accountant in India, along with important metrics about compensation, growth trajectory, and so on. So, continue treading to learn more about cost accounting as a career in India.

Why Choose a Career in Cost Accounting?

There are a number of key considerations to make when considering a particular career. There are often a number of pros and cons associated with a career, and it is important to weigh them before selecting a particular career. Herein, we have elaborated upon a few of the key reasons to consider becoming a cost accountant.

- Cross-Industrial Demand: Some of the high-grossing industries like the retail sector, IT sector, BFSI sector as well as FMCG sector provide scope of employability to cost accountants, making their role well-demanded across a number of industries.

- Compliance Needs Leading to High Job Demand: As financial and legal regulations and compliance needs are becoming more complex and stringent, organisations require well-trained cost accountants to meet their cost audit requirements and compliance with respect to taxation laws, corporate regulations etc.

- Vast Opportunities for Consulting: Cost accountants also get the opportunity to indulge in entrepreneurial ventures, start their own consulting firms and explore freelance opportunities in addition to full-time roles.

- Lucrative Salary Potential: Cost accountants have the scope of earning lucrative packages in their professional journeys as the domain is well-paid in itself and expansive at the national and global levels.

- Stability of Career: Not only is the professional demand for cost accountants on the rise, both financial management and cost control are relatively stable and critical for businesses, which translates to greater job security for a cost accountant.

Roles & Responsibilities of a Cost Accountant

The role of a cost accountant revolves around the holistic assessment of the costs incurred by an organisation/enterprise, as well as an evaluation and management plan to control and optimise them further through research, analysis, forecasting and so on.

Some of the primary job responsibilities of a cost accountant have been elaborated upon below.

Key Skills Needed for Cost Accounting

The key skills needed to thrive as a cost accountant revolve around knowledge and expertise in functional areas of banking and cost accounting, along with a strong suite of soft skills, which have been elaborated below.

1. Technical Skills & Knowledge to Succeed as a Cost Accountant

Technical or functional competence is essential for success in any job role, and in the case of cost accounting, it becomes further critical for success in the role, allowing the professional to thrive and expand their expertise.

Some of the key skills needed by cost accountants to succeed in their role are enlisted below.

|

Key Skills |

Specifications |

|

Cost Accounting |

Being well-versed with concepts and principles of standard costing, job costing, activity-based costing, etc., and applying them efficiently in the cost management of organisations. |

|

Financial Analysis & Reporting |

Being proficient in financial statement analysis, profitability assessment and analysis, variance analysis, etc., as well as creating impactful and comprehensible cost reports, budgets, and forecasts. |

|

Taxation & Regulatory Guidelines |

Knowing the latest taxation and regulatory guidelines, such as those related to GST, indirect and direct taxes, corporate financial regulations, and acts and laws surrounding the same. |

|

Financial Budgeting & Forecasting |

Being adept with financial softwares that allow for conducting operations and capital budgeting as well as read data to forecast future financial trends and needs. |

|

Auditing & Internal Controls |

A cost accountant must have skills in conducting cost audits, internal audits, risk assessments and so on. |

|

Enterprise Resource Planning (ERP) Systems |

Being adept at working in ERP systems like SAP, Oracle, Tally, QuickBooks etc. |

2. Soft Skills to Succeed as a Cost Accountant

Soft skills refer to the interpersonal and behavioural areas in which a professional must have an excellent grasp. Strong cognitive skills are also essential for the role of a cost accountant. Some of the important soft skill areas for a cost accountant are mentioned below.

|

Key Skills |

Specifications |

|

Analytical Thinking |

Being able to manage complex and large pieces of data to break them down systematically into workable components, as well as analysing to arrive at meaningful solutions. |

|

Attention to Detail |

Having a keen eye for details which in turn enhances error detection, precision and accuracy in one’s work, all of which are crucial for cost accounting. |

|

Communication Skills |

Having a grasp over verbal and written communication so as to communicate financial findings, trends, and insights clearly to stakeholders and non-financial teams. |

|

Decision-Making Abilities |

Being adept at arriving at decisions, tolerating ambiguity to identify the best possible alternatives and calmly pursuing high-stakes decisions. |

|

Adaptability |

Having a flexible and adaptive approach towards solving problems encountered at work, including tweaking one’s approach to tasks, effectively tackling unforeseen challenges etc. |

Career Analysis: Scope of Cost Accounting

In this section, we dive into the industrial landscape of the BFSI sector and cost accounting, considering aspects like the career scope of cost accounting, the scope for growth across the years, and related career options.

1. Career Opportunities in Cost Accounting

Individuals who venture into cost accounting in India usually get a formal qualification in cost and management accounting, which opens up doors for career exploration in fields like management accounting, financial analysis, budget analysis, financial consulting, risk analysis, and so on.

Most of these domains are handsomely compensated, with salary packages growing from moderate ranges for freshers to fairly high ranges for experienced professionals. Some of these job roles are mentioned below with their average compensation as per the latest Indian metrics.

|

Career Option |

Average Salary (Per Annum) |

|

Cost Accountant |

INR 6 LPA |

|

Management Accountant |

INR 4.87 LPA |

|

Financial Analyst |

INR 5.11 LPA |

|

Budget Analyst |

INR 10.5 LPA |

|

Tax Consultant |

INR 5.5 LPA |

|

Risk Analyst |

INR 5.99 LPA |

|

Internal Auditor |

INR 7.09 LPA |

|

Financial Consultant |

INR 7.43 LPA |

|

Public Sector Accountant |

INR 5 LPA |

When it comes to companies that hire cost accountants, the scope is virtually endless in India and beyond. Most organisations today hire professionally trained individuals to look into and manage their expenditures for profit maximization, and this trend is common across industries. Hence., cost accountants are highly valued professionals in not only the BFSI sector but also IT sector, healthcare, consulting services and so on.

Some of the top recruiters for cost accountants are mentioned below.

- Deloitte

- Amazon

- Boston Consultancy Group (BCG)

- McKinsey & Company

- Goldman Sachs

- IBM

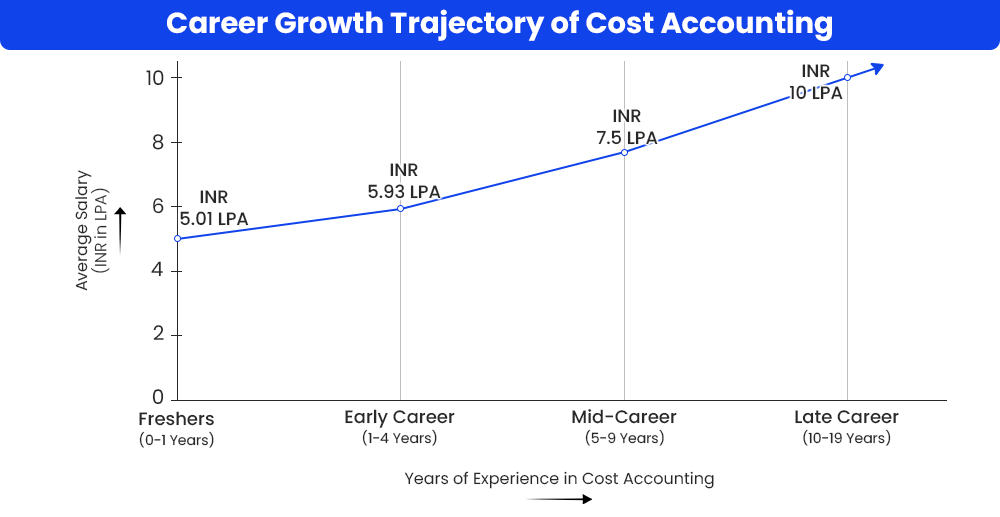

2. Career Growth Trajectory of Cost Accounting

The growth trajectory that a field can potentially offer is an important factor to consider before making an irreversible career decision. For cost accounting, the overall scope in terms of growth is fairly vast, as freshers can start with decently high compensation packages and grow their way to handsome salary packages with gained experience. Further, starting with executive or entry-level roles, qualified cost accountants can climb their way up the career ladder to leadership roles in their domain.

The projected growth trajectory for the role of a cost accountant is illustrated below based on current statistics for the role.

Career Navigator: What Course to Pursue for a Career in Cost Accounting?

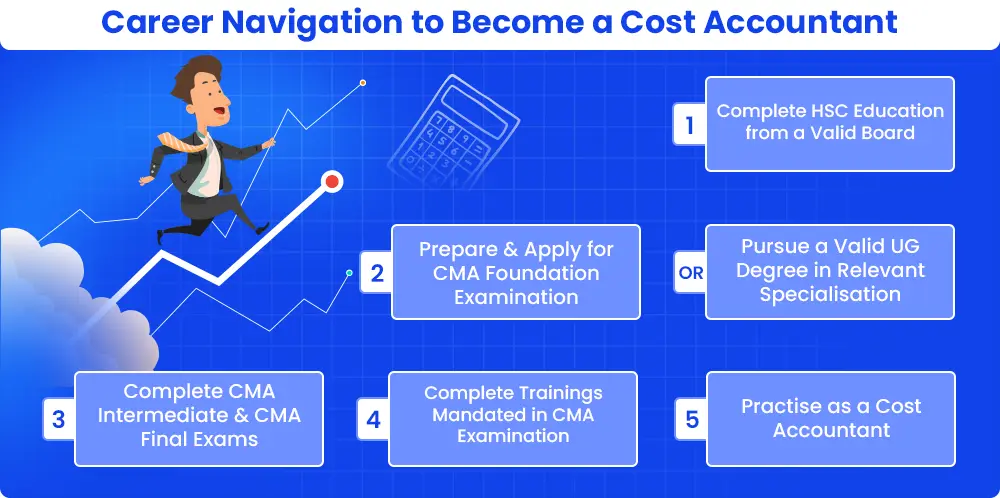

To practise professionally as a cost accountant, a formal qualification in the domain of cost and management accounting is required. While having a commerce stream is not a mandatory criterion for venturing into cost accounting, a background in commerce helps build a strong foundation for further studies in CMA.

The most well-recognised course for cost accountants is the Cost and Management Accounting or CMA program offered by the ICAI in India. This qualification requires the candidate to complete three levels of the program- the Foundation exam (eligibility: after HSC education), the Intermediate exam (eligibility: after qualifying UG or Foundation course) and the Final exam (eligibility: after qualifying the Intermediate Exam). The overall career navigation has been outlined below.

The most eminent institution to become a cost accountant in India is the Institute of Chartered Accountants of India or the ICAI. A number of other public and private colleges also provide Bachelors and Masters degrees in specialisations related to cost accounting, accounting and banking, financial services etc. These institutions have been enumerated below.

Conclusion

Cost accounting as a career path is one of the crucial financial domains in India, allowing for significant exposure and growth opportunities. As already discussed, the available opportunities in the field, the scope for growth as well as the compensation offered in this domain make it a lucrative option for students and aspirants to consider.

FAQs (Frequently Asked Questions)

To become a cost accountant in India, the most popular career pathway is to take up the Cost & Management Accounting (CMA) offered by ICAI in India. To pursue this course, you must have completed at least your HSC education from a recognised board, followed by which you can start the CMA Foundation course. College graduates can directly take up the CMA Intermediate or CMa Final examinations. After completing the CMA qualification, one is eligible to pursue professional roles as a cost accountant.

While having a commerce background at the HSC or UG levels is highly advantageous to pursue a career in cost accounting, it is not a mandatory criteria to take up the CMA course. You can belong to other streams but take up a bridging or training course to train oneself in the essential accounting areas.

On an average, a cost accountant can earn about INR 6 LPA to INR 8 LPA in India with a few years of experience. More experienced professionals can make anywhere between INR 10 LPA to INR 12 LPA as latest statistics indicate.

The most well-regarded and recognised course to pursue for becoming a cost accountant is the Cost and Management Accounting or CMA course offered by the Institute of Chartered Accountants of India (ICAI), which consists of three phases- Beginner, Intermediate and Final examinations.

Yes, you can pursue the CMA course after completing grade 12 education from a recognised board. You can apply and clear the CMA Foundation examination for which you are eligible after completing higher secondary education.

Idea Alchemist / Concept Creator / Insight Generator

We are an online education platform where users can compare 100+ online universities on 30+ X-factors in just 2 minutes. With an active CV community, we have transformed online learning to quite an extent. With the CV Subsidy scheme, we contributing to GER in India while helping our learners with their finances in their “Chuno Apna Sahi” journey!

Every query is essential.

Our team of experts, or experienced individuals, will answer it within 24 hours.

Recommended for you

Tired of dealing with call centers!

Get a professional advisor for Career!

LIFETIME FREE

Rs.1499(Exclusive offer for today)

Pooja

MBA 7 yrs exp

Sarthak

M.Com 4 yrs exp

Kapil Gupta

MCA 5 yrs exp

or

Career Finder

(Career Suitability Test)

Explore and Find out your Most Suitable Career Path. Get Started with our Career Finder Tool Now!

ROI Calculator

Find out the expected salary, costs, and ROI of your chosen online university with our free calculator.