Expert Interviews

- University Reviews

- Career Guide

Video Counseling

Video CounselingImportant Facts

- Ask any Question - CV Forum

Online B.Com for CA Aspirants - Flexible & Accredited

Isha Adhikari May 8, 2025 1.2K Reads

The BCom (Bachelor of Commerce) course is one of the common UG programs in which students enroll, especially CA aspirants. The syllabus revolves around topics such as corporate accounting, business law, financial management, taxation, and economics. These subjects are part of this course because the Chartered Accountant's exam structure has questions regarding them. Thus, these courses offer a solid foundation that helps in seamless exam preparation.

In fact, after the post-pandemic situation, UG courses such as the BCom programs are now available in an online mode. The population of the online BCom course enrollees has increased a lot in a few years due to its flexibility, affordability, and most importantly, its recognition from the different regulatory bodies, such as the UGC (University Grants Commission), that ensure its credibility, helping the learners to get into the top recruiting companies or top business schools for further degrees or even for competitive exams such as CA, CFA, CMS, and so on. Furthermore, many recruiting companies welcome this degree while hiring candidates.

However, the main query arises as to whether the online BCom course is valid for those who see their bright future as a reputable Chartered Accountant (CA). Since the course of the regular BCom course and the online BCom course are quite similar when it comes to the course outline or syllabus. Well, other than validation of the online BCom course for the CA exam or its syllabus, is there anything that differentiates these two courses, or is an online BCom course enough to crack one of the toughest exams that is of CA conducted by the ICAI (Institute of Chartered Accountants of India)?

Hold tight! Because all your questions will be answered in this blog. So, let’s get started.

Is Online BCom Valid?

When it comes to the online courses, whether they are UG courses or PG courses, the doubt that arises within the learner’s or candidate’s mind is their validation. These students are still in doubt whether these courses will help them to crack the competitive exams, such as the CA exam. However, after the legal notifications from the University Grants Commission (UGC) and Distance Education Bureau (DEB) end, the enrollment of those students who desire to pursue an online BCom course and also prepare for the CA exam has increased a lot. These degrees are equivalent to those obtained by learning traditionally.

Online education has gained tremendous recognition in this regard over the last few years. Employers nowadays look forward to the skills a candidate possesses rather than their mode of education. The online courses are flexible, which lets the CA students prepare easily for the exam while gaining a bachelor’s degree.

So, yeah, those who are thinking of opting for the online BCom course while preparing for the CA exam are on the right track. Moreover, the syllabus of the online BCom course is designed in such a way that it includes all the subjects that are going to help you in the CA exam prep and ace the exam.

What are the Types of Online BCom Courses?

The different types of online BCom courses available include the online BCom course (General), which covers a wide array of subjects related to commerce, such as English, accounting, economics, and so on. BCom Honours, on the other hand, is specialized in a specific subject such as cost accounting, business law, taxation, and so on. In this type of online BCom course, the professional courses, CA, CS, or CMA, with subjects on practical issues, such as taxation, financial management, and auditing, are also incorporated into the curriculum.

What are the Different Modes of BCom Degrees Available?

While students may pay different attention to formats for the completion of the BCom degree, there are still a few divisions to consider. A regular or on-campus BCom mode implies classroom-oriented education with the traditional systems of timetable and attendance. Distance mode means very little teacher-student classroom interaction, since students attend the classes on the weekend and then study on their own most of the time and appear in the exam at different centers. The online mode completes all transactions relating to lectures, notes, exams, and assignments digitally and truly provides maximum flexibility, especially to those students who are also preparing for competitive exams such as CMA, CA, or CFA.

Every mode has its positives and negatives; however, for CA aspirants, the online mode enhances their time management. Let’s have a look at each of the modes one by one:

- Regular BCom Program: The regular BCom course is a UG program with a course span of 3 years. This is one of the traditional UG courses that is opted for by commerce students, especially those who want to make their future in the commerce field or prepare for the CA exam. The regular BCom program is one of the best modes of study since it includes teacher-student interaction, making it easier for the students.

- Distance BCom Program: The BCom distance education program is a remote UG course in bachelor of commerce. This bachelor’s degree program is quite similar to the regular mode, but there is only one condition: enrollees have to attend the weekend or evening classes to gain insights about this course. It is more flexible than the regular B.Com. Of course, working professionals or CA aspirants can easily adjust their work or study schedule accordingly.

- Online BCom Program: The online BCom course is one of the most modern approaches to pursuing the BCom degree. The reason is that it is more flexible, affordable, and convenient as compared to the traditional BCom course and BCom distance education. Since it allows the student to learn the course at their own pace.

What are the Eligibility Criteria for Online BCom for CA?

The eligibility criteria for an online BCom for CA are that the candidate needs to complete their 10+2 from a recognized board to enroll in an online BCom program. However, most universities would generally ask for a minimum of 50% marks, although this may vary. Some institutions might also have entrance tests that are required to be passed by the candidate to get enrolled in the BCom program of a particular university, other than your 12th-grade marks, but in general, admission is based on the 12th-grade performance.

Is an Online B.Com degree Necessary for CA?

Well, it is not a complete truth that it is important to pursue an online BCom course to pursue a CA degree. These days, you can become a chartered accountant without an online BCom course. Since any stream student may enter the CA course after completing their 12th examination. However, most of the students find it helpful to do an online BCom course alongside CA since the subjects and topics covered in the online BCom course are quite similar to the syllabus of the CA exam, which helps them to better understand CA subjects. Also, it may work as a backup as well as an alternative job option if you decide against completing CA.

Can I Do an Online BCom Course and CA Together?

Combining the online BCom course isn’t mandatory, but if you do, then voila, you are opening a gate of golden opportunity for yourself. Since this combo will strengthen your CA prep, and that’s why many students do this, combining an online BCom course with CA allows one to take the same subjects in both courses. Doing both together saves effort and time. An online BCom course is very beneficial for CA aspirants because it provides flexibility in a schedule, allows one to focus much more on CA studies, and avoids the hassle of going to daily college lectures. Time management is critical when pursuing your bachelor’s degree and CA exam preparation.

Best Online BCom Colleges for CA Aspirants in India

India has top colleges that provide the best online BCom courses. From providing quality education and the best learning management systems to the students to seamlessly complete their online BCom journey, these universities have everything that stands out from the other colleges and universities. Here is the list of the top online BCom colleges and their fee structures:

|

Top Online BCom Colleges |

Fee Structure (INR) |

|

INR 15,000/sem |

|

|

INR 18,000/sem |

|

|

INR 16,500/sem |

|

|

INR 16,500/sem |

|

|

INR 8,320/year |

|

|

INR 2,666/sem |

|

|

INR 20,000/sem |

|

|

INR 9,500/sem |

|

|

INR 9,000/sem |

|

|

Mizoram University Online BCom |

INR 12,000/year |

- Note: This is the general information about the best online BCom colleges and their fee structure (excluding registration and exam fees). Also, for more details, you can directly visit the official websites of these universities or colleges.

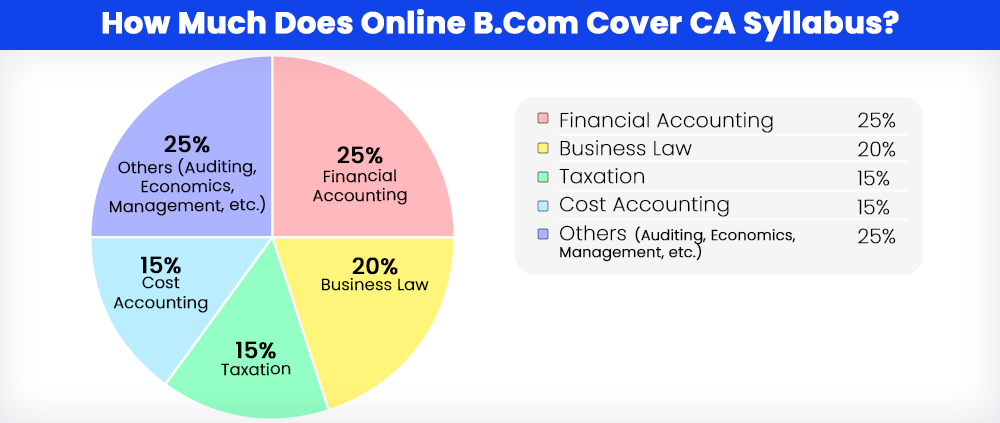

Syllabus of Online BCom for CA

The syllabus of an online BCom for CA consists of subjects that are directly related to the commerce field and to strengthening your foundation for the CA exam, such as tax accounting, business law, economics, and so on. Here is the structured form of the course outline or syllabus of the BCom for CA program:

|

Semester - 1 |

Semester - 2 |

|

|

|

Semester - 3 |

Semester - 4 |

|

|

|

Semester - 5 |

Semester - 6 |

|

|

- Note: This is the general information about the syllabus for online BCom courses semester-wise. For more details, you can directly visit the official websites of the particular university in which you are planning to enroll.

Pattern of CA (Chartered Accountant) Exam

The chartered accountant (CA) exam is one of the toughest exams to crack that needs dedication as well as smart strategy and that’s why it is mandatory for the candidates to thoroughly check the pattern of the CA (Chartered Accountant) examination to have prior knowledge about the upcoming exam.

The CA exam consists of 3 levels: CA Foundation, CA Intermediate, and CA Final. Each exam has a different number of questions that contain both subjective and objective questions to check the ability and knowledge of the candidates about the commerce field. Let’s have a look at the exam pattern for each level one by one:

- CA FOUNDATION: The CA Foundation Exam is the first step towards the journey of becoming a successful Chartered Accountant (CA). Earlier, it was known as the CA CPT (Common Proficiency Test) exam, and it is conducted by the ICAI (Institute of Chartered Accountants of India). It is a national-level exam that is conducted thrice a year in offline mode. With an easy-to-moderate difficulty level, this exam is divided into 4 papers. Let’s know about each section in detail:

|

No. of Paper |

Exam Topics (Section Wise) |

|

PAPER: 1 |

Accounting |

|

PAPER: 2 |

Business Laws |

|

PAPER: 3 |

Quantitative Aptitude

|

|

PAPER: 4 |

Business Economics |

Each paper contains 100 marks (400 marks for all the papers), and Papers 1 & 2 will contain subjective questions with a time limit of 3 hours, and Papers 3 & 4 will contain objective questions with a time limit of 2 hours. There is no negative marking for Papers 1 & 2 (Subjective Part), but for Papers 3 & 4 (Objective Part), there is a negative marking of -0.25 marks for each wrong attempt.

Note: The candidates can answer the exams either in hindi or english laguage however, the section b (logical reasoning) will be attempted in English only.

- CA INTERMEDIATE: After passing the CA Foundation exam, candidates have to attempt the CA Intermediate exam. This exam has 6 sections of 100 marks each (600 marks in total). Overall, this exam is a blend of subjective as well as objective questions, with a weightage of 70% subjective questions and 30% objective questions (MCQs/case studies). Let’s learn more about the marking scheme and exam pattern from the following table:

CA Intermediate Marking Scheme

|

Paper |

Marks Distribution |

|

GROUP - 1 |

|

|

PAPER: 1 Advanced Accounting PAPER: 2 Corporate & Other Law PAPER: 3 Taxation

|

100 Marks 100 Marks 100 Marks (50 marks for each part) |

|

GROUP - 2 |

|

|

PAPER: 4 Cost & Management Accounting PAPER: 5 Auditing & Assurance PAPER: 6 Financial Management & Strategic Management

|

100 Marks 100 Marks 100 Marks (50 marks for each part) |

CA Intermediate Exam Pattern

|

CA Intermediate Exam Pattern |

|||

|

Papers |

Subject |

Subjective |

Objective |

|

PAPER: 1 |

Advanced Accounting |

70 Marks |

30 Marks |

|

PAPER: 2 |

Corporate Laws |

70 Marks |

30 Marks |

|

PAPER: 3 |

Cost & Management Accounting |

70 Marks |

30 Marks |

|

PAPER: 4 |

Taxation |

70 Marks |

30 Marks |

|

PAPER: 5 |

Auditing & Code of Ethics |

70 Marks |

30 Marks |

|

PAPER: 6 |

Financial Management |

35 Marks |

15 Marks |

|

Strategic Management |

35 Marks |

15 Marks |

|

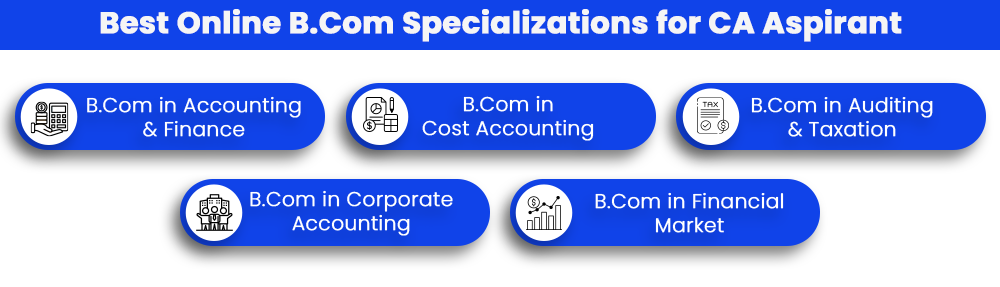

Which Online BCom Is Best for CA Students?

Being a CA aspirant with a strong desire for an online BCom course, it becomes crucial to choose the right specialization so that your transition process is smoother. It speaks volumes considering the syllabus of CA; hence, the choice of subjects in the online BCom course has to be strongly related to the CA rather than adopting what might seem unrelated topics.

|

Top Specializations in Online BCom Course for CA Aspirants |

|

| Online BCom in Fintech | Online BCom in Banking and Finance |

Does Online BCom CA Have Scope?

Definitely. An online BCom course combined with CA will surely prove beneficial, as it involves less time consumption and equips one with the skill set relevant for the CA examination, while at the same time serving as a backup degree that may be helpful to get job opportunities in the fields of finance, accounts, and taxation. If you are someone who has a doubt about CA, an online BCom course still counts toward recognition in any job market.

What is the Salary of a CA in India?

The earning prospects of a chartered accountant (CA) are highly influenced by experience, the presence of skills, and the organization for which you are working. Freshers currently earn between Rs. 6 to 8 lakhs annually. After gaining 5 to 10 years of experience, they fall in the salary range of Rs. 12 to 20 lakhs per annum. However, those who have spent a considerable amount of time in the industry can make more than Rs. 25 lakh per annum for top firms or international roles.

Conclusion

It's an intelligent option to pursue an online BCom course for the aspirants of CA. It gives more flexibility, more time in relevant subjects, and helps in better time management. Also, in case you are unable to crack your CA exam, then also an online B.Com course is a good option that provides you with wide career opportunities. Choose a recognized university, keep scheduling your classes cleverly, and maintain consistency. With effort, you might be able to pass your CA examination and earn a really good degree.

FAQs (Frequently Asked Questions)

Yes, it is valid in every way. An online BCom course is considered valid for CA studies as long as the university offering it is approved by the regulatory bodies such as the University Grants Commission (UGC) and Distance Education Bureau (DEB).

Definitely! In fact, a lot of students do it together. And it is this flexible nature of the online BCom course that supports CA studies alongside your UG syllabus of the online BCom course.

An online BCom course usually includes subjects like accounting, business law, taxation, and economics, all of which come in very handy when preparing for the CA exam.

It is true that while its syllabus is helpful for CA preparation, it still requires one to read through other materials provided by ICAI meant for the CA exam. But yes, an online BCom course builds a strong foundation that helps you strengthen your foundation for the CA exam.

The biggest advantage of pursuing an online BCom course with a CA exam would be flexibility in managing one's time and focusing more on CA studies while getting a graduation degree at the same time.

Definitely, An online BCom course opens jobs in finance, accounting, banking, and even the government sector. So, yeah, even if you are unable to crack the CA exam, you still have many other options in which you can build your career and can earn a high salary package.

Yes, an online BCom course is recognized by the employers as long as your course is from a UGC-approved university; employers accept it like any other regular degree.

You should go for online BCom courses in the specializations of accounting, finance, cost accounting, or taxation. These subjects will help you a lot in the CA exam prep.

The fees of an online BCom course in India vary from university to university, but on average, it costs around INR 2,000 to INR 20,000 for a semester.

Well, the online BCom course is not easier but more flexible than the regular Bcom program in that you can learn at your own pace with no forced daily college schedules.

Well, both the online BCom course and the regular BCom course hold the same credibility. However, in your degree, it will be mentioned in your degree certificate that you have pursued an online BCom degree.

Yes, the online BCom courses include live lectures, recorded lectures, and digital study material that helps the learners (especially those who are working professionals or preparing for their CA exam).

3 Years of Experience / Narrator

With 3 years of experience in content writing and copywriting and keen interest in voiceover and scripting, I, Isha Adhikari, am passionate about content creation and narration.

Every query is essential.

Our team of experts, or experienced individuals, will answer it within 24 hours.

Recommended for you

Tired of dealing with call centers!

Get a professional advisor for Career!

LIFETIME FREE

Rs.1499(Exclusive offer for today)

Pooja

MBA 7 yrs exp

Sarthak

M.Com 4 yrs exp

Kapil Gupta

MCA 5 yrs exp

or

Career Finder

(Career Suitability Test)

Explore and Find out your Most Suitable Career Path. Get Started with our Career Finder Tool Now!

ROI Calculator

Find out the expected salary, costs, and ROI of your chosen online university with our free calculator.