Expert Interviews

- University Reviews

- Career Guide

Video Counseling

Video CounselingImportant Facts

- Ask any Question - CV Forum

Role of Foreign Banks in Indian Banking System

Kumkum Tamang Sep 27, 2024 1.4K Reads

Foreign banks have played a significant role in shaping the Indian banking System.Their entry into the Indian market has brought in new capital, advanced technologies, and international best practices.

By offering a wide range of financial products and services, foreign banks have contributed to increased competition, improved customer service, and the overall development of the Indian banking sector.

Background

In the list of foreign banks in India, Hong Kong and Shanghai Banking Corporation (HSBC) is the oldest, established in 1853 also known as the 'Mercantile Bank of India'. During the British regime, foreign banks, such as Standard Chartered Bank, were in the country. In 1991, a committee called 'The Narasimha Committee Report' provided a path for foreign banks to open fully-owned banks, subsidiaries, or joint venture banks.

Furthermore, in 2005, the RBI also released a roadmap for the presence of foreign banks in India. To make sure that there is fair competition in the banking industry. It also gave insight into how the banking system in India should look in the coming decades to be very precise.

RBI basically provided ways for foreign banks to enter India. In 2005 only, RBI proposed the 'twin tracks' method which means two ways foreign banks can enter the Indian Banking system;

- Branch presence model

- Wholly owned subsidiary model

Indian Banking System

Let's understand the term banking first, banking is getting deposits as the savings from the public in low interest and lending money with high interest. For the economic development of a country, banking plays a crucial role. Indian banking system includes a varied range of Indian banks that provide financial services to the public, businesses, and governments.

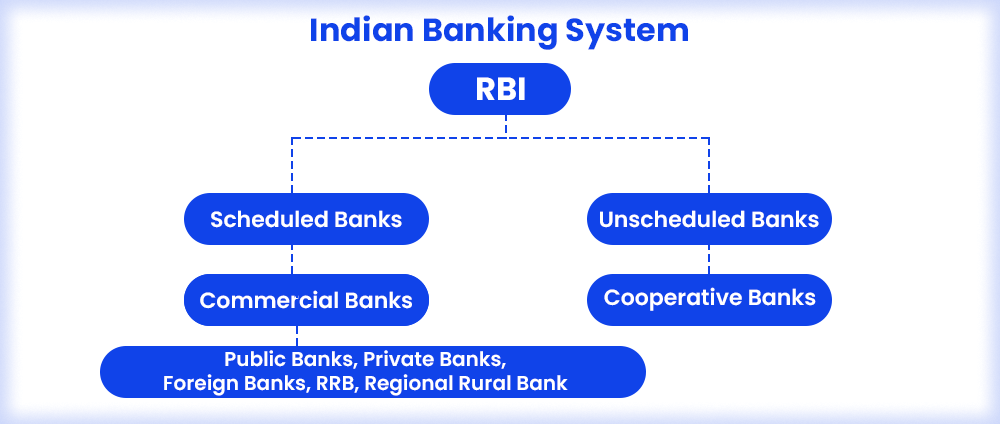

The Reserve Bank of India (RBI) also comes under the Indian banking system. Money is the main factor of any growing startup or a well-settled organization, banks provide a flexible place for them to continue their businesses strategically. The main key factor of the Indian banking system includes the RBI, RBI is furthermore divided into two parts; Scheduled Banks and Unscheduled Banks. Scheduled banks are those banks that are registered by the IInd schedule of the RBI Act. These banks required a minimum 0.5 million reserve and followed RBI guidelines correctly.

Moreover, scheduled banks are divided into Commercial and cooperative banks. Commercial banks work the same as normal banks which mainly focus on the public sector. Banks covered in this sector are as follows;

- Public Banks: State Bank of India (1860), Bank of Baroda, Punjab National Bank, Bank of India, Union Bank of India, etc.

- Private Banks :HDFC bank, ICICI bank, Kotak Mahindra Bank, Axis bank, IndusInd bank, etc.

- Foreign Banks :Standard Chartered Bank, Citibank, Royal Bank of Scotland, BNP Paribas, Bank of America, etc.

- RRB :Andhra Pragathi Grameena Bank, Chhattisgarh Rajya Gramin Bank, Utkal Grameen Bank, Andhra Pradesh Grameena Vikas Bank, etc.

Foreign Banking System

The foreign bank provides financial services to customers outside its home country. The main head office of these banks is in another country, and they provide the facilities to the citizens of India. They basically open a varied range of branches in other countries.

Foreign banks need to follow the rules and regulations of their parent company as well as the host country. These banks are known as the foreign branch banks in India. The loan limits of these banks are completely based on the capital of foreign bank branches in India. Now, let's try to understand this with some top foreign banks in India;

Standard Chartered Bank's extensive network of 96 branches across India ensures widespread accessibility to its banking services first established in Africa. The name Standard Chartered Bank is a combination of two banks, Standard Bank (from Africa) and Chartered Bank (from India). The bank's headquarters is in London, UK.

Hong Kong and Shanghai Banking Corporation (HSBC) consists of 50 branches in India. The headquarters is in London, UK only. HSBC acquired the Mercantile Bank of India and brought the first-ever ATM facility in India (1987). It is the most successful foreign bank in India. HRBC is the third-largest owned bank in the world.

Citibank has 42 branches in 40 cities with more than 70 ATMs in India. In 1902, Citibank began operations, making it one of the oldest foreign banks in India, with a history of 119 years. It provides several financial services and lends money to foreign investors in India.

Advantages of Foreign Banks in India

With the presence of foreign banks in India, technology, employment, and foreign exchange have developed massively which helped in the healthy increase in competitiveness of the Indian banking sector.

As we have already discussed how HSBC first introduced the ATMs in India. The quality of policies and facilities in banks is also getting better in the Indian banking system. Below we have discussed the major advantages of foreign banks in India.

- Greater Investment Ability:Foreign banks usually come with a larger capital base, that provides people to have economic growth. It allows people and the host country to have better opportunities with more capital flow. Foreign banks have better risk management techniques, which makes them more trustworthy and advanced as compared to the local banks that protect the financial system of the country.

- Technology Advancements :With the help of advanced technology, the Indian banking system has come a long way. Foreign banks provide the best advanced technical support to their customer in order to provide a premium customer experience, this developed the overall performance of the Indian banking system. Technology advancements like, easy accessibility, convenience, good quality customer experience, and digital banking have brought advanced technology and best practices to the Indian banking sector.

- Global Access:As the name itself indicates the involvement of the international finance system, foreign banks open the door for the Indian public to have experience in a wide range of financial products and services. It also offers a varied range of foreign currency in the country.

Challenges faced by Foreign Banks in India

Despite the varied range of advantages foreign banks need to face several challenges, which we have discussed further.

- Cultural differences:Due to the different origin countries, foreign banks sometimes need to face challenges as the customer may have various expectations. It may include language barriers, Social norms and customs, religious and cultural sensitivity, and decision-making styles.

- Competition from Domestic Banks:Foreign banks have to face constant competition with local or domestic banks available in the market as the local banks already have strong customer connections and a wider range of branches. This automatically increases the level of competition for foreign banks.

- Strict RBI Policies:Foreign banks need to qualify for all the RBI policies. It includes an initial minimum amount for the equity capital for WOS is 5 billion rupees, only those banks will be permitted who have a set up of Wholly Owned Subsidiaries (WOS), and many other strict RBI policies.

Role of Foreign Banks in India

Now, let’s discuss some major roles of foreign banks in the Indian banking system.

- Generation of Employment Opportunities :Foreign banks provide a varied range of career opportunities in business process outsourcing (BPO) sectors and the banking sector. As India is an emerging technology service provider with and maximum no. of English-speaking graduates, it gives acceleration to the BPO sector and increases employment generation.

- Foreign Capital Flow:The main motto of foreign banks is to have a huge market base in all the countries around the world and dealing with multinational corporations is helpful in bringing foreign capital flow in India as an investment destination.

- Competition in the Banking Sector:At first domestic banks in India had the same policies and facilities, but due to the foreign banks' new and advanced policies Indian banking system got the opportunity to improve the banking system for good.

Conclusion

In this blog, we have thoroughly discussed foreign banks as a whole. We are now well aware of the fact that foreign banks play a crucial role in the Indian banking system. Despite facing multiple challenges, foreign banks bring positivity to the system. It also increases the healthy competition among domestic and foreign banks which eventually enhances the quality experience of the Indian customers.

FAQs (Frequently Asked Questions)

In all sectors, banks play a crucial role in each individual's life and business. People need to buy things they need and make payments for their expenses. The bank connects customers with the policies and facilities across the country and overseas.

The World Bank mainly works for the public and private sectors. It majorly includes the living quality, economic condition, and supporting the government of the developing or poor countries. In India World Bank universalized primary education, empowering rural communities, combating diseases, and revolutionizing agriculture.

International banks play a vital role in the field of finance and international trade. These banks also work in the improvement of financial services in a country will lead to healthy competition between banks, get to know about international standards, and many more. International banks include services like letters of credit, export credit, and foreign exchange.

Foreign banks are like a global citizen, who can travel to places of their choice. In simple words, a foreign bank is a bank that operates in countries other than its home country. It's like a bank that travels and offers its services to citizens of different countries.

Functions of Foreign banks include; Banking services, Currency exchange, International clients, Insurance and credit lines, and many more.

3 Years of Experience / Narrator

Dedicated writer with a passion for research and creativity.

Every query is essential.

Our team of experts, or experienced individuals, will answer it within 24 hours.

Recommended for you

Tired of dealing with call centers!

Get a professional advisor for Career!

LIFETIME FREE

Rs.1499(Exclusive offer for today)

Pooja

MBA 7 yrs exp

Sarthak

M.Com 4 yrs exp

Kapil Gupta

MCA 5 yrs exp

or

Career Finder

(Career Suitability Test)

Explore and Find out your Most Suitable Career Path. Get Started with our Career Finder Tool Now!

ROI Calculator

Find out the expected salary, costs, and ROI of your chosen online university with our free calculator.