Expert Interviews

- University Reviews

- Career Guide

Video Counseling

Video CounselingImportant Facts

- Ask any Question - CV Forum

What is Financial Management? - Role, Scope & Nature

Kumkum Tamang Sep 25, 2024 1.2K Reads

In this blog, we have thoroughly discussed financial management, the objectives of financial management, the career scopes or functions of financial management, and the types of financial management.

Any startup, business, or organization requires a well-planned financial strategy in order to make the roots strong. Not only does it play a significant role in the starting period but throughout the lifetime of a business if the organization is completely built up and manages its finances in a way that helps in the bigger plans and can make informed decisions for the organization.

What is Financial Management?

Financial management plays a crucial role in the controlling, monitoring, and protecting of an organization's management. In simple words, financial management is a way through which a company takes care of its financial ins and outs, tax management, and profit possibilities.

Managing the budget leads to further work for an organization. Finance managers are responsible for making informed decisions about the organization's resource allocation, investment, and cost management. In simple words, financial management is crucial for the increase of the shareholder's wealth which will eventually increase the long-term availability and growth of the company.

Importance of Financial Management

For an individual with the determination to establish a business, financial management is the most crucial aspect. The excellent knowledge of finance and applying it in the strategic planning of an organization increase the probability of a successful business. Let's discuss the importance of financial management;

In order to get diverse career opportunities in the private or public sector of finance, many career explorers find finance management a good field to invest in. Finance management has given us so many successful entrepreneurs in recent years.

A well-known importance of finance management is that it plans the organization's finances strategically. With the help of finance, comprehensive plans increase the cash flow in the organization.

Organizations can effectively use the resources and funds for investments, stability, and profitability. This helps increase the value of the organization automatically.

By finance management, we get the image of making critical financial decisions that allow the company to manage its resources and funds while minimizing the risk of loss.

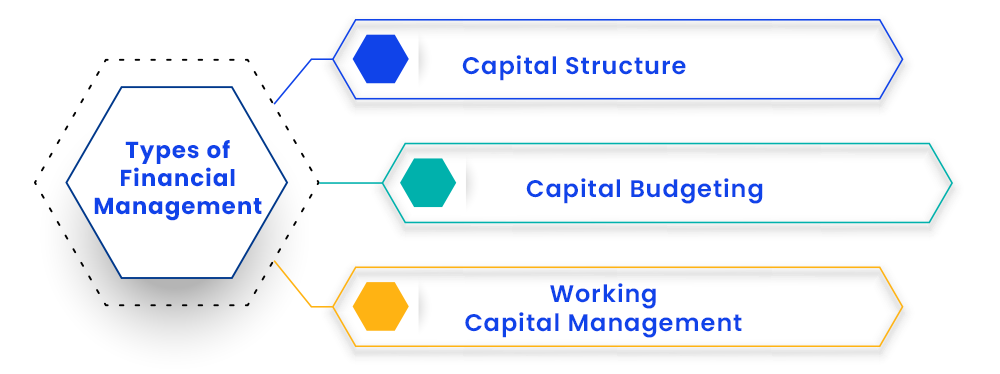

Types of Financial Management

Now, let's dig into the types of financial management;

- Capital structure:Capital structure refers to the mix of long-term sources of financing used by a company. These sources can include equity shares, preference shares, debentures, retained earnings, and loans. The way these sources are combined determines the company's capital structure. Ultimately, the goal of capital structure is to ensure that a company has the necessary funds to achieve its objectives while minimizing the cost of those funds and managing financial risk.

- Capital Budgeting :Capital budgeting is a process of making decisions about long-term investments, such as purchasing new equipment, expanding facilities, or investing in research and development. These decisions are important because they can remarkably impact an organization’s profitability and growth. Capital budgeting is crucial for ensuring that an organization’s investments are profitable with its long-term goals.

- Working Capital Management:Working Capital Management is the third type of financial management that works on the short-term assets and liabilities of the organizations which includes ensuring funds for basic operations. In easy language, we can say that working capital management works as a fund manager of the organization, responsible for short-term investment decisions like paying small bills and keeping an eye on the future needs of the organization.

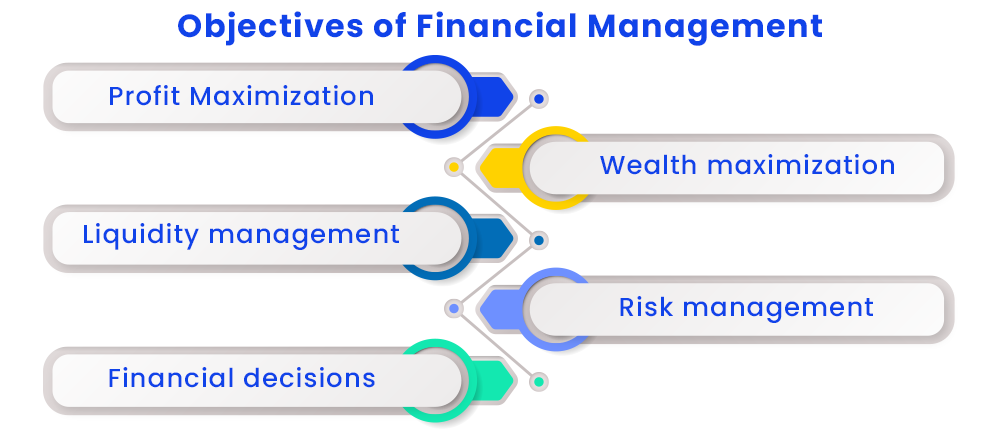

Objectives of Financial Management

Below we have mentioned the main objectives of financial management;

- Profit maximization:Profit maximization is the foremost objective of financial management as it involves taking risks in order to achieve financial goals and business strategy. Profit maximization is all about making possibilities into reality which makes it even more crucial as an objective of financial management. For the company's longevity determining the price, inputs, and outputs profit maximization helps manage all factors.

- Wealth maximization:Wealth maximization is crucial in order to maintain the worth and value of an organization's stockholders' shares. It includes making crucial decisions, worth increment of an organization, investments, etc. The objective is responsible for making the organization's long-term financial goals achievable.

- Liquidity management:Ensuring the organization's need of short-term money requirements for smooth business and the services the bank provides to its corporate customers is known as liquidity management. It is also responsible for the positive working capital. Liquidity management looks after the cash flow of the company.

- Risk management:As the name itself clarifies this objective of financial management includes factors related to controlling financial loss and identification of important organization assets. Making the experience of legal activities smoother and safe risk management not only ensures these but also looks after the strategic management errors, accidents, and natural climatic disasters.

- Financial decisions:Financial decisions taken at the managerial level come under financial management. Finding non-harmful, and profitable ways lies under the responsibilities of financial decisions. Mainly it includes making decisions in investment, financing, and dividends.

Nature of Financial Management

Financial management is about making sure a business has enough money to do what is needed to enhance economic and marketing growth. The nature of financial management is like planning a trip, making a budget, and keeping track of your spending. It’s crucial for businesses to perform and act strategically so they can grow and be successful.

What is the Financial Management Cycle?

The financial management cycle is a process of planning strategies and budgeting for an organization's financial growth and development. It mainly includes planning and budgeting, Resource allocation, operations, and monitoring.

- Planning and Budgeting:Planning in any organization is a must as it helps in the establishment of financial objectives for the next 3 to 5 years. In order to plan everything specifically it is required to set a budget along with the planning including revenue, expenses, cash flow, and debt reduction. How do we get to know how to start executing planning and budgeting? In simple words the budget should be the first approach it's better to start with you having for example revenue and cash flow, then only one should be able to plan accordingly.

- Resource Allocation:As the name itself describes resource allocation is the process of assigning valuable and available resources which can be for projects or tasks in the organization. Allocation of resources in an organization could be a difficult task as it is required to ensure that the resources are used effectively and reduce waste. Quick allocations of resources are the main criteria of resource allocation in the financial management cycle.

- Operations and Monitoring:Monitoring in financial management is to analyze the economic and financial activity of the organization. It's like keeping an eye on activities taking place in the organization. All the operations conducted in the company should be monitored. Whereas operations in finance management refers to the various functions and financial activities of the organization. It also includes budgeting, accounting, and analyzing financial data.

Career Opportunities in Financial Management

After completing the higher secondary, students may go for several career opportunities in the finance field. But what if an individual wants to have a career in finance management only? Let's dig into the most popular and different types of careers in finance management.

1) Auditors

An auditor looks after the company's financial records and ensures that the activities or operations comply with the law. Auditors mainly provide unfiltered opinions on the financial records of the company. They also work in the reporting of any irregularities happening in the organization's premises.In simple words, auditors protect businesses from fraud, illegal activities, and negative account management. The average package of an auditor lies between 50,000 to 60,000 per month.

2) Commercial Finance Manager

Commercial finance managers are also known as business development managers. They basically work towards improving an organization's profit, commercial decision-making, and financial performance. Commercial finance managers are responsible for providing high-quality analysis, making informed decisions, and making an impactful financial performance business of an organization. It also includes quality, productivity, and employee satisfaction as employees are the core strength of an organization. Strong analytical skills are required for this job role.

3) Financial Analyst

Financial analyst mainly works in evaluating financial data, examining current events and market developments, examining an organization’s financial needs, and creating financial planning for great future performance. Most entry-level financial analyst jobs require a bachelor's degree in finance, economics, accounting, and many more. whereas the senior financial analyst position requires a varied range of client contacts, and marketing development ideas to promote the financial growth of a company.

4) Risk Analysts and Risk Managers

Risk analysts are the potential risk identifiers of an organization, they mainly look after the negative effects of risk-related activities. Working as a risk analyst can be a challenging task, as it includes making difficult decisions and risk-related data does not always provide correct solutions. On the other hand, Risk managers evaluates data and make strategies to mitigate negative financial outcomes. Some of the areas that risk managers specialize are credit risk, transaction fraud risk, liquidity risk, tradeable risk, and many more.

Conclusion

In this blog, we have thoroughly grasped what financial management really is! Managing an organization requires a highly qualified team of finance as budgeting out the whole finances of a company is a real deal. furthermore, we have discussed the importance of financial management and how it plays a vital role in a company's management. Ultimately, effective financial management not only supports sustainable business operations but also contributes to long-term value creation, positioning organizations for success in a competitive environment. As such, a deep understanding of its principles and practices is vital for finance professionals and business leaders alike.

FAQs (Frequently Asked Questions)

The main goal of financial management is to make sure of the increase of profit in the organization, it can be financial growth, shareholder growth, and many more. Profit maximization is utilizing the available resources to their fullest.

The 4C's of financial management are as follows;

- Cash flow

- Credit

- Customers

- Collateral

The 4 different types of financial information are as follows;

- Balance sheets

- Income statements

- Cash flow statements

- Statements of shareholders equity

The four steps of financial management include;

- A well-informed Budgeting

- An effective Planning with all the mentioned resources required

- Managing operations in a way that will cover all the activities for the company's growth.

- An Annual report for a clear image of growth and challenges.

The most popular financial management courses are as follows;

- Corporate Finance

- Financial Accounting

- Investment Fundamentals

- Capital Budgeting Decisions

- Financial Management Capstone

3 Years of Experience / Narrator

Dedicated writer with a passion for research and creativity.

Every query is essential.

Our team of experts, or experienced individuals, will answer it within 24 hours.

Recommended for you

Tired of dealing with call centers!

Get a professional advisor for Career!

LIFETIME FREE

Rs.1499(Exclusive offer for today)

Pooja

MBA 7 yrs exp

Sarthak

M.Com 4 yrs exp

Kapil Gupta

MCA 5 yrs exp

or

Career Finder

(Career Suitability Test)

Explore and Find out your Most Suitable Career Path. Get Started with our Career Finder Tool Now!

ROI Calculator

Find out the expected salary, costs, and ROI of your chosen online university with our free calculator.