Starting a career in finance can be a fruitful step forward for those interested in domains related to economy, financial management, financial growth etc. The field of finance is a well-developed domain to explore a career in and there are a vast number of choices of jobs and career paths to choose from in it.

If you are also someone who is searching for or pondering over developing a career in finance and are confused as to which domain to venture into, then this blog

will provide you an easy navigation through some of the top career domains in this field along with pertinent details about the job salaries, top recruiters in the field, benefits of a career in finance and courses to upskill in this domain effectively.

Top Career Options in Finance

Enlisted below is a table that summarises the major well-regarded career options in the field of finance. You May Interested | MBA Online Course In Finance!

|

Job Profile |

Average Salary (p.a.) |

Top Recruiters |

|

Chartered Accountancy (CA) |

INR 8.72 LPA |

Standard Chartered, Deloitte, Ernst & Young, KPMG etc. |

|

INR 8.80 LPA |

JP Morgan Chase, Morgan Stanley, ICICI Bank, Kotak Mahindra, HDFC Bank, Goldman Sachs, Wipro, McKinsey and Company |

|

|

Financial Analyst |

INR 4.86 LPA |

Accenture, Deloitte, Morgan Chase, eClerx, Ernst & Young, JP Morgan & Chase Co |

|

Financial Risk Manager |

INR 10.41 LPA |

Amazon, ICICI Bank, JP Morgan & Chase Co, HSBC |

|

Public Accountant |

INR 6.90 LPA |

Deloitte, PwC, BDO India, Ernst & Young, KPMG, Grant Thornton International |

|

Corporate Finance Officer |

INR 5.35 LPA |

Deloitte, KPMG, PwC, Boston Consulting Group, McKinsey & Company, Ernst & Young |

|

Hedge Fund Manager |

INR 9.81 LPA |

Elliott Investment Banking, Citadel, Goldman Sachs, Yes Bank, Standard Chartered |

|

Wealth Manager |

INR 7.20 LPA |

Edelweiss, ICICI Bank, State Bank of India, Bajaj Capital, Yes Bank, Axis Bank |

|

Insurance and Claims Officer |

INR 5.22 LPA |

Yes Bank, ICICI Bank, HDFC Bank, Axis Bank |

|

Private Equity Associate |

INR 8.27 LPA |

ICICI Venture, ChrysCapital, Bain Capital, Matrix Partners, IDFC First Bank |

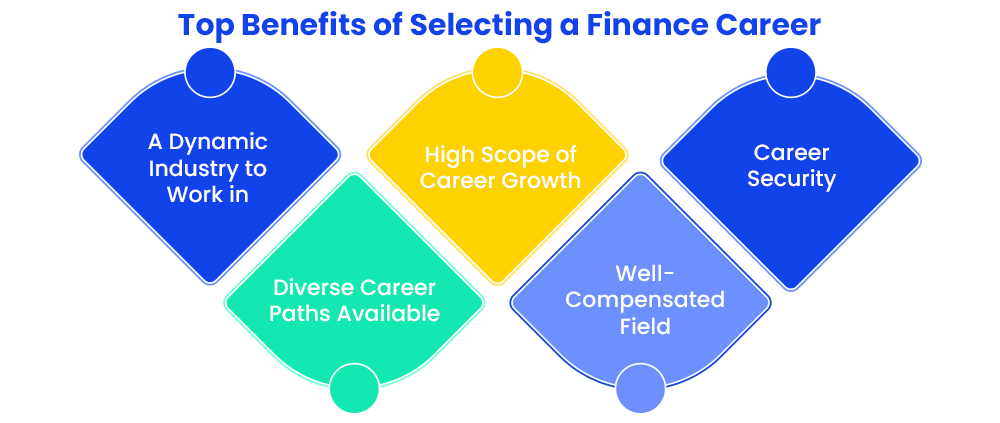

Why Go for a Career in Finance?

The field of finance is central to the development of the economy for any organisation, region or nation. As a result, it is one of those career fields which won’t go obsolete in the future.

While there are many career options and domains available to choose from, finance is one of the most alluring fields to students and professionals alike.

But why is a well-established career in finance so appealing? What are the benefits associated with going for a career in finance? Here, we have enlisted a few of the reasons that account for why finance is such a highly chosen career domain.

- Dynamic and Ever-Changing Industry

The finance industry is constantly shifting shapes and evolving to venture into new avenues and carve out new career paths for finance professionals. Due to the dynamicity of this field, many students and professionals prefer to venture into the field for opportunities of career growth and exploration of novel career avenues.

- Diversity of Available Career Paths

Since the industry of finance is ever-evolving and quite dynamic, it is finding new use cases and new modalities of operations continuously. As a result, new job domains are emerging in this field in addition to a diverse avenue of existing career paths and job options. This makes finance one of the most flexible and appealing industrial domains for developing a career in.

- Scope of Career Growth

The job domain of finance is not only well-paid but also offers scope for career growth. The field being dynamic and evolving, students and professionals get multiple opportunities to upskill themselves as well as climb up their career ladders with experience. This comes as an added benefit for those seeking intrinsically motivating jobs that allow for the development of one’s self and career and prevent stagnation.

- Well-Compensated Field

When it comes to establishing a successful and meaningful career, the pay and compensation is understandably a crucial deciding factor. Finance is a well-established career domain in India and abroad and owing to its centrality in the very development of the economy, is highly compensated. The job roles in financial fields are not only highly paid but also very fairly compensated with respect to perks and other benefits.

- Stable Domain of Career

Finance is one of the fields that is expected to remain ever viable and relevant owing to its fundamental role in the running and management of the economy and commercial activities. Thus, as a field of career development, it is quite a safe and promising option since the field is expected to transform radically and expand to unchartered avenues in the future.

Thus, it can be seen that finance is quite promising as a career field and can be quite beneficial to one’s career journey. There are a number of highly regarded job roles and domains that can contribute to the meaningful growth of one’s career. You May Interested | MBA Online Course In Banking and Finance!

Top 10 Career Options in Finance

Read more to find out some of the most valued career domains in finance and other pertinent details related to them.

1. Chartered Accountancy

Chartered accountancy is one of the most valued careers related to finance and commerce in India and abroad. It is also one of the most challenging qualifications to complete, as it involves a rigorous course curriculum. The key aspects of the job of a CA include updation and auditing of accounts, preparation of financial reports and statements of organisations, income statements etc. This field is very well-paid and with significant scope of career growth.

- The average salary that a chartered accountant in India can earn is between INR 8.5 LPA to INR 9 LPA, with significant raises with experience.

- The top recruiters of CAs include those like Standard Chartered, Deloitte, Ernst & Young, KPMG etc.

2. Investment Banking

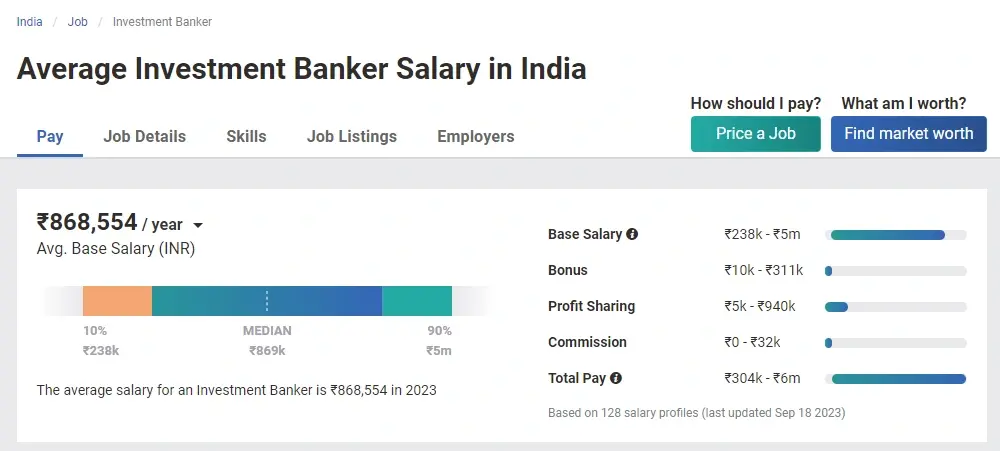

Investment banking is one of the most lucrative and valued job roles in the financial sector. It is concerned with the support provided by the investment banker with respect to consultation, data driven insights and smart decisions about investments to companies. It is a greatly revered field for career development among commerce students and professionals. The field is highly paid and students can experience significant growth rates in investment banking with growing years of experience.

- The salary packages in this field range from INR 8.5 LPA to Inr 9 LPA in the initial roles. Significant salary hikes and promotions can be expected with 2 to 3 years of professional experience.

- Some of the top hiring firms for investment bankers include Goldman Sachs, Morgan Stanley, ICICI Bank, Kotak Mahindra, HDFC Bank etc.

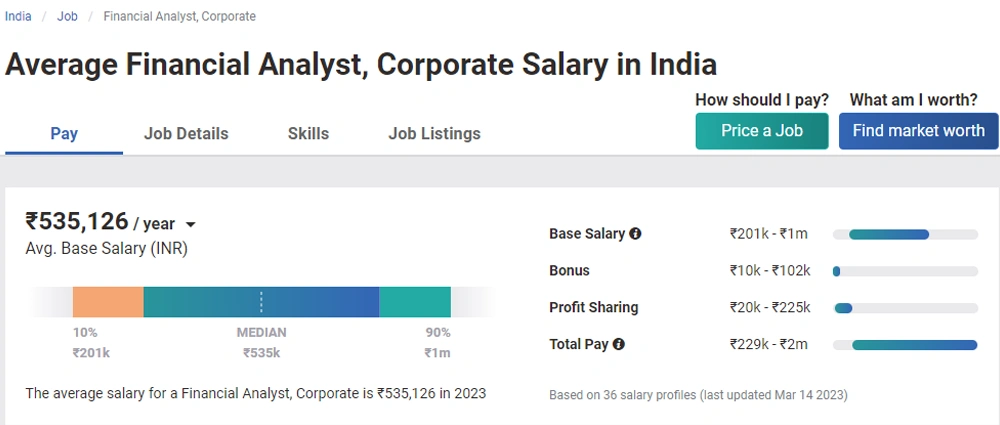

3. Financial Analyst

A financial analyst is a professional who manages and prepares detailed yet comprehensible financial reports of a company’s funds, investments, sales, business trends etc. Financial analysis is among the top paid job roles in the field of finance. This requires the student/professional to possess skills related to financial reporting, financial modelling, operational efficiency etc.

- While the initial salary packages for a financial analysts are in the range of INR 4.5 LPA-INR 5 LPA, the field of financial analysis offers significant chances of promotions and career escalation with experience.

- A few of the key recruiting companies for financial analysts include Morgan Stanley, JP Morgan and Chase, Deloitte, Accenture, eClerx etc.

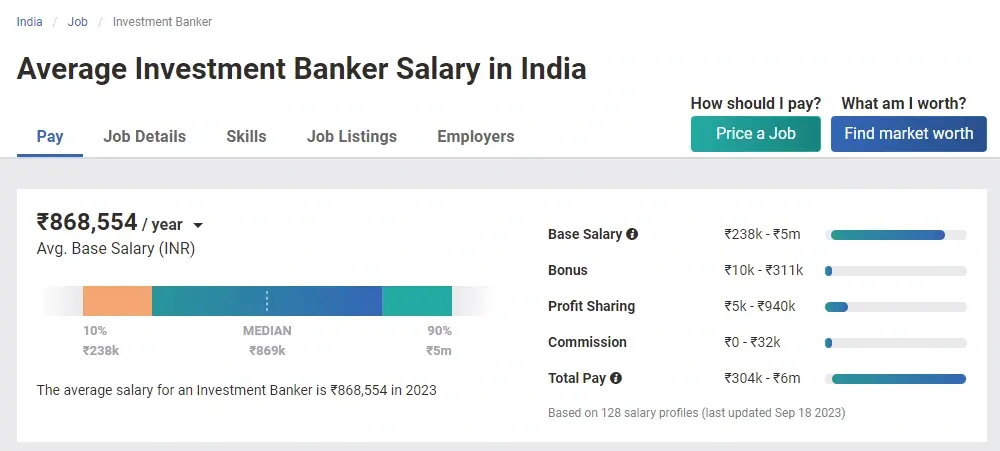

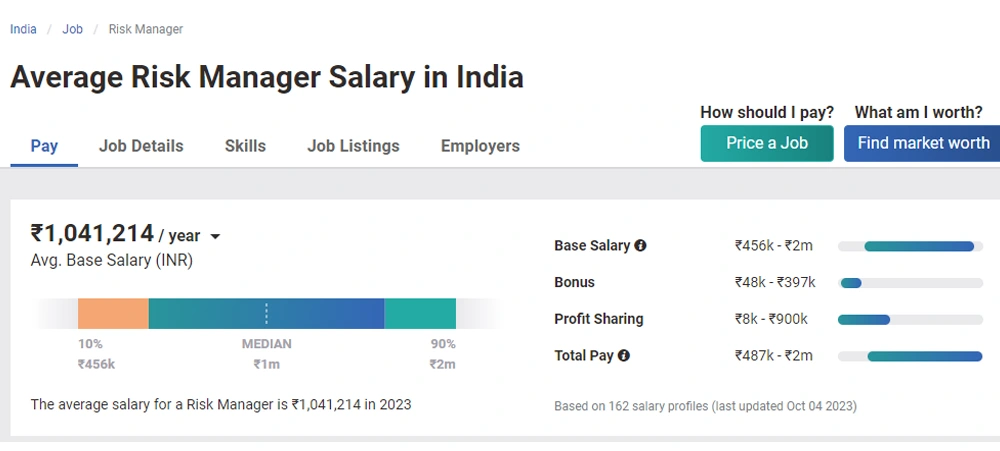

4. Financial Risk Manager

Financial risk managers are concerned with the research, identification and mitigation of the various financial risks that a company or business unit is likely to face. A financial risk manager occupies a consultant position in the organisation who analyses the financial data of the company in addition to their investments, sales record data, financial statements etc. to develop detailed financial reports that capture the financial risks for the company and then work collaboratively with the major stakeholders to develop risk mitigation plans. This job domain is quite fairly compensated and also of great strategic importance to organisations, hence adding significant scope of career escalation for the professional.

- As already discussed, this field is one of the most fairly compensated career in finance. The initial salary packages that a person can grab as a financial risk manager are in the range of INR 10 LPA-INR 10.4 LPA.

- Banks and major conglomerates like Amazon, State Bank of India, HSBC Bank, ICICI Bank, JP Morgan and Chase etc. hire financial risk analysts.

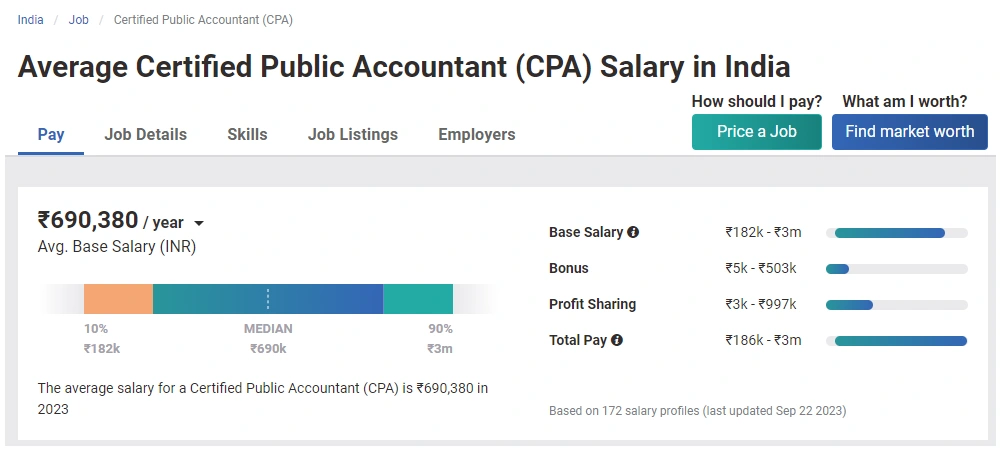

5. Public Accountant

The field of public accounting is related to providing financial and accounting assistance to individuals, teams or enterprises on a one-on-one clientele basis. Public accounting is concerned with a variety of tasks, ranging from financial advisory in case of mergers and acquisitions, to preparing financial reports based on regular financial auditing. This job role is a prominent upcoming domain that allows for working with a diverse range of clients, providing excellent exposure and insights to the client.

- Public accountants in their initial years of the career can earn nearly 7 LPA, with the package subject to significant rise with a couple of years of experience itself. The compensation growth rates are the significant highlight of a career as a public accountant.

- Companies and banks like BDO India, Grant Thornton International, JP Morgan and Chase, Ernst & Young, Deloitte, PwC etc. hire public accountants regularly.

6. Corporate Finance Officer

A corporate finance officer is concerned with all the major handlings related to finances and accounting in a corporate setup. The job responsibilities of a corporate finance officer range are quite vast and can range from identifying the risks and profits for a corporate house, preparation of and reviewing of financial reports, funds management, financial risk analysis etc. The scope of this domain sprawls from small corporate houses in the private sector to the corporate giants of the world.

- Corporate finance is a well-paid career domain in finance and the average packages that are offered in it are in the range of INR 5.45 LPA to INR 5.6.LPA.

- The key recruiters of corporate finance officers include KPMG, PwC, Boston Consulting Group, McKinsey & Company, Ernst & Young, Deloitte etc.

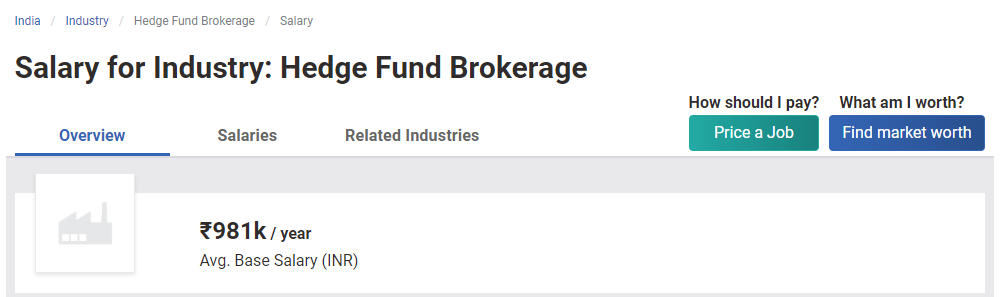

7. Hedge Fund Manager

A hedge fund manager is concerned with the management and maximisation of profits of hedge funds or collective pooled funds to ensure high return on investments to the shareholders. In this regard, hedge fund managers have a similar responsibility like investment bankers, but specifically limited to collective funds, or hedge funds. This is one of the most highly paid job roles in the field of finance.

- Hedge fund managers can fetch salary packages between INR 9.5 LPA to INR 10 LPA as beginners in their career and this can grow significantly over the years of experience as well.

- Companies that recruit hedge fund managers include those like Goldman Sachs, Yes Bank, Standard Chartered, Elliott Investment Banking, Citadel etc.

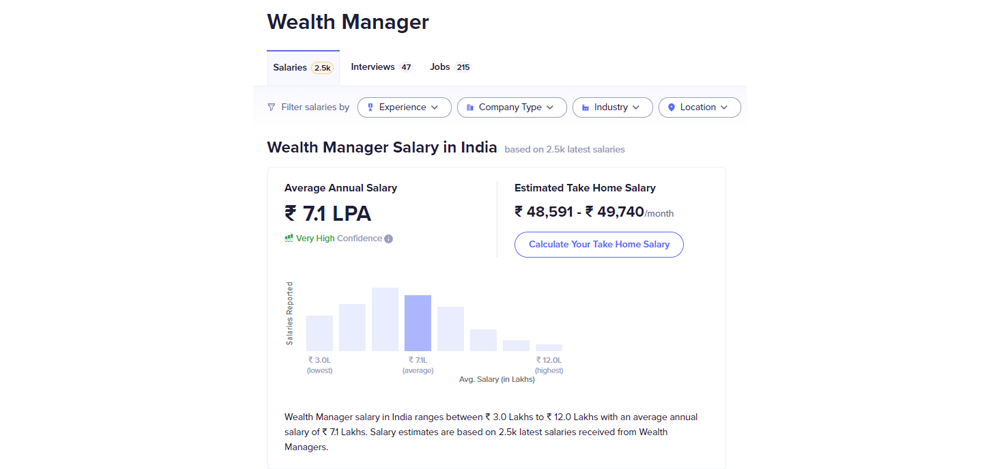

8. Wealth Manager

Wealth management is a novel and freshly emerged area of commerce and finance that is related to the management of the wealth and assets of individual clients. Developed in response to the growing complexities of wealth management for individuals in recent times, the profession of wealth management brings together a vast number of financial services from domains like accounting, account management, investment banking, estate management and planning etc. into one consultative job domain. The field is accordingly paid quite well, with packages growing manifold with experience of the professional.

- Wealth management freshers can earn packages between INR 7 LPA to INR 7.5 LPA easily, with significant growth rates seen in packages with growing experience.

- Wealth managers can find jobs in both public sectors, e.g. public banks like the State Bank of India, and in the private sector, e.g. banks like HDFC Bank, Axis Bank, Yes Bank etc.

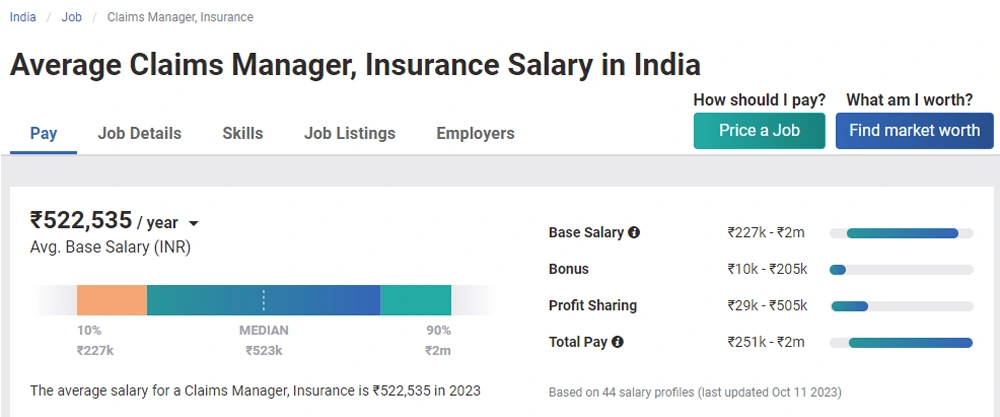

9. Insurance and Claims Officer

A job role relating specifically to the field of insurance services, an insurance and claims officer is concerned with the effective management of insurance claims made by the insurers after evaluation of whether the claim disputes are authentic and whether the company is legally required to resolve those claims. This job domain is quite high-stakes, both from the perspective of the clients and the insurance firm, and hence requires the officer to also train insurance agents to effectively manage customer relations.

- Insurance and claims officers can earn upto an average of INR 4 LPA to INR 5 LPA with 1-2 years of experience.

- They can find jobs in various public and private banks like State Bank of India, Axis Bank, ICICI Bank, HDFC Bank, HSBC Bank etc.

10. Private Equity Associate

Private equity or PE is a domain related to investment banking that is concerned with advanced financial consultancy to firms and clients. The major task of PE revolves around the acquisition of companies to maximise their financial performance for consequent sale of their profits. A few of the key aspects of the job role of a private equity associate include preparation of detailed financial analysis, financial modelling, due diligence testing etc. Being a profile above investment bankers, a certain period of experience is required before a finance professional can venture into this field.

- Private equity is a highly paid field in finance, with average beginner salaries ranging from INR 8 LPA to INR 8.5 LPA. The growth rates in salary packages offered in this field make it one of the most lucrative job domains in finance.

- Top recruiters of private equity associates include ChrysCapital, Bain Capital, Matrix Partners, IDFC First Bank, ICICI Venture etc.

Top Courses for Finance in India

In today’s fast-paced industrial world, the need of the hour is to have efficiency and working knowledge of your field of interest. Hands-on skills are central to making oneself stand out among the crowd of contemporaries and build a successful career.

Finance being a field requiring both sound foundational knowledge and practical hands-on skills and competencies, an aspirant of finance needs to seek formal education in the subject to grow professionally. Whether in the long-term or short-term format, a formal qualification in finance can add a leverage to one’s resume and contribute effectively to their professional skills set.

Here we have tabulated some of the most fundamental courses that an aspirant of finance can seek to start a career in this field.

|

Bachelor of Commerce (B.Com) Online |

Bachelor of Business Administration (BBA) in Finance |

|

Bachelor of Commerce (B.Com) in Accounting and Finance |

Bachelor of Commerce (B.Com) in Banking and Finance |

|

Bachelor of Commerce (B.Com) in International Finance |

Bachelor of Commerce (B.Com) in Auditing and Taxation |

|

Master in Business Administration (MBA) in Finance |

Master in Business Administration (MBA) in Financial Market Management |

|

Master in Business Administration (MBA) in Banking, Financial Services and Insurance |

Master in Business Administration (MBA) in Fintech Management |

|

Executive Courses in Financial Risk Management |

Executive Courses in Business Finance |

|

Certification Course in Fintech |

Certification Course in Technological Banking and Financial Services |

|

Certification Course in Debt and Money Market |

Master in Business Administration (MBA) in Wealth Management |

Important Skills Needed for Career in Finance

There are certain core skill sets which are essential to thrive in any career. Before venturing into a career field, it is a good practice to evaluate one’s aptitude and skills to assess if they are a good fit for a job role in the field of finance.

Here are some of the key skills and competencies that can help a student or professional excel in a career in finance.

- Mathematical Aptitude: Various job roles related to finance like financial analysis, financial modelling, banking, accounting etc. require the professional to have competent mathematical skills and strong foundational knowledge for performing the job role effectively.

- Analytical and Critical Aptitude: Analytical and critical aptitude are a must-have for someone who wants to venture into any field related to finance. Financial assets being one of the most crucial aspects of any company or commercial venture, analytical and critical aptitude is needed to handle such resources and carry out such operations well. These become even more important considering job roles related to financial consultancy, financial analysts, financial risk managers etc.

- Financial Modelling: financial modelling is a very important skill for financial professionals as they are frequently required to represent their complex findings related to finances in simple abstract visualisations. Such projects and responsibilities require the professional to be well-adept in financial modelling.

- Financial Reporting: Financial reporting is considerably different from normal or conventional reporting of results. It requires technical prowess and skills in reporting that can communicate the results effectively while still capturing the key findings and insights.

- Accounting Skills: Accounting skills are surely a must-have for every financial professional. Even while a large number of financial tasks and job responsibilities have now become automated, the need for sound accounting skills is still fundamental to performing any job role related to finance.

- Interpersonal Skills: In addition to effective technical and hard skills, effective interpersonal skills are central to thriving in the workplace in financial domains. Many job roles like financial consultancy, investment banking, financial risk management etc. the professional is required to present their findings and communicate them effectively to their clients as well.

- Problem-Solving Ability: Effective problem-solving skills are central to any job domain, but in technical and high-stakes fields like finance, its importance becomes manifold. Effective ability to identify problems, ideate over them and develop the right solutions are some of the aspects that are crucially required in the various job domains related to the field of finance.

With the aforementioned skills, it is much more likely for an individual to thrive and grow in a field related to finance. Evaluation of one’s skill set and aptitude is important before venturing into any career-field. Professional guidance and expert mentorship can ease this journey by leaps and bounds, and hence, it is essential that aspirants of finance, especially students, get professional guidance when confused about venturing into the field since professional and unbiased guidance is invaluable to a successful career journey. [Also Read | What Is Career Counselling?]

Conclusion

Thus, it can be seen that the field of finance is not only highly revered but also among the most fairly compensated in modern times. The job roles in this field are diverse and offer scope for excellent career development trajectories. A student interested in venturing into a career in finance can accordingly grow their knowledge and upskill themselves through short-term and long-term courses in the subject.