Expert Interviews

- University Reviews

- Career Guide

Video Counseling

Video CounselingImportant Facts

- Ask any Question - CV Forum

How To Become A Finance Manager [A Complete Guide 2024]

College Vidya News Team Jan 23, 2026 1.2K Reads

A dynamic field in the domain of finance and the BFSI sector, business financial management is a career domain that can interest you if you are someone driven by the opportunity to contribute to the growth of financial resources for companies and organizations. Business financial management concerns itself with the streamlining of organizational practices, investments, and goals with the long-term financial goals and accordingly growing the assets of the company.

This is a stable and dynamic career field for commerce and accounting enthusiasts who have a knack for management and are seeking to develop a lucrative career in it. However, venturing into this career requires a repertoire of functional and soft skills along with certain qualifications. This blog outlines these aspects in detail, providing a detailed career guide to you for venturing into business financial management.

Why Choose a Career in Business Financial Management?

While BFSI and finance-sector jobs are quite lucrative in general, business financial management provides vast exposure and the opportunity to contribute to financial decision-making and strategic decisions.

Some of the key reasons to consider a career in this domain have been enlisted below:

- High Job Demand: This is a dynamic but stable career field that has recently seen a growth in the job demand for professionally trained managers. Given the growing financial assets of firms, business financial managers are witnessing a surge in job demand.

- Scope for Rapid Career Growth: The role is highly demanded and with a wide scope, a financial manager can experience significant growth in short periods with the right experience and skillset.

- Lucratively Compensated Field: The field of financial management is not only attractive in terms of its prospects for career growth, but is one of the financially lucrative career options as well. On average, professionals with a few years of experience can easily earn between INR 14 LPA to INR 16 LPA in this domain.

- Opportunity to Contribute to Strategic Decision-Making: One of the striking aspects of this career domain is its scope for contribution to organizational decision-making. Suppose you are someone driven by the need to make meaningful contributions to decision-making and strategic planning. In that case, financial manager roles in corporations will provide you the opportunity to do so.

- High Relevance in Digital Economy: As newer financial technologies such as blockchain, fintech software, e-finance, and digital payments are rising rapidly, financial managers have more scope to explore opportunities in digital or fintech organizations.

As highlighted above, a finance aspirant can explore the domain of business financial management if they wish to venture into the corporate sector and use their financial proficiency in strategic and corporate decision-making.

Roles & Responsibilities of a Business Financial Manager

Understanding the nature of this career domain is imperative to the decision to venture into the field as a professional. Being a field requiring significant educational investments for training, one must understand the scope and purview of the domain to decide if this is the right fit for their occupational goals.

The role of a financial manager in a business firm revolves around the all-round management of their financial resources as well as growing the assets alongside. Thus, they participate in the complete cycle of financial planning for the organization, budgeting, forecasting of financial needs, creation of financial plans, analytical reports, models, etc.,

assessing the market and forecasting risk, managing the same, looking into financial and tax regulations, and providing consultancy about the investments the company should venture into. The core responsibilities of a business financial manager are listed below :

Key Skills Needed for Business Financial Management

A business financial manager must possess proficiency across several functional domains and interpersonal or soft skill domains. Both financial know-how and skills to apply the knowledge in professional situations are important for this role. The repertoire of skills for this role has been elaborated herein.

Technical Skills & Knowledge to Succeed as a Business Financial Manager

To succeed as a business financial manager, a professional must possess a host of technical knowledge and practical skills related to finances, accounting, data analytics, etc. The details of the same have been provided below.

|

Key Skills |

Specifications |

|

Financial Analysis |

Being able to efficiently comprehend and interpret financial documents including the likes of financial statements, trends, etc. |

|

Data Analysis & Modelling |

Being proficient in data analytical tools and data modeling to derive meaningful insights about financial data and trends and create predictive models. |

|

Knowledge of Accounting |

Having a thorough understanding of the foundations and nuances of accounting and banking including areas like GAAP, IFRS, etc. |

|

Proficiency in Fintech |

Being well-acquainted and familiar in operating financial technology including financial software and related platforms for analytical and other purposes. |

|

Knowledge of Regulatory & Tax Compliance |

Staying updated with the financial compliance regulations and laws that dictate financial practices in businesses. |

|

Budgeting & Financial Forecasting |

Being proficient in skills of budgeting, resource allocation, regular supervision, and further forecasting of financial needs in the future. |

Soft Skills to Succeed as a Business Financial Manager

Soft skills and interpersonal skills also form a crucial part of the repertoire of competencies needed to succeed in this role. Further details about the important soft skills needed to become a business financial manager have been listed below.

|

Key Skills |

Specifications |

|

Analytical Thinking |

Being able to approach problems from an analytical lens, breaking down complex pieces into manageable chunks to solve concerns. |

|

Problem-solving Ability |

Being adept at identifying and comprehending various problems including unforeseen concerns and efficiently being able to identify potential and the best solution to the same. |

|

Attention to Detail |

Having an eye for detail in analyzing datasets, being able to spot patterns easily, identify gaps and errors, and further enhance accuracy. |

|

Communication Skills |

Being articulate in one’s written and verbal communication, while also being precise, clear, and comprehensible; having convincing communication strategies to get stakeholder buy-ins. |

|

Strategic Thinking |

Being able to think and approach problems from a futuristic perspective as well as aligning the financial plans with the long-term goals of the organization. |

|

Ethical Orientation |

Being ethical, transparent, and upholding one’s integrity in decision-making and other financial practices. |

What are the Career Opportunities in Business Financial Management (Types of Options available in Business Financial Management)

Studying business financial management also confers skills to the professional in related areas such as financial risk analysis, financial consultancy, treasury management, investments and analysis, forecasting and market research, etc. Hence, in addition to practicing as a financial manager, one can also explore related prospective fields that have been enlisted below. The job scope in this domain of finance is considerably appealing, with multiple career options available to explore along with lucrative compensation and scope for growth.

|

Career Option |

Average Salary (Per Annum) |

|

Business Financial Manager |

INR 14 LPA |

|

Budget Analyst |

INR 10.5 LPA |

|

Financial Risk Manager |

INR 8 LPA |

|

Corporate Treasurer |

INR 32.5 LPA |

|

Investment Consultant |

INR 25 LPA |

|

Financial Planner |

INR 3.8 LPA |

|

Asset Manager |

INR 8.8 LPA |

|

Cost Accountant |

INR 6 LPA |

|

Merger & Acquisition Analyst |

INR 18 LPA |

|

Financial Consultant |

INR 5.1 LPA |

|

Wealth Manager |

INR 5 LPA |

Career Analysis: Scope of Business Financial Management

While exploring the nature of a career domain is essential, it is also imperative to take a look at how the career is flourishing from an industrial perspective. Here, we dive deep into the industrial analytics around business financial management and also understand the fees and investments needed to venture into this profession.

Demand for Business Financial Managers: Industry Trends

Some of the general trends around business financial management as a career domain have been provided below:

- The growth of the BFSI sector, which is expected to provide an employment growth of 7.1% in the first fiscal half of 2026, also reflects the growing demand for professionally-trained business financial managers.

- The growth observed in the integration of AI services into financial services reflects that AI can in turn help support financial analysis instead of replacing financial analysts, while the dependency on human intelligence would be for novel insights and strategies.

- With the growing fintech sector opportunities available in India, the job scope of financial managers is expected to grow by 7.5% in the fintech sector.

- While the job demand for financial managers is on the rise, there is still a marked gap between the skills possessed by professionals and the required skills for the role. Resultantly, nearly 38.41% of the finance job positions generated in the past year remained unfilled. This makes clear the need for upskilling in the finance sector and related domains for jobs.

Fees & Costs Involved in Becoming a Business Financial Manager

There are several career pathways to venture into business financial management, and students can explore relevant courses in the field either at the UG or the PG levels. Online as well as regular and ODL courses are available to upskill in this domain, thus providing a range of courses in different fee bands to choose from.

Some of the prominent UG and PG courses one can choose to take up in this domain are listed below:

|

Financial Management Courses |

Approximate Course Fees |

|

Bachelor of Commerce (Specialisations: Accounting & Finance, Banking & Finance, Auditing & Finance |

INR 2,50,000 |

|

INR 1,50,000 |

|

|

INR 20,000 |

|

|

INR 1,50,000 |

|

|

INR 1,62,000 |

|

|

INR 5,00,000 |

|

|

INR 4,50,000 |

|

|

INR 2,00,000 |

|

|

INR 2,50,000 |

|

|

INR 4,00,000 |

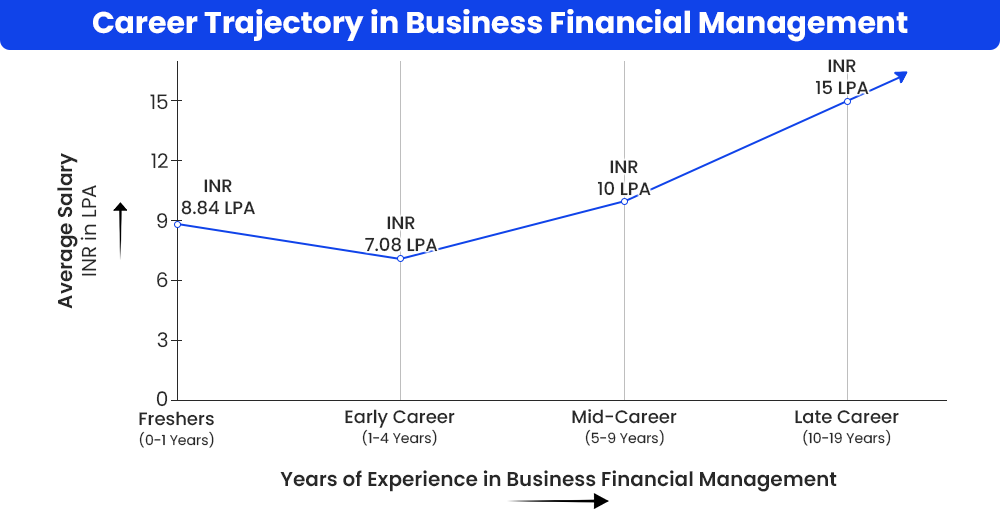

Career Growth Trajectory of Business Financial Manager

When it comes to selecting business financial management as a career path, the growth trajectory of the field can be significantly appealing. A fresher in the field can kickstart their career with a package ranging between INR 8 LPA to INR 9 LPA. While mid-level professionals may see a slight dip in compensation standards (owing to multiple industrial factors and personal exigencies), the overall scope for growth is significantly high, with packages ranging easily above INR 15 LPA.

The overall career trajectory one can expect as they grow from a financial executive to a senior financial manager is described below:

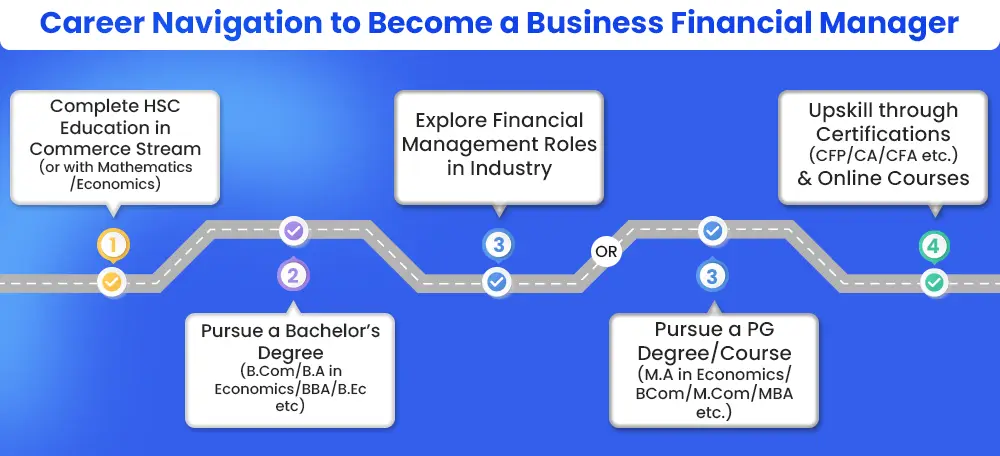

Career Navigator: What Course to Pursue for a Career in Business Financial Management?

To venture into business financial management, an aspirant must come from a commerce background in higher secondary education or have studied mathematics/economics. Post this, one can follow a traditional career pathway of having by pursuing a UG degree in commerce followed by an M.Com/MBA/PG certification in financial management.

Conversely, one can also pursue a regular UG degree in any educational background (but must have an HSC background in the commerce stream/with mathematics/economics) and then upskill in financial management at the postgraduate level with a PG degree (e.g. MBA/M.Com, etc.) or professional certifications.

With online and regular degrees and courses available to pursue financial management, one can select a career pathway that meets their career needs in terms of required investments, available time, and professional or other commitments. The navigational path to becoming a business financial manager has been outlined below.

Top Colleges & Institutes for Business Financial Management

Financial studies in India is one of the higher educational domains that is well-established, with several elite universities, colleges, and institutes offering UG and PG courses in the domain. Enlisted below are a few of the prestigious institutions one can look at for a career in business financial management.

Conclusion

Business financial management is one of the lucrative and appealing career domains that integrate financial expertise with managerial prowess and offers immense scope to the professional to grow in their career.

FAQs (Frequently Asked Questions)

To become a financial manager in India, you must have pursued undergraduate or postgraduate education to a relevant degree. Upon completing a BBA or a B.Com you can further take up PG education or professional courses in financial management alongside exploring professional opportunities.

Yes, you can become a financial manager if you have not studied commerce in class 12th, provided you have studied subjects like mathematics or economics in HSC level. In this case, you can take up a B.Com or BBA and accordingly pursue further education or explore job options in financial management.

On an average, a business financial manager can earn upto INR 14 LPA with a few years of experience. As a fresher, one can earn upto INR 8.84 LPA as a business financial manager.

To become a financial manager, the minimum qualification one should have is a relevant Bachelor’s degree such as a BBA, a B.Com or a B.A. (Economics) post which they can explore financial management roles.

Yes. When taken up from a valid, recognised and duly accredited (by UGC-DEB) institution, online courses, whether a degree, a diploma or a certificate, are considered valid and equally credible as a similar regular course.

Online Education News / Colleges & Universities / Admission Assistance

College Vidya is India’s leading online education advisory platform that has been covered by top media houses like Forbes India, Hindustan Times, etc. Recently, College Vidya’s newly launched CV subsidy has been making headlines all over the internet. For any details about educational news, College Vidya is your go-to source.

Every query is essential.

Our team of experts, or experienced individuals, will answer it within 24 hours.

Recommended for you

Tired of dealing with call centers!

Get a professional advisor for Career!

LIFETIME FREE

Rs.1499(Exclusive offer for today)

Pooja

MBA 7 yrs exp

Sarthak

M.Com 4 yrs exp

Kapil Gupta

MCA 5 yrs exp

or

Career Finder

(Career Suitability Test)

Explore and Find out your Most Suitable Career Path. Get Started with our Career Finder Tool Now!

ROI Calculator

Find out the expected salary, costs, and ROI of your chosen online university with our free calculator.