Expert Interviews

- University Reviews

- Career Guide

Video Counseling

Video CounselingImportant Facts

- Ask any Question - CV Forum

How To Become a Financial Risk Manager In 2026: A Complete Career Guide

College Vidya Team Jan 23, 2026 1.2K Reads

Financial risk management, often abbreviated as FRM, is a career field in finance which focuses on the identification and management of financial risks that an organisation may face. A highly agile and dynamic career in nature, FRM involves a myriad of opportunities to explore in allied domains, offering a wide job scope to aspirants.

In this blog, we shall take a walk-through of the career pathway to become a financial risk manager and explore the options and scope of the field.

Why Choose a Career in Financial Risk Management?

In addition to the multiple benefits of venturing into the field of finance, financial risk management in itself offers a number of advantages to professionals, as mentioned below:

- Lucrative Compensation Offered: Financial risk managers (FRM) are highly revered professionals who have a great earning scope, as the industry hires FRMs at lucrative packages from entry level roles.

- Globally Recognised Credential: The professional credential of Financial Risk Manager or FRM is a globally recognised one, which opens up opportunities across the globe for someone venturing into this field.

- Resilient Career Domain: While quite a few career paths in finance may get impacted during economic downturns, FRMs are core finance professionals who remain in demand during such periods as well, thus enhancing the job security of this role.

- Diverse Career Opportunities: FRMs have the opportunity of exploring multiple closely related fields in the finance sector such as financial consulting, asset management, financial planning, budget analysis etc.

- Growing Job Demand: The job roles of FRMs are highly demanded across the globe, thus allowing for secure and appealing career prospects.

Roles & Responsibilities of a Financial Risk Manager

The job role of an FRM involves domains starting from market analysis and trend analysis to evaluation of existing financial practices of an organisation/party and devising risk mitigation strategies.

The details of job responsibilities that an FRM must fulfill have been listed below:

Key Skills Needed for Financial Risk Management

The desirable skill repertoire for financial risk management involves a number of domains, including knowledge about key areas of finance, banking etc., hands-on skills of working with financial software as well soft skills including communication skills, analytical aptitude and so on. These important skill areas have been described below.

Technical Skills & Knowledge to Succeed as a Financial Risk Manager

Having proficiency over the key skill areas of financial management, knowledge areas like statistics, mathematics, familiarity with fintech softwares and so on. The details of the same have been elaborated upon below:

|

Key Skills |

Specifications |

|

Financial Risk Analysis |

Having a thorough understanding of market risks, liquidity risks, credit and asset risks etc. |

|

Financial Modelling & Prediction |

Being proficient in predictive analytics, financial modelling and overall risk assessment. |

|

Financial Regulations & Frameworks |

Staying updated with knowledge of financial regulations, legal compliances, rules and policies. |

|

Statistical & Quantitative Analysis |

Being adept in conducting statistical functions, quantitative analysis and drawing inferences to optimise financial decision making. |

|

Risk Management Softwares |

Having working knowledge of risk management softwares, fintech softwares and solutions and regularly upskilling in the same with emerging technologies. |

Soft Skills to Succeed as a Financial Risk Manager

Soft skills and interpersonal competency is an equally critical part of the role of an FRM as technical expertise. Whether it is general cognitive aptitude or soft skills, financial risk management requires some of the key soft skills as mentioned below:

|

Key Skills |

Specifications |

|

Analytical Aptitude |

Having an analytical, detail driven and logical approach in devising feasible solutions to complex problems and potential risks. |

|

Attention to Detail |

Being precise, accurate, highly observant and cautious in understanding, interpreting and managing financial data. |

|

Adaptability |

Having an agile, flexible and evolving approach to solving problems so as to come up with tailored solutions based on the needs of particular cases. |

|

Ethical Judgment & Integrity |

Being driven in one’s professional responsibilities and financial dealings by honesty, integrity and transparency, upholding the highest standards of integrity. |

What are the Career Opportunities in Financial Risk Management (Types of Options available in Financial Risk Management)

FRMs, in addition to practising as certified professionals in their own field, can also explore related opportunities including those like financial consulting, budget analysis, risk analysis, market research, business financial management and so on. In addition to being lucratively compensated, these fields also offer global scope of opportunities. Thus, as a career domain, FRM opens up job opportunities in a number of related fields.

A few of the prospective job roles an FRM can explore along with the average compensation offered for them in India are tabulated below:

|

Career Option |

Average Salary (Per Annum) |

|

Financial Risk Manager |

INR 8 LPA |

|

Investment Consultant |

INR 25 LPA |

|

Financial Planner |

INR 3.8 LPA |

|

Financial Consultant |

INR 5.1 LPA |

|

Business Financial Manager |

INR 14 LPA |

|

Budget Analyst |

INR 10.5 LPA |

|

Asset Manager |

INR 8.8 LPA |

|

Risk Analyst |

INR 5.99 LPA |

|

Market Risk Manager |

INR 12 LPA |

Career Analysis: Scope of Financial Risk Management

Viewing the career from an industrial standpoint calls for analysing the job demand for FRM, the financial investments one must consider making in the field as well as the scope of growth one can expect in this domain through the years. These have been addressed herein:

Demand for Financial Risk Managers: Industry Trends

Provided below are a few of the key industrial insights which highlight the career scope and demand for financial risk managers at the global and Indian levels:

- Some of the key sectors in finance for FRMs include those like financial institutions, banking, insurance, credit rating agencies etc. These are a few sectors which present the highest job scope for financial risk managers.

- Notable employers for financial risk managers include Boston Consulting Group, Deloitte, Aon, Ernst & Young, pwc, JP Morgan and Chase, ICICI Bank etc.

- The U.S. Bureau of Labor Statistics predicts that the industry for risk management is to grow to $28.87 billion by 2027, reflecting a CAGR of 18.8%..

- It is also predicted that out of the total job market of risk management expected in the future, financial risk management will comprise about 17%of the professional opportunities.

Fees & Cost Involved in Becoming a Financial Risk Manager

There are a number of courses at the UG and PG levels that one can consider in FRM. These include courses like B.Com (in relevant specialisations), BBA, MBA, M.Com and relevant PG diplomas and certifications. Additionally the certified Financial Risk Management Exam by GARP is another course that one can pursue to gain an internationally recognised qualification as an FRM.

The average fee involved in pursuing some of the popular courses for FRM have been mentioned below for reference:

|

Financial Risk Management Courses |

Approximate Course Fees |

|

Bachelor of Commerce (Specialisations: Accounting & Finance, Banking & Finance, Auditing & Finance |

INR 2,50,000 |

|

INR 20,000 |

|

|

INR 1,62,000 |

|

|

INR 1,50,000 |

|

|

INR 2,00,000 |

|

|

INR 5,00,000 |

|

|

INR 2,50,000 |

|

|

INR 4,50,000 |

|

|

Financial Risk Management Exam by GARP |

INR 1,50,000 |

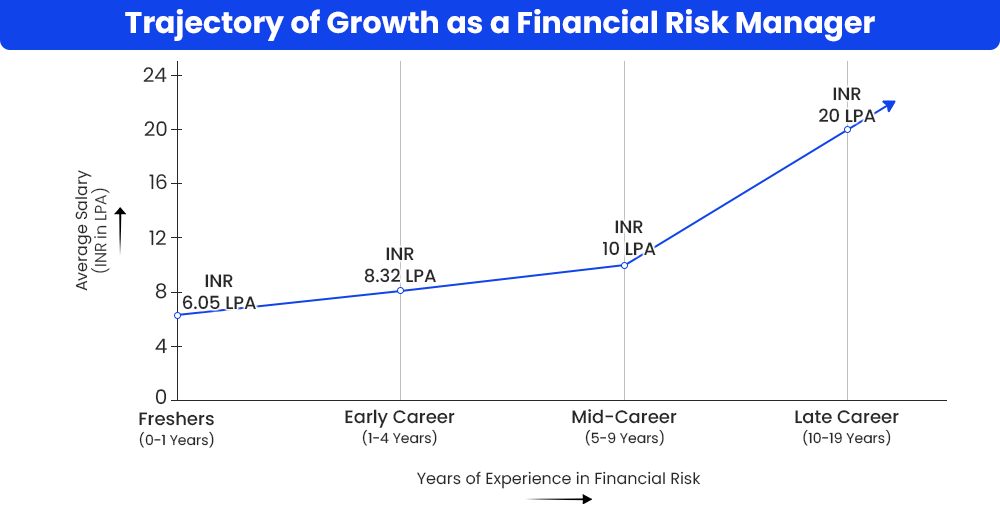

Career Growth Trajectory of Financial Risk Manager

The scope of growth in the domain of financial risk management is quite prospective, especially with respect to financial prospects. Being a career in the BFSI sector, the compensation in FRM is in the moderate-high range for entry level roles, which further grows significantly in a few years. As illustrated below, one can start off in roles providing about INR 6 LPA as compensation, and quickly escalate to roles paying as high as INR 20 LPA and above.

Career Navigator: What Course to Pursue for a Career in Financial Risk Management?

While having an undergraduate degree in a finance related domain such as B.Com or BBA facilitates developing a career in FRM, it isn’t sufficient in itself to start a career in FRM roles. For this, one must either pursue the certified FRM examination-an internationally recognised credential for financial risk managers provided by GARP, or higher education such as a PG diploma/PG degree in financial risk management. Typical examples for this include an MBA, an M.Com, PG diploma courses etc.

The career navigation pathway for FRM is outlined below for reference:

Some of India's top private and public institutions in addition to the eminent and prestigious Global Association of Risk Professionals (GARP), have been mentioned below:

Conclusion

Financial risk management (FRM) is a career domain within the finance sector that concerns itself with the assessment, evaluation and mitigation of financial risks that organisations and entities may face. This career path is an internationally recognised and booming domain owing to the rapid growth of financial assets of enterprises and the larger number of financial threats on such assets. The dynamicity, growing demand, fair compensation and scope for career growth from a futuristic perspective in FRM make it a lucrative domain to venture into for students and aspirants.

FAQs (Frequently Asked Questions)

To become a financial risk manager in India, you must first complete your Bachelor’s education in a relevant finance domain (e.g. BBA/B.Com), followed by completing the FRM Examination by GARP or a PG degree/diploma in financial risk management. Post this, you can start exploring professional opportunities in FRM, either as internships or part-time/full-time roles.

On an average, a financial risk manager can make anywhere between INR 8.5 LPA to INR 11 LPA with 1 to 9 years of experience.

Some of the top firms that hire for financial risk management include those like Shell, American Express, JP Morgan Chase, Standard Chartered Bank, Ernst & Young etc.

Yes, even if you do not belong to a commerce background, you can take up a career in financial risk management. If you hold any valid Bachelor’s degree from a duly accredited institution, you can go for taking the FRM examination. However you may need to complete certain bridging courses so as to gain a good grasp about the fundamentals of financial risk management and ace the examinations.

Some of the leading organisations which hire financial risk managers at entry level to senior positions include JP Morgan & Chase, BCG, PWC, ICICI Bank, Aon, Ernst & Young, Aon etc.

Idea Alchemist / Concept Creator / Insight Generator

We are an online education platform where users can compare 100+ online universities on 30+ X-factors in just 2 minutes. With an active CV community, we have transformed online learning to quite an extent. With the CV Subsidy scheme, we contributing to GER in India while helping our learners with their finances in their “Chuno Apna Sahi” journey!

Every query is essential.

Our team of experts, or experienced individuals, will answer it within 24 hours.

Recommended for you

Tired of dealing with call centers!

Get a professional advisor for Career!

LIFETIME FREE

Rs.1499(Exclusive offer for today)

Pooja

MBA 7 yrs exp

Sarthak

M.Com 4 yrs exp

Kapil Gupta

MCA 5 yrs exp

or

Career Finder

(Career Suitability Test)

Explore and Find out your Most Suitable Career Path. Get Started with our Career Finder Tool Now!

ROI Calculator

Find out the expected salary, costs, and ROI of your chosen online university with our free calculator.