Expert Interviews

- University Reviews

- Career Guide

Video Counseling

Video CounselingImportant Facts

- Ask any Question - CV Forum

How To Become a Wealth Manager In 2026: A Complete Career Guide

College Vidya Team Jan 23, 2026 1.1K Reads

If you are someone who is interested in a career in finance and is adept at holistic financial planning, then wealth management is a prospective career for you. In this career domain, a professional provides consultative financial support to “High-Net-Worth-Individuals” (HNWIs) to help manage their financial assets and wealth.

Wealth management is coming up as an in-demand career as more and more individuals and families are looking for professional support to manage their assets and plan its saving and usage. Wealth management is a lucrative career domain wherein professionals looking for diverse exposure in financial management can venture into.

Why Choose a Career in Wealth Management?

While the lucrative nature of the field is one of the significant factors guiding students and professionals to venture into wealth management, there are a number of other prospective factors that make it an attractive field, a few of which are mentioned below:

- Diversity in Work Exposure: When working as a wealth manager, a professional gets to manage diverse aspects of financial management including those like financial planning, financial analysis, risk management, investment planning, retirement planning and so on. The diversity of work possible to achieve in this domain can be highly central to specialising in one key domain of it in future years of one’s experience.

- Lucrative Compensation & Scope: Being a growing career in financial management, the salary packages and compensation provided to wealth managers is highly lucrative, making it one of the potent job arenas to venture into from a financial standpoint as well.

- Futuristic Career Domain: The growth opportunities in wealth management are another key reason to consider this as a career in finance. Wealth management is becoming increasingly emanded due to the need for well-trained professionals to manage complex financial assets individuals possess. Hence, its globally rising demand makes it a career with high future potential for growth and income generation.

- Chance to Form Impactful Client Relationships: If interacting with and connecting meaningfully with clients is a calling you feel passionately about, then wealth management will provide you an opportunity to regularly interact with such clients and form on-going impactful relationships with them, some of which can also prolong into the future.

- Opportunity for Continuous Learning & Professional Growth: Since the nature of the financial market is highly dynamic, volatile and ever-changing, wealth managers must constantly upskill themselves and keep up with changing financial laes, regulations and developments.

Roles & Responsibilities of a Wealth Manager

The responsibilities and tasks that a wealth manager is required to handle are diverse and holistic, encompassing broad areas such as overall financial assessment, planning and strategizing for wealth management, handling estate planning, investments, taxes and so on.

Elaborated below are a few of the key domains of the role of a wealth manager:

- Development of Financial Plans which are tailored as per the requirements of different clients.

- Investment Management with strategically designed layouts for investments upon consideration of various factors including market conditions, assets of the client, financial industry trends etc.

- Conduction of Client Financial Assessment to get in-depth insights about the financial state of a client, including their income, expenses, assets, savings and so on.

- Tax Planning which involves supporting and providing advisory information to clients about managing their taxes, investing in tac-efficient systems and so on.

- Financial Risk Assessment & Consultancy to identify potential financial risks that a client may face and consequently provide consulting to mitigate those risks and avoid them.

- Market & Industry Analysis to gather insights about the market conditions which may be facilitative for investments and so forth, i.e. to guide effective financial planning.

- Client Relationship Management, including regularly interacting with clients with varying net worths, building rapport with them, conducting their financial assessment, helping devise personally-tailored financial plans for them and so on.

Key Skills Needed for Wealth Management

Since a wealth manager needs to handle diverse aspects of financial and stakeholder management, a repertoire of technical and soft skills are needed to thrive in this domain. As a result, upskilling and staying updated with the best practices of the industry is crucial for this role.

Technical Skills & Knowledge to Succeed as a Wealth Manager

The key technical or hard skills required for this domain relate to areas like running financial data analytics on financial softwares, having proficiency in understanding compliance guidelines and regulations, investments, tax planning, financial risk analysis etc. Further details of the essential skills needed for becoming a wealth manager are provided below.

|

Key Skills |

Specifications |

|

Financial Markets & Economic Trends |

A wealth manager must possess nuanced understanding of the market dynamics, economic factors, financial trends and so on for effectively supporting clients in planning their wealth management. |

|

Regulatory & Compliance Management |

A wealth manager must possess knowledge of the regulatory rules, policies and compliance guidelines such anti-money laundering (AML), financial regulations etc. |

|

Financial Softwares |

Having proficiency in leveraging various advanced financial softwares and tools for data analysis, modelling and so on is required for a wealth manager. |

|

Investment Management |

A wealth manager must possess detailed knowledge of the classes of assets, investment planning, risks involved in the same and so forth to help develop tailored portfolios for various clients. |

|

Quantitative & Statistical Analysis |

Having proficiency in statistical analysis and quantitative techniques are needed to conduct data analysis, data modeling, run predictive analytics etc. |

|

Retirement Planning |

Helping clients plan their retirement from a financial standpoint is a core aspect of wealth management and hence strong knowledge of retirement plans, asset management, investments etc. to secure one’s retired life is essential. |

|

Financial Planning |

A wealth manager must possess due knowledge of overall financial planning to support clients through various phases of managing their wealth. |

Soft Skills to Succeed as a Wealth Manager

As a field in finance, wealth manager is one requiring considerable and frequent stakeholder engagement and interaction. Hence, soft skills like interpersonal skills, critical thinking, adaptability, confidentiality etc are quite essential for a wealth manager to possess. Details of the same are provided below:

|

Key Skills |

Specifications |

|

Interpersonal Skills |

Since the job of a wealth manager requires frequent client interactions and internal stakeholder management, it is essential to possess strong influencing and interpersonal skills. |

|

Communication Skills |

Being articulate, convincing, clear and concise in one’s communication patterns is essential to impact clients and effectively communicate with people having varying financial literacy. |

|

Critical Thinking |

Being able to approach and analyse situations holistically and from a critical lens is central to devising financial strategies for wealth management for clients with varying net worths. |

|

Time Management & Organisation |

Managing multiple clients and packed timelines for various tasks–both common aspects of the role of a wealth manager, call for skills in time management. |

|

Adaptability |

Being able to adapt and flexibly change one’s approach to solutioning when dealing with different clients and in various projects calls for sufficient adaptability in one’s nature. |

|

Confidentiality & Ethical Integrity |

Since working in the domain of wealth management involves dealing with sensitive and crucial personal information of many individuals, possessing sound ethical integrity as well as skills to uphold confidentiality are highly crucial for a wealth manager. |

What are the Career Opportunities for Wealth Management (Types of Options available in Wealth Management)

A wealth manager is a professional in the domain of finance who handles a myriad of responsibilities around managing individuals’ assets and wealth. As a result, they need to have proficiency in a number of domains in finance management including risk analysis, estate planning, financial consulting, tax advising and so on. As a result, a wealth manager can venture into each of these specialised areas as well for career development. These domains are well-compensated along with significant scope of career escalation with due experience and skill sets.

A number of relevant career domains which a professional experienced in wealth management can explore are mentioned below:

|

Career Option |

Average Salary (Per Annum) |

|

Wealth Manager |

INR 5 LPA |

|

Financial Advisor |

INR 5.1 LPA |

|

Private Banker |

INR 9 LPA |

|

Financial Risk Analyst |

INR 9 LPA |

|

Investment Consultant |

INR 6 LPA |

|

Tax Advisor |

INR 6.2 LPA |

|

Financial Analyst |

INR 7 LPA |

|

Certified Financial Planner (CFP) |

INR 5 LPA |

|

Corporate Wealth Advisor |

INR 4.95 LPA |

|

Family Office Executive |

INR 14 LPA |

|

Estate Planner |

INR 15 LPA |

Career Analysis: Scope of Advertising and Communications

To get a better understanding of the nature of wealth management as a career in the BFSI sector, let's dive deep into the industry insights in this domain, the courses to take up to kickstart your career and the expected growth trajectory as a wealth manager.

Demand for Wealth Managers : Industry Trends

Wealth management as a domain of financial services has gained more prominence with the growing net worth of individuals and families, leading to the requirement for formally trained professionals to manage assets.

- A report by PwC suggests that nearly 90% of investors (institutional) believe that leveraging AI and related technological tools can improve returns on their portfolio, hence prompting more wealth managers to leverage GenAI tools in wealth management.

- Automation of Client-Servicing has become a prominent trend in wealth management, allowing wealth managers to focus on more complex client needs rather than catering to basic support needs. [Empaxis]

- Thecentrality of AI and cloud platforms for wealth management has become more popular in the recent decade with the HNWIs from the current generations looking for more seamless and convenient portfolio management. [Empaxis]

- Some of the top challenges being faced by wealth managers and the industry includes inflation, along with market volatility as well as recession [empaxis]

- There is a growing shift in wealth management in assisting retail investors (or individual investors) in managing their assets and investing in private markets, which were earlier solely available for institutional investors.

- Trends based on a PwC report also indicate that ESG-focused portfolios(Environment-Social-Government) are popular among younger investors, marking a potent area for support.

Fees & Cost Involved in Becoming a Wealth Manager

Aspirants who wish to explore wealth management as a career need to have a strong foundation in the basics of commerce, asset management, financial planning and analysis etc. As a result, the person must preferably choose a degree such as B.Com, BBA, B.Sc or B.A. in a relevant specialisation (related to banking, finance or wealth management). Additionally, having a masters level degree or diploma in wealth management such as an MBA, PGD or a PG certification helps gain a competitive leverage in bagging career opportunities.

Courses in the domain of finance are in a slightly higher fee bracket, requiring more financial investments in comparison to other theoretical degree courses. However, to make the course more accessible to students and aspirants from diverse backgrounds, many eminent institutions have started offering duly accredited online degrees, diplomas and certifications with a relatively affordable fee range.

Mentioned below are a few of the pertinent online and regular courses that an aspiring wealth manager can take up:

|

Wealth Management Courses |

Approximate Course Fees |

|

B.Com in Economics |

INR 2,50,000 |

|

B.A. in Economics |

INR 3,00,000 |

|

B.Sc in Mathematics |

INR 1,50,000 |

|

INR 2,00,000 |

|

|

INR 1,60,000 |

|

|

INR 1,35,000 |

|

|

INR 5,00,000 |

|

|

INR 1,75,000 |

|

|

INR 5,00,000 |

|

|

INR 5,00,000 |

|

|

INR 75,000 |

|

|

INR 60,000 |

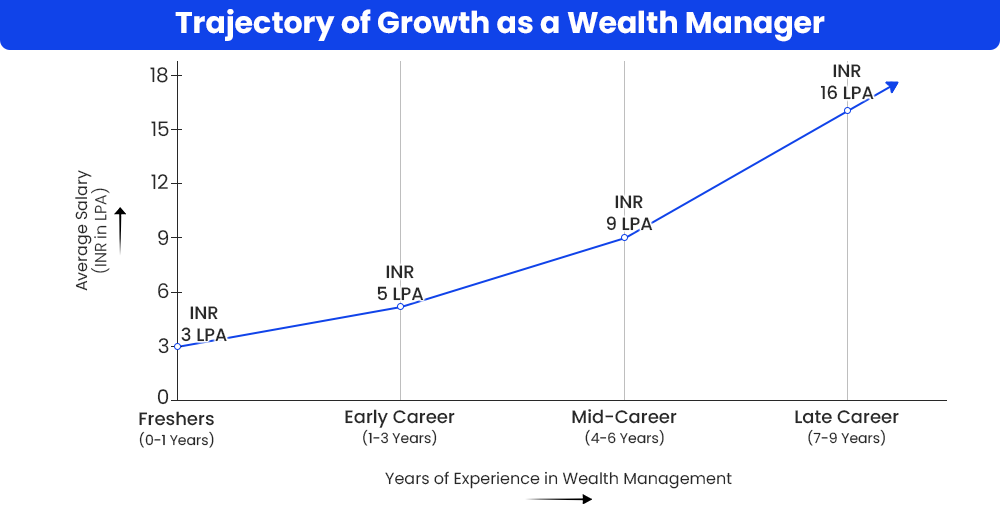

Career Growth Trajectory of Wealth Management

While the earning potential in wealth management starts off in a moderate range, this potential escalates manifold as one moves through opportunities in the domain to gain valuable experience. Forming close relationships with HNWIs also helps increase one’s prospects of further career growth.

The trajectory that a wealth manager’s career is likely to follow based on current statistics and industry trends is given below:

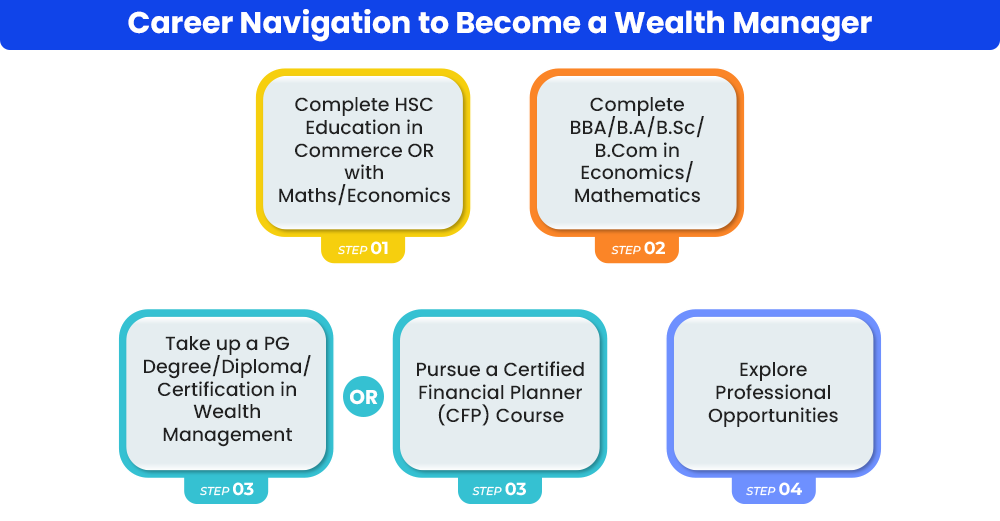

Career Navigator: What Course to Pursue for a Career in Wealth Management?

As we have discussed previously, pursuing the requisite degree/diploma in finance/banking/wealth management is important to explore this career domain. Well-regarded options in wealth management include those like a B.A., B.Com, B.Sc (Mathematics) etc. Students should have a background in Mathematics and/or Economics at the higher secondary level to be able to pursue wealth management. PG diplomas and certifications are also quite popular options to begin a career in wealth management.

The overall career navigation path to become a wealth manager has been laid down below:

Some of the eminent colleges, institutions and universities to consider as options for education in wealth management have been enlisted below:

Conclusion

In consideration of the expected boom of wealth management as an up and coming field of the BFSI sector, it is quite a lucrative domain to venture into. Educational options available for aspirants can venture into are varied and the field is open for students from a commerce or mathematics/economics background–allowing for immense potential for growth and success.

FAQs (Frequently Asked Questions)

To become a wealth manager in India, one must have studied maths or economics at the HSC level, followed by a relevant degree like BBA/B.Com/B.Sc (in economics, mathematics, banking etc.) at the undergraduate level. Most aspirants go on to also pursue relevant PG diplomas/certifications or degrees like MBA to upskill themselves further. Post this education, one can explore job opportunities related to financial consulting and wealth management.

Wealth management is quite a well-regarded and lucrative career domain in finance. The scope of the domain along with opportunities available for career growth and escalation are fairly attractive in this role. As a result, venturing into wealth management is quite worth it for an aspirant of financial services.

There are a number of options in terms of courses to pursue for becoming a wealth manager. At the undergraduate level, degrees like a B.A. (Economics), B.Com, BBA (in specialisations like financial management, banking and finance etc.) are considered valid to venture into wealth management. At the postgraduate level, degrees like an M.Com, M.A. (Economics), M.Sc (Mathematics) or an MBA (in domains like finance, banking and finance, BFSI, wealth management) are considered valid. PG diplomas and certifications in wealth management domain can also be taken up to pursue a career in this domain.

As a wealth manager with 0 to 2 years of experience, one can approximately earn about INR 3 to INR 5 LPA, and with further years of experience, they can earn anywhere between INR 6 LPA to INR 9 LPA.

Yes, you can pursue a career in the domain of wealth management even if you don't have a commerce background at the HSC level. However, you must have studied mathematics or economics at the HSC level to further pursue courses in wealth management at the collegiate levels.

The job option at the highest hierarchy in wealth management includes that of a portfolio manager or an investment manager, and an individual can earn anywhere between INR 19 LPA to INR 25 LPA on an average.

Idea Alchemist / Concept Creator / Insight Generator

We are an online education platform where users can compare 100+ online universities on 30+ X-factors in just 2 minutes. With an active CV community, we have transformed online learning to quite an extent. With the CV Subsidy scheme, we contributing to GER in India while helping our learners with their finances in their “Chuno Apna Sahi” journey!

Every query is essential.

Our team of experts, or experienced individuals, will answer it within 24 hours.

Recommended for you

Tired of dealing with call centers!

Get a professional advisor for Career!

LIFETIME FREE

Rs.1499(Exclusive offer for today)

Pooja

MBA 7 yrs exp

Sarthak

M.Com 4 yrs exp

Kapil Gupta

MCA 5 yrs exp

or

Career Finder

(Career Suitability Test)

Explore and Find out your Most Suitable Career Path. Get Started with our Career Finder Tool Now!

ROI Calculator

Find out the expected salary, costs, and ROI of your chosen online university with our free calculator.