Expert Interviews

- University Reviews

- Career Guide

Video Counseling

Video CounselingImportant Facts

- Ask any Question - CV Forum

How to Become an Investment Banker: Qualifications, Skills, Career Scope [Updated 2025]

College Vidya Team Jan 11, 2025 2.6K Reads

Investment banking is a lucrative job field in the domain of commerce and finance that finds significant importance in the modern professional landscape. Investment banking is a job domain that has existed over decades and seen considerable evolution to offer new prospects and avenues for exploration. Becoming an investment banker in India involves pursuing certain critical qualifications which help provide the foundation of practice and success in the field.

If you are also an aspirant looking to kickstart and excel in your career as an investment banker, then a lot of your questions and queries about becoming an investment banker and practising in India will be clarified through this blog. Continue reading to find answers related to how to become an investment banker in India as well as its career prospects!

Investment Banking: Basic Career Details

Investment banking is a financial sector professional domain concerned with the provision of services related to financial risk analysis, financial modelling, capital growth and financial strategy formulation. Job Guarantee Course | Investment Banking Operations!

The key details related to this job domain, including the average salary of investment bankers that can be earned by a professional investment banker, the job prospects, the prominent hirers in the field and more, have been enlisted below for quick reference.

|

Job Title |

Investment Banker |

|

Key Sector of Job |

Finance |

|

Eligibility Criteria in India |

|

|

Average Salary P.A. |

INR 8.86 LPA |

|

Key Skills Needed |

|

|

Key Job Responsibilities |

|

|

Top Hiring Firms |

|

How to Become an Investment Banker in India: Top Qualifications

While the job domain of investment banking requires proficiency in a host of technical skills and hard skills, there are certain educational qualifications that can effectively provide the requisite knowledge foundation as well as exposure for development of financial management skills.

While the exact qualification demanded by a hiring organisation for an investment banker may vary specific to that organisation’s hiring policies and requirements, certain basic qualifications are required at the undergraduate and postgraduate levels to get entry into the field. Being a high stakes field, professional opportunities as an investment banker mandate formal education and training in the domain.

Enlisted here are a few of the qualifications that are considered useful for developing a career as an investment banker and can smooth the journey of career escalation.

1. B.Com (Bachelor of Commerce)

A Bachelor’s in Commerce or a B.Com is one of the most fundamental degrees one should possess if they aspire to practise as an investment banker in the future. This undergraduate course’s coverage of topics and principles related to financial accounting, analysis, mathematical principles, business principles and economics make it useful to start a career as an investment banker. This is often the minimum requirement course to become an investment banker in India. Study At Home | Bcom Online Course!

- A B.Com is a three-years degree course at the undergraduate level that provides students with knowledge in domains related to commerce, banking and investments.

- Useful specialisations in a B.Com degree for a career in investment banking include those like banking and finance, banking and accounting, accounting and investment equity etc.

- After completing a B.Com, a graduate can seek jobs in entry-level positions such as financial analysts, financial modelling associate investment banking intern etc.

2. BBA (Bachelor of Business Administration)

A Bachelor’s in Business Administration is an undergraduate management degree that also provides specialisations in domains related to finance, financial accounting, banking and finance etc. that can be useful for starting a career in investment banking. The course can be useful for developing a dual basis in management and finance and banking, making it an excellent course for job prospects in investment banking. Study At Home | BBA Online Course!

- A BBA is a three-year degree course that is designed to provide students with theoretical basis and practical, hands-on skills in domains related to management.

- The relevant BBA specialisations to practise as an investment banker in the future include those like finance, banking and finance, international markets, financial markets, finance and leadership etc.

- With a BBA degree, one can start entry-level jobs in investment banking as analysts, interns or associates, much similar to a B.Com qualification.

3. M.Com (Master of Commerce)

A Masters in Commerce or an M.Com degree is a postgraduate degree course in the domain of commercial studies and provides more advanced knowledge to students in the fields related to finance, accounting, taxation, banking, financial services etc. An M.Com in a relevant specialisation can open doors to beginners to middle level investment banking jobs for students in corporate sectors. Study At Home | Mcom Online Course!

- An M.Com is a two-years degree course in commerce that can be taken up from a private or public institution, in the regular, distance or online modes of education.

- A few of the relevant specialisations in M.Com for enhancing one’s career in investment banking include investment banking, international finances, internet financial markets, banking and accounting, accounting and finance etc.

- With professional exposure and an M.Com degree, a graduate can apply to lucrative job positions in top corporations or practise independently as an investment banker.

4. MBA (Master of Business Administration)

A Master’s in Business Administration or an MBA is a much-coveted degree course in management which also offers specialisations pertinent to investment banking. It is a postgraduate degree program and offers thorough knowledge in managerial foundations as well as the nuances of the finance and BFSI sector, thus allowing for greater job scope in the investment banking domain. Study At Home | MBA Online Course!

- An MBA is a two-years PG degree course that can be taken up in relevant specialisations to enhance one’s career in investment banking.

- Some of the specialisations that can provide job opportunities in the investment banking sector include those like finance, international finance, financial markets, investment banking, equity research, banking and finance, finance and accounting and so on.

- An MBA can open up vast job domains in the field of investment banking, and can be quite useful for career escalation to managerial and strategic job positions.

5. CFA (Chartered Financial Analyst)

Another qualification that can open up vast opportunities in the domain of investment banking is the Chartered Financial Analyst course. This is a professional course offered at the postgraduate level which can provide professional opportunities not only in the investment banking sector but also in auditing, taxation, BFSI domains etc. Study At Home | CFA Online Course!

- The CFA is a postgraduate professional course consisting of three levels, namely, Level I, Level II and Level III exams.

- The CFA course varies in duration, from 1.5 years to 4 years, depending upon the level from which one pursues the course.

- CFA can open up lucrative job opportunities in the financial sector, including, but not limited to investment banking.

6. CA (Chartered Accountant)

Chartered accountants are trained professionals who perform a variety of financial tasks for organisations related to their financial management ranging from taxation, auditing, financial reviewing as well as planning services.

- A course in Chartered Accountancy or CA is offered in India by the Institute of Cost Accountants of India or ICAI.

- The course lasts for about 5 years, however, repeated attempts might warrant a longer duration of investment.

- A course in CA can provide an aspirant with chances to explore professional roles as investment bankers in top MNCs, corporates and financial firms.

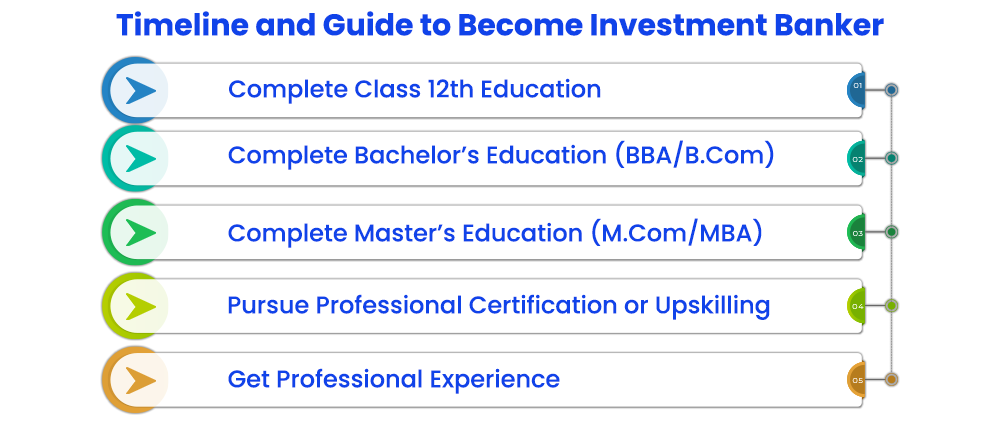

Steps to Become an Investment Banker

There are certain key steps to become an investment banker and practise professionally in India, and to kickstart a successful career in this field, one should start preparing from after class 10th. Considering that the professional practice of investment banking requires certain proficiency in certain key domains, early birds who systematically pursue education that covers these skill areas are quite helpful in enhancing one’s chances of professional success as an investment banker.

Given below is a broad outline of the steps or milestones one needs to accomplish to practise as an investment banker.

Step 1: Complete Class 12th Board Education

The cornerstone to a strong foundation in the practice of investment banking is one’s higher secondary education, i.e. their class 11th and class 12th education. For future practice as an investment banker, opting for the commerce stream, along with mathematics is the most helpful.

The courses, subjects and conceptual domains covered in through the eleventh and twelfth standards in India provide a strong foundation for the concepts involved in investment banking. Aspects like business studies, accounting, balance sheet maintenance etc. are a few of the key domains that are relevant to investment banking. While completing one’s higher secondary education and qualifying the boards examination, students can also prepare for entrance examinations like CUET for admission to a repeated institution for undergraduate education.

Step 2: Complete Bachelor’s Education in Relevant Field

The second and the most crucial step forward in your journey to become an investment banker is pursuing a relevant Bachelor’s degree course which lays the foundation for investment banking concepts and theoretical framework. The most relevant undergraduate degree course for investment bankers is a B.Com, which is a three-year degree course covering the nuances of business studies, accounting and banking, investments, taxation, auditing and so on.

Another option to consider for a Bachelor's level of education for investment banking is a BBA degree in specialisations such as banking, finance, accounting, BFSI etc. (as already delved upon earlier).

While pursuing a Bachelor’s degree can provide entry-level job opportunities to graduates as associates, analysts or investment banking interns, obtaining further education is essential to escalate in one’s career. So, undergraduates can also start preparing for entrance examinations for further education (such as entrances for CFA and CA examinations, CAT examination for admission to an MBA, CUET-PG examination for admission to M.Com and so on).

Step 3: Pursue Master’s Course in Relevant Field

Pursuing postgraduate education is essential in the field of investment banking if one wishes to escalate to higher positions or obtain professional proficiency in the actual practice of investments and financial analysis. While a B.Com or BBA can provide essential theoretical knowledge bases about the field, postgraduate education provides advanced knowledge and exposure for development of hands-on skills for professional practice as an investment banker.

Pursuing an M.Com degree or an MBA (in specializations related to finance) can be quite helpful for upskilling and opening up middle to top level professional opportunities for your future as an investment banker.

Step 4: Pursue Professional Certification or Upskilling Course

Another useful step that one can consider if they want to practise as an investment banker is to take up professional education in financial analysis or chartered accountancy. The CFA or the CA course can be taken up by students who have completed their Bachelor’s education and offer detailed education in commerce and financial domains beyond investment banking, thus opening up a number of lucrative job options in investment banking and related financial fields.

Courses like CFA and CA provide ample exposure to students about the working aspects of the field in investment banking and consequently open up professional avenues at middle to top levels. Courses like CFA and CA through their rigorous and thorough curriculum ease the path of career escalation in investment banking manifold.

Step 5: Get Professional Experience

The last and an essential aspect of the steps of becoming an investment banker is to gain hands-on professional experience of investment banking. While educational qualifications are certainly important for upskilling and gaining a theoretical understanding and underpinnings of professional aspects, the insights and skills exposure that an actual field experience in investment banking renders is indispensable for success.

Thus, one of the important aspects of becoming an investment banker is to engage with professionals through internships, apprenticeship programs with investment bankers, associate positions in financial firms and financial analysis roles in financial firms or banks and so on.

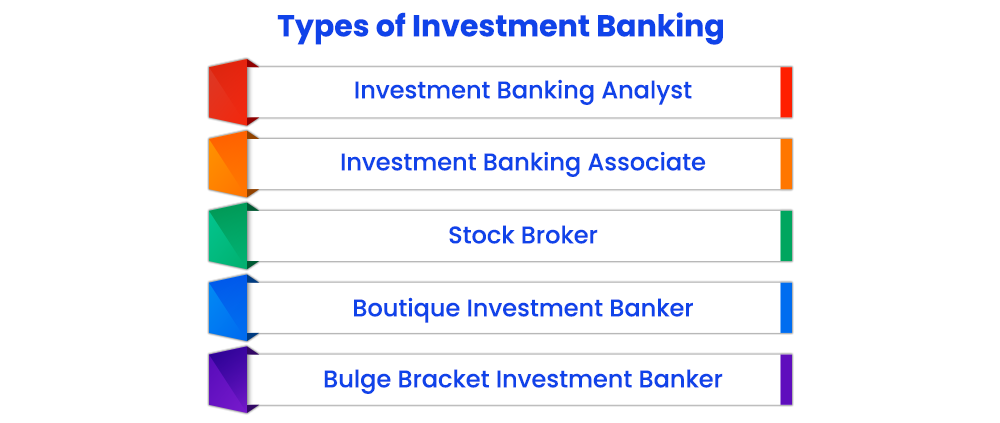

Types of Investment Bankers in India

The job domain of investment banking offers a number of prospective opportunities for professionals, which means those aspiring to venture in this field have a diversity of professional options to choose from for developing their careers.

Mentioned below are a few of the types of investment bankers or domains of investment banking in India that you can venture into for career development.

- Investment Banking Analyst: Investment banking analysis is an entry-level position in the field of investment banking wherein graduates at the Bachelor’s or Master’s level can work with associates and advanced investment bankers as interns or full-time beginners to gain field experience and professional exposure. This job offers lucrative salaries ranging from INR 10 LPA to INR 12 LPA.

- Investment Banking Associate: In addition to the job responsibilities that an investment banking analyst can perform, an investment banking associate performs analytical tasks (including financial analysis, risk analysis, financial modelling etc.) as well as interacts with clients for financial pitches and deal proposals.

- Stock Broker: While not an investment banking type per se, stock brokers are involved in generation of wealth for individuals and organisations through the sale and purchase of funds like mutual funds, market stocks etc. Stock brokers can work with organisations and corporates as well as independently.

- Boutique Investment Banker: Boutique investment bankers work with small investment banks or organisations and engage in providing specialised services to clients and other organisations. For instance, boutique investment bankers can work specifically in the domain of corporate finance, providing financial consultancy for mergers and acquisitions, layoffs or restructuring etc.

- Bulge Bracket Investment Banker: In contrast to the boutique investment banker who works in providing niche financial consultancy, a bulge bracket investment banker is a professional who works in an investment bank providing the full host of services associated with investment banking such as financial analysis, financial modelling, financial consultancy, risk assessment, corporate financial strategy formulation, business pitching, wealth management pitches etc.

Thus, it can be seen that there are a number of job options in the domain of investment banking, and students and aspirants in the field can grow through the various stages of their career to escalate from analyst to associate and higher job positions.

What does an Investment Banker Do: Key Job Responsibilities

A number of financial job roles and tasks fall within the purview of the investment banker. A few investment bankers may be professionally trained to cater to specific financial needs and investment services of clients whereas others, usually more experienced investment bankers provide a host of financial services.

A few of the major job responsibilities that investment bankers are required to handle have been listed below.

- Performing Financial Analysis: Financial analysis for business and organisational purposes is one of the most central job responsibilities of an investment banker. An investment banker or an investment analyst engages in thorough research and analysis of datasets to analyse a company’s financial expenditures, investments, stocks, budgeting and financial strategies etc. Financial analysis also includes the examination and analysis of the company’s balance sheet, cash flow sheets, income statements, tax returns etc.

- Performing Due Diligence: A part of an investment’s banker’s job responsibilities is to provide assistance to companies and firms about their investment decisions, especially for major ventures like mergers and acquisitions. Financial due diligence is performed by investment bankers to understand how the organisation being acquired is financially sound and having scope for growth of financial resources and capital. Financial due diligence also includes the analysis of financial statements, books and taxations to analyse the financial grounding of the company/entity being merged with/acquired.

- Create Financial Models: Considering that an investment banker’s job role is associated with assisting financial stability and growth of companies and clients via informed financial investments, they are also often involved in financial modelling to record a company’s financial structure, gains and losses and further predict the impact of a future investment/expenditure.

- Research: Research is a thorough part of the career of an investment banker and at all stages of their career, whether as an intern, analyst, associate or senior banker, having proficient research skills and engaging in thorough research and analysis for the purpose of drawing financial insights, stay updated with trends and developments in the financial sector and drive data-driven solutions for clients.

- Deal Structuring and Client Interaction: Investment bankers also have a prominent role to play during mergers and acquisitions. In addition to performing financial due diligence tests, investment bankers are also involved in creating and structuring financial deals and interacting with clients about pitches, financial strategies, deal structures etc. These job responsibilities are generally fulfilled by the senior or experienced investment bankers.

The aforementioned job responsibilities represent a few of the tasks that encompass the profession of investment banking.

Top Skills Needed to Become an Investment Banker

There are a host of skills and competencies that enable professionals to thrive as investment bankers. The field requires certain key technical skills (or hard skills) as well as a number of crucial soft skills that help smooth progression of their career.

Technical Skills

The field of investment banking calls for significant financial analysis as well as fulfilling high-stakes financial responsibilities. In such a situation, the role of proficiency in the requisite technical and hard skills takes centre-stage. Thus, having proficient working knowledge in certain key areas related to finance and banking is essential to thrive as an investment banker. A few of the most crucial technical skills involved in the job role of an investment banker include those mentioned below:

- Financial Analysis

- Financial Modelling

- Valuation Techniques

- Financial Statement Analysis

- Knowledge of Capital Markets

- Mergers and Acquisitions (M&A) Concepts

- Legal and Regulatory Compliance

Soft Skills

White technical skills are important to perform key job responsibilities, soft skills are needed for seamless communication, management of subordinates and colleague relationships, leadership and so on as a professional. As a result, possession and the effective use of soft skills in the workplace as an investment banker is essential for career mobility and escalation in the field. A few of the key soft skills necessary to prosper as an investment banker have been listed below.

- Risk Management

- Communication Skills

- Persuasion Skills

- Analytical and Critical Skills

- Attention to Detail

- Confidentiality’

Through the development of important technical and soft skills as well as ensuring constant upskilling to stay relevant with respect to the evolving professional practices in investment banking, the chances of prospering and furthering one’s career as a professional investment banker grow manifold.

Average Salary and Top Recruiters of Investment Bankers

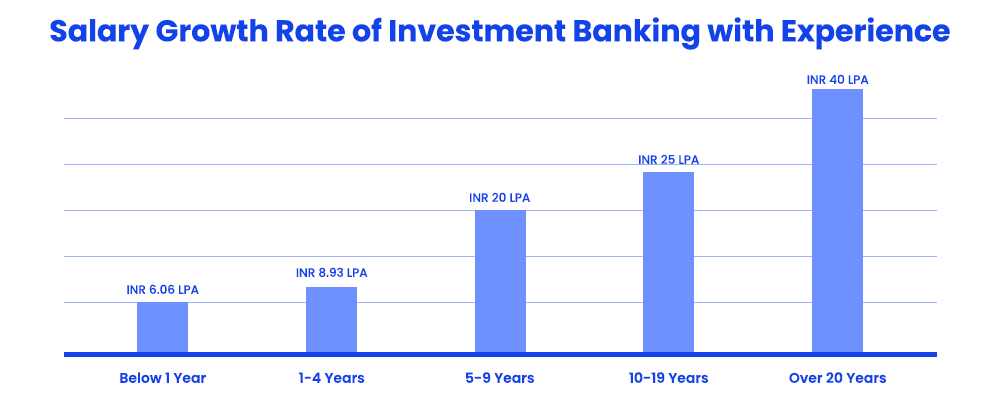

The field of investment banking is definitely one of the most lucrative fields to work in the financial sector. The career domain is evolving, dynamic, well-developed in India and prosperous for future growth.

The earning potential in investment banking is quite prosperous, with opportunities for appealing career escalation and salary hikes with growing years of experience. The salary potential for earning in investment banking has a hike rate of nearly 3%-73% throughout one’s career (based on Payscale data).

Given below is a tabulation of the average salaries that can be earned as an investment banker in India as one gains years of experience.

|

Years of Professional Experience |

Approximate Average Salary p.a. |

|

Below 1 Year |

INR 6.06 LPA |

|

1 Years- 4 Years |

INR 8.93 LPA |

|

5 Years- 9 Years |

INR 20 LPA |

|

10 Years - 19 Years |

INR 25 LPA |

|

Over 20 Years |

INR 40 LPA |

There are a number of MNCs, banks, financial conglomerates, bulge bracket companies and boutique investment banks that provide lucrative job options to graduates and trained investment bankers. Job roles in the public sector (banks, stock exchanges etc.) as well as the private sector (banks, financial firms, investment banks, boutique banks or bulge bracket companies) are available in this field.

A few of the prominent and reputed organizations that hire investment bankers have been listed here:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Top Online Courses for Pursuing Investment Banking

In addition to the number of educational qualifications like B.Com, BBA, MBA and M.Com that students can take up from regular colleges and universities, the option of pursuing these degrees in the online mode have made an impactful change in enabling students to take up higher education while gaining professional experience alongside.

With an online BBA, B.Com, MBA or M.Com degree, a student/aspirant of investment banking can also pursue relevant internships or professional endeavours like jobs/freelancing opportunities etc. without halting their higher education. This confers the dual advantage of gaining professional experience alongside higher education, allowing for greater chances of career escalation.

Enlisted below are a few of the most relevant online courses to take up if you desire to pursue a career in investment banking in the future:

|

Executive Program Online in Applied Financial Risk Management |

|

|

Online Certification in Technological Banking & Financial Services |

|

Is a Career in Investment Banking Worth It: Concluding Remarks

As a concluding remark on the scope of investment banker, we posit that developing a career in investment banking can indeed be highly rewarding to a professional. One should consider venturing into the field if they have a keen interest in financial modelling, financial analysis, strategizing and risk analysis. The career domain is well-suited for those commerce and banking aspirants who are adept and interested in dealing with financial risks and high-stakes financial operations.

With respect to the career scope and appeal, investment banking is a lucratively paid field with sufficient scope for career escalation. Considering that job opportunities are available for investment bankers in both public and private sectors, pursuing this career is definitely worth pursuing.

FAQs (Frequently Asked Questions)

Yes, investment banking is a well-developed and lucrative field with public-sector and private-sector jobs with high-paying salaries. Therefore it is an excellent field to pursue for commerce students.

The average salary that an investment banker with one to five years of experience can earn in India is INR 8.93 LPA.

The sector of investment banking presents lucrative job opportunities in public sectors as well as private sectors such as in banks, stock exchange companies, investment banking firms and in MNCs. There are a number of job options within this domain ranging from boutique investment banking to bulge bracket investment banking, all of which are highly paid (nearly between INR 8 LPA to INR 9 LPA). Hence the job scope in investment banking is wide, diverse and appealing.

Companies and banks like the National Stock Exchange, SBI, HDFC Bank, Goldman Sachs, JP Morgan and Chase, Standard Chartered Bank etc. are some of the prominent firms that hire investment bankers.

While an MBA course is not necessary, it is one of the best degrees of higher education to pursue for a successful career in investment banking.

A CFA course, while not a mandatory qualification to become an investment banker, is a professional course that opens up lucrative career opportunities in fields related to investment banking and beyond.

If one starts their career in investment banking right after completion of their Bachelor’s degree, then they can become an investment banker in 3 years of their undergraduate degree completion. However, since it is preferable to complete a CFA/CA/MBA/M.Com course before venturing into the field, a total of 5 years of higher education (3 years of UG degree and 2 years of PG degree) is needed before one can venture into the field.

The best undergraduate degree for investment banking is a B.Com closely followed by a BBA in finance. Similarly, at the postgraduate levels, the best degree for a career in investment banking is an M.Com followed closely by an MBA in a relevant finance specialisation. Professional certification courses like CFA and CA are also preferred by many professionals for a career in investment banking.

Idea Alchemist / Concept Creator / Insight Generator

We are an online education platform where users can compare 100+ online universities on 30+ X-factors in just 2 minutes. With an active CV community, we have transformed online learning to quite an extent. With the CV Subsidy scheme, we contributing to GER in India while helping our learners with their finances in their “Chuno Apna Sahi” journey!

Every query is essential.

Our team of experts, or experienced individuals, will answer it within 24 hours.

Recommended for you

Tired of dealing with call centers!

Get a professional advisor for Career!

LIFETIME FREE

Rs.1499(Exclusive offer for today)

Pooja

MBA 7 yrs exp

Sarthak

M.Com 4 yrs exp

Kapil Gupta

MCA 5 yrs exp

or

Career Finder

(Career Suitability Test)

Explore and Find out your Most Suitable Career Path. Get Started with our Career Finder Tool Now!

ROI Calculator

Find out the expected salary, costs, and ROI of your chosen online university with our free calculator.