Expert Interviews

- University Reviews

- Career Guide

Video Counseling

Video CounselingImportant Facts

- Ask any Question - CV Forum

What is CA All About? Eligibility, Exam, Salary & Careers

Isha Adhikari Sep 25, 2025 1.1K Reads

Have you ever considered becoming a Chartered Accountant (CA)? Then you will have heard things such as, "It is hard, or only toppers can become one." But what's the reality? Is CA really that hard? Is it worth all the effort? And what then, in case you fail, how is that to be done?

We will make it simple for you. This article will help you understand what the CA course is, what it requires, and what it offers, as well as how to build your path, whether you are a recent graduate or someone looking to change careers.

What is a Chartered Accountant (CA)?

Chartered Accountancy is a professional degree that helps you to know about how to handle money, business, tax calculation, business audits, and financial law. Simply, the CAs are the doctors of finance in the business world. Businesses, individuals, and even the government count on CAs to maintain their financial well-being.

The title of CA implies that you have heavy responsibilities. This is why the course is comprehensive, and yes, somewhat demanding. However, when you are ready to be regular and disciplined, it is quite achievable.

Who Can Become a CA? (Eligibility)

The good news is that anyone can become a Chartered Accountant (CA); there is no need to be a genius or a high achiever. The important thing is the correct attitude and a minimum qualification.

- You must complete Class 12 in any stream to be eligible to take the CA Foundation exam.

- In the case of graduates or postgraduates (primarily commerce), you will be able to omit the Foundation and register directly for the CA Intermediate level, so long as you satisfy the percentage requirements.

- Also, there is no age restriction, so even when you change careers later in life, there is nothing to stop you from becoming a CA.

What Is The Overall Course Structure of CA?

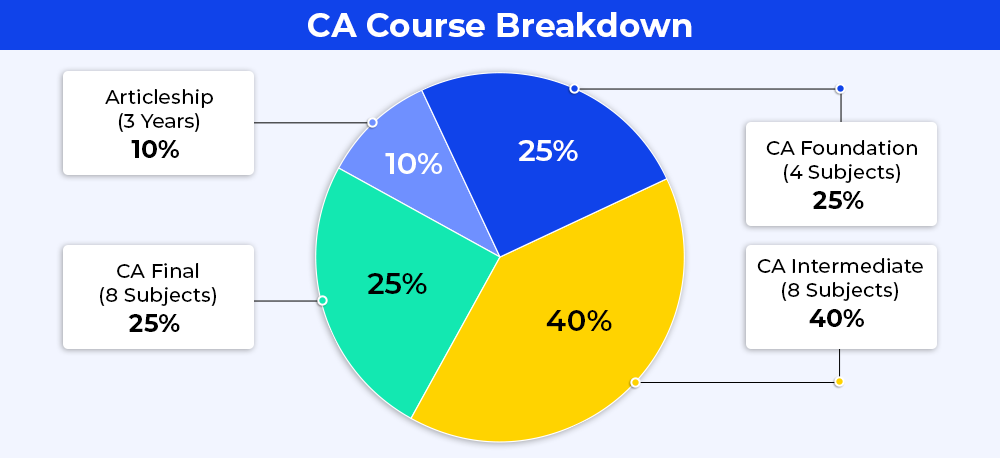

There are three main levels of the CA course in addition to a practical training known as Articleship. Each tier builds upon the last, so you become more proficient and confident with every step.

The course structure in the CA exam is as follows:

- CA Foundation - 4 subjects (after 12th basic level)

- CA Intermediate - 8 papers (2 sets of 4 papers)

- CA Final - 8 subjects (once more 2 groups of 4 papers)

- Articleship - 3 years of on-the-job training with a practicing CA.

The average student will have to take 4-5 years to complete the entire course, provided they pass all the exams on the first attempt. It is a long-term commitment, yet not impossible.

Is Becoming CA a Tough Call?

To be frank, CA exams are not easy, not due to their complexity. The actual difficulty is the amount of syllabus and the necessity to work constantly.

You will be tested on practical knowledge, application, and understanding, not only theory. Good planning and discipline make it manageable. There are also a lot of students who prefer to attend coaching classes to stay on track.

The exams are given twice a year (May and November); thus, when you miss one, you do not have to wait a whole year before you can reappear.

What Is the CA Exam Pattern?

The CA exam is divided into three grades, namely Foundation, Intermediate, and Final. Each level tests certain skills and areas of knowledge, while increasing in difficulty as a student moves on. The examinations have multiple-choice questions, questions that require written answers, and practical case studies to assess your grasp of accounting, law, taxation, auditing, etc.

These are the three key facts regarding the CA exam pattern:

- Foundation Level: It is the basic exam with four papers, most of which are objective and subjective in nature, and all include topics such as Accounting, Business Laws, Economics, and Quantitative Aptitude. It challenges your basic-level knowledge and prepares your case to be the next level.

- Intermediate Level: The level is broken into two parts with eight papers (four in each part). The questions will be an amalgamation of theory and real issues and will be based on accounting, taxation, law, auditing, and financial management. You may appeal to one or both of the groups.

- Final Level: The hardest stage, with two groups, and each group consisting of four papers. It focuses on higher accounting, audit, corporate law, and electives. It is a test with case studies and practical questions to find out how you will apply it in real life.

How Much Does the CA Course Cost?

The fact that the CA course is very cost-effective, particularly as compared to the Engineering, medical, or MBA Course fees, can be listed among the largest benefits.

Here's a general breakdown:

- CA Foundation: INR 10,000 - INR 15,000 (registration and coaching included)

- CA Intermediate: INR 20,000 - INR 30,000

- CA Final: INR 30,000 - INR 40,000

- Coaching (not compulsory): INR 1,000,000 to INR 1,50,000 (differing by city/institute)

Then, all in all, it would be INR 2 to INR 3 lakhs of the total journey. And keep in mind that in your 3 years of Articleship, you begin to receive a monthly stipend (INR 5,000-INR 15,000), which will be able to cover some of the costs.

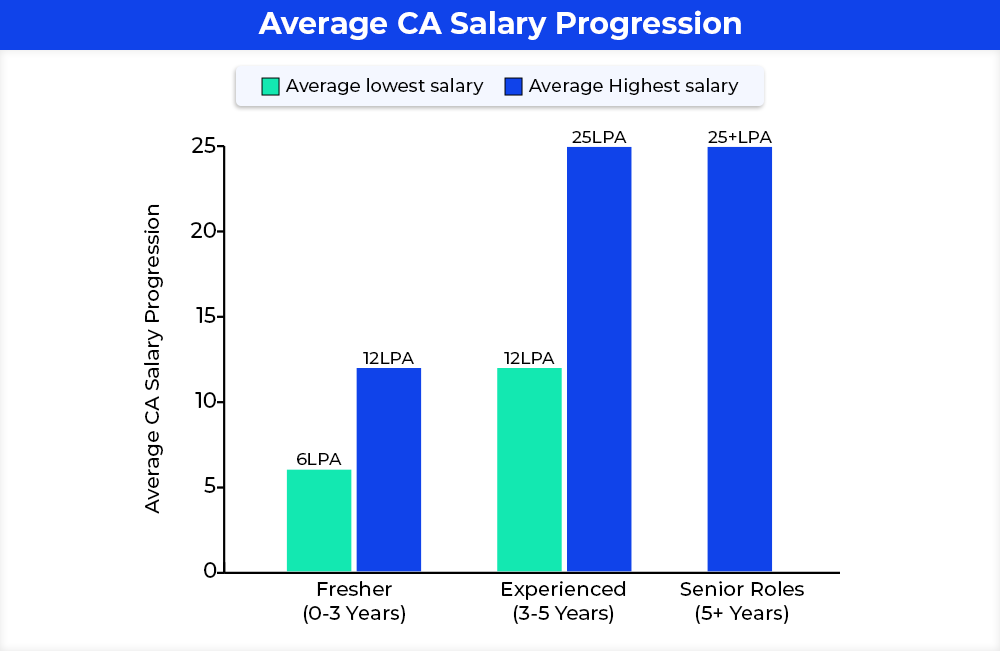

What Is The Salary Package of a CA (Fresher)?

Chartered Accountant (CA) starting salary may differ according to the nature of work, organization, place, and your talent, though on average it is highly encouraging as opposed to many other employment opportunities at the entry level. Fresh CAs typically receive a range of INR 6 lakh to INR 12 lakh annually (approximately INR 50,000 to INR 100,000 per month) at the time of their engagement in the well-known firms or companies.

Factors That Fluctuate the Salary of A Fresher CA

Many factors can affect the salary of a CA fresher in the initial stage, such as the role, in which company they are hired, in which city they are working, and so on. Let’s understand these factors that will influence CA’s initial salary in detail:

- Employer Type: Top-notch companies and big multinational corporations are bombarded with higher pay. Fewer packages may be offered by small companies or start-ups, with worthwhile work experience being the remuneration!

- Job Role: The pay may depend on whether you do auditing, taxation, accounts, or consultancy. Careers such as a financial analyst or risk management may earn more compensation.

- Location: In metropolitan cities like Mumbai, Delhi, Bangalore, and Pune, people give a huge monetary amount because of high living expenses and the need for professionals.

Apart from that, most Chartered Accountants get a bonus along with some perks and benefits. Your pay may shoot up with experience and skills gained. In addition, CAs are granted the privilege to open their firms and practice for money depending on their own client base, which could be fairly rewarding financially.

What Is The Salary Package of a CA (Experienced)?

When you have experience as a Chartered Accountant (CA), then your salary package can be considerably higher. A typical CA with experience of about 3 years to 5 years may then expect a salary between INR 12 lakh and INR 25 lakh/per annum or higher, depending on his or her experience, industry, and job profile.

These are the factors that affect the remuneration of qualified CAs:

- Industry and Company Size: CAs in large multinational corporations, higher banks, or leading consulting firms are likely to get a better pay package. Industries such as finance, investment banking, and consulting usually pay more than smaller companies or smaller local firms.

- Role and Expertise: The position of a CA at the senior level is usually secured by such jobs as Finance Manager, Tax Manager, internal auditor, or financial analyst. Specialists in other areas, like forensic accounting, risk management, or mergers and acquisitions, will be paid a higher rate.

- Work Region or Cities: All the cities with high metro areas, like Mumbai, Delhi, Bengaluru, and Chennai, are better paid due to the demand and are also costly to reside in.

Other than the salary, experienced CAs will be offered bonuses, profit sharing, and stock options, among others. Moreover, the vast majority of trained CAs would choose to become independent practitioners/consultants, which was even more profitable based on their clients and reputation.

Are There Any Scholarships or Financial Aid?

Yes, ICAI also provides scholarships on the basis of merit and need. There are also government programs, as well as other non-government institutions, that support qualified students. CA students are also known to use education loans. In recent years, ICAI has raised its support fund to INR 400 crore to assist the poor students.

What Are the Careers After CA?

Cracking the CA Exam is the ladder to reach diverse careers across these sectors. Have a look at these sectors:

|

Sectors In Which CAs Can Get A Job |

||

|

Audit & Assurance |

Tax Consultancy |

Corporate Finance |

|

Forensic Accounting |

||

|

Academia |

Entrepreneurship |

Financial Management |

Top recruiters include global consulting and finance names like Deloitte, KPMG, PwC, EY, ICICI Bank, HDFC, Reliance, Tata Group, and others.

Is the CA Journey Worth It?

The CA path is considered to be challenging, and its pass rates are low, which can make the journey daunting. But this is what makes the qualification very valuable and prestigious. When you get the CA title, you are regarded as a specialist in accounting, finance, and business management. The benefits of course completion are substantial; there are numerous successful Chartered Accountants who continue to perform in senior roles like Chief Financial Officer (CFOs) positions in large corporations or even as owners of a practice of their own. These positions not only attract excellent financial compensation but also a lot of respect in the business world.

In the future, the Institute of Chartered Accountants of India (ICAI) sees a bright future for CAs and forecasts that, by 2050, India will require 50 lakh new CAs. This requirement is driven by the fact that India has a fast-growing economy, enhanced financial regulations, and the complexity of business and taxation systems has increased. With industries expanding and businesses rising, the need to have skilled CAs to lead the firm is also on the increase.

Further, ICAI is keeping up with the times. As they acknowledge the significance of modern technology, they are currently incorporating artificial intelligence (AI) and digital technology such as CA-GPT into their training. This transition makes sure that CAs are not only masters of the traditional accounting sphere but also professionals in applying breakthrough tools to keep up with the technological environment of the world. Consequently, future accountants are currently being trained to work in a future where they will be able to use technology to more efficiently and effectively address the complex business issues around them.

What Online Courses can Boost your CA Journey?

When you are studying to crack your CA exam, online courses such as online BCom with ACCA could be a game-changer in improving your skills and knowledge. Not only do these courses offer advanced resources and a comfortable learning experience, but they also keep you aware of the latest events in finance and accounting.

- Accounting Software and Tools: Learning software and hardware such as Tally, QuickBooks, or SAP may provide you with practical experience in handling financial information, which is essential in the work of CAs.

- Taxation and Auditing: There are many universities in which you can get yourself into to get a degree in this subject, such as Amrita Online BCom in Taxation and Auditing, which provides in-depth courses on direct and indirect taxation and auditing, which are prime CA domains.

- Financial Modelling: Financial modeling courses online may enable you to realize the complexity of forecasting and financial analysis required in top positions, such as CFO.

- Soft Skills Development: CAs need soft skills, particularly in communicating, leading, and negotiating with others, particularly when dealing with a team or client relationship.

These online courses not only complement your CA preparation, but also serve as a supplement if you may wish to pursue alternative career opportunities in the future.

Conclusion

One of the highly esteemed careers in the financial field is Chartered Accountancy. It requires hard work, good morals, and discipline, but it is very rewarding, multi-skilled, and has long-term growth. With numbers, laws, and commitment, you can wonderfully crack your CA exam. For more info on the assistance with a certain section, such as study tips or exam preparation, you can read this blog carefully!

FAQs (Frequently Asked Questions)

A CA (Chartered Accountant) is in the field of financial practices such as accounting, auditing, tax, and financial planning. They assist business people and individuals to control their money, make tax payments, and maintain financial records. They basically ensure that all the money stuff is done by the rules and is correct.

A CA's salary may differ significantly depending on experience, place of work, and the organization in which one is employed. New CAs may hope to earn INR 6 to INR 12 lakhs in one year. However, when you are more experienced or when you are employed with larger companies, you can earn considerably more, up to INR 25 lakhs or even more per year.

The course to be a CA involves the study of financial laws, accounting principles, taxes, auditing, and other related fields. It is created to provide you with an in-depth understanding of how businesses deal with money, to ensure they deal with it in the right way.

The first step to becoming a CA after 12th is to register for the CA Foundation course. Then there is the Foundation exam, followed by the Intermediate level, and finally the final exams. You also undertake hands-on training (article ship) in a CA firm along the way. The normal time required to complete all the stages is approximately 4-5 years.

Yes, the CA exams are said to be very hard. They need profound knowledge, effort, and good training. Many learners undergo several tries to pass all the exams, and it takes much commitment to pass them.

Both the CA and NEET exams are difficult, yet they do not test the same things. NEET concentrates on medical knowledge, whereas CA concentrates on finance and accounting. One can hardly say that one is harder than the other; however, many people consider CA to be more difficult due to its extensive syllabus and the high degree of precision required.

No, the job of CA is not a government job. It is a career qualification, and CAs may be employed in either a private company or securing a good government job, but CAs are not government employees. CAs, however, can serve in firms in the government sector or even get jobs in government-related areas.

You have up to 6 sittings to complete each level (Foundation, Intermediate, and Final) of the CA exams. In total, then, you have 18 tries in all of three levels.

The unemployment rate of CA students is not very high, although there is no precise figure. The majority of CAs secure employment after their exams since their qualification is required particularly in accounting, auditing, and tax.

Becoming a CA costs you registration fees, the cost of study materials, the cost of coaching classes (assuming you take them), and the cost of exams. An average cost is between INR 1-2 lakhs for the total coverage of your studies. But with extra coaching or study material, the price may rise.

3 Years of Experience / Narrator

With 3 years of experience in content writing and copywriting and keen interest in voiceover and scripting, I, Isha Adhikari, am passionate about content creation and narration.

Every query is essential.

Our team of experts, or experienced individuals, will answer it within 24 hours.

Recommended for you

Tired of dealing with call centers!

Get a professional advisor for Career!

LIFETIME FREE

Rs.1499(Exclusive offer for today)

Pooja

MBA 7 yrs exp

Sarthak

M.Com 4 yrs exp

Kapil Gupta

MCA 5 yrs exp

or

Career Finder

(Career Suitability Test)

Explore and Find out your Most Suitable Career Path. Get Started with our Career Finder Tool Now!

ROI Calculator

Find out the expected salary, costs, and ROI of your chosen online university with our free calculator.