India's leading Online Universities on a Single Platform within two minutes

Compare & Apply from 100+

Online FRM Certification Universities

Get an

Online Discount of 15%

College Vidya Promise

Lowest Price Guarantee

Online FRMCertification Program Overview

FRM is abbreviated for Financial Risk Manager and is offered by the Global Association of Risk Professionals (GARP, USA). This certification is quite well-known in the finance sector and is highly demanded by banks and related firms globally. This certification is designed to equip professionals with the necessary skills they must have to face the risks in the business field.

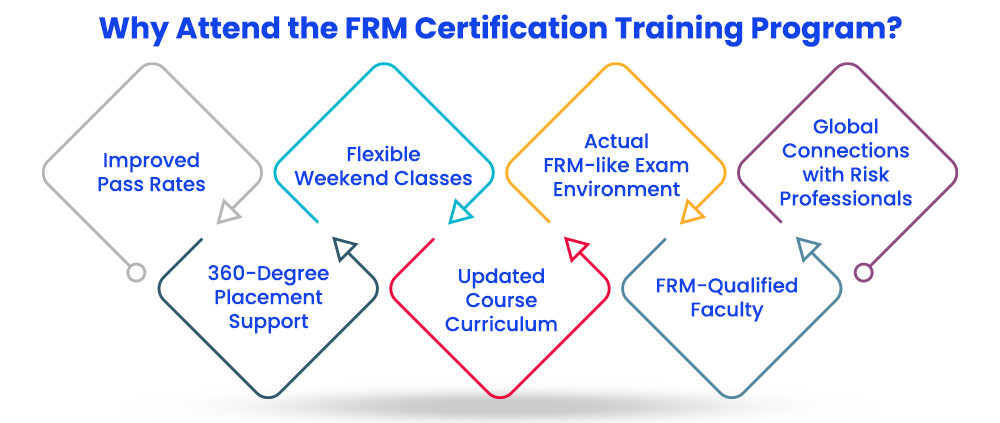

A FRM certification training program is one of the ways to get enlightened about the course curriculum, exam pattern, and preparation strategy for the actual exam. This program makes you learn not only technical skills but also helps you develop soft skills for better work performance. It is offered in both online and offline modes, thus, you can choose the mode of learning as per your schedule and requirements.

The curriculum design of this training course matches that of the actual FRM exam and hence prepares you for it in all possible ways. It covers all the major topics of the real exam and even provides you with additional reference materials for self-study. The knowledge imparted by FRM-qualified trainers makes it easy for you to crack the FRM exam and get certified.

Not only technical knowledge but this training course also provides 100% placement assistance by making you explore a varied number of job options in the finance sector. Thus, qualifying FRM not only enhances your job designation but lands you at your dream organization with a well-paying profile.

Refer & Earn Rewards!

Refer someone and earn up to Rs.20,000 and more exciting coupons and vouchers

Transforming Careers Through Learning

Manan Panchal

Athul Anil

Deepak Chaudhary

Deepika Chandani

Yogesh Chauhan

FAQ's

Lets clear up some doubts

College Vidya Smart Choice Checklist

A checklist to help you reach your goal!

College Vidya Smart Choice Checklist

A checklist to help you reach your goal!

Compare Universities

Add 2 more colleges to compare

Ask Sara