India's leading Online Universities on a Single Platform within two minutes.

100+ Universities

30X comparison factors

Free expert consultation

Quick Loan facility

Celebrating 1 lac admissions

Post Admission Support

Exclusive Community

Job + Internship Portal

Compare & Apply from 100+

PhD for Working Professionals in Banking and Insurance

- No-Cost EMI From ₹4,999

- Comparison on 30+ Factors

Share

Share Updated at : March 6, 2025

PhD In Banking and Insurance for Working Professionals

A working professional who desires career advancement in finance can opt for a PhD in Banking and Insurance for working professionals. You will be equipped deep into finance studies while simultaneously being able to carry on your job. However, if flexibility is your demand, then consider doing a part-time PhD program specially designed for working professionals. In addition, it is available in the top institutes such as IITs and also can be done in at least 5-8 years. You can learn at your own pace without sacrificing a job opportunity. For those who want to have even more convenience, online DBA provides ready-to-use skills in hands-on.Watch Video

Listen Podcast

PhD for Working Professionals in Banking and Insurance Program Overview

Being in the banking and insurance industry and working here could really get a boost to one's career through a PhD in Banking and Insurance. In today's competitive world and environment, you need to be kept above the level of others with advanced qualifications, thereby opening avenues of new prospects for one's professional life. Program PhD equips with all the essential requirements of a particular industry for deeper knowledge to confront the industry challenges. This is especially crucial in an environment like that of banking and insurance, where professionals are expected to tackle a fast-changing environment with emerging regulatory changes, technological advances, and evolving expectations by customers.

Deciding to go for a PhD is a big deal, with many professionals worrying about how they can fit the study time into their already busy lives. That's where the part-time PhD in Banking and Insurance is the best option. Whereas full-time PhD programs tend to be focused towards full-time learners, this program is oriented more towards professional practitioners. As you can learn alongside your working job, one continues to enjoy one's profession as well. Such a plan provides flexibility about time, whereby it allows going to classes and researching and carrying out assignments alongside maintaining one's work and life schedule.

Many students in part-time programs claim that they enjoy their learning experience more when they can apply what they learn right away in the workplace. While you work on your coursework, you can translate theories and concepts into real-world applications, thereby enriching your academic understanding as well as professional practice. In industries like banking and insurance, where rapid change is common and innovation is constantly in demand, this direct application of knowledge is especially important. Moreover, after completing the program, you will be able to apply for various job roles mentioned below.

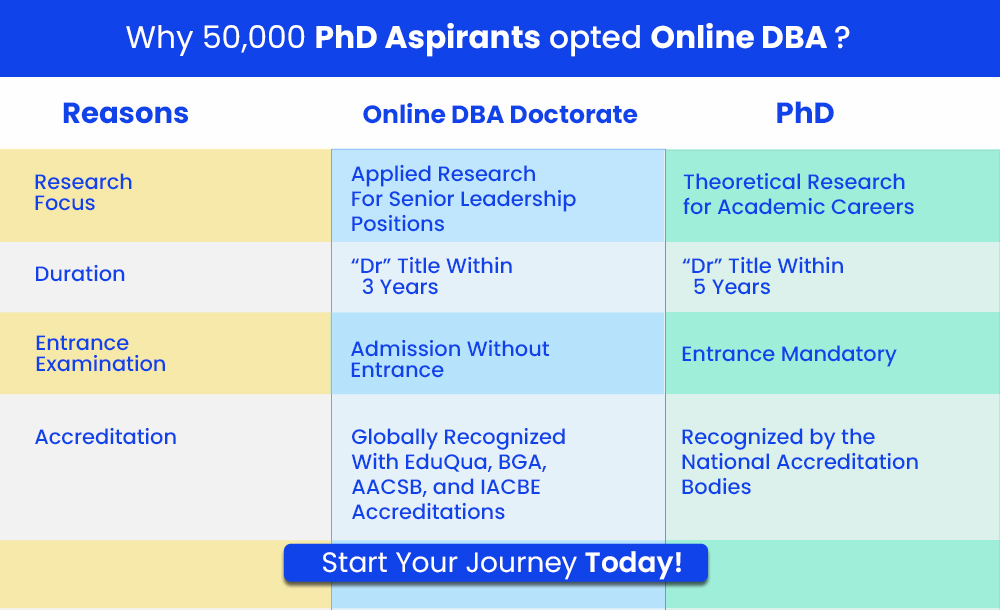

Besides part-time options, the concept of online learning has changed the nature of how professionals might continue their studies. If flexibility is a must for you, then an online DBA in Banking and Insurance is excellent. DBA programs include students who study via virtual means, taking their quality equivalent of traditional study. You can attend classes from the comfort of your home or office, engage with interactive course materials, and have access to a wealth of resources without the need to commute. Online courses are tailored to accommodate your daily life commitments. This way, you can schedule a study routine that best suits your lifestyle. The digital nature of online courses also fosters a wider perspective because you might engage with fellow students and instructors from different geographical locations, thereby bringing more varied perspectives and experiences to your learning process.

The PhD and DBA programs focus intensively on practical knowledge. You will learn how to apply theoretical frames of reference to real-world settings, a priority in application areas like banking and insurance. For example, you might read about how to analyze market conditions, evaluate risk, design innovative financial products, or set up successful marketing strategies. Understanding these practical applications will enable you to contribute meaningfully to your organization, drive innovation, and make informed decisions.

Another benefit of further education in a networked world is that one gets to share, and bond with peers, professors, and industry leaders during their studies. Sometimes, the connections developed are useful all the way in a career. Perhaps it will be collaboration for research projects discussions on current developments in the industry or even gaining insight into job openings not advertised. Networking can lead to new job opportunities, mentorships, and collaborative ventures that enhance your career trajectory. Moreover, an advanced degree such as a PhD or DBA can position you as a thought leader in your field.

As you research and publish your findings, you contribute to the body of knowledge in banking and insurance. This can help strengthen your professional reputation and increase your visibility within the industry. Being considered an expert can result in speaking engagements, opportunities to contribute to publications, and invitations to participate in industry forums and panels. Besides the academic knowledge and networking opportunities, pursuing a PhD or DBA in Banking and Insurance encourages personal growth.

The challenges of managing rigorous study alongside work and personal life can enhance your time management skills, critical thinking abilities, and resilience. You will learn how to navigate obstacles and balance competing priorities, skills that are highly valued in the workplace as well. This personal development is not just useful for your studies but automatically rolls over into the professional role, making you a more effective leader and team player. To sum it up, if you want to boost your career prospects in the banking and insurance sector, go for a PhD or DBA.

A part-time option allows for balancing work and studies efficiently, whereas an online program is convenient to use in a fast-paced today's world. Both ways present great knowledge and skills for professional use and make one's networks move forward in his career. Whether you do a PhD or DBA journey, these degrees can be an essential step up for you as a professional stepping towards leadership or professional positions that could be attained with such a degree in banking or insurance. Look forward to going deep into some specialized knowledge by making connections with people in related industries and starting paving the highway for a thriving and fulfilling experience in banking or insurance.

Key Highlights of PhD for Working Professionals in Banking and Insurance In India

- Career Boost: In a competitive job market, acquiring a PhD in Banking and Insurance can be significantly beneficial for working professionals. You are equipped with advanced qualifications, which make you stand out.

- Part-time Flexibility: A part-time PhD program is ideal for professionals with busy schedules. You can balance work and study, so you can apply your learning directly to your job while enjoying your current role.

- Direct Application: Most students in part-time programs find that they enjoy learning more when they can apply theories directly in their workplace, enriching both their academic and professional experience.

- Convenience of Online Learning: If you want flexibility to the maximum, then an online DBA in Banking and Insurance is the best option. You can learn from the comfort of your home, fitting studies into your busy schedule without commuting.

- Networking Opportunities: Studying in a PhD or DBA program allows you to connect with peers, professors, and industry leaders, which can lead to new job opportunities and collaborations.

- Practical Knowledge Focus: Such programs focus on how theoretical knowledge can be applied to real life, and you are effective in dealing with problems in the banking and insurance sectors.

- Personal Growth: Maintaining studies, work, and personal life will develop many virtues, such as proper time management, critical thinking, and resilience, which are desirable in the workplace.

- Building Expertise: As you are researching and publishing findings, you contribute to the knowledge pool in banking and insurance, thereby making your professional reputation stronger and setting you up as a thought leader in your domain.

- if one wants to upscale their career in the banking and insurance sector, then pursuing a PhD or DBA is definitely a good option. The part-time or online options make it feasible to achieve your goals while managing your current responsibilities. With these advanced degrees, you’ll develop specialized knowledge, expand your professional network, and prepare yourself for leadership roles in a dynamic industry. Embrace this opportunity to pave the way for a thriving and fulfilling career.

Admission Closing Soon

Compare & Enroll NOW

- To avoid paying 25% Late Fees on all the online courses

- To secure a seat in your dream university

- To avail of some amazing Early Benefits

PhD for Working Professionals in Banking and Insurance Course Subjects/Syllabus

The PhD in Banking and Insurance for Working Professionals is aimed at equipping experienced professionals with advanced knowledge and research skills in these dynamic fields. The curriculum covers core topics such as financial theories, risk management, and regulatory frameworks to ensure a comprehensive understanding of banking operations and insurance principles. Modules of specialization will be used, which will include investment strategies, corporate finance, and actuarial science, each one designed to overcome the particular difficulties that a professional in the field faces.

Practical applications will be emphasized by allowing students to use theoretical knowledge on real problems, through case studies and research projects. Due to its flexible schedules, working people can balance both work and college at the same time, and hence it's excellent for students wishing to make career advancement. Rigorous academic training combined with relevance in industry helps prepare students for contribution to this ever-changing world of banking and insurance. The PhD program develops expertise along with leadership abilities, which helps people navigate difficult economic environments. If you're a working professional ready to elevate your knowledge in banking and insurance, this curriculum could be your next step toward success.

|

Semester 1 |

Semester 2 |

Semester 3 |

Semester 4 |

Semester 5 |

Semester 6 |

|

Data Collection and Analysis |

Doctoral Thesis (Dissertation) |

|||

|

|

||||

|

30 ECTS / 5 modules at 6 ECTS Each |

150 ECTS - The thesis contributes around 85% to the overall result of the doctoral studies. |

||||

| PhD in Banking and Insurance for Working Professionals (Duration Wise Details) |

|

|

Within 1st Month |

Within 2nd - 7th Month |

|

|

|

Within 8th - 10th Month |

Within 10th - 12th Month |

|

|

|

Within 13th - 33th Month |

Within 34th - 36th Month |

|

|

Note- The curriculum structure provided above is not the same for every university. Make sure you visit the official website of the particular university for an updated curriculum.

PhD for Working Professionals in Banking and Insurance Eligibility & Duration

When considering a PhD in Banking and Insurance for working professionals, keep these important points in mind:

- Educational Requirements: A Master’s degree is essential, with a minimum of 55% marks required (or 50% for candidates from reserved categories).

- Entrance Exams: Be prepared for national entrance exams such as GATE or NET. Alternatively, check if the institution you’re interested in has its own admission test.

- Academic Background: A solid academic record paired with a genuine interest in research is crucial for your application.

- Professional Experience: While many institutions prefer candidates with 2-3 years of relevant work experience, this expectation can differ among universities.

- No Objection Certificate (NOC): If you are currently employed, securing a No Objection Certificate from your employer is necessary.

In summary, universities assess your entire profile. Strong academic results and entrance exam scores matter, but relevant work experience or published research can enhance your application significantly. An NOC also shows your capacity to balance work and academic responsibilities effectively. Understanding these factors can help you better prepare for a part-time PhD while maintaining your professional career.

Course Duration of PhD in Banking and Insurance for Working Professionals

If you are a working professional eyeing a PhD in Banking and Insurance, you may be asking how long the course will take. Generally, a PhD in this field will take 5 to 8 years to complete, depending on your dedication and prior qualifications.

By the nature of things, work time clashes with study time. An Online Doctorate in Business Administration (DBA) is, therefore, a great opportunity. It allows you to continue your education without losing your job. You will be learning at the pace that is comfortable for you, allowing you to balance coursework with your prevailing commitments.

The great thing about a DBA done online is accessibility. You can engage with course materials and participate in discussions from anywhere, perfect for the busy professional. Also, through such classes, you go deeply into the specialization topics in banking and insurance, preparing you for higher leadership roles or even academic positions.

Online forums and collaborative projects ensure that you connect with fellow professionals and experts in the field, adding value to your learning experience. An Online DBA will help you enhance your expertise, gain critical insights, and apply newfound knowledge directly to your work. This will not only boost your career prospects but also contribute positively to your organization.

In short, if you're passionate about advancing in the banking and insurance sector, consider an Online DBA. It’s an excellent pathway to achieving your PhD while continuing your professional journey.

Benefits of learning from us

- Join Community for peer interaction

- Get placement support via webinars & networking sessions

- Dedicated Buddy for your queries

- One-on-One career mentorship sessions

- Ensures timely delivery of LMS & degree

- A career advisor for life

Program Fees for PhD for Working Professionals in Banking and Insurance

Starting at ₹ 6,776/month

Program Fee: ₹7,130 - ₹24,50,000

Low Cost EMI Available

Recommended

The expense for an Online DBA in Banking and Insurance ranges between ₹5,00,000 and ₹10,00,000, making it generally more economical than a PhD in Banking and Insurance at an Indian university. Moreover, when factoring in costs such as travel, meals, and relocation, the online program becomes even more attractive. One major advantage of pursuing an online DBA is the flexibility to study from home while keeping your current job. This arrangement allows you to continue earning an income as you pursue your education, easing the burden of tuition fees on your finances.

PhD for Working Professionals in Banking and Insurance Admission Procedure

Admission to a PhD program in Banking and Insurance in India is rather hectic. It requires passing entrance exams which it is a little tough to pass. However, admission into an Online DBA in Banking and Insurance from a certified foreign university is relatively less complicated. Here is how to apply for an Online DBA in Banking and Insurance step by step,

- University selection and navigating their admissions site.

- Search for the section on doctoral programs and click on the registration link.

- Register to get a user ID and password.

- Log in using the user ID and password acquired.

- Fill up the application form with your details

- Upload all necessary documents required

- Carefully read the entire application form before submitting it

- Click the option for paying the application fee.

- Pay for it and retain the confirmation slip.

After the application is submitted, the university assesses the application. Once found qualified, a candidate will be shortlisted, and one is then able to pay for admission fees in order to be considered confirmed.

Trusted Information

We provide only authentic information from verified universities to save you from fraud.

Hassle-Free Admission Process

Enroll in your program via a simplified process guided by our expert counselors.

Pay Directly to the University

The guidance & support offered by us is completely free, so you can trust us & pay directly to the university.

Community at the Center

Join our telegram community to share your thoughts with other learners & alumni.

Other Specializations for PhD for Working Professionals in 2026

Education Loan/EMI Facilities for PhD for Working Professionals in Banking and Insurance

Numerous universities provide EMI options and education loans for an Online DBA in Banking and Insurance. This allows you to make payments in smaller installments rather than a single lump sum, making it easier and more budget-friendly for working professionals.

Apply For No Cost EMI

Compare EMI Partners

Is PhD for Working Professionals in Banking and Insurance Worth it?

Pursuing a PhD in Banking and Insurance may prove to be a real career changer for any working professional. If one already is in the industry, why not grow one's knowledge and expertise to the level of understanding that this advanced degree can open doors for?

Part-time PhD in Banking and Insurance- One will manage both work and studies with minimal problems. They are not bound to sacrifice employment since one would increase his/her qualifications while remaining in a position. The curriculums also provide some freedom and flexibility as some would have when undergoing a more regular course.

Have you considered an online DBA? It can be very effective if you need to make high-level strategic decisions in banking and insurance. An online DBA can provide you with the advanced skills necessary for strategic decision-making through a combination of practicality and academic rigor, which is suitable for professionals wanting to take their careers to the next level.

With both paths, you gain networking opportunities, advanced research skills, and a deeper understanding of industry dynamics. This knowledge is invaluable for tackling contemporary challenges in the financial sector.

In short, whether it is a PhD in Banking and Insurance for working professionals or an online DBA, investing in your education is investing in your future. It's not just the degree; it's your capabilities to enhance and stand out as leaders in your profession.

College Vidya Advantages

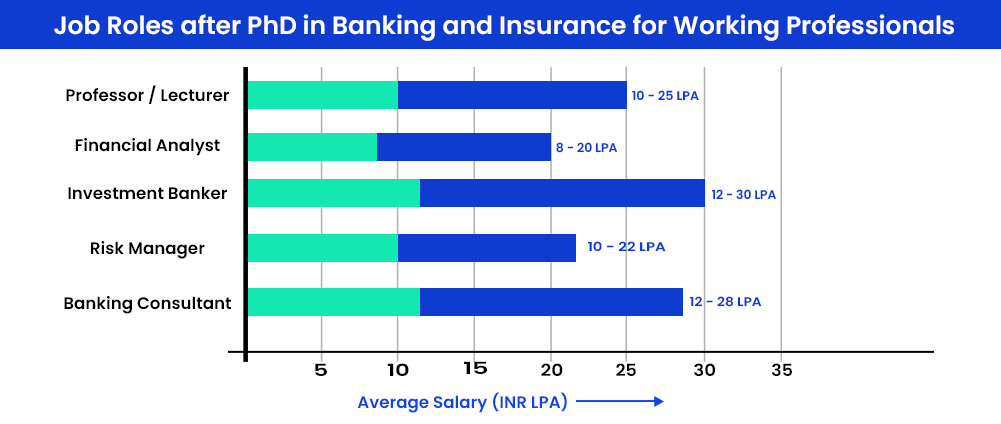

Job Opportunity after PhD for Working Professionals in Banking and Insurance

Are you a working professional with a PhD in Banking and Insurance? Exciting job opportunities await you. The financial sector is evolving, and your advanced degree puts you ahead of the competition. Companies are actively seeking individuals with expertise to navigate complex banking regulations and innovative insurance products.

With such a background, you can delve into various career roles such as risk management specialists, financial analysts, or even managerial positions in esteemed banks and insurance firms. Not only does it offer a chance to apply your research but also influences industry practices. Networking is key; connect with industry professionals through seminars and online platforms to unlock more opportunities.

Moreover, consider enhancing your skill set with certifications in fintech or data analytics to further boost your employability. Companies value professionals who can blend traditional banking and insurance knowledge with modern technological advancements. Being prepared is essential, and there's no harm in browsing around for job postings or even asking for mentorship.

|

Job Profiles PhD in Banking and Insurance for Working Professionals |

|

|

Professor / Lecturer |

Investment Banker |

|

Financial Analyst |

Risk Manager |

Top Recruiters for PhD for Working Professionals in Banking and Insurance

When it comes to recruitment, top companies are on the lookout for candidates who exhibit strong analytical skills, leadership qualities, and a thorough understanding of financial regulations. Some of the leading recruiters in this field include major banks like JPMorgan Chase, Deutsche Bank, and Goldman Sachs, which often target PhD graduates for high-level roles.

Consulting firms like McKinsey & Company and Deloitte also value the analytical mindset that comes with doctoral education, seeking professionals who can tackle complex financial issues. Insurance giants such as Allianz and AIG are similarly keen on hiring experts with advanced research skills to innovate and enhance their services.

Networking can work incredibly in your favor for a job hunt. Connect with professionals from the banking and insurance industry by attending events or even through platforms like LinkedIn. The right qualifications and connections will make all the doors swing open to exciting opportunities.

Our students work at

ICICI Bank

Airtel

Flipkart

HDFC Bank

Paytm

Tata Sky

JP Morgan

Let's clear up some doubts about PhD for Working Professionals in Banking and Insurance

Yes, many programs are designed for working professionals, offering flexible schedules and online options.

Typically, a master’s degree in finance, economics, or a related field is required, along with relevant work experience.

It generally takes 3 to 5 years, depending on your research pace and commitment.

Absolutely! Online DBA programs specifically tailored for banking and insurance professionals provide the same rigorous education with added convenience.

A PhD can enhance your expertise, open up advanced leadership roles, and provide opportunities in academia or high-level research.

Yes, many programs are designed for working professionals, offering flexible schedules and online options.

Typically, a master’s degree in finance, economics, or a related field is required, along with relevant work experience.

It generally takes 3 to 5 years, depending on your research pace and commitment.

Absolutely! Online DBA programs specifically tailored for banking and insurance professionals provide the same rigorous education with added convenience.

A PhD can enhance your expertise, open up advanced leadership roles, and provide opportunities in academia or high-level research.

View More

Every query is essential.

Our team of experts, or experienced individuals, will answer it within 24 hours.

Popular Calculators

Discover our user-friendly calculators tailored to help you make informed university selection decisions. Our Diverse range of calculators & tools ensures you find the perfect fit for your needs. Explore the options below to get started.

ROI CalculatorCareer Finder (Career Suitability Test)

Explore and Find out your Most Suitable Career Path. Get Started with our Career Finder Tool Now!

Online & Distance MBA

Online & Distance UG Courses

- 1 Year MBA Online

- IIM Online Courses

- IIIT Online Courses

- Data Science & Analytics

- Executive M.Tech for Working Professionals

- AI and Machine Learning

- Generative AI

- UI UX Certificate Program

- Online PG Diploma & Certificate

- Leadership & Management

- Finance

- Marketing

- Human Resource (HR)

- Healthcare

- Operations

- Business Analytics

- Software & Technology

- PG Diploma Applied Statistics

- IIT Courses Online

- Blockchain

- Cloud Computing

- PG Program In Technology Management

- Big Data Engineering

- DevOps

- Quantum Computing

- Digital Transformation and Innovation

- Public Policy Management

- Cyber Security

- Executive Program in Retail Management

- Online Executive Program in Emerging Technologies

- Online Executive PG Diploma in Sports Management

- View All

Online & Distance PG Courses

- Online MBA

- 1 Year MBA Online

- Distance MBA

- Executive MBA for Working Professionals

- Online Global MBA

- Online MCA

- M.Tech

- Online M.Sc

- MS Degree Online

- Online MA

- Online M.Com

- Dual MBA Online

- Online MBA after Diploma

- Online Master of Education (M.Ed)

- Online Global MCA

- Online PGDM

- Distance MCA

- Distance M.Com

- Distance M.Sc

- Distance MA

- Online MBA Plus

- MBA in Business Analytics

- M.A. in Public Policy

- M.A. in International Relations, Security, and Strategy

- Online Master of Social Work

- Online MBA & Doctorate

- Online M.Ed & Ed.D

- Online Master of Management Studies

- Blended MBA

- View All

Online & Distance Best Colleges for

India has a net of 9.6 Million students that will enroll in online education by the end of 2024. Still, the online education sector in India is unorganized and students face a lot of difficulties in getting information on it. College Vidya aims to tackle the current difficulties of students. College Vidya is India's first online platform that brings you all the online universities at a single platform. College Vidya provides unbiased information about every online course and the university providing this course.

The online portal of College Vidya is aimed to complete information to the students about every aspect of online education without being biased.

College Vidya gives the power to the students to get the best universities in online education. College Vidya's compare feature gives the comparison of every online university on the various parameters such as E-learning system, EMI, Faculties, and fees.

Disclaimer / Terms & Conditions / Refund Policy / Our PolicyThe intend of College Vidya is to provide unbiased precise information & comparative guidance on Universities and its Programs of Study to the Admission Aspirants. The contents of the College vidya Site, such as Texts, Graphics, Images, Blogs, Videos, University Logos, and other materials contained on College vidya Site (collectively, “Content”) are for information purpose only. The content is not intended to be a substitute for in any form on offerings of its Academia Partner. Infringing on intellectual property or associated rights is not intended or deliberately acted upon. The information provided by College Vidya on www.collegevidya.com or any of its mobile or any other applications is for general information purposes only. All information on the site and our mobile application is provided in good faith with accuracy and to the best of our knowledge, however, we make nor representation or warranty of any kind, express or implied, regarding the accuracy, adequacy, validity, reliability, completeness of any information on the Site or our mobile application. College vidya & its fraternity will not be liable for any errors or omissions and damages or losses resultant if any from the usage of its information.More+

© 2026 College Vidya, Inc. All Rights Reserved.

Build with Made in India.