Expert Interviews

- University Reviews

- Career Guide

Video Counseling

Video CounselingImportant Facts

- Ask any Question - CV Forum

IBPS Bank PO vs MBA: Which is a Better Career Option?

vaishnavi Jan 2, 2026 1.1K Reads

Selecting a suitable career is one of the most crucial decisions for any working individual or student. In India, two options are available: pursuing an MBA or cracking Bank PO exams, such as those conducted by IBPS. Both have stability, growth, and prestige associated with them, but are suited to varying ambitions and skill sets.

Bank PO is a popular route for securing a safe government job in the banking industry. With frequent recruitments through exams such as IBPS, SBI, and others, lakhs of candidates vie for a few spots each year. As we know that this job provides a secure salary, social prestige, and career prospects in the banking system. But the recruitment process is challenging, as the government sometimes does not allow the recruitment money for some posts.

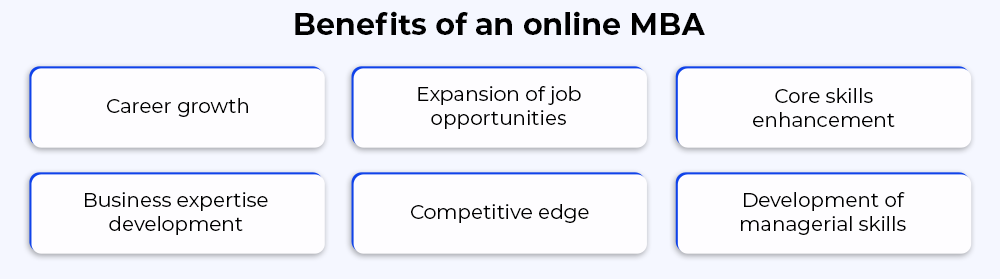

An Online MBA, a well-known university provides access to the business world. It helps students develop managerial skills, business knowledge, and leadership abilities. Although a full-time MBA involves time and money, online MBA courses have become a convenient and value-for-money option. For IBPS contenders, an online MBA can prove to be a brilliant step to add to their profile, increase their knowledge of finance and management, and even prepare them for more senior jobs in banking after getting selected.

Understanding The Two Career Paths

Learning about the Two Career Paths entails comparing different professional paths to see which one better suits your goals. An Online MBA provides flexibility and time management, and is perfect for those with sights set on corporate management or entrepreneurship.

A Bank PO job provides a safe government post with moderate growth in the banking business for candidates who excel in competitive tests and seek long-term stability. Individuals can make sensible judgments based on cost, career advancement, work security, and entrance requirements that match their personal and professional goals. It's about choosing the course that best matches your prospects.

What Is an Online MBA?

An Online MBA (Master of Business Administration) is a business management postgraduate program presented on the internet. It is meant for working professionals or students who want flexibility.

Major Features:

- The courses cover finance, marketing, human resources, operations, and data analytics.

- Flexible time that includes live or pre-recorded classes.

- Presented by top institutes like Amity, Manipal

Eligibility:

- Bachelor's degree from a recognized college or university.

- Some courses value work experience

Cost:

- Variation of ₹1.5 lakh to ₹22 lakh based on the college

What Is a Bank PO?

A Bank PO (Probationary Officer) is an entry-level position in both government and private sector banks.

Key Features:

- The job includes customer handling, loan processing, account maintenance, and financial operations

- Hired through competitive exams such as IBPS PO and SBI PO.

- Career advancement within the banking industry, including promotion to senior management positions.

- Needs high aptitude, reasoning, and overall awareness ability

Eligibility:

- Postgraduate degree

- Age: 21–30 years (age relaxation for reserved categories)

Salary:

- ₹52,000–₹55,000/month with allowances

Which One Should You Choose?

Choose Online MBA if you:

- Aspire to work under business management or start your own business

- Want different career opportunities in industries

- Want a promotion or a higher package salary

Choose Bank PO if you:

- Prefer job stability and government benefits

- Are good at competitive exams and want a structured career

- Need a low-cost entry into a respectable profession

Both paths are different according to salary and many points. It is based on your goals, financial status, and interests.. As a Bank PO, you can choose an online MBA, which will not enhance your but it will help in a greater position in the bank only.

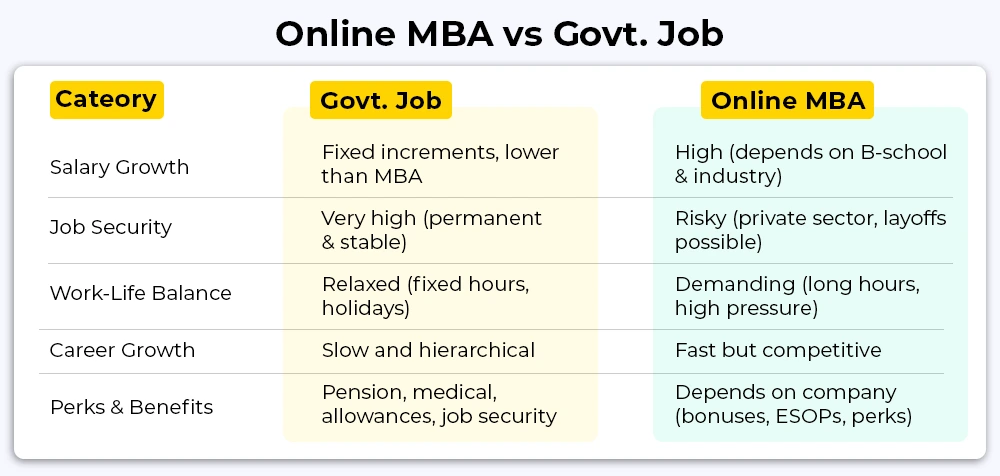

Comparing Online MBA And Bank PO Career Opportunities

Are you also confused between an Online MBA and a Bank PO job? It depends on the interest, which subject you want to study, what career path you have chosen, and which opportunities you want.

-

Entry Requirements

To become a Bank PO, one has to crack competitive exams such as IBPS PO, SBI PO, or bank exams. The tests measure your reasoning, math, English, and general knowledge. A graduate degree is sufficient to apply.

For an Online MBA, you require a bachelor's degree and occasionally some work experience. Admission varies with the college or university that is providing the course. There might be a requirement for entrance tests such as CAT, GMAT, or their respective tests.

-

Job Role and Work Style

A Bank PO is employed in public or private banks. The work involves serving the customers, maintaining accounts, sanctioning loans, and overseeing the clerks. It's a secure job with fixed timings, although at times you might have to work overtime during peak season.

An Online MBA makes you ready for business, management, marketing, finance, HR, and other roles. You can get a high salary in corporations, startups, or even become an entrepreneur. The lifestyle is more hectic that including travel, meetings, and flexible working hours, depending on the industry.

-

Salary and Growth

sBank POs receive a good salary, typically ranging from ₹40,000 to ₹50,000 a month, with allowances. Over time and promotions, you can rise to a manager, senior manager, or general manager rank. The growth is consistent but is based on experience as well as performance.

Online MBA pass-outs can earn more based on the industry and organization. Initial salaries can vary from ₹6 to ₹12 lakh annually or even higher. Jobs in good organizations or multinationals pay better. Promotion can be quick if you excel and change jobs intelligently.

-

Job Security and Stability

Bank PO positions provide great job security, particularly for public sector banks. Once you are selected, you have a secure career with pension benefits, retirement, and all other advantages.

Online MBA professions are based on the organization and sector. Private employment may not be as secure, but it provides greater flexibility to develop and create new positions.

-

Career Flexibility

An online MBA allows you to work in various fields, including IT, healthcare, finance, marketing, and consulting. You have the choice of changing employment or starting your own business.

Bank PO positions are restricted to banking. Even though you can develop within the bank, changing to other sectors can be more difficult without additional qualifications.

If you need a stable, government-backed job with consistent growth, a Bank PO career is suitable. If you would like a flexible, high-growth business career with greater earning opportunities, an Online MBA might be the right choice for you, as it will give you a hike in your post and salary package, and you will be able to enhance your skills without sacrificing your time.

Why IBPS Aspirants consider an online MBA

Most of those who aspire to appear for IBPS exams are now finding online MBA programs a smart augmentation of their career strategy. The IBPS exams, which hire candidates into public sector banks, are extremely competitive and demand months and even years of focused preparation. But not all candidates pass the exam on their first attempt, and a few might fail even after attempting it a couple of times.

An online MBA programs provide a secure backup option to ensure that their efforts and time are not lost and that they remain open to lucrative professional opportunities elsewhere. Online MBA degree programs provide the advantage of flexibility since you can learn at your convenience and from anywhere. This is especially useful for IBPS contenders who work long hours studying for exams and are unable to dedicate themselves to a full-time, on-campus MBA. With e-learning, they are able to pursue both their exam studies and academic progress without sacrificing either.

An online MBA teaches students valuable skills that are useful not just in the corporate world but also in the banking industry. Candidates can get more knowledge through an understanding of market trends by taking courses in finance, marketing, human resource management, corporate strategy, and leadership. These are directly transferable to banking jobs, particularly for those seeking to evolve past entry-level levels. For example, a probation period during the online MBA will better equip students to handle management functions, organize teams, and make strategic contributions. This can lead to sharp mention and praise in the bank. Apart from this, banks change at a very rapid pace, embracing digital technologies and customer-oriented practices. An online MBA prepares candidates with current business practices, making them more flexible and knowledgeable related to the trends.

Another reason IBPS aspirants look to online MBAs is because of their affordability and convenience. Most of the top-notch universities and institutions now provide accredited online MBA programs at a fourth of the cost of conventional programs. This way, students from all walks of life can seek higher studies without incurring massive loans or migrating to costly cities.

The convenience of studying from home also implies that rural or distant area aspirants can opt for quality education without any logistical constraints. Also, an online MBA opens up more career avenues than banking. Suppose an aspirant passes the IBPS exam and gets employment in a bank.

An online MBA is a sensible and pragmatic option for IBPS candidates. It provides flexibility, improves professional prospects, and allows their time invested in preparing for competitive exams to be supplemented by professional development.

Career Opportunities After Completing an Online MBA for IBPS Aspirants

An Online MBA with a specialization in banking opens up a wide range of career options in the banking and financial services sector. Graduates of the program are well-prepared for leadership roles and managerial positions. Here are some of the career options available:

|

Job Role |

Job Description |

Potential Employers |

Average Annual Salary (INR) |

|

Bank Manager |

Responsible for overseeing branch operations, managing staff, and ensuring financial goals are met. |

Public & Private Banks |

₹6,00,000 - ₹12,00,000 |

|

Risk Manager |

Manages risk exposure, ensures compliance with financial regulations, and assesses potential risks. |

Commercial Banks, Investment Banks, Insurance Firms |

₹8,00,000 - ₹20,00,000 |

|

Financial Analyst |

Analyze financial data to help organizations make informed investment decisions. |

Investment Banks, Financial Consultancies, Corporations |

₹4,50,000 - ₹10,00,000 |

|

Investment Banker |

Works on mergers and acquisitions, raising capital, and providing advisory services. |

Investment Banks, Private Equity Firms |

|

|

Relationship Manager |

Manages relationships with high-net-worth individuals (HNWIs) and corporate clients. |

Banks, Private Wealth Management Firms |

₹5,00,000 - ₹12,00,000 |

Skills Gained From An Online MBA That Benefit IBP Aspirants' Careers

Taking advantage of an online MBA while preparing for IBPS aspirants can offer various benefits from the professional sector to the financial sector. Below are the advantages:

-

Improved Career Opportunities

An Online MBA in Banking brings significant value to career prospects for working professionals. By acquiring higher knowledge and skills, the applicants make themselves more valuable resources to their organizations. With an MBA, banking professionals become eligible for managerial and leadership roles, which would otherwise be out of reach for them in the absence of higher degrees.

-

Higher Earning Ability

An Online MBA is likely to have higher salary potential. IBPS Aspirants who take an online MBA typically earn more than those without one. In the financial sector, posts such as investment bankers, risk managers, or Money managers are associated with attractive compensation packages, such as Aadhaar compensation, bonuses, and other incentives. On average, an online MBA in bank earns 20% more than 40% more than a bachelor's degree in banking or finance.

-

Working Professionals Flexibility

One of the best advantages of an Online MBA in Banking is the flexibility it offers. Learners can study at their convenience and time by taking courses that best fit their style. You can study from anywhere and anytime makes an Online MBA ideal for banking executives who must balance their job, family, and education.

-

Specialized Knowledge and Skills

An Online MBA in Banking provides tailored education in highly technical topics such as the banking and financial sectors. Topics such as financial modeling, risk management, investment analysis, banking regulations, and corporate finance. Such advanced education gives you the power to overcome difficult problems in the banking sector and provide valuable solutions to organizations and banks.

-

Networking Opportunities

Online MBA courses facilitate the attainment oan f international perspective, enabling students to interact with trends, educators, and enterprise professionals globally. The virtual learning environments contain discussion forums, webinars, virtual group projects, and networking sessions where banking experts can connect with industry professionals.

Best online MBA Specializations For Banking Professionals

Here are the top Online MBA Specializations for banking professionals:

|

Specializations |

Career Opportunities |

|

Finance management |

Credit manager, Account executive, Financial analyst, Senior accountant, Management consultant, Senior auditor, Accounting manager, Senior tax accountant. |

|

Business Analytics |

Finance, health care, education, IT, consulting, e-commerce, government, and manufacturing. |

|

Healthcare Management |

Hospital Administrator, Healthcare Consultant, Public Health Manager, Healthcare IT Manager, Medical Practice Manager |

|

Hospital Management |

HR Manager / Business Partner, Talent Acquisition Specialist, Compensation & Benefits Manager, Employee Relations Manager, HRIS Analyst |

|

HR Management |

Operations Manager, Supply Chain Manager, Logistics Manager, Quality Control Manager, Project Manager |

|

Operations Management |

Marketing Manager, Brand Manager, Digital Marketing Specialist, SEO/SEM Analyst, Content Marketing Manager, Performance Marketing Manager |

|

Marketing Management |

IT Project Manager, Chief Information Officer (CIO), Enterprise Architect, IT Consultant, Cloud Architect |

|

IT Management |

Data Scientist, Machine Learning Engineer, Data Analyst, Data Engineer, NLP Specialist |

|

Digital Marketing |

SEO, Google Ads, Meta Ads |

|

Data Science |

Extracts insights from complex datasets |

For more specialization, you can also visit this website.

Top Affordable universities for online MBA

|

Universities (Online MBA Course) |

Universities Accreditations |

|

AIU, WES, AACSB, WSCUC |

|

|

CIE, FAPSC, CECU, QAHE |

|

|

UGC, NIRF, NAAC A++, QS World University Rankings |

|

|

UGC- DEB, AICTE, NIRF, WES, NAAC A++ |

|

|

NAAC A++, UGC, AICTE, NIRF, QS World University Rankings, AUAP |

|

|

UGC- DEB, AICTE, AIU, NIRF, WES, NAAC A++, ISO |

|

|

UFC- DEB, AICTE, AIU, NIRF, WES, NAAC A++ |

Conclusion

An online MBA degree benefits every professional seeking long-term growth and success. What matters is the right goal, motivation, and a good curriculum that aligns with your field. Since the online MBA programme has a variety of specialisations available, it is convenient to tailor your degree based on your individual needs. If you are a banking professional, getting an online MBA degree at this point of high competition is your chance to grab the opportunity and lead.

FAQs (Frequently Asked Questions)

An online MBA degree for IBPS aspirants can be flexible; it is designed in such a manner that a working professional can enhance their skills in the banking sector.

You should have a bachelor’s degree, with a minimum of 50% marks, and some work experience, depending on the college.

An Online MBA opens doors to both government and private sector roles. For IBPS aspirants, it enhances eligibility and competitiveness for managerial positions in banks:

- Government Sector Roles:

- Bank Manager / Branch Manager

- Risk Manager

- Credit Officer

- Financial Analyst

- Specialist Officer (SO) in HR, Marketing, IT, etc

Yes, Online MBAs are tailored for working professionals, offering:

- Weekend live classes

- Recorded sessions for flexibility

- Real-world case studies and projects

- Specializations in BFSI (Banking, Financial Services & Insurance)

Banks like SBI promote officers to Branch Manager roles typically after 5 to 8 years of service. An MBA (even online) adds weight to your profile and helps fulfill educational requirements for managerial posts.

By vaishnavi

3 Years of experience/ academic writer/ freelance writer

An academic writing expert and a freelancer with an experience of 3 years.

Every query is essential.

Our team of experts, or experienced individuals, will answer it within 24 hours.

Recommended for you

Tired of dealing with call centers!

Get a professional advisor for Career!

LIFETIME FREE

Rs.1499(Exclusive offer for today)

Pooja

MBA 7 yrs exp

Sarthak

M.Com 4 yrs exp

Kapil Gupta

MCA 5 yrs exp

or

Career Finder

(Career Suitability Test)

Explore and Find out your Most Suitable Career Path. Get Started with our Career Finder Tool Now!

ROI Calculator

Find out the expected salary, costs, and ROI of your chosen online university with our free calculator.