What makes CV different? Social Experiment by CV

Get Best University at Affordable Fee

Real Time Data of Universities to help you to decide

Dedicated Assistance from our Certified Experts

Compare & Select from 100+ Best University for your Online Accounting Certificates Online FRM Certification Course

- No-Cost EMI From ₹4,999/-

- 100% Placement Assistance

Updated at : February 20, 2024

Online FRM Certification Training Program

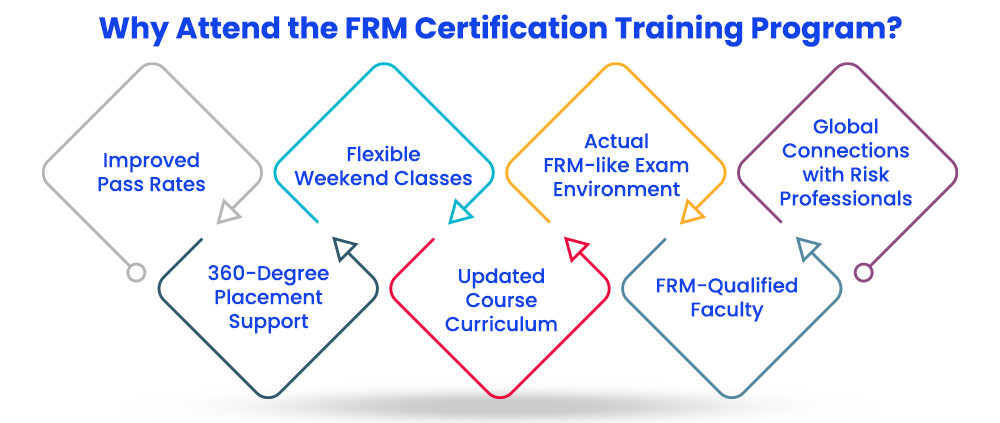

Financial Risk Manager or FRM certification is one of the renowned certifications in the risk management sector. A FRM training program is designed to help you clear the actual FRM exam and a global certification in the same. The updated course content, mock tests, previous year papers, and many other services offered in this training program improve your pass rate for the final exam.Watch Video

Online Accounting Certificates in Online FRM Certification Program Overview

FRM is abbreviated for Financial Risk Manager and is offered by the Global Association of Risk Professionals (GARP, USA). This certification is quite well-known in the finance sector and is highly demanded by banks and related firms globally. This certification is designed to equip professionals with the necessary skills they must have to face the risks in the business field.

A FRM certification training program is one of the ways to get enlightened about the course curriculum, exam pattern, and preparation strategy for the actual exam. This program makes you learn not only technical skills but also helps you develop soft skills for better work performance. It is offered in both online and offline modes, thus, you can choose the mode of learning as per your schedule and requirements.

The curriculum design of this training course matches that of the actual FRM exam and hence prepares you for it in all possible ways. It covers all the major topics of the real exam and even provides you with additional reference materials for self-study. The knowledge imparted by FRM-qualified trainers makes it easy for you to crack the FRM exam and get certified.

Not only technical knowledge but this training course also provides 100% placement assistance by making you explore a varied number of job options in the finance sector. Thus, qualifying FRM not only enhances your job designation but lands you at your dream organization with a well-paying profile.

Key Highlights of Online Accounting Certificates in Online FRM Certification In India

- Learn the core topics of FRM certification with a flexible weekend batch training program in online or offline mode.

- Join the program right after completing your 12th grade and join the team of risk professionals.

- Improve your exam pass rate by 80% in around 1 year with this training course.

- Prepare for the actual exam with updated course content divided into 2 parts similar to the real exam pattern.

- Interact with the FRM-qualified trailers and clear all your doubts about the exam.

- Get access to an integrated LMS portal for study material and mock tests.

- Join this course and crack the globally recognized FRM exam.

- Fulfill your dream of working with Big 4 and Big 6 firms with FRM certification.

Admission Closing Soon

Compare & Enroll NOW

- To avoid paying 25% Late Fees on all the online courses

- To secure a seat in your dream university

- To avail of some amazing Early Benefits

Online Accounting Certificates in Online FRM Certification Course Subjects/Syllabus

The curriculum design of this course resembles completely the actual FRM exam pattern. There is a division of the core topics into two parts, i.e., Part 1 and 2 just like the categories of the FRM exam.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AnalystPrep, a GARP-approved and trusted exam prep provider for FRM, provides the study materials for this training course to provide you with a ‘Golden benchmark’ in risk management.

Online Accounting Certificates in Online FRM Certification Eligibility & Duration

If you have cleared your 12th grade from a recognized Board of Education or have enrolled in your graduation, you can easily join this training course. Moreover, with the above-mentioned qualification, you are even eligible to appear for the FRM exam. However, considering the complexity of the exam, it is advised to attend the training course first before wasting even your single exam attempt.

The approximate preparation time needed to crack the FRM exam is 1 year. Thus, the duration of this training program is planned between 12-18 months which covers all of the essential topics of the actual exam.

Benefits of learning from us

- Join CV Community for peer interaction

- Get placement support via webinars & networking sessions

- Dedicated CV Buddy for your queries

- One-on-One career mentorship sessions

- Ensures timely delivery of LMS & degree

- A career advisor for life

Program Fees for Online Accounting Certificates in Online FRM Certification

Starting at ₹ 6,776/month

Program Fee: ₹65,000 - ₹65,000

Low Cost EMI Available

Recommended

The FRM training course is available for part 1, part 2, and part 1+2. Thus, the fee structure is designed for the program considering the parts you have chosen. The overall fee range for the program lies between 40,000 to 70,000 INR. This package does not involve registration fees for the FRM exam.

Online Accounting Certificates in Online FRM Certification Admission Procedure

Enrolling in this specific training program involves a straightforward and organized admissions process. Choose the course from a reputable instructor or training provider. Go to the training provider's official website to fill out the online application. To continue with the admissions procedures, fill out the form with your personal and academic information. The requirements for your program may include appearing for an assessment or interview.

The completed application, test results, and interview findings are assessed to determine eligibility for admission. The admission committee will send you a notification via mail regarding your admission status. Those who are chosen for enrollment must complete the procedure by sending in the required paperwork and payment.

Trusted Information

We provide only authentic information from verified universities to save you from fraud.

Hassle-Free Admission Process

Enroll in your program via a simplified process guided by our expert counselors.

Pay Directly to the University

The guidance & support offered by us is completely free, so you can trust us & pay directly to the university.

CV Community at the Center

Join our telegram community to share your thoughts with other learners & alumni.

Other Specializations for Online Accounting Certificates in 2024

Education Loan/EMI Facilities for Online Accounting Certificates in Online FRM Certification

With EMI options available, the FRM certification training program is affordable for all candidates, regardless of their financial situation. One of the main factors contributing to this course's appeal to professionals is its "No Cost EMI" option for paying the tuition. You must visit the official websites of the coaching facility and its loan partners that you have selected for this course to understand all of the terms and restrictions.

Apply For No Cost EMI

Is Online Accounting Certificates in Online FRM Certification Worth it?

The need for Financial Risk Managers has grown by over 60%. This is because there are a plethora of options for trained professionals due to the notable expansion the finance industry has experienced in recent years. A FRM certification can help you fulfill this industry demand and will make you join the team of elite professionals in the field. The best part about this certification is that it is globally recognized and covers all aspects of risk management.

A FRM certification training program is one of the ways to prepare for the actual FRM certification exam. It makes you learn the identification and analysis of the risks in the business which is one of the top responsibilities of the risk professionals. The FRM-qualified trainer-led online classes strengthen your confidence in the program's scope and help you work on your weak sections. Moreover, this training course helps you conquer exam phobia by equipping you with the minimum time and effort to invest in exam preparation and exam difficulty level.

Above all, enhanced career prospects, improved pass rates, skill development, increased earning potential, and networking opportunities are some of the key benefits of the FRM certification training program that make it completely worthwhile.

College Vidya Advantages

Job Opportunity after Online Accounting Certificates in Online FRM Certification

FRM is designed to help professionals learn about many types of financial risks, such as potential credit risk, liquidity risk, operational risk, and market risk. It is more of a specialized certification than a generic one. Due to the frequent dealing with such risks that all banks and financial institutions must undertake, FRM is the most sought-after job path among professionals and students alike.

The scope of this certification is quite good not only in India but across the globe. Upon getting certified as a FRM, you become eligible for numerous job profiles in the finance sector. This is due to strategic thinking, analytical skills, financial knowledge, problem-solving, and other skills that you learned during the FRM course.

A few of the job profiles are listed below to provide you with an idea of the opportunities available post-completion of this certification.

|

|

|

|

|

|

|

|

|

|

|

|

Top Recruiters for Online Accounting Certificates in Online FRM Certification

A FRM-certified professional has a plethora of opportunities in the big firms and MNCs of the finance sector. With an average salary package of up to 10 LPA, the top recruiters of this designation include Investment Banks, Insurance companies, Commercial Banks, and consulting firms.

Our students work at

ICICI Bank

Amazon

Axis Bank

Deloitte

PWC

HSBC

Dell

JP Morgan

Let's clear up some doubts about Online Accounting Certificates in Online FRM Certification

To get FRM certified, you need to clear parts 1 and 2 of the FRM examinations and acquire a minimum of 2 years of work experience in the related field.

FRM certification is offered by the Global Association of Risk Professionals (GARP, USA). It is globally recognized and considered as the No.1 course for risk professionals.

The FRM certification training program makes you aware of the exam pattern, marking scheme, and latest exam curriculum. It even helps you with your preparation strategies by making you interact with FRM-qualified trainers. LMS access for mock tests and other reference materials allows you to practice for the exam at any time from anywhere.

Considering the authenticity of your training center, the FRM training course costs you approximately 50,000 to 70,000 INR.

The average salary package of a FRM professional is 10 LPA in India. However, this figure varies based on your profile, experience years, and reputation of the recruiter.

View More

By clicking, you agree to our Privacy Policy, & Our Trust

The intend of College Vidya is to provide unbiased precise information & comparative guidance on Universities and its Programs of Study to the Admission Aspirants. The contents of the College vidya Site, such as Texts, Graphics, Images, Blogs, Videos, University Logos, and other materials contained on College vidya Site (collectively, “Content”) are for information purpose only. The content is not intended to be a substitute for in any form on offerings of its Academia Partner. Infringing on intellectual property or associated rights is not intended or deliberately acted upon. The information provided by College Vidya on www.collegevidya.com or any of its mobile or any other applications is for general information purposes only. All information on the site and our mobile application is provided in good faith with accuracy and to the best of our knowledge, however, we make nor representation or warranty of any kind, express or implied, regarding the accuracy, adequacy, validity, reliability, completeness of any information on the Site or our mobile application. College vidya & its fraternity will not be liable for any errors or omissions and damages or losses resultant if any from the usage of its information.

Build with . Made in India.