India's leading Online Universities on a Single Platform within two minutes

Compare & Apply from 100+

Wealth Management Universities

Get an

Online Discount of 15%

College Vidya Promise

Lowest Price Guarantee

Online MBAin Wealth Management Program Overview

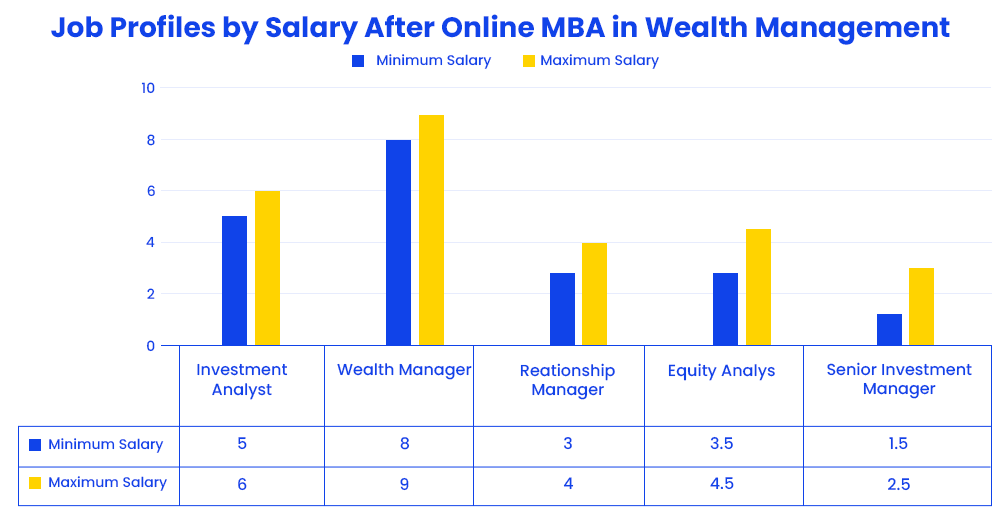

Online MBA Wealth Management is a 2-year flexible postgraduate program particularly designed for professionals looking to upgrade their skills and knowledge in the finance field. Enrolling in this program, students and working professionals learn at selected hours and their own pace. The specialized subjects of the program are investment analysis, portfolio management, financial planning, tax planning, and risk management, etc. Additionally, This course is comparably cost-effective than regular programs and the coursework provided in this program is designed to equip students with modern learning concepts and industry-relevant knowledge that result in skill building and eventually getting better jobs or entrepreneurship opportunities.

Online MBA in Wealth Management is a UGC-approved program, a degree pursued from a recognized university is valid and respected in India as well as abroad. With the advanced learning in the program and personalized study environment, students become well-skilled and achieve better job roles than regular students. Achieving the degree would result in a successful career ahead.

One of the major advantages of MBA online programs, students can pursue it from global institutions also, as the program is conducted completely online mode, there is no need to be physically available at institutions. By pursuing an online MBA in wealth management from reputed global institutions students get to interact with top-quality faculty, peers and alumni from all over the world. Learning in this kind of environment will help in soft skill development and help students to make valuable networks.

Why Pursue an Online MBA in Wealth Management

Pursuing an online MBA in Wealth Management not only provides growth in your career but with great flexibility and convenience to fulfill other personal and professional commitments. Students who opt for this online program, can enroll in a job/internship with it and gain a valuable working experience with their master's studies and later after completing the flexible degree get higher package job roles. The program is also cost-effective, provides a high quality of education and offers learnings in core MBA subjects with wealth management specialized subjects. Also, there are no constraints available physically at college, students from anywhere apply for the program at any institute Indian or International.

Who Should Pursue Online MBA in Wealth Management

Anybody who wants to build expertise in the finance domain can pursue this flexible course and achieve their goals.

- Finance Professionals- individuals already working in finance and want to master the wealth management specialization to take on future managerial responsibilities in the organization, the work area investment analysis, financial planning, etc.

- Bachelor Graduates- who are interested in finance specialization wealth management can choose this flexible master's degree and also enroll in jobs with it to gain work experience.

- Working professionals- Those who are already working in any field and want to switch to the wealth management domain can do so with the online MBA wealth management program without quitting their existing jobs.

- Business Owners- who are eager to learn and build expertise in wealth management to grow their businesses and direct their teams for better outcomes.

When Should I do an Online MBA in Wealth Management

To be honest, it is never too late or never early to pursue higher education, however achieving this flexible post-graduation degree right after completing a bachelor's would result in a better start to a career and quicker growth. When to pursue it also depends on personal and professional goals. Achieving the degree after gaining some substantial working experience is also beneficial because a prior understanding of the finance industry would help in understanding the coursework more effectively. However, it is important to evaluate your current life situation before deciding to pursue a wealth management MBA online degree.

Top Universities Offering Online MBA in Wealth Management

| Name of the University | Annual Course Fee (Might Vary) | Duration |

| Suresh Gyan Vihar University | INR 80,000 | 2 Years |

Refer & Earn Rewards!

Refer someone and earn up to Rs.20,000 and more exciting coupons and vouchers

Transforming Careers Through Learning

Manan Panchal

Athul Anil

Deepak Chaudhary

Deepika Chandani

Yogesh Chauhan

FAQ's

Lets clear up some doubts

College Vidya Smart Choice Checklist

A checklist to help you reach your goal!

College Vidya Smart Choice Checklist

A checklist to help you reach your goal!

Compare Universities

Add 2 more colleges to compare

Ask Sara