Expert Interviews

- University Reviews

- Career Guide

Video Counseling

Video CounselingImportant Facts

- Ask any Question - CV Forum

Financial Management: Nature, Scope and Career Opportunities

Nirupam Lal Jan 24, 2026 1K Reads

What does one need to run a successful business or even start a business? Finance! But what if one has funds but does not know the right way to use it? The life of their business will be very short. So, in order to start and run a successful business, a good combination of sufficient funds and financial management skills is what you need. When you manage the available finance with the right principles and procedure, it helps a business age well.

Exponential growth is the only goal behind running a business and if we look at the past, the companies which have managed their finances well have experienced better exponential growth. On the other hand, the companies or businesses which do not have a proper plan to allocate the financial resources, face repetitive losses and struggle to make profit.

What is Financial Management?

Financial Management could be defined as a practice of planning, organizing, directing and controlling the financial resources or funds available to an individual or a business organization. In order to reach personal financial goals or profit as a business, one needs to to manage the available financial resources well which includes obtaining, distributing and at last using money correctly. This makes financial management important for both businesses and individuals.

The same individual financial management techniques when used at an organizational level become slightly more complex, but considering the importance and effectiveness of these techniques, financial management becomes an essential part of all business strategies.

Why is Financial Management Necessary?

If put in a few words, financial management is the foundation for business revenue. What does one do under financial management? The practice involves deciding and defining goals, making rules, executing plans, and designing the budget for decided goals. If a company follows this process without failing, there will never be a shortage of funds which will ultimately help the company focus on its main goal which is exponential growth.

These are some essential principles of financial management that portray the importance of the practice for an organisation:

- A company should always have sufficient funds available.

- There should be a perfect balance between income and expenditure to establish financial stability.

- Establishing long-term high ROI.

- Creation and execution of plans for exponential growth and business expansion.

- The business should remain unaffected by the market fluctuations with enough buffer funds.

What is the Nature of Financial Management?

If we decode the nature of financial management from its definition, we can understand that the practice involves answering questions like where and how a business should invest the funds available. The practice hence involves a set of rules and principles. Let us now understand the nature and characteristics of the same to get a better understanding:

-

To Evaluate the Risk and Returns

The primary goal or let’s say the first characteristic of Financial Management as a practice is Risk and Return Evaluation. The process involves analysing and quantifying the risk and returns involved in undertaking a business strategy with scientific techniques like data science and more.

-

To Make Financial Affairs Market Proof

One of the most important characteristics that come under the nature of financial management is making the financial affairs of an organisation or a business stable and safe from changes in economic conditions that usually keep taking place in a market.

-

To Be the Integral Management for The Whole System

Financial Management is a practice performed with an intention that the processes involved in it become an integral part of all other business functions that take place in an organisation, be it operations, growth, decision making, human resources, product management, and more.

-

To Maximize the Shareholder Wealth

A built-in characteristic in the nature of financial management, the main aim of the financial management as a practice is to make an organisation goal oriented to strive towards revenue maximization that makes an organization profitable and stable in terms of finances and revenue.

-

To Carry Out Investment, Capital Structuring, and Payout Operations

Last, but not the least, a very important characteristic of financial management is to carry out operational decisions like allotment of funds, investment strategies & execution, structuring the available funds (capital), and creating an effective and a layered dividend policy for carrying out payouts.

What is the Scope of Financial Management?

We are now done discussing all the components of Nature of Financial Management, let us now move on to the scope of financial management. If we try to put scope of financial management in simpler terms, the same can be defined as a broader spectrum that covers practices like Capital Budgeting (Making Investment Decisions), Capital Structuring (Organising the Available Funds), and Payout Planning (Making Dividend Decisions). The process hence involves daily operations, long-term strategy executions, and decision making. The end-goal of all the practices involved in the scope of financial management is to use funds for revenue maximization.

Let us now take an in-depth look at all components of Scope of Financial Management:

- Capital Budgeting (Making Investment Decisions) - The first aspect under the scope of financial management is making decisions that lay out the structure for a company's investment plans and execution. The process involves deciding which are the key assets with a future potential which the company shall invest in. This also is a key function under the nature of financial management.

- Capital Structuring (Organising the Available Funds) - The next component under the scope of financial management is organising the funds available to the business, deciding the allocation of funds to debts and equities that in turn decides the company’s investment and operations portfolio.

- Decision Making for Dividends (Planning the Payouts) - Lastly, we land upon the payouts and their structuring which also comes under the scope of financial management where in the financial planners of an organisation take important decisions for dividends to carry out hassle free payouts.

We are now done with all the theoretical aspects of Financial Management practice, let us now discuss the practical career opportunities in the field if you have developed a keen interest in the same by now. Let me tell you that Financial Management and Planning are one of the most high-paying job-fields in the finance industry with very high-paying job roles like Financial Analyst, Investment Banker, CFO, and Risk Manager.

Let us now explore the career opportunities in detail.

The Career Paths after FM -

- Corporate Finance - The career that deals with managing a company’s finances internally alongside taking care of other aspects like annual budgeting, investment strategies, and execution. Roles like Financial Analysts, Treasurer, and more come under this role.

- Financial Planning (And Wealth Management) - A profession in which you will help individuals and organisations with their finance strategies to help them meet their financial goals. Jobs like Investment Advisor and Financial Planner are the most high-paying ones in this career.

- Investment Banking - One of the highest, most-rewarding, and evergreen finance careers, the primary role of a financial advisor is to guide and advise their clients on business acquisitions, mergers, and most importantly on how to raise capital (funds).

- Risk Management - Another highly-rewarding profession associated with the nature of financial management, the primary role of a risk manager is to perform descriptive, predictive, and then prescriptive analysis for the potential financial risks a company can face. Credit Analyst, Compliance Analyst, are some of other high-paying jobs in the field.

- Quantitative Data Analysis - Another high-paying finance career, but this one requires more specific and technical skills like data analysis, data science, and more to help the organization use the past data for financial modelling to meet its financial goals.

Industries and Sectors to Look for in Financial Management:

- Banking Industry - Banks and NBFCs.

- Tech Industry - Fintech and Data Analytics (Finance)

- Consulting - The Big 4 Firms that include EY, and Deloitte, help organizations with risk management, and strategy.

- Equity and Funds - Helps private organisations or individuals manage their investments in different ways.

- Government Sector - Roles like Comptroller, and City Treasure get unlocked in the sector.

List of High Paying Jobs and Their Salaries in Financial Management:

| Job Roles in Financial Management | |

|

Job Roles |

Average Salary |

|

Financial Analyst |

₹10 L - ₹20 L |

|

Financial Controller |

₹15 L - ₹25 L |

|

Chief Financial Officer (CFO) |

₹20 L - ₹75 L+ |

|

Investment Banker |

₹15 L - ₹30 L+ |

|

Risk Manager |

₹15 L - ₹25 L |

|

Budget Analyst |

₹7.7 L - ₹11 L |

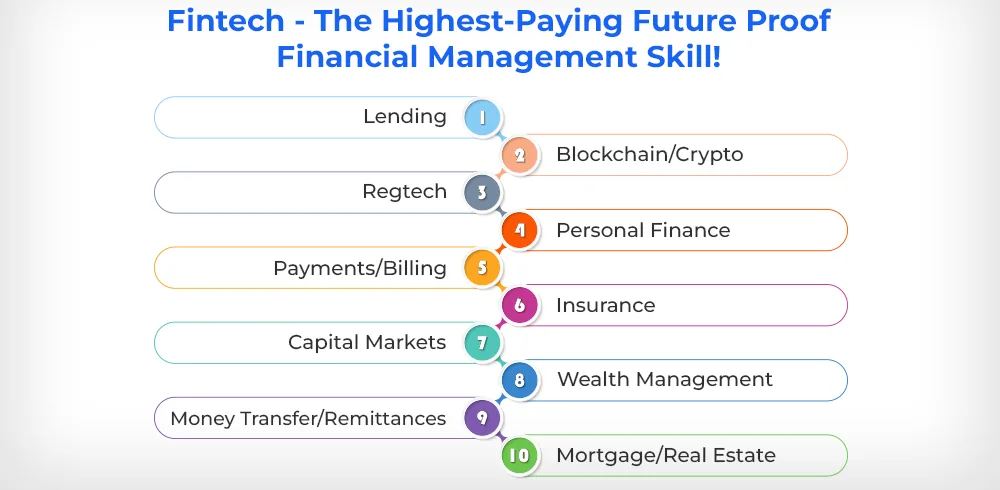

Let us now move to the bonus we promised you with! An in-depth discussion for the latest, highest paying and most-in demand Finance Skill which is Fintech. As the name suggests one who is an expert in this field of financial management, is a master of both finance principles and technology skills.

As told in the very beginning, one of the primary aspects of the nature of financial management is to analyse and assess data to help an organisation meet its financial goals. How does one do it with perfection? Only, if they have skills like Data Analytics, Data Science and more, which are essential parts of modern technology.

Some emerging technologies like CSE, Machine Learning, Artificial Intelligence, and Data Science help students become an expert at analysing data without any hassles on their journey. Such skills make one job-ready and eligible to enter the Fintech Industry.

So if you are someone who has already done a B.Tech in the above mentioned specialization, your next step should be to go for an Online MBA in Financial Technology from a reputed university with a good placement record! Why Online? Being a graduate, you might already have some work obligations and an online degree helps you crack the code without any hassles, with the exams conducted online too.

Here are two of the most reputed online university options offering an MBA in Fintech, you can explore these. Let me tell you that these are the ones with the best placement records in the country with their pass-outs already working in industry leaders like EY, Accenture and more.

Fintech For Diploma Engineers - Is It Possible?

Are you reading this article as someone who has a diploma? You don’t need to feel left out like you usually do, at life and at work. I have got your back! Let us have a look at the roadmap with which many working junior engineers like you grabbed some of the most high-paying job roles in the Fintech Industry with just a diploma in their kitty.

Let us begin with the very next step you have to take! First of all, you need to keep in mind that you are a working professional with certain responsibilities, hence you can not choose to leave your work obligations aside to do a B.Tech.

This is where an idea of B.Tech Distance Education, Online B.Tech or a Part-time B.Tech course comes into the picture! Are these courses legal and valid in India?

Absolutely not!

But, to help diploma holding engineers like you, UGC and some of the highly reputed universities in India have come up with a solution which is a B.Tech Lateral Entry Programme but designed only for the junior engineers of our country, like you.

The name of the course is B.Tech for Working Professionals. And there are quite a few universities that offer courses in specializations like Artificial Intelligence, Machine Learning, and Data Science, your first step towards the Fintech World!

Here is the list of the most trusted, reputed and completely UGC and AICTE approved universities that offer the B.Tech courses. Have a look:

- Kalinga University

- Sri Venkateshwara University

- Lingya’s Vidyapeeth Engineering University

- Sanskriti University

Now let us assume that you are done with your B.Tech with zero disturbance with a hybrid module B.Tech degree in one of the emerging technologies from any of the above universities. You are now on the same path as any other B.Tech graduate from a regular university. You can now go ahead, and pursue an MBA in Fintech from a reputed university. We have already mentioned two of the most trusted options above.

Highest Paying Job Roles in Fintech Industry

Let us now get practical, and have a look at why I have been insisting you to take the longer route for an MBA in Fintech, what is the potential, and how highly are the employees getting paid! Have a look:

| Job Roles in Fintech | |

|

Job Roles |

Average Salary |

|

Data Scientist / ML Engineer |

₹10 Lakhs – ₹20 Lakhs+ |

|

Software Engineer (Senior/Lead) |

₹8 Lakhs – ₹15 Lakhs+ |

|

Product Manager |

₹12 Lakhs – ₹20 Lakhs+ |

|

Engineering Manager/Tech Lead |

₹15 Lakhs – ₹30 Lakhs+ |

|

Quantitative Analyst (Quant) |

₹15 Lakhs – ₹25 Lakhs+ |

|

Blockchain Developer |

₹12 Lakhs – ₹22 Lakhs+ |

|

Product Owner |

₹10 Lakhs – ₹18 Lakhs+ |

Conclusion

We have now reached the end of our discussion where we primarily discussed the nature of financial management along with the scope of the practice. In the later parts of our discussion, we covered the career opportunities in the financial management sector.

At the end of our discussion, we told you about the most future-proof, and safe Financial Management career sector which is Fintech, and also the roadmap with which you can see yourself in the highest paying jobs of the industry. If we have to choose one key takeaway from our discussion, then it has to be the potential the fields like Fintech and Financial planning have for young professionals like you.

You can experience the fastest career growth if you choose Finance as a future, but you have to be careful with what you choose. You always have College Vidya for a better assessment!

FAQs (Frequently Asked Questions)

Financial Management could be defined as a practice of planning, organizing, directing and controlling the financial resources or funds available to an individual or a business organization.

Because financial management is the foundation for business revenue. The practice involves deciding and defining goals, making rules, executing plans, and designing the budget for decided goals. If a company follows this process without failing, there will never be a shortage of funds which will ultimately help the company focus on its main goal which is exponential growth.

If we decode the nature of financial management from its definition, we can understand that the practice involves answering questions like where and how a business should invest the funds available. The practice hence involves a set of rules and principles.

If we try to put scope of financial management in simpler terms, the same can be defined as a broader spectrum that covers practices like Capital Budgeting (Making Investment Decisions), Capital Structuring (Organising the Available Funds), and Payout Planning (Making Dividend Decisions). The process hence involves daily operations, long-term strategy executions, and decision making.

To help diploma holding engineers like you, UGC and some of the highly reputed universities in India have come up with a solution which is a B.Tech Lateral Entry Programme but designed only for the junior engineers of our country, like you.

The name of the course is B.Tech for Working Professionals. And there are quite a few universities that offer courses in specializations like Artificial Intelligence, Machine Learning, and Data Science, your first step towards the Fintech World!

By Nirupam Lal

2+ Years of Experience / Storyteller / Research-driven Writer

Aspiring content writer with more than 2 years of experience who likes to work with a team | Observational Writer | Adaptive thinker.

Every query is essential.

Our team of experts, or experienced individuals, will answer it within 24 hours.

Recommended for you

Tired of dealing with call centers!

Get a professional advisor for Career!

LIFETIME FREE

Rs.1499(Exclusive offer for today)

Pooja

MBA 7 yrs exp

Sarthak

M.Com 4 yrs exp

Kapil Gupta

MCA 5 yrs exp

or

Career Finder

(Career Suitability Test)

Explore and Find out your Most Suitable Career Path. Get Started with our Career Finder Tool Now!

ROI Calculator

Find out the expected salary, costs, and ROI of your chosen online university with our free calculator.