Expert Interviews

- University Reviews

- Career Guide

Video Counseling

Video CounselingImportant Facts

- Ask any Question - CV Forum

Education Loan: Online Courses, Process, EMI, Interest 2026

College Vidya Team Jan 12, 2026 6.4K Reads

As the name suggests, an education loan is an amount that has been borrowed to complete one’s education. The education loan need generally occurs when an individual goes for higher education. This is because most of the higher degree course fee is quite expensive and is not everyone’s cup of tea.

So, the problem of funding education is a major concern that students dealt with nowadays. And, the solution to such a problem is pursuing an education loan from either government/private banks or even universities that also offer various financing options like fee breakdown into easy-paying EMIs.

But pursuing an education loan or Calculating your EMI is a much more complex process in which one gets confused. So, for clearing these confusions and making this complex process a simpler one let’s move forward with us in our blog.

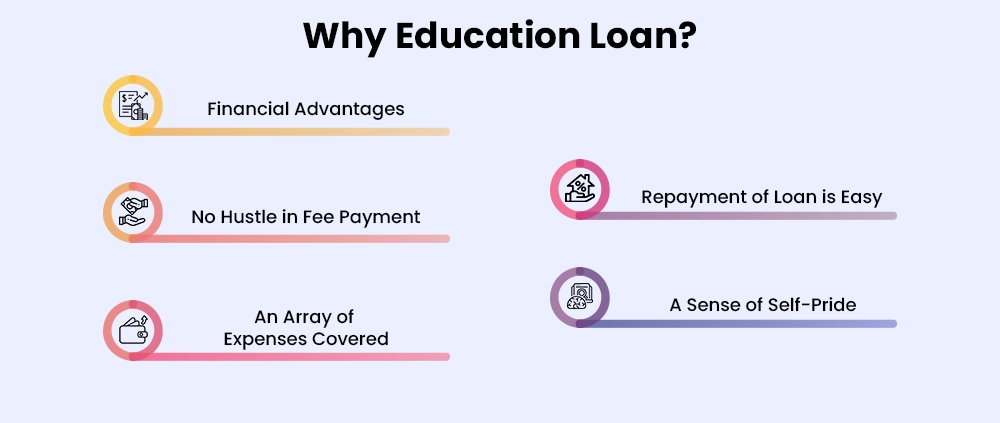

Why Opt for Education Loan?

As we know almost every student wants to pursue a quality education from the best institutions. But for getting quality things in life comes one has to also spend a great amount of money also. And there is no easy money nowadays, so maintaining this quality in our life gets difficult.

So for resolving this problem, educational institutes and financing bodies have come up with a solution for funding one’s education which is providing an education loan. But what are the benefits that an education loan provides to students? Let's discuss some of the benefits in detail:

- Financial Advantages: When one enrolls for an education loan the major benefit that one gets is they get relieved of the burden of paying the fee in one go. That is kind of very hectic for a student and their parents. And, also even if they cannot afford an expensive course fee then they get an alternative option to pursue the same course for the same fee only the process of fee payment is kind of different.

- No Hustle in Fee Payment: In the case of an education loan, there is no hustle or deadline that we have to pay the whole fee instantly. Students can easily pay their education loan amount after completing their whole course or during the course session with the help of the easy EMIs option. These EMI options can be made as per the student's budget and criteria one can make a 12-month EMI plan or a 24-month EMI plan depending on their capabilities and criteria.

- An Array of Expenses Covered: It is not fixed that an education loan that a student has taken will only cover the tuition fee of the student. The education loan amount also covers their additional education expenses like living and travel expenses, study materials, laptop allowances, and much more. All these expenses that are covered in the loan amount ease the additional burden on the student.

- Repayment of Loan is Easy: The financial authorities through which a student pursues an education loan offer reasonable interest rates and loan schemes. They also offer various easy repayment policies that help the student to pay the education loan amount quite easily with no stress and confusion.

- A Sense of Self-Pride: The most important thing that a student gets after pursuing an education loan is the sense of pride that we have freed our family of the major responsibility of financing our education. An education loan provides the student with a great opportunity of financing their own education. And repaying the loan amount with their own caliber and skills generates a sense of self-pride in the students.

Top Universities Regular Programs Fees in India

As said above, that quality comes up with a certain amount of quantity which is money. Nowadays, it is kind of every student’s wish to pursue a course from a top university. This is because it is a thought process that at the top institutes the quality of education and the benefits provided are better. But the problem of affordability of course fees persists at these top institutes.

So let’s take a look at this problem by taking into consideration at the top universities' course fees:

|

Top Universities/Colleges |

Popular Course |

Average Fee (in total) |

|

IIM Bangalore |

MBA/PGDM |

24.5 Lakhs |

|

IIT Madras |

B.E./B.Tech |

3-4 Lakhs |

|

IIT Delhi |

B.E./B.Tech |

8-9 Lakhs |

|

IIFT Delhi |

MBA |

16-18 Lakhs |

|

Symbiosis Institute Of Business Management, Pune |

MBA |

16-17 Lakhs |

|

IMT Ghaziabad |

PGDM |

17-18 Lakhs |

|

BIMTECH, Greater Noida |

PGDM |

10-12 Lakhs |

So we can see the high course fee ranges that are the problem that we students face while wishing to pursue a course from top universities. So the education loan option is quite a good solution in this regard. As discussed above the several benefits of opting for an education loan, we should explore this funding your own education option in detail. So let’s move forward and find out more about this complex education loan process.

Is Education Loan Also Available for Online Programs

It is kind of an important doubt that come across various student mind that there are various education loan options available for regular degree programs but does the same apply to online programs also? Let’s find out about the same.

Education loan options are also available for the online programs also. Currently, various online programs are provided along with such educational loan benefits to enable students to easily pay their online program fees. But are the online program education loan options the same as the regular program education loan?

Actually, the education loan options might differ in the case of online programs. It strictly depends on the bank you are availing of the loan from. The options that might differ in the case of online programs are that:

- No moratorium period available in case of Online Programs.

- As per some banks the minimum qualification to apply for online programs education loan is to be a graduate in any field.

- Along with education in the case of online programs some banks also require eligibility that the applicant must be a working professional.

Online Universities and Their EMI Plans

There are various online universities that are present out there offering education loan options for various online programs. These education loans can be easily paid through easy EMI installments monthly. Let’s check out some online universities and EMI plans.

- Online Manipal: Online Manipal University offers various programs in online mode. And the fee of these programs can be easily paid through easy installments. Here are some of the online programs of this university and their EMI plans.

|

Course |

Full Fees (INR) |

Application Fees |

Loan Amount (INR) |

EMI as Per Tenure (INR) |

|||||

|

6 Months |

12 Months |

18 Months |

24 Months |

30 Months |

36 Months |

||||

|

B Com |

80000 |

500 |

79500 |

13250 |

6625 |

4417 |

3313 |

2650 |

2208 |

|

BCA |

120000 |

500 |

119500 |

19917 |

9958 |

6639 |

4979 |

3983 |

3319 |

|

BBA |

120000 |

500 |

119500 |

19917 |

9958 |

6639 |

4979 |

3983 |

3319 |

|

M Com |

100000 |

500 |

99500 |

16583 |

8292 |

5528 |

4146 |

NA |

NA |

|

MCA |

150000 |

500 |

149500 |

24917 |

12458 |

8306 |

6229 |

NA |

NA |

|

MBA |

150000 |

500 |

149500 |

24917 |

12458 |

8306 |

6229 |

NA |

NA |

|

MAJMC |

130000 |

500 |

129500 |

21583 |

10792 |

7194 |

5396 |

NA |

NA |

- Lovely Professional University (LPU) Online: LPU online university also offers various online programs through the mode of education loans. But there are some respective criteria and requirements for availing of this education loan. Let’s check it out.

Some specific requirements and features of the LPU Online education loan:

- Minimum age of the applicant should be at least 21 years.

- CIBIL Score is not necessary.

- Admission confirmation in the university is necessary before going for an education loan.

- The rate of interest (ROI) depends upon the time period of the loan.

- The maximum time in which the loan gets approved is around 10-15 days.

- 24-month EMI options are available with 18% ROI.

- Students can also get a loan on the basis of their co-applicant that is father, mother, siblings, etc.

- Some Documentation is also needed while applying for the education loan. These are-

- 6 months Bank statement

- Aadhar Card

- Pan Card

- Passport Size Photo

- Address Proof

The LPU Online Education Loan Scheme and their EMI Plans

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

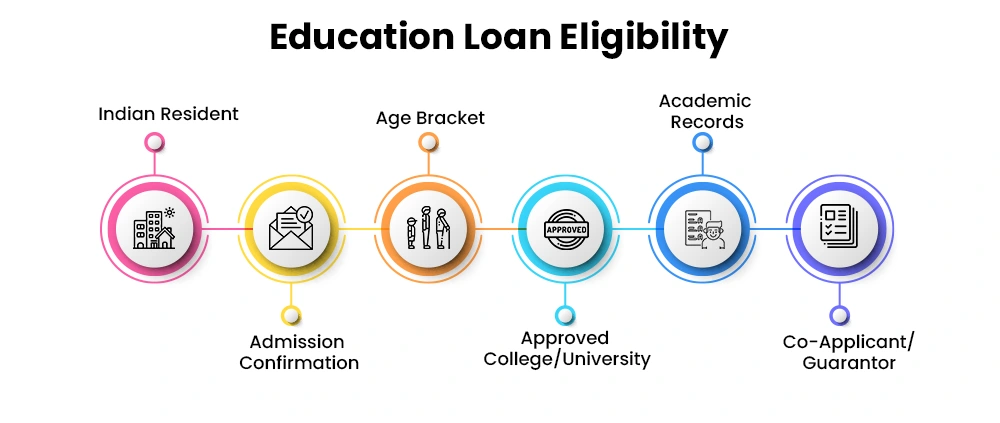

Education Loan Eligibility Criteria

To be eligible to apply for an education loan, you must meet some requirements. A student or loan application will not be given the chance to apply for an education loan if they do not meet these requirements. Here are some prerequisites that must be met in order to be eligible for an education loan:

- Indian Resident: The minimum eligibility criteria or the basic eligibility is that the candidate applying for the loan must be a resident of India. If one is a resident of India then they need to submit any Indian government IDs as proof of their citizenship.

- Admission Confirmation: For getting an education loan, one must have confirmed admission to an education institute that is recognized around the globe. An admission confirmation letter will be needed while applying for the education loan so, it is kind of an important eligibility criterion.

- Age Bracket: For becoming eligible for an education loan, the applicant must fall into the following age bracket of 18-35 years. If not belonging to this age range then it might lead to the cancellation of the education loan.

- Approved College/University: The educational institute to which the student has gotten the admission must be approved by the University Grants Commission (UGC)/All India Council of Technical Education (AICTE)/ Government approved, etc. In short, the institute must be well-accredited and has got all the necessary approvals.

- Academic Records: It is not an important eligibility criterion but it also plays a major role in education loan clearance. If the candidate’s academic records are good in their previous classes then it helps in the easy clearance of an education loan. No ruckus or barriers occur then in the process of education loan.

- Co-Applicant/Guarantor: If the applicant is pursuing a full-time course then they will need a co-applicant with them while applying for the loan. The co-applicant can be anyone like parents/guardians/spouses or in-laws in the case of a married candidate. And there is one more condition that the co-applicant applying must be a working professional. This is required to compensate the loan amount if the applicant fails to pay for it due to any condition.

All these above-mentioned criteria must be fulfilled for the successful clearance of an education loan. Sometimes there is an additional requirement depending upon the bank or financing authority, where one must be applying for the loan.

Documents Needed for an Education Loan

There are a certain set of documents needed while applying for an education loan. These sets of documents must be prepared as per the guidelines given in the information brochure on education loans. If not provided as per the guidelines, then it might lead to the cancellation of the concerned loan application. So be alert and careful while sending the following set of documents. The required documents for an education loan are

- The application form completed in all respects along with attached photographs.

- A copy of class 10th/12th or the last completed education mark sheet.

- Passport Size Photographs-2 in number.

- Aadhar Card and Pan Card of the applicant and the co-applicant.

- A detailed summary or statement of expenses of the course or the whole study cost.

- Documents that can be used as evidence of the applicant’s age proof. These can be:

- A photocopy of an Aadhar Card or

- A photocopy of your Voter ID or

- A photocopy of a Passport or

- Any Government ID that validates your date of birth.

- A copy of an evidence document that validates your identity needs to be submitted like-

- Aadhar Card

- Voter ID

- Any government-issued ID card

- Copy of the documents that can be used as proof of your residence:

- Electricity Bill

- Ration Card, etc.

- In case one doesn’t have a permanent address then the copy of the rental agreement can also be submitted.

- Copy of the documents that serve as income proof:

- Last 3-month salary slip of the Co-applicant or the applicant itself if working.

- Last 6-month bank statement of the co-applicant or applicant.

- Last 2 years updated ITR records of the co-applicant.

Depending upon the needs and situation bank/financing bodies might also ask for any other additional documents. So one must be prepared for that if thinking to apply for an education loan.

Top Banks Offering Education Loans

Now as we have learned about the whole education loan requirements and the documents needed for them, then we must also compare and study the several top banks offering education loans. There are various banks present out there that offer different education loan amounts at specific interest rates and other conditions. Some of the banks and their criteria for offering education loans are mentioned below:

|

Banks |

Loan Amount |

Interest Rate (Per Annum) |

Other Specifications |

|

State Bank of India |

Upto Rs. 7.5 lakhs without any guarantor |

10.90% |

|

|

Punjab National Bank |

As per the need of the applicant |

10.25% |

|

|

Axis Bank |

Minimum amount of loan is Rs. 50,000. |

8-16% depending upon the loan amount or tenure |

|

|

Bank of Baroda |

Rs. 1.5 Crore |

5 to 15 % depending upon the loan amount or tenure |

|

|

HDFC Bank |

Rs. 1.5 crore |

Between 9.55- 13.25% |

|

|

Tata Capital |

Rs. 30 lakhs |

10.99% |

|

Students applying for an education loan can compare among various banks present out there which works best for them in terms of all regards.

One can also compare various online universities in India and choose which one is best for them at College Vidya Portal, an unbiased platform.

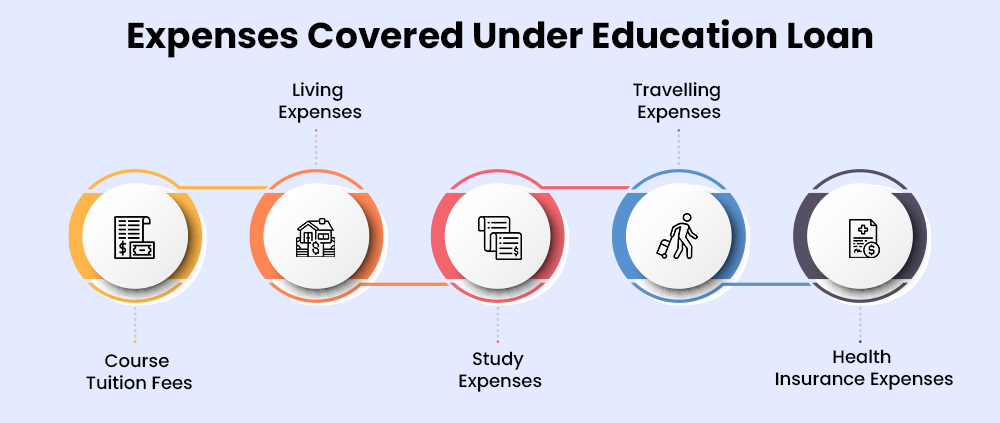

What are the Expenses Covered Under an Education Loan?

It is a myth among everyone that the only expense that an education loan covers are only the tuition fee of the course for which one is applying the loan for. But that is so not true as with a period of years the education loan has also started to cover a variety of additional expenses. So let’s know about all the expenses that get covered through the mode of education loan. The expenses covered under an education loan are described in detail below:

- Course Tuition Fees: It is one of the basic expenses that gets covered under an education loan. As it is an important requirement due to which a student in the first place has applied for the loan. So this expense is the most important that gets covered under any education loan.

- Living Expenses: The living expenses that get covered under education include lodging, food, transportation charges, etc. So it is kind of a broad area which is why the extent of covering its expenses might vary from bank to bank. Some might cover the whole living expenses and some might cover a partial amount. Due to this when applying for an education loan, one must keep a detailed check on the loan coverage by a particular bank.

- Study Expenses: Nowadays, the education loan also covers various additional study expenses like research, projects, field visits, etc. But the expense coverage options differ from bank to bank. Even now most banks even don’t cover these kinds of expenses. The coverage of these expenses provides additional benefits to the student during their study period.

- Travelling Expenses: These expenses are covered if one has applied for an education loan to pursue a course in abroad. All the travel expenses like ticketing costs, or any other necessary travel expenses are covered in this. Generally, the travel expenses are not covered by the bank but if you want that this should be covered under your education loan then this must be separately mentioned while applying for the loan. Otherwise, this expense will not be covered under the education loan.

- Health Insurance Expenses: This is the least important expense as it is generally not covered under most education loans. But some banks also include health insurance benefits as a part of their education loan. It is kind of an additional benefit that the bank provides for selling their education loan scheme.

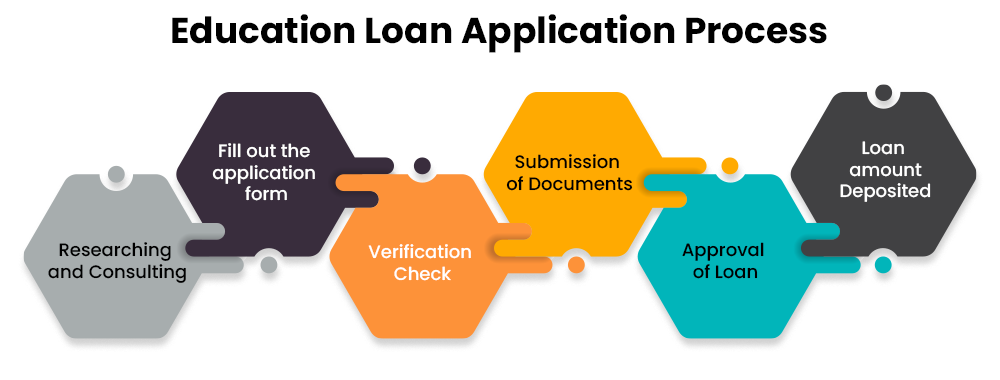

Education Loan Application Process

The most complex that an individual finds when they have started to think about an education loan is their application process. Some find it quite easy but the majority persons find it quite hard to understand. So here I am to help you with this complex application process and understand it in a quite easier manner. So one needs to just follow a simple set of steps when applying for an education loan:

- Researching and Consulting: First, one must do complete and detailed research about the various banks present out there offering education loans. Like how much loan amount one can offer, at what interest rate they are offering loans, and much more. One must research all the aspects before applying for a loan. Explore as many options available for selecting a great and cost-effective deal for oneself.

- Fill out the application form: After going through detailed research and selecting a bank in which you wish to apply for the loan. One must fill out the application form available on the website or collect the application form from the bank in case of an offline application process.

- Verification Check: After our application form is submitted to the respective bank. The loan agent will contact you with the further process and ask you about all your details and loan requirements. This is kind of also a verification check that a bank conducts for moving forward with your application.

- Submission of Documents: After the successful verification check, the bank calls the individual to its office for an understanding of the loan procedure and submission of all the required documents needed. Individuals are advised to take someone experienced person along with them for understanding the whole loan procedure.

- Approval of Loan: After all the necessary documentation work, the bank does a verification check of the documents. After a successful verification check if the bank found the candidate eligible for the loan then it moves forwards with the loan application process. And finally approves the loan application.

- Loan amount Deposited: After the successful approval of the loan application the bank first checks the college or university requirements. After this, either the bank deposits the loan amount directly in the college or university account or the student’s bank account. It depends strictly on the individual requirements at the time of loan application.

I hope now, one could easily understand this complex loan process easily and move forward with their education loan application easily.

How to Calculate EMI for Education Loan?

We were all have a confusion about how we would pay our loan amounts. On what basis the loan amount would be paid? So it is a major concern how our monthly Equivalent Monthly Installment (EMI) will be calculated. So, for resolving this concern one can use an Education Loan EMI Calculator.

This tool helps the individual to clearly understand the loan and its repayment structure. One simply has to enter some information in this tool to get the detailed information regarding your loan amount and its EMIs. Information like loan amount, interest rate, processing fee, the tenure helps to rectify the accurate EMIs that we have to pay monthly for loan repayment. And it also provides us with a piece of information after incorporating all the above factors what will the total loan amount that an individual has to pay back to the bank be?

The EMI calculator actually helps and guides you with all the necessary information on the total loan amount, the principal amount, and the benefits that one will get if one pays in a prescribed time at a prescribed interest rate. It kind of eases our stress of understanding and simplifying these complex factors.

The prime formula at which these EMI calculator works is -

- P x R x (1+R)^N / [(1+R)^N-1] where

- P stands for The Principal Loan Amount

- R stands for the Rate of Interest

- N stands for the period of time for loan repayment

Education Loan-Major Features

There are certain features and benefits that an education loan consists of due to which one must definitely go for these options to fund their own education. These are

- One can avail of the loan amount benefit up to Rs.1 crore.

- The maximum tenure in which one can repay the loan amount varies from 15-20 years.

- Not only for Indian universities/colleges one can also apply for an education loan for abroad universities also.

- A feature of a moratorium period of 1 year is provided to the individual. In this period, one doesn’t have to make any repayments for the loan amount.

- Several tax benefits are also provided upon the education loan.

- For female students, there are a variety of benefits and features available on education loans like a concession in interest rate, processing fee concession, etc.

Education Loan Repayment Process- Things We Need To Know

We currently have a thorough understanding of the entire application process for student loans, including the requirements for applicants, the paperwork needed, and the eligibility requirements.

However, one question still sticks in our mind when must we begin repaying the loan balance? Is it immediately after we finish our course, or do the lenders give us some wiggle room?

Don't worry, we've got you covered and can help you quickly grasp the loan payback process. After a course is finished, usually 12 months later, the payback process for student loans begins. It also begins six months after the person starts working. The procedure of loan repayment will begin based on whichever period ends first.

Through convenient monthly EMI installments, one can effortlessly pay off their loan balance.

Every loan has a variable moratorium term depending on the lender because each lender has a unique repayment schedule. I'll now go over the most fundamental repayment methods that are typically used:

- Net Banking: One can easily pay their monthly EMIs through net banking. By simply transferring the monthly EMI amount to the bank website or application.

- Direct Cheque: One can also deposit monthly EMI cheques directly in the name of the bank and submit it to the nearest bank branch.

- Debt from the individual account directly: If a problem of forgetting to submit the EMIs on time happens to you also then one can also set up a way through which the monthly EMIs can be directly debited from the individual bank account. This can be set to a fixed time period at which the payment will automatically deduct from an individual account.

- Demand Draft: The last mode can be making the EMI payments through Demand Draft.

All of these methods make it very simple to settle your debt and keep track of how many EMIs you have already paid. Before submitting a loan application, one should be aware that the loan payback terms vary from bank to bank. One must select the loan repayment option that is most convenient and comfortable for them.

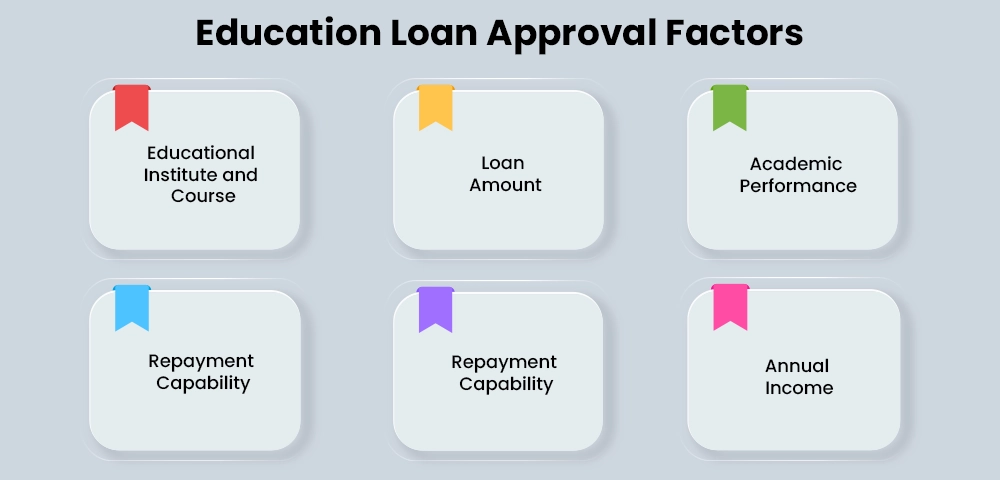

Factors Considered by the Lenders While Approving an Education Loan

We all have heard that various education loan applications get rejected or canceled. What is the reason for these canceled applications, what exactly do the education loan lenders see in a loan application, and on what parameters does the education loan application get accepted? Let’s find out more about this further.

There are several factors that are considered by loan lenders while reviewing an education loan. Some of these factors are

- Educational Institute and Course: The first factor that a lender considers is for which course and the educational institute, the individual applying for the education loan.

- Loan Amount: The next in the line is the amount of the loan that an individual wants, as whether or not the lender would give such loan amount or not that is why it is considered.

- Academic Performance: The individual academic performance in past classes is also considered when approving the loan application. This is considered to see the caliber of the student.

- Repayment Capability: The repayment capability of the individual or the individual’s family is also checked so that the lender gets trust that one can repay the loan amount or not.

- Security Assets: The security assets or family assets are also considered for approving the loan.

- Annual Income: The annual income of the individual’s family is also considered while giving approval for the loan.

All these factors are considered to understand and check the capability of the applicant to repay the loan amount. If not considered the lender faces the problem in the future if an individual fails to repay the loan amount due to any certain reason.

Why Is The EMI Factor Now Considered So Important When Selecting an Online University or Course?

The answer to this question is very simple. This is due to the various benefit that an education loan provides. And as online learning is a kind of trend nowadays so the EMI or fee payment benefits are also considered when choosing an online university or course also. Online education providers are also using this factor as their course-selling strategies because students are seeing a varied number of benefits when paying their education fees through easy EMI modes. So it is a kind of attractive factor that pulls the student towards a course and university. Let’s see some of the online courses' total education loan amount breakdown into easy-to-pay EMIs:

|

Course |

Total Loan Amount |

Monthly EMIs (If paid in 24 months) |

|

Rs. 149500 |

Rs. 6229 |

|

|

Rs. 119500 |

Rs. 4979 |

|

|

Rs. 99500 |

Rs. 4146 |

|

|

Rs. 79500 |

Rs. 3313 |

|

|

Rs. 149500 |

Rs. 6229 |

|

|

Rs. 119500 |

Rs. 4979 |

These are some of the courses and also for a certain tenure if the tenure of loan repayment increases the monthly EMIs decreases. This is a rough idea, for one to get detailed information about this one should clearly consult the concerned online university providing this feature.

Isn’t it great to fund your own education while working along? Looking at the following data we can surely say that one can very easily their expensive course fee through the help of the easy EMIs method.

When an individual nowadays doesn’t think while purchasing a phone or a product on EMI then why think so much when it comes to education? Don’t make a compromise when it comes to education otherwise for your whole life you have to compromise on everything. It's better to pay for education with the help of EMIs for a certain duration rather than purchase a product on EMIs for the whole life.

At last, I can only say that an education loan can be a great option to pursue the education that you wish for instead of making a compromise on such an important aspect of life.

Explorer Trending Article

FAQs (Frequently Asked Questions)

There are certain eligibility criteria for education loans. The applicant must be an Indian resident. The applicant must have a strong academic performance, etc.

No, an education loan is not interest-free. A certain interest rate is charged against the loan amount.

Yes, definitely it is a good idea to get an education loan. This is because it provides an individual with a great number of benefits and features.

One must meet all the eligibility criteria, proper documentation work, and meet all the criteria that a lender considers while approving a loan will help the one to get the education loan quite easily.

The current interest rate may depend on several factors and might also differ from bank to bank. But in a rough idea, it is ranging from 6.7% to 11.6%.

Nowadays, there is the availability of several Education Loan EMI calculator that helps an individual easily calculate their monthly EMIs. So one can use these tools for easy calculation.

Idea Alchemist / Concept Creator / Insight Generator

We are an online education platform where users can compare 100+ online universities on 30+ X-factors in just 2 minutes. With an active CV community, we have transformed online learning to quite an extent. With the CV Subsidy scheme, we contributing to GER in India while helping our learners with their finances in their “Chuno Apna Sahi” journey!

Every query is essential.

Our team of experts, or experienced individuals, will answer it within 24 hours.

Recommended for you

Tired of dealing with call centers!

Get a professional advisor for Career!

LIFETIME FREE

Rs.1499(Exclusive offer for today)

Pooja

MBA 7 yrs exp

Sarthak

M.Com 4 yrs exp

Kapil Gupta

MCA 5 yrs exp

or

Career Finder

(Career Suitability Test)

Explore and Find out your Most Suitable Career Path. Get Started with our Career Finder Tool Now!

ROI Calculator

Find out the expected salary, costs, and ROI of your chosen online university with our free calculator.