India's leading Online Universities on a Single Platform within two minutes.

100+ Universities

30X comparison factors

Free expert consultation

Quick Loan facility

Celebrating 1 lac admissions

Post Admission Support

Exclusive Community

Job + Internship Portal

Compare & Apply from 100+

Online CPA Certification Universities

- No-Cost EMI From ₹4,999

- Comparison on 30+ Factors

Share

Share Updated at : January 28, 2026

Online Certified Public Accountant Training Program

CPA is abbreviated for Certified Public Accountant. It is a globally recognized designation in the finance and accounting field. It is conducted by the AICPA, American Institute of Certified Professional Accountants, one of the leading organizations for accountants in the USA. An online CPA training course is designed to help accounting professionals extend their reach to the international market without perturbing their daily routines. This training program improves your chances of clearing the US CPA exam and getting the prestigious CPA title.Watch Video

Online CPA Certification Program Overview

Certified Public Accountant (CPA) is a globally recognized designation that is respected and accepted in over 130 countries including the US and India. This title can be earned by clearing a set of exams which is organized by the AICPA (American Institute of Certified Professional Accountants). Thus, it is also famous under the name of US CPA.

An online CPA training program is designed to make the CPA aspirants pass the certification exams without causing many changes to their daily lifestyle at a flexible schedule. With online classes, a comprehensive curriculum, live practical sessions, internship/live projects, and many other learning facilitations offered in this program, you can enhance your understanding of the subjects and exam pattern.

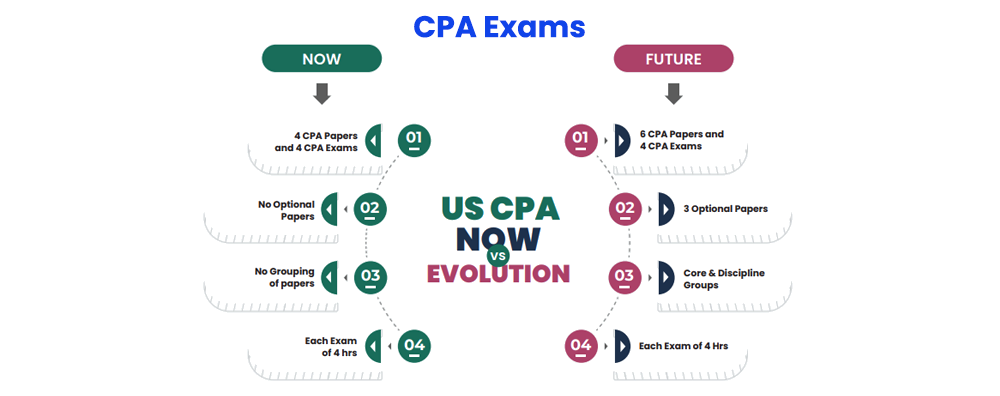

The existing US CPA exam has 4 papers but the upcoming exam of CPA Evolution has a slightly different course structure. It consists of 6 papers with 3 core and 1 elective paper. This online training course for US CPA makes you learn the details of all topics of this exam in 12-18 months.

CPAs are in high demand in the US and Indian markets. Thus, by clearing the US CPA exam, you can expand your professional network not only to international firms in India but also to those based in the US. With a CPA designation, your career opportunities are not limited to the accounting and finance sector but are also recognized by the manufacturing, IT, pharma, etc. Moreover, the placement assistance services offered by your US CPA training institute help you crack the interviews of top firms and get placed at your desired one right after receiving the CPA license.

Key Highlights of Online CPA Certification In India

- Prepare yourself for one of the prestigious designations of the accounting field with an online CPA training course.

- Get unlimited access to the CPA books, practice questions, study materials, reference material, and mock tests to improve your exam preparation.

- Learn practicals on MS Excel, Advanced Excel, Financial Modeling, etc. to resolve real-life situations in the financial domain.

- Attend 24*7 available doubt-clearing sessions with highly qualified CPA, CFA, CA, and CMA faculty members.

- Complete your exam preparation and get your US CPA license in just 12-18 months.

- Clear the US CPA exam and become a member of one of the world's oldest and most respected Accountancy bodies, i.e., AICPA.

- Take advantage of the high demands of CPAs and use your expertise to avail yourself of alluring career roles in the Indian and International financial domains.

- At some institutions, you can also get a “pass guarantee feature” that gives you 100% assurance that you clear your exams. In case you do not pass all CPA exams, the institution will give a refund of 50% of the course fee.

- Optional internships and live projects offered in the program make you learn the application of financial concepts for a result-oriented outcome.

- Mentoring sessions, soft skill training, interview preparation assistance, and many other placement-assuring services help you secure a well-paying job profile in the top MNCs.

Admission Closing Soon

Compare & Enroll NOW

- To avoid paying 25% Late Fees on all the online courses

- To secure a seat in your dream university

- To avail of some amazing Early Benefits

Online CPA Certification Course Subjects/Syllabus

The curriculum design of CPA is going to change from 1st Jan 2025. In the updated exam pattern, you will have 3 compulsory core papers and 3 discipline papers that are electives. Only 1 of the 3 electives is to be studied. The table below will give you a comparative summary of the existing and upcoming US CPA exam structure.

|

CPA Existing Exam Structure (4 Subjects-4 Exams) |

|

|

Business Environment and Concepts (BEC)

|

Auditing & Attestation (AUD)

|

|

Taxation & Regulations (REG)

|

Financial Accounting & Reporting (FAR)

|

|

CPA Upcoming Exam Structure (6 Subjects-4 Exams) |

|

|

Compulsory Topics |

Elective Topics (Choose Any 1) |

|

Auditing & Attestation (AUD)

|

Information System & Controls (ISC)

|

|

Taxation & Regulations (REG)

|

Business Analysis & Reporting (BAR)

|

|

Financial Accounting & Reporting (FAR)

|

Tax Compliance & Planning (TCP)

|

CPA Exam Pattern

|

CPA Existing Exam Pattern |

||

|

Papers |

Count of Questions |

Weightage of Score |

|

BEC |

MCQs: 62 TBUs: 5 |

MCQs: 50% TBUs: 35% |

|

AUD |

MCQs: 72 TBUs: 9 |

MCQs: 50% TBUs: 50% |

|

FAR |

MCQs: 66 TBUs: 9 |

MCQs: 50% TBUs: 50% |

|

REG |

MCQs: 76 TBUs: 9 |

MCQs: 50% TBUs: 50% |

|

CPA Upcoming Exam Pattern |

||

|

AUD-Core |

MCQs: 78 TBUs: 7 |

MCQs: 50% TBUs: 50% |

|

FAR-Core |

MCQs: 50 TBUs: 7 |

MCQs: 50% TBUs: 50% |

|

REG-Core |

MCQs: 72 TBUs: 8 |

MCQs: 50% TBUs: 50% |

|

BAR-Discipline* |

MCQs: 50 TBUs: 7 |

MCQs: 50% TBUs: 50% |

|

ISC-Discipline* |

MCQs: 82 TBUs: 6 |

MCQs: 60% TBUs: 40% |

|

TCP-Discipline* |

MCQs: 68 TBUs: 7 |

MCQs: 50% TBUs: 50% |

Online CPA Certification Eligibility & Duration

To be eligible for the US CPA designation, you need to fulfill the 3 Es, i.e., Educational, Examination, and Experience. Here is an elaborate brief of these requirements.

- Education: To pass the CPA exam, you must have 120 credit points and to get the CPA license, these credit points go up to 150. These credit points are as per the US education. Since 1 year of Indian University education is equal to 30 credits of US education, thus, a bachelor’s degree makes you eligible for the CPA exam, and a master’s degree for the CPA license. A CA/CS/CWA can also get you a US CPA license.

- Examination: Pass all the exams of the CPA exam structure within the specified timeframe.

- Experience: For CPA designation, you need to have at least 2 years of work experience in finance and accounting.

The duration to clear all the US CPA exams is 18 months from the 1st passed exam. The best part is that the training course offered by certain institutions to prepare for the exam falls in a similar time frame ranging between 12-18 months.

Benefits of learning from us

- Join Community for peer interaction

- Get placement support via webinars & networking sessions

- Dedicated Buddy for your queries

- One-on-One career mentorship sessions

- Ensures timely delivery of LMS & degree

- A career advisor for life

Program Fees for Online CPA Certification

Starting at ₹ 6,776/month

Program Fee: ₹1,90,000 - ₹1,90,000

Low Cost EMI Available

Recommended

The online CPA training program fee is 1,10,000 INR. This figure includes all the charges except for the one-time registration fee which is 10,000 INR. These fee figures associated with this program are subject to change and vary with your choice of institution. At certain institutions, you get a money-back guarantee of 50% of the full program fee in case you do not pass the US CPA exams.

Online CPA Certification Admission Procedure

The online CPA training course is designed for professionals who want to earn the globally recognized CPA designation without quitting their jobs or hampering their personal commitments. The first step in the procedure for those who wish to participate is to apply online and pay the registration fee. Upon completion of this initial round, candidates are required to submit pertinent documents, including transcripts of records, employment histories, and professional certifications.

The selection committee carefully reviews these applications to assess if they are eligible and a suitable match for the program. Those who are accepted receive an offer of admission, which initiates a 12-18-month journey that will transform their life. This meticulous procedure guarantees that the group consists of individuals with strong academic backgrounds, a wealth of professional experience, and a sincere desire to advance their financial leadership abilities in the dynamic realm of the finance and accounting sector.

Trusted Information

We provide only authentic information from verified universities to save you from fraud.

Hassle-Free Admission Process

Enroll in your program via a simplified process guided by our expert counselors.

Pay Directly to the University

The guidance & support offered by us is completely free, so you can trust us & pay directly to the university.

Community at the Center

Join our telegram community to share your thoughts with other learners & alumni.

Growth of Online Education in India

- Online education in India is set to grow at a CAGR of 19.9% by 2030.

- Skill development and employment are the major driving forces for this growth.

- Higher education is gaining popularity in this online medium.

- Financially affordability is a significant contributor to this boom.

- The increased adoption of technologies, i.e., the Internet and smartphones, has increased accessibility significantly.

- The advantage of flexibility in terms of time and location is the key highlight.

Education Loan/EMI Facilities for Online CPA Certification

The online CPA training program provides a variety of flexible financial choices, including the opportunity to apply for student loans, for the convenience of its students. To help participants spread out their payments over time, the program also offers EMI (Equated Monthly Installment) choices. These financial assistance programs guarantee that eligible individuals do not miss out on the opportunity to scale up their knowledge and extend their financial expertise in the global market. Moreover, it will help them find the time to dedicate to their professional development, embarking on a transformative journey to become proficient financial professionals not only in the Indian financial market but in over 130 countries.

Apply For No Cost EMI

Compare EMI Partners

Is Online CPA Certification Worth it?

An online CPA training program is recommended for those who wish to advance their career in the fields of audit, tax, financial advisory, consulting, valuation, etc. The program's carefully designed curriculum, together with its well-known instructors and business professionals, equip students with the strategic insights and state-of-the-art financial knowledge they need to excel in today's fast-paced corporate world. Students are guaranteed a flexible and comprehensive learning experience with the online learning approach, which combines live lessons, internships/live projects, and one-on-one instruction. Your social net worth rises when you can network with other professionals and industry leaders at a global level.

The US CPA license is well-known globally and committed to cultivating future leaders. The true benefits—promotion in the workplace, higher earning potential, and the chance to lead productive teams—provide a strong return on investment. For those who wish to stay ahead of the curve as the financial industry develops, the online US CPA training program is a once-in-a-lifetime opportunity. Because of this, it is unquestionably a wise investment for not only qualifying as a CPA but also for exploring high-level financial leadership roles.

College Vidya Advantages

Job Opportunity after Online CPA Certification

A US CPA designation is considered the gold standard in the international finance and accounting field. Its global reputation provides you with a range of career opportunities in 130+ countries. After completion of the CPA exam and upon getting a CPA license, you can serve the following roles and responsibilities in different sectors.

| Job opportunity | |

|

Auditing Financial Statements |

Financial Consulting |

|

Tax Planning and Preparation |

Accounting and Bookkeeping Services |

|

Business Valuation |

Forensic Accounting |

|

Regulatory Compliance |

Tax Analyst |

Top Recruiters for Online CPA Certification

CPAs have expertise in the US GAAP, Financial Analysis & Reporting, Audit, and Taxation which makes them ideal accounting professionals irrespective of the sector of the industry they are serving. Even the Big 4 firms like KPMG, Deloitte, PwC, and EY have a keen eye for the CPAs making this program quite popular among accounting professionals in India and overseas.

Our students work at

Accenture

Amazon

Capgemini

Deloitte

Ey

KPMG

PWC

HSBC

Let's clear up some doubts about Online CPA Certification

CPA is the abbreviation for Certified Public Accountant which gives you recognition in the accounting and finance field across 130+ countries. It is offered by the American Institute of Certified Professional Accountants (AICPA) and is also known by US CPA.

Multiple Choice Questions (MCQs) and Task Based Units (TBUs) are two categories of questions asked in the US CPA exam. The weightage of these questions in the newly structured CPA exam is provided below:

|

CPA Upcoming Exam Pattern |

|||||

|

Exam Type |

Papers |

Count of Questions |

Weightage of Score |

||

|

MCQs |

TBUs |

MCQs |

TBUs |

||

|

Compulsory |

AUD-Core |

78 |

7 |

50% |

50% |

|

FAR-Core |

50 |

7 |

50% |

50% |

|

|

REG-Core |

72 |

8 |

50% |

50% |

|

|

Elective (Choose any 1 of the 3) |

BAR-Discipline |

50 |

7 |

50% |

50% |

|

ISC-Discipline |

82 |

6 |

60% |

40% |

|

|

TCP-Discipline |

68 |

7 |

50% |

50% |

|

In the online CPA training course, you will get access to Gleim, an AICPA-approved content provider. This will provide you with:

- 1,300+ Task-Based Simulations for practice

- 10,000+ MCQs for practice

- Guidance from personal mentors

- Digital and physical books

- Audio lessons

- Expert-led class videos

- Access to private study groups and many more.

As per the latest updates, CPA will follow a different exam structure from the current one. Right now, you need to study 4 topics and clear 4 compulsory exams to get the US CPA license. However, from 2026, you will have 3 compulsory and 1 elective topic (to be selected out of 3 options) to study and 4 exams to crack.

Upon getting a CPA license, you can work in Public Accounting (including the Big 4) and Industry/CFO Team. In both areas, you can secure a profile in accounting, tax, treasury, internal audit, financial planning & analysis (FP&A), mergers and acquisitions (M&A), risk management, corporate finance, and other related domains.

The top four firms in India, KPMG, Deloitte, Ernst & Young India, and PwC India known as the Big 4 actively hire CPAs at salary packages ranging between 12-25 LPA. Based on your experience and responsibilities towards your job roles, you can get exciting annual increments.

To clear the CPA exam, you need to score 75 on each of the 4 exams that make up this global certification.

The best part about the US CPA exam is that there is no negative marking for wrong answers.

View More

Every query is essential.

Our team of experts, or experienced individuals, will answer it within 24 hours.

Popular Calculators

Discover our user-friendly calculators tailored to help you make informed university selection decisions. Our Diverse range of calculators & tools ensures you find the perfect fit for your needs. Explore the options below to get started.

ROI CalculatorCareer Finder (Career Suitability Test)

Explore and Find out your Most Suitable Career Path. Get Started with our Career Finder Tool Now!

Online & Distance MBA

Online & Distance UG Courses

- 1 Year MBA Online

- IIM Online Courses

- IIIT Online Courses

- Data Science & Analytics

- Executive M.Tech for Working Professionals

- AI and Machine Learning

- Generative AI

- UI UX Certificate Program

- Online PG Diploma & Certificate

- Leadership & Management

- Finance

- Marketing

- Human Resource (HR)

- Healthcare

- Operations

- Business Analytics

- Software & Technology

- PG Diploma Applied Statistics

- IIT Courses Online

- Blockchain

- Cloud Computing

- PG Program In Technology Management

- Big Data Engineering

- DevOps

- Quantum Computing

- Digital Transformation and Innovation

- Public Policy Management

- Cyber Security

- Executive Program in Retail Management

- Online Executive Program in Emerging Technologies

- Online Executive PG Diploma in Sports Management

- View All

Online & Distance PG Courses

- Online MBA

- 1 Year MBA Online

- Distance MBA

- Executive MBA for Working Professionals

- Online Global MBA

- Online MCA

- M.Tech

- Online M.Sc

- MS Degree Online

- Online MA

- Online M.Com

- Dual MBA Online

- Online MBA after Diploma

- Online Master of Education (M.Ed)

- Online Global MCA

- Online PGDM

- Distance MCA

- Distance M.Com

- Distance M.Sc

- Distance MA

- Online MBA Plus

- MBA in Business Analytics

- M.A. in Public Policy

- M.A. in International Relations, Security, and Strategy

- Online Master of Social Work

- Online MBA & Doctorate

- Online M.Ed & Ed.D

- Online Master of Management Studies

- Blended MBA

- View All

Online & Distance Best Colleges for

India has a net of 9.6 Million students that will enroll in online education by the end of 2024. Still, the online education sector in India is unorganized and students face a lot of difficulties in getting information on it. College Vidya aims to tackle the current difficulties of students. College Vidya is India's first online platform that brings you all the online universities at a single platform. College Vidya provides unbiased information about every online course and the university providing this course.

The online portal of College Vidya is aimed to complete information to the students about every aspect of online education without being biased.

College Vidya gives the power to the students to get the best universities in online education. College Vidya's compare feature gives the comparison of every online university on the various parameters such as E-learning system, EMI, Faculties, and fees.

Disclaimer / Terms & Conditions / Refund Policy / Our PolicyThe intend of College Vidya is to provide unbiased precise information & comparative guidance on Universities and its Programs of Study to the Admission Aspirants. The contents of the College vidya Site, such as Texts, Graphics, Images, Blogs, Videos, University Logos, and other materials contained on College vidya Site (collectively, “Content”) are for information purpose only. The content is not intended to be a substitute for in any form on offerings of its Academia Partner. Infringing on intellectual property or associated rights is not intended or deliberately acted upon. The information provided by College Vidya on www.collegevidya.com or any of its mobile or any other applications is for general information purposes only. All information on the site and our mobile application is provided in good faith with accuracy and to the best of our knowledge, however, we make nor representation or warranty of any kind, express or implied, regarding the accuracy, adequacy, validity, reliability, completeness of any information on the Site or our mobile application. College vidya & its fraternity will not be liable for any errors or omissions and damages or losses resultant if any from the usage of its information.More+

© 2026 College Vidya, Inc. All Rights Reserved.

Build with Made in India.