India's leading Online Universities on a Single Platform within two minutes.

100+ Universities

30X comparison factors

Free expert consultation

Quick Loan facility

Celebrating 1 lac admissions

Post Admission Support

CV Exclusive Community

Job + Internship Portal

Compare & Apply from 100+

Online Finance in Quantitative Finance

- No-Cost EMI From ₹4,999

- Comparison on 30+ Factors

Share

Share Updated at : February 12, 2025

Online Certificate in Quantitative Finance

An online certificate in quantitative finance (CQF) is one of the most prominent choices for account professionals worldwide. This program teaches you all the financial engineering techniques in just 6 months via digital learning forums. Experts curate the curriculum of this online program to help you understand the practical implementation of techniques as per your employer’s needs. Join this course to earn the renowned designation of CQF and evolve in your career after mastering the field of finance.Watch Video

Listen Podcast

Online Finance in Quantitative Finance Program Overview

A 6-month certification program called the online Certificate in Quantitative Finance (CQF) is intended for professionals who have completed their bachelor's degree from an accredited university. To help students effectively evaluate and make the greatest use of available cash or capital, the curriculum attempts to educate them on how to invest in and manage a firm. The goal of this program is to prepare students for leadership roles in the banking, investment, and financial services industries, as well as for employment in research and analysis, stockbroking, ITES, wealth management, and financial planning firms.

To succeed in the quickly changing finance business, professionals would be well advised to enroll in an online CQF program. This unique program goes beyond traditional business education by giving students knowledge about the financial industry. With the study of topics including fixed income, machine learning, stocks, risk and return, and more, this certification ensures that graduates have a solid grasp of the financial aspect of the company.

The online model of this course is advantageous for working people since it gives them flexibility without sacrificing academic standards. Furthermore, focusing on global perspectives, utilizing technology, and developing leadership skills equips people to manage international financial markets, take on leadership roles in the finance industry, and fully utilize technological breakthroughs. As a result, the school promotes professional progression by giving students the skills and information required to excel in the crucial and quickly evolving financial services sectors.

Key Highlights of Online Finance in Quantitative Finance In India

- An online CQF course is suitable for both undergraduate and postgraduate working professionals who wish to develop their careers in the financial sector by learning all of its technical needs.

- This course will help you jumpstart your career in a short span of 6 months without making you leave your current employer.

- Anyone from any background can take admissions in this course to earn an in-depth knowledge of quantitative finance.

- Get access to the lifelong learning library in this program without paying for any additional cost.

- You can improve your practical grasp of the subject by using learning aids including case studies, recorded lectures, live projects, and online classes.

- Experts from the industry and highly experienced faculty members conduct the online classes, answering any questions you may have right away.

- You can broaden your professional networking by participating in the online discussion boards designed to facilitate connections with colleagues, instructors, and business leaders.

- A certification in CQF will help you improve your professional status both in terms of designation and salary.

Admission Closing Soon

Compare & Enroll NOW

- To avoid paying 25% Late Fees on all the online courses

- To secure a seat in your dream university

- To avail of some amazing Early Benefits

Online Finance in Quantitative Finance Course Subjects/Syllabus

The topics that are coveted in the online CQF program are listed in the table below:

|

|

|

|

|

|

|

|

|

|

|

|

*The list of advanced electives includes Advanced Machine Learning I, Advanced Machine Learning II, Advanced Risk Management, Advanced Portfolio Management, Advanced Volatility Modeling, Algorithmic Trading II, Algorithmic Trading I, Behavioural Finance for Quants, C++, FinTech, Numerical Methods, Counterparty Credit Risk Modeling, Risk Budgeting: Risk-Based Approaches to Asset Allocation, R for Data Science and Machine Learning.

Online Finance in Quantitative Finance Eligibility & Duration

If you are interested in enrolling in this online CQF course, you must meet its basic eligibility requirements as mentioned below:

- Candidates must hold a bachelor's degree or its equivalent in any subject/stream.

- Candidates must have a minimum aggregate percentage of 45% to 55% in the qualifying examination.

- Candidates must have professional experience in finance or related fields for a minimum of 1 year.

- A strong foundation in the subjects of mathematics and statistics is preferred for this course.

The minimum duration of this online CQF program is 6 months. In this period you will have a 360-degree knowledge of the financial aspects that will help you implement technical financial tools to solve real-world issues.

Benefits of learning from us

- Join CV Community for peer interaction

- Get placement support via webinars & networking sessions

- Dedicated CV Buddy for your queries

- One-on-One career mentorship sessions

- Ensures timely delivery of LMS & degree

- A career advisor for life

Program Fees for Online Finance in Quantitative Finance

Starting at ₹ 6,776/month

Program Fee: ₹9,900 - ₹5,00,000

Low Cost EMI Available

Recommended

The fee range for this course varies quite a lot and will be decided after you finalize your university or institution. At most of the institutions, you will get an exact idea of the course fee after consulting with their expert counselors.

Online Finance in Quantitative Finance Admission Procedure

Enrollment in this online certification program follows a standard process. Visiting the program's official website is the first step in the process. Sign up and provide your details on the application form. Upload your articles and complete the application form with your professional and academic information. Complete the application and submit it, along with any applicable registration fees. The academic fee must then be paid using the method designated by the course. An email containing your enrollment number and confirmation of admission will be sent to you.

Trusted Information

We provide only authentic information from verified universities to save you from fraud.

Hassle-Free Admission Process

Enroll in your program via a simplified process guided by our expert counselors.

Pay Directly to the University

The guidance & support offered by us is completely free, so you can trust us & pay directly to the university.

CV Community at the Center

Join our telegram community to share your thoughts with other learners & alumni.

Other Specializations for Online Finance in 2025

Education Loan/EMI Facilities for Online Finance in Quantitative Finance

Numerous colleges offer educational loans to students enrolled in online CQF programs. Tuition and other related expenses can be covered via education loans. Furthermore, some colleges could provide EMI plans, which help students pay back the loan balance in manageable installments after finishing their degree. With these financial choices, ambitious individuals can study this more accessible and affordable course in finance.

Apply For No Cost EMI

Compare EMI Partners

Is Online Finance in Quantitative Finance Worth it?

If candidates are looking to advance quickly in their finance-related employment, they should sign up for an online CQF program. Because of the program's distinctive coursework, which teaches students how to control risks, maximize revenues, and function in the technically driven finance business, graduates will have a thorough understanding of the financial sector.

Leaders in the workforce can improve their skills without taking time away from their careers because of the flexibility of online learning. Graduates' emphasis on leadership development, global perspectives, and technological integration equips them to take on the complicated world of international finance.

This course offers individuals the chance to progress in their careers by taking on leadership roles, introducing new ideas to their organizations, and leaving a lasting impression on the financial industry, all through the use of digitally accessible materials. A CQF certificate proves that you are dedicated to staying ahead of the curve in a world that is ever-changing. This online certification program is a fantastic choice for people who want to flourish in the banking, financial services, and related fields.

College Vidya Advantages

Job Opportunity after Online Finance in Quantitative Finance

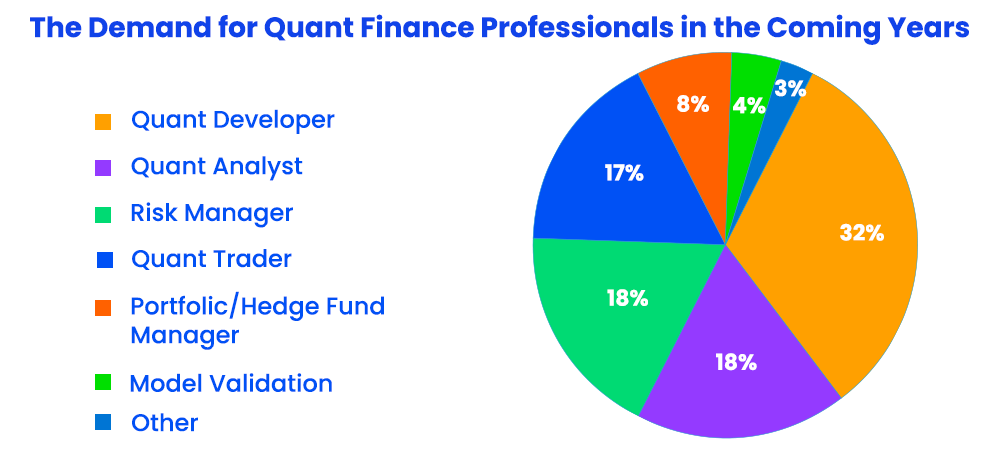

Students can obtain senior positions in the finance sector with the aid of the online CQF course. After completing this course, students will have an advantage over others in the financial markets when applying for reputable positions with the government and major private corporations. As a result, their career options are not restricted to banks. Graduates of this program can choose from a variety of jobs, including:

|

|

|

|

|

|

|

|

|

|

|

|

Top Recruiters for Online Finance in Quantitative Finance

In the finance industry, a CQF designation is highly valued by recruiters. With this accreditation, your chances of being employed by reputable companies, such as banks and multinational corporations, increase significantly. Additionally, your pay scale rises between 40 and 50 percent above your existing CTC.

Our students work at

ICICI Bank

Accenture

Axis Bank

Bajaj Finserv

Capgemini

Deloitte

HDFC Bank

IBM

Infosys

L&T

Paytm

Let's clear up some doubts about Online Finance in Quantitative Finance

A Certificate in Quantitative Finance (CQF) is both a program and an institution. As a program, it delivers the knowledge of quant finance to professionals from diverse backgrounds. On the other hand, the CQF institute awards the CQF designation on course completion.

Topics like risk management, data science, Machine learning, portfolio management, and quantitative trading strategies are some of the core parts of the curriculum offered in an online CQF course.

An online CQF course is one of the best possible ways to enter the financial engineering field for all finance aspirants who are either from different academic backgrounds or serving different domains of the industry.

If you wish to build a successful career in the finance sector, you must possess a good knowledge of maths and statistics. For an online CQF course, you also need basic knowledge of these subjects.

An online CQF course uses digital platforms to deliver the course content. These platforms are used for online lectures and interactive sessions with experts. Even for accessing digital labs and other reference materials, a digital forum is available 24*7.

Every query is essential.

Our team of experts, or experienced individuals, will answer it within 24 hours.

Popular Calculators

Discover our user-friendly calculators tailored to help you make informed university selection decisions. Our Diverse range of calculators & tools ensures you find the perfect fit for your needs. Explore the options below to get started.

ROI CalculatorCareer Finder (Career Suitability Test)

Explore and Find out your Most Suitable Career Path. Get Started with our Career Finder Tool Now!

Online & Distance MBA

Online & Distance UG Courses

- 1 Year MBA Online

- IIM Online Courses

- IIIT Online Courses

- Data Science & Analytics

- Executive M.Tech for Working Professionals

- AI and Machine Learning

- Generative AI

- UI UX Certificate Program

- Leadership & Management

- Finance

- Marketing

- Human Resource (HR)

- Healthcare

- Operations

- Business Analytics

- Software & Technology

- PG Diploma Applied Statistics

- IIT Courses Online

- Blockchain

- Cloud Computing

- PG Program In Technology Management

- Big Data Engineering

- DevOps

- Quantum Computing

- Digital Transformation and Innovation

- Public Policy Management

- Cyber Security

- Executive Program in Retail Management

- Online Executive Program in Emerging Technologies

- Online Executive PG Diploma in Sports Management

- View All

Online & Distance PG Courses

- Online MBA

- 1 Year MBA Online

- Distance MBA

- Executive MBA for Working Professionals

- Online Global MBA

- Online MCA

- M.Tech

- Online M.Sc

- MS Degree Online

- Online MA

- Online M.Com

- Online Master of Design

- Dual MBA Online

- Online MBA after Diploma

- Online Master of Education (M.Ed)

- Online Global MCA

- Online PGDM

- Online PG Diploma & Certificate

- Distance MCA

- Distance M.Com

- Distance M.Sc

- Distance MA

- Online MBA Plus

- MBA in Business Analytics

- M.A. in Public Policy

- M.A. in International Relations, Security, and Strategy

- Online Master of Social Work

- Online MBA & Doctorate

- Online M.Ed & Ed.D

- View All

Online & Distance Best Colleges for

India has a net of 9.6 Million students that will enroll in online education by the end of 2024. Still, the online education sector in India is unorganized and students face a lot of difficulties in getting information on it. College Vidya aims to tackle the current difficulties of students. College Vidya is India's first online platform that brings you all the online universities at a single platform. College Vidya provides unbiased information about every online course and the university providing this course.

The online portal of College Vidya is aimed to complete information to the students about every aspect of online education without being biased.

College Vidya gives the power to the students to get the best universities in online education. College Vidya's compare feature gives the comparison of every online university on the various parameters such as E-learning system, EMI, Faculties, and fees.

Disclaimer / Terms & Conditions / Refund Policy / Our PolicyThe intend of College Vidya is to provide unbiased precise information & comparative guidance on Universities and its Programs of Study to the Admission Aspirants. The contents of the College vidya Site, such as Texts, Graphics, Images, Blogs, Videos, University Logos, and other materials contained on College vidya Site (collectively, “Content”) are for information purpose only. The content is not intended to be a substitute for in any form on offerings of its Academia Partner. Infringing on intellectual property or associated rights is not intended or deliberately acted upon. The information provided by College Vidya on www.collegevidya.com or any of its mobile or any other applications is for general information purposes only. All information on the site and our mobile application is provided in good faith with accuracy and to the best of our knowledge, however, we make nor representation or warranty of any kind, express or implied, regarding the accuracy, adequacy, validity, reliability, completeness of any information on the Site or our mobile application. College vidya & its fraternity will not be liable for any errors or omissions and damages or losses resultant if any from the usage of its information.More+

© 2025 College Vidya, Inc. All Rights Reserved.

Build with Made in India.