India's leading Online Universities on a Single Platform within two minutes.

100+ Universities

30X comparison factors

Free expert consultation

Quick Loan facility

Celebrating 1 lac admissions

Post Admission Support

CV Exclusive Community

Job + Internship Portal

Compare & Apply from 100+

Online MBA in Banking and Insurance

- No-Cost EMI From ₹4,999

- Comparison on 30+ Factors

Share

Share Updated at : June 25, 2025DOWNLOAD E-BOOK

Online MBA In Banking and Insurance

Online MBA in Banking and Insurance is a niche postgraduate program that is specifically arranged to provide professionals with the comprehensive knowledge of how the financial service industry works, how banking works, the risks, the insurance market, the financial regulation, digital finance, and innovation in customer service. The program is designed to suit those who may want to acquire or develop their career in either a banking or insurance environment, which are fast evolving under the influence of technology, regulation, and consumer attitudes. This MBA is fully online, thus providing flexibility to working professionals who may want to learn without taking a sabbatical.Watch Video

Listen Podcast

Online MBA in Banking and Insurance Program Overview

Banking laws and regulations, insurance product management, credit and risk assessment, investment planning, international finance, financial technology (FinTech), actuarial science, and corporate governance are typical examples of the core curriculum. Students also acquire critical managerial skills, including leadership, strategy, and analytics. Besides academic intensity, most online MBA programs also provide live sessions, industry case studies, and virtual simulations, whereby learning is kept grounded and business-oriented.

Among the key strengths of the program, one can highlight its power to take care of the changing digital environment in the world of finance. Due to the emergence of mobile banking, digital wallets, artificial intelligence-based underwriting, and blockchain technologies, modern banks and insurance firms are turning more tech-savvy. The Online MBA in Banking and Insurance has also become more future-proof by inserting data analytics, cyber security, financial innovation, and regulatory tech modules so the graduates can read into these changes.

Career-wise, this MBA has access to the following jobs: Bank Manager, Investment Analyst, Risk Manager, Insurance Underwriter, Claims Manager, Compliance Officer, Loan Officer, and Financial Consultant. Practitioners can be employed in commercial banks, central banks, insurance firms, credit rating agencies, NBFCs, and new FinTech firms. The degree can also act as a linkage into leadership at the regulatory bodies such as the RBI, the IRDAI, and other SEBI.

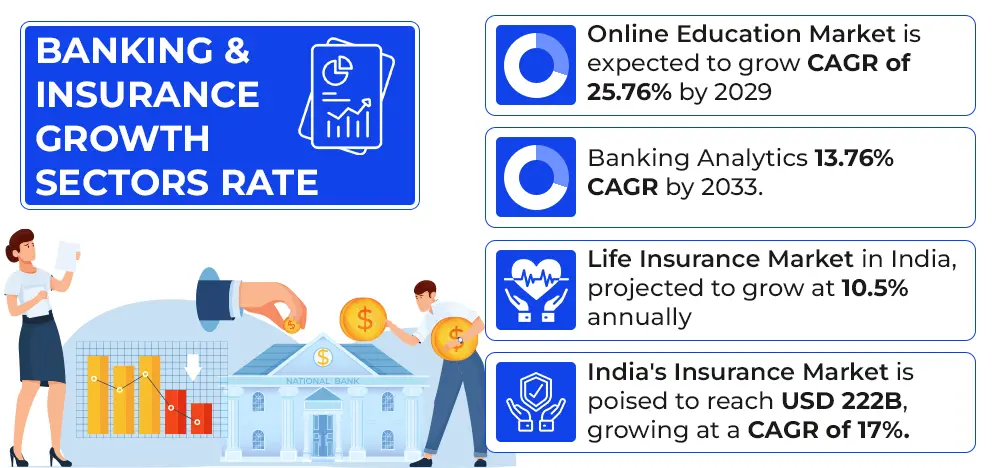

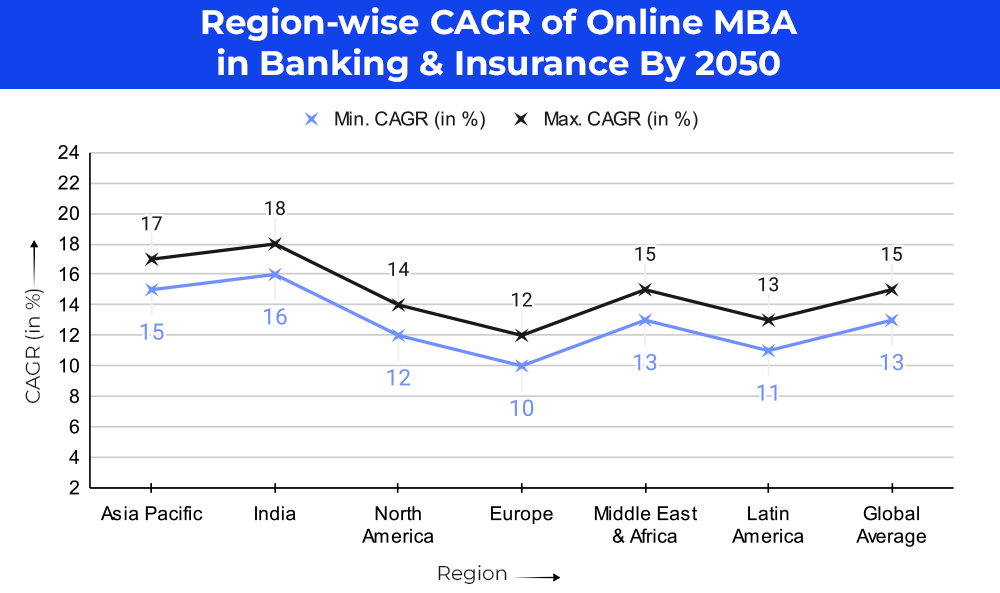

Where will online MBA in Banking and Insurance be in 2050?

By 2050, the banking and insurance world will look very different, and it is AI, quantum computing, hyper-personally financing, bowels insurance, decentralized finance (DeFi), and climate-laden risk modeling that will effect the change. Traditional functions will change, and there will be an interaction of functions as people will be taking hybrid roles that combine finance, technology, and green impacts. Immersive learning (virtual reality classrooms, AI tutors, blockchain-verified micro-credentials, real-time simulation-based evaluations, and so forth) will probably be used to drive the Online MBA in Banking and Insurance.

Hyper-personalized learning paths will be provided through programs, in which students will be able to develop the modules with respect to live data being transacted in financial systems the world over and build AI-created predictive models.

The 2050 economy will require bankers and insurers who understand how to manage green finance portfolios, calculate climate-related risks, operate underwriting systems to automate, and be able to lead a moral AI implementation within customer service. In this way, the curriculum will be more interdisciplinary and will combine the areas of environmental science, behavioral finance, and advanced machine learning.

Thus, not only does an Online MBA in Banking and Insurance remain relevant in the current environment, but it is also future-proof and is developing in the dynamic financial system. In the era of the digital-first sustainable economy, this MBA will become an essential contributor to the next generation of ethical and innovative financial executives in the sustainable, tech-savvy world.

Why an online MBA in Banking and Insurance?

- Deep Understanding of Banking and Insurance

- Financial Intermediation

- Transaction Processing

- Credit Provision

- Payment Systems

- Risk Management

- Financial Security

- Capital Mobilization

- Bancassurance

Who should pursue an online MBA in Banking and Insurance?

The Online MBA in Banking and Insurance is designed to meet the needs of a wide range of students and working professionals who want to learn more about these important financial areas. However, below are some people who can pursue this MBA specialization:

- Banking Professionals

- Insurance Specialists

- Financial Analysts

- Risk Managers

- Recent Graduates in Finance,

- Professionals in Regulatory Compliance

- Career Changers with Financial Interest

Where should I get an online MBA in Banking and Insurance?

Multiple colleges/ institutions/ universities proffers the Online MBA in Banking and Insurance program with prior accreditations; get through the list below.

Top affordable universities for online MBA in Banking and Insurance

|

Top Universities for Online MBA in Banking and Insurance |

|

|

Universities (online MBA in Banking and Insurance) |

Universities Accreditations |

|

UGC-DEB | AICTE | NIRF | WES | QS World University |

|

|

UGC | AICTE | NIRF | WES | NAAC A+ | QS World University Rankings | NBA |

|

|

UGC-DEB | AICTE | NIRF | WES | NAAC A+ | QS World University Rankings | ACCA | Harvard Business Publishing Education |

|

|

UGC | NIRF | NAAC | ISO |

|

|

UGC-DEB | AICTE | WES | NAAC A |

|

Key Highlights of Online MBA in Banking and Insurance In India

- The course is specifically developed to meet the requirements of the banking, financial services, and insurance (BFSI) sector, and it attempts to harmonize theory and practice.

- Learn on a pace of your convenience and without losing your professional duties. Perfect fit with working individuals who want a career progression.

- Major subjects of online MBA in Banking and Insurance are Risk Management, Investment Banking, Financial Market, Insurance Business, Regulatory Structures, and Wealth Management.

- Embraces such aspects to be in line with contemporary financial environments as digital banking, fintech developments, cyber insurance, and analytics.

- The UGC-entitled and AICTE-approved universities can be permitted to offer Accredited Programs and hence prove to be credible and recognized within and outside India.

- The video lectures are joined with live webinars, case studies, and quizzes to make them more effective and memorable.

- The mismatch between practice and theory can be addressed by practical exposure in industry projects and internships.

- Be taught by the professionals and other leaders in the industry who deliver the latest trends in the virtual classroom.

- Affordable as opposed to the traditional MBA programs, which have flexible payment options and scholarship availability.

- International Career avenues: Access to a career such as Bank Manager, Insurance Analyst, Financial Consultant, Risk Analyst, and Compliance Officer in local and foreign markets.

- Resume building, interview preparation, and employment placement are areas of career support services rendered as student assistance services.

Admission Closing Soon

Compare & Enroll NOW

- To avoid paying 25% Late Fees on all the online courses

- To secure a seat in your dream university

- To avail of some amazing Early Benefits

Online MBA in Banking and Insurance Course Subjects/Syllabus

The online MBA in Banking and Insurance is a 2-year postgraduate degree course divided into 4 semesters. Given below is a general syllabus for all 4 semesters. The syllabus in the first two semesters is similar to that of the General MBA. The specialization-specific topics have been taught in the last two semesters.

|

Online MBA in Banking and Insurance Syllabus |

|

|

Semester 1 |

Semester 2 |

|

|

|

Semester 3 |

Semester 4 |

|

|

|

Skills obtained in the Online MBA in Banking and Insurance |

|

|

|

| Other Types of MBA Programs | |

Online MBA in Banking and Insurance Eligibility & Duration

Students must meet some basic requirements to be able to apply for this online MBA program. The requirements to get into this MBA in banking and insurance are very simple and easy to meet. Some universities may have specific needs, but here are some general ones:

- The applicant should have a bachelor’s degree from a recognized higher education institution.

- The applicant should have scored a minimum of 45% to 55% aggregate marks or an equivalent grade in graduation.

- Professionals from relevant fields can also apply for the online MBA in Banking and Insurance course.

Duration of the Online MBA in Banking and Insurance

The online MBA in Banking and Insurance is a professional postgraduate degree course of 2 years. There are a total of 4 semesters of six months each, which gives you enough time to learn a lot about how banks work, how to handle risks, how insurance works, and how to make smart decisions.

Skills Required for Online MBA in Banking and Insurance

- You must be good at analyzing money, which means knowing how banks work, how to evaluate risk, and how insurance works.

- The candidate must be able to find, evaluate, and lower financial threats in insurance and banking settings.

- Developing and carrying out long-term plans to improve operations and ensure long-term success in the fast-paced banking and insurance industries is also required.

- A potential candidate must have the ability to talk to people clearly so that you can explain complicated financial information, reach deals, and work with people from different backgrounds.

- Another necessary skill is financial technology (FinTech) and digital tools to make banking and insurance processes more efficient and open to new ideas.

Benefits of learning from us

- Join CV Community for peer interaction

- Get placement support via webinars & networking sessions

- Dedicated CV Buddy for your queries

- One-on-One career mentorship sessions

- Ensures timely delivery of LMS & degree

- A career advisor for life

Program Fees for Online MBA in Banking and Insurance

Starting at ₹ 6,776/month

Program Fee: ₹60,000 - ₹1,99,000

Low Cost EMI Available

Recommended

The Online MBA in Banking and Insurance program should be completed in 2 years, which requires fees from INR 1 lakh to INR 5.5 lakhs, approximately. This course fees are estimated because; vary from university to university.

Students can pay the fees throughout the payment cycle:

- The program fee is a one-time fee available

- Semester-wise payment is accessible at several universities

- Students can pay throughout the year

- Take EMI options

Comparison in b/w the Top Universities offering an Online MBA in Banking and Insurance course fees:

|

Top Universities for Online MBA in Banking and Insurance Course Fees |

||

|

List of Universities |

Course Fees |

Detailed Fee Structure |

|

Amity Online MBA in Banking and Insurance |

INR 1.99 lakhs |

|

|

Manipal Online MBA in Banking and Insurance |

INR 1.75 lakhs |

|

|

INR 1.58 lakhs |

|

|

|

INR 1.10 lakhs |

|

|

|

Manav Rachna Online MBA in Banking and Insurance |

INR 1.28 lakhs |

|

Online MBA in Banking and Insurance Admission Procedure

All the steps of the online MBA in Banking and Insurance admission procedure are described below:

- Go to the official website of the university where you seek admission.

- Register as a new user on the website and fill out the application form.

- After filling in your details in the application form, upload all the necessary documents in the digital format.

- If there is a registration fee, then pay the fee online and submit the application form.

- After this, you must pay the course's academic fee to secure your seat.

- After successfully paying the academic fee, you will receive your student ID and other enrollment details, like your login credentials.

Trusted Information

We provide only authentic information from verified universities to save you from fraud.

Hassle-Free Admission Process

Enroll in your program via a simplified process guided by our expert counselors.

Pay Directly to the University

The guidance & support offered by us is completely free, so you can trust us & pay directly to the university.

CV Community at the Center

Join our telegram community to share your thoughts with other learners & alumni.

Other Specializations for Online MBA in 2025

Education Loan/EMI Facilities for Online MBA in Banking and Insurance

Not all students can access the fees of the Online MBA in Banking and Insurance program; for that, most universities now offer EMI Facilities, which cover the tuition costs, study tools, and other costs of education. However, with EMI facilities, it is easier to pay for programs because they have low interest rates and flexible payment plans. This lets people focus on their studies without worrying about money right away.

Apply For No Cost EMI

Compare EMI Partners

Is Online MBA in Banking and Insurance Worth it?

Getting an online MBA in banking and insurance is a great idea for people who need to learn more about the complicated world of finance. The program's specialized curriculum teaches you how banks work, how to handle risk, and how insurance works, ensuring that graduates have the in-depth information they need for top positions. Due to the flexibility of the online format, working people can balance their education work with their regular jobs.

Online MBA in Banking and Insurance gives people the skills they need to deal with the changing problems in the banking and insurance industries by giving them a world view and including the latest trends in financial technology. An Online MBA in Banking and Insurance is more than a good way to improve your grades. It's also a smart investment that can help you advance in your job and become an expert.

This program is, without a doubt, an asset in the competitive world of finance because it provides networking chances, a diverse cohort, and expert views. As the need for skilled workers in insurance and banking continues to grow, this program's benefits show that it is worth it. It promises a life-changing educational journey that will have long-lasting effects on job paths and services to the financial industry.

College Vidya Advantages

Job Opportunity after Online MBA in Banking and Insurance

After completing your online MBA in Banking and Insurance, the jobs you get are highly reputed, well-paid, and secure. Therefore, the future scope of a career in this field is wide and prosperous. Some of the popular job roles after the online MBA in Banking and Insurance are given in the table below:

*The mentioned data of Salaries of Online MBA in Banking and Insurance graduates are estimated and belong to the Ambition Box and Glassdoor.

|

Job Roles after an Online MBA in Banking and Insurance |

Wages in INR (annually) |

|

Risk Manager |

3.4 LPA to 53.6 LPA |

|

Financial Advisor |

1.2 LPA to 15 LPA |

|

Bank Manager |

1.5 LPA to 18 LPA |

|

Credit & Collections Manager |

2.6 LPA to 25.2 LPA |

|

Portfolio Manager |

3.5 LPA to 77.4 LPA |

|

Equity Analyst |

1.2 LPA to 26.8 LPA |

|

Commercial Banker |

2.3 LPA to 69.3 LPA |

|

Investment Manager |

3.1 LPA to 50.7 LPA |

|

Management Consultant |

9.4 LPA to 45 LPA |

|

Insurance Advisor |

1.1 LPA to 8.9 LPA |

Top Recruiters for Online MBA in Banking and Insurance

Online MBA in Banking and Insurance might sound like a course for jobs only in the banking sector. However, this is different. Since it is a management course, you get job opportunities in various public and private insurance and finance firms, apart from banks. Even top companies and corporate firms from all other sectors hire banking and insurance management graduates to manage their organizations' accounts and finances.

*There is are prompt list of top companies that hire online MBA in Banking & Insurance graduate with salary packages mentioned below belongs to the Naukri’s official page.

|

Top MNCs hire an online MBA in Banking and Insurance Graduate |

Salary Packages (yearly) (in INR) |

|

Mercer |

4.4 lakhs to 51 lakhs |

|

Acuity Knowledge Partner |

3 lakhs to 24 lakhs |

|

IndiaMart |

3.5 lakhs to 14.8 lakhs |

|

HSBC |

2.1 lakhs to 27.9 lakhs |

|

Incedo |

3.6 lakhs to 62 lakhs |

|

Evaluesserve |

6.2 lakhs to 45.9 lakhs |

|

Bajaj Capital |

1.2 lakhs to 31.5 lakhs |

|

Leading Bank |

3.4 lakhs to 32 lakhs |

|

American Express |

3.3 lakhs to 31.5 lakhs |

|

Cirsil |

6.4 lakh to 13.8 lakhs |

Our students work at

ICICI Bank

Axis Bank

HDFC Bank

India Mart

Bajaj Capital

HSBC

Let's clear up some doubts about Online MBA in Banking and Insurance

The minimum eligibility criteria for online MBA in Banking and Insurance is a Bachelor’s degree in any discipline from a recognized university with a minimum of 45% to 55% aggregate marks.

The academic fee for the online MBA in Banking and Insurance may vary across universities and colleges. However, the average fee ranges between INR 1 Lakhs to INR 5.5 Lakhs for the full course.

Yes, the duration for the online MBA in Banking and Insurance is 2 years, which is the same as that of the offline course. The maximum period of course completion in the case of an online MBA (Banking and Insurance) is 4 years.

After pursuing the online MBA in Banking and Insurance course, you will be able to get jobs in fields like investment banking analysis, credit analysis, insurance investigation, equity management, business consultancy, and alike. Job scope is available in both private and public domains in top companies, corporate firms, banks, financial firms and insurance companies. The jobs are handsomely paid as well.

Yes, as per the guidelines from UGC-DEB regarding online and ODL education in India, an online MBA in the specialization of Banking and Insurance is completely valid and also equal in value and credibility to a regular MBA course.

No, most of the universities that offer this course in the online or ODL mode do not conduct any entrance examinations for admissions. They complete admissions mainly on the basis of eligibility criteria.

The highlights of the online MBA in banking and insurance are: Principles of Banking and Financial Services, Insurance Management and Underwriting, Risk Management and Compliance, Investment Banking and Portfolio Management, Financial Markets and Institutions, Insurance Laws and Regulations, Digital Banking and Fintech, Credit Analysis and Loan Management, and more.

Financial Management, Business analytics, Human Resources, International business, Risk Management, Corporate finance, Insurance Management, Operations management, Business economics, Entrepreneurship, Finance, Financial services, Managerial economics, Organizational behavior, Retail banking, Strategic Management, Banking management, Investment Analysis and Portfolio Management, Financial markets and instruments, Financial accounting, Legal Aspects of banking, Merchant banking and more topics covered in the online MBA in Banking and Insurance program.

Yes, after doing an online MBA in Banking and Insurance, the top recruiters hire you and consider your degree valuable.

- In-depth understanding of the BFSI sector

- Relevant skills for various roles

- Adaptability to digital transformation

- Proactive career development

- Adaptability and resilience

- Meeting evolving regulatory requirements

View More

Every query is essential.

Our team of experts, or experienced individuals, will answer it within 24 hours.

Popular Calculators

Discover our user-friendly calculators tailored to help you make informed university selection decisions. Our Diverse range of calculators & tools ensures you find the perfect fit for your needs. Explore the options below to get started.

ROI CalculatorCareer Finder (Career Suitability Test)

Explore and Find out your Most Suitable Career Path. Get Started with our Career Finder Tool Now!

Online & Distance MBA

Online & Distance UG Courses

- 1 Year MBA Online

- IIM Online Courses

- IIIT Online Courses

- Data Science & Analytics

- Executive M.Tech for Working Professionals

- AI and Machine Learning

- Generative AI

- UI UX Certificate Program

- Leadership & Management

- Finance

- Marketing

- Human Resource (HR)

- Healthcare

- Operations

- Business Analytics

- Software & Technology

- PG Diploma Applied Statistics

- IIT Courses Online

- Blockchain

- Cloud Computing

- PG Program In Technology Management

- Big Data Engineering

- DevOps

- Quantum Computing

- Digital Transformation and Innovation

- Public Policy Management

- Cyber Security

- Executive Program in Retail Management

- Online Executive Program in Emerging Technologies

- Online Executive PG Diploma in Sports Management

- View All

Online & Distance PG Courses

- Online MBA

- 1 Year MBA Online

- Distance MBA

- Executive MBA for Working Professionals

- Online Global MBA

- Online MCA

- M.Tech

- Online M.Sc

- MS Degree Online

- Online MA

- Online M.Com

- Online Master of Design

- Dual MBA Online

- Online MBA after Diploma

- Online Master of Education (M.Ed)

- Online Global MCA

- Online PGDM

- Online PG Diploma & Certificate

- Distance MCA

- Distance M.Com

- Distance M.Sc

- Distance MA

- Online MBA Plus

- MBA in Business Analytics

- M.A. in Public Policy

- M.A. in International Relations, Security, and Strategy

- Online Master of Social Work

- Online MBA & Doctorate

- Online M.Ed & Ed.D

- View All

Online & Distance Best Colleges for

India has a net of 9.6 Million students that will enroll in online education by the end of 2024. Still, the online education sector in India is unorganized and students face a lot of difficulties in getting information on it. College Vidya aims to tackle the current difficulties of students. College Vidya is India's first online platform that brings you all the online universities at a single platform. College Vidya provides unbiased information about every online course and the university providing this course.

The online portal of College Vidya is aimed to complete information to the students about every aspect of online education without being biased.

College Vidya gives the power to the students to get the best universities in online education. College Vidya's compare feature gives the comparison of every online university on the various parameters such as E-learning system, EMI, Faculties, and fees.

Disclaimer / Terms & Conditions / Refund Policy / Our PolicyThe intend of College Vidya is to provide unbiased precise information & comparative guidance on Universities and its Programs of Study to the Admission Aspirants. The contents of the College vidya Site, such as Texts, Graphics, Images, Blogs, Videos, University Logos, and other materials contained on College vidya Site (collectively, “Content”) are for information purpose only. The content is not intended to be a substitute for in any form on offerings of its Academia Partner. Infringing on intellectual property or associated rights is not intended or deliberately acted upon. The information provided by College Vidya on www.collegevidya.com or any of its mobile or any other applications is for general information purposes only. All information on the site and our mobile application is provided in good faith with accuracy and to the best of our knowledge, however, we make nor representation or warranty of any kind, express or implied, regarding the accuracy, adequacy, validity, reliability, completeness of any information on the Site or our mobile application. College vidya & its fraternity will not be liable for any errors or omissions and damages or losses resultant if any from the usage of its information.More+

© 2025 College Vidya, Inc. All Rights Reserved.

Build with Made in India.