India's leading Online Universities on a Single Platform within two minutes.

100+ Universities

30X comparison factors

Free expert consultation

Quick Loan facility

Celebrating 1 lac admissions

Post Admission Support

Exclusive Community

Job + Internship Portal

Compare & Apply from 100+

Online MBA in Fintech Management

- No-Cost EMI From ₹4,999

- Comparison on 30+ Factors

Share

Share Updated at : January 12, 2026DOWNLOAD E-BOOK

Online MBA In Fintech Management

The Online MBA in FinTech Management is a 2-year postgraduate program and a life-changing way for workers who want to lead in the fast-paced FinTech industry to learn. Fintech Management is an emerging field that combines technology with finance to deliver financial services efficiently. This MBA program is designed for workers who want to learn more about the quickly changing field of financial technology. It combines basic business administration principles with specific FinTech information. This program is merely lying on the digital platforms, cryptocurrencies, blockchain, and artificial intelligence to manage innovations and financial services.Watch Video

Listen Podcast

Online MBA in Fintech Management Program Overview

An online MBA in Fintech Management not only provides students with an opportunity to learn the use of various AI and related software for financial services but also trains them in important managerial skills like decision-making, problem-solving ability, strategic skills, and critical and analytical skills.

A fintech management course provides a detailed understanding of the logical structure with the limitations of business, new and old management, and marketing concepts, theories, and ideas. It means the fusion of finance and technology.

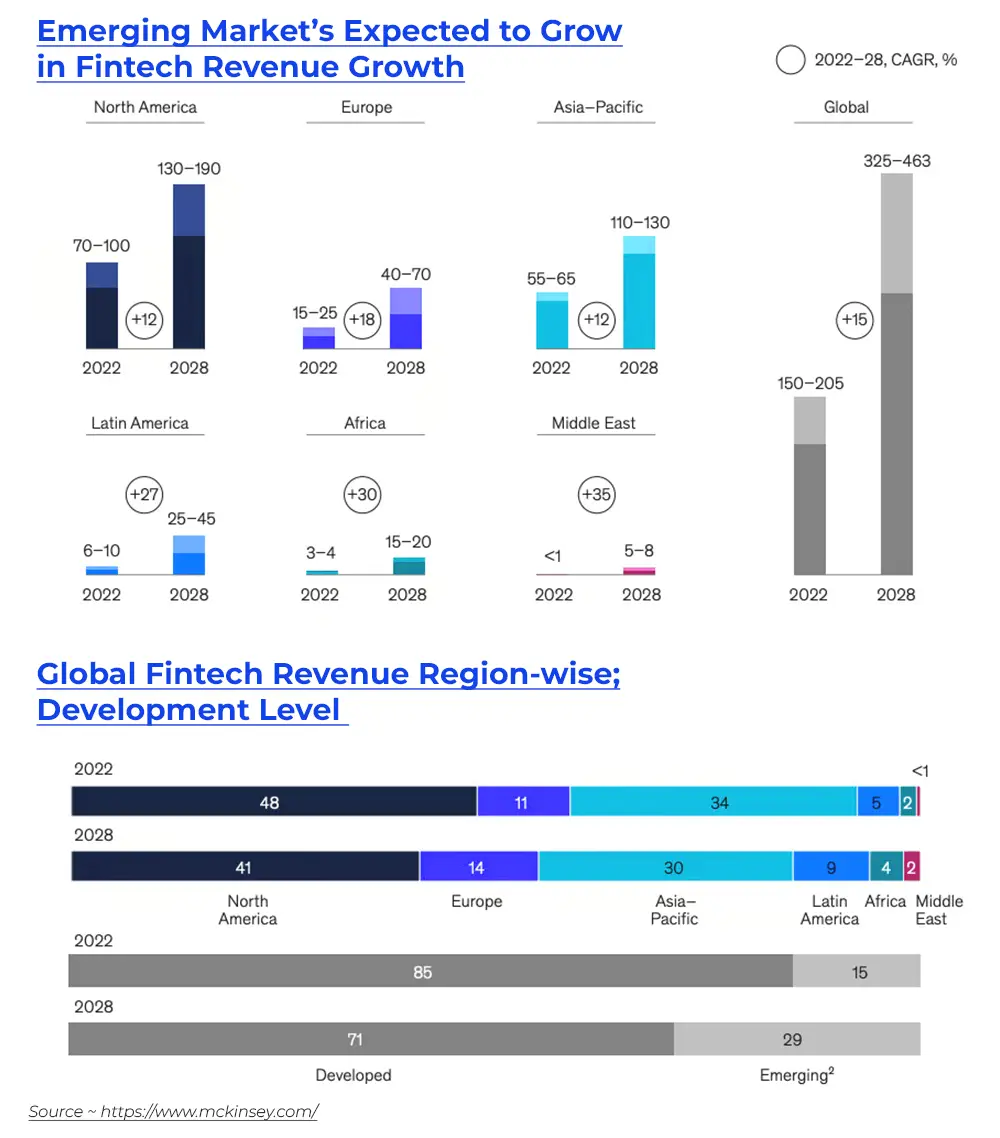

By 2032, the Fintech market is projected to expand to USD 990.45 Billion with a 30.26% CAGR in India. In addition, globally, the Fintech Market is projected to reach USD 1.13 Trillion by 2032, with a 16.2% CAGR. This growth can be attributed to such factors as robust growth in India, Global Expansion, Focus on Financial Inclusion, Emerging Technologies, or more.

The Online MBA in Fintech Management is a postgraduate program of a period of 2 years, which deals with subjects and topics like; Banking and Risk Management, Financial Markets and Services, FinTech, Digital Innovation and Transformation, Investment Analysis and Portfolio Management, Financial Modeling, Corporate, Restructuring and Business Valuation, Design Thinking and Creativity for Business, or more.

Why choose an online MBA in FinTech Management?

An online MBA in FinTech management can help professionals easily fit advanced education into their plans without breaking any responsibilities they already have because of the online format's extreme flexibility. This specialized online MBA program teaches business management skills and covers cutting-edge FinTech ideas. Online learning makes it easy to connect with leaders and experts in the financial technology field. Pursuing this online MBA will give you a personalized, easy-to-access, and cutting-edge way to learn how to run FinTech companies.

Who Should Pursue an Online MBA in FinTech Management?

- People who work in standard finance jobs like bankers, financial analysts, or investment managers want to focus on FinTech.

- People who work in technology-related areas, like IT specialists and software writers, want to use their skills in the finance business.

- Business owners or people who want to be entrepreneurs who want to start FinTech businesses and want to learn a lot about both technology and banking.

- People who want to learn about and contribute to FinTech globally and gain from the program's foreign views.

- People with busy lives need the freedom of an online program to get more education without quitting their jobs.

When should I do an Online MBA in FinTech Management?

Online MBA in FinTech management is best for people with a basic understanding of either business or technology. It then helps them combine the two smartly. The best time is for workers who want to be on the cutting edge of FinTech innovation and want to use the program's insights to do well in this quickly changing and globally important field.

Where should I get an online MBA in Fintech Management?

An online MBA in FinTech management is best for people with a basic understanding of either business or technology. It then helps them combine the two smartly. The best time is for workers who want to be on the cutting edge of FinTech innovation and want to use the program's insights to do well in this quickly changing and globally important field.

However, the Online MBA in Fintech Management program can be obtained from multiple universities which has appropriate accreditations; read it thoroughly.

Top affordable universities for online MBA in Fintech Management

|

Top Universities for Online MBA in Fintech Management |

|

|

Universities (online MBA in Fintech Management) |

Universities Accreditations |

|

UGC-DEB | AICTE | AIU | NIRF | WES | NAAC A++ | ISO |

|

|

NIRF |

|

|

UGC | AICTE | NIRF | WES | NAAC A++ | Category-1 |

|

Key Highlights of Online MBA in Fintech Management In India

- The online MBA in Fintech Management program course lasts for 2 years.

- Modern FinTech topics like blockchain, digital currencies, and cybersecurity are taught in the syllabus. This makes sure that grads know about the newest developments in the field.

- The program gives students in-depth knowledge about the areas where finance and technology meet. It prepares graduates for jobs requiring a special financial and technological knowledge mix.

- Case studies and practical uses from the real world are used throughout the program to improve students' problem-solving skills and help them use their academic knowledge in real-life FinTech situations.

- Virtual teams, guest talks, and workshops let students meet with FinTech leaders and experts in the field, building useful networks and giving students information on new developments and trends.

- The online MBA in Fintech Management program gives graduates the skills to understand and manage the global FinTech scene, preparing them for a wide range of possibilities spanning borders.

- The online MBA in Fintech Management program covers the topics of Cryptocurrency and blockchain, Retail banking, Business intelligence, Quantitative analysis, Accounting, Capital market analytics, Database management system, E-Commerce, Marketing, Technology management, Cyber Security, Data analysis, Digital marketing, Enterprise resource planning, Fintech risk management, Human Resource Management, Insurtech, Investment banking, Lending and investing, Artificial intelligence in finance, Financial markets and instruments, Security Analysis and Portfolio Management, Financial big data analytics, FinTech Foundations or more.

Admission Closing Soon

Compare & Enroll NOW

- To avoid paying 25% Late Fees on all the online courses

- To secure a seat in your dream university

- To avail of some amazing Early Benefits

Online MBA in Fintech Management Course Subjects/Syllabus

Many different topics are usually covered in an online MBA in FinTech Management so that students can fully understand FinTech ideas. However, the course plan at each university might be different; so, there is a general syllabus mentioned, get through it with apprehending the skills.

|

Online MBA in Fintech Management Syllabus |

|

|

Semester 1 |

Semester 2 |

|

|

|

Semester 3 |

Semester 4 |

|

|

|

Skills obtained in the Online MBA in Fintech Management |

|

|

|

| Other Types of MBA Programs | |

Online MBA in Fintech Management Eligibility & Duration

If an individual is interested in pursuing an Online MBA in FinTech Management, then they must meet these eligibility requirements to be admitted, which are as follows:

- Requires 50% to 55% marks in the Graduation

- Final year students are accessible to take admission

- Graduation with a business, economics, mathematics, engineering, computer science, or a related discipline may be preferred.

- CAT, XAT, MAT, GMAT, or NMAT are accepted, but not necessary in the online program.

- No Age Restrictions.

Duration of the Online MBA in FinTech Management

The minimum duration of an online MBA in Fintech Management is 2 years, and the maximum duration is 4 years. This online program consists of 4 semesters. The students of online MBA in Fintech Management get an extra 2 years to pass all the exams. During this time, workers learn basic business administration principles and more advanced FinTech topics, ensuring they have many skills. This amount of time makes it easier to fully understand all the complexities of FinTech but also ensures that grads have all the skills and information they need to be great leaders in the constantly changing world of financial technology.

Online Degree Courses You May Be Interested In- Online MBA In India

Skills Required for Online MBA in FinTech Management

- You must know enough about money and how it works to be able to examine and plan in the FinTech world.

- A deep understanding of important technologies like Bitcoin, data analytics, and cybersecurity is needed to implement FinTech ideas.

- Understanding complicated data, spotting market trends, and making smart choices are very important for dealing with FinTech problems.

- The ability to think creatively and change quickly to keep up with FinTech trends and help technology move forward.

- The ability to clearly explain complicated financial and technological ideas makes it easier for teams from different fields to work together in the FinTech environment.

Recommended Books

Below is a list of the popular books used in the Online MBA in FinTech Management curriculum.

|

Title |

Author(s) |

Publication Year |

|

"Blockchain Basics: A Non-Technical Introduction in 25 Steps" |

Daniel Drescher |

2017 |

|

"The FinTech Book: The Financial Technology Handbook for Investors, Entrepreneurs, and Visionaries" |

Susanne Chishti, Janos Barberis |

2016 |

|

"Digital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent Money" |

Nathaniel Popper |

2015 |

|

"Fintech Innovation: From Robo-Advisors to Goal Based Investing and Gamification" |

Paolo Sironi |

2016 |

|

"The Age of Cryptocurrency: How Bitcoin and Digital Money are Challenging the Global Economic Order" |

Paul Vigna, Michael J. Casey |

2015 |

|

"Fintech: Financial Technology Beginner Guide CherryTree Style (Beginner Guide)" |

Mark Jobs |

2016 |

Benefits of learning from us

- Join Community for peer interaction

- Get placement support via webinars & networking sessions

- Dedicated Buddy for your queries

- One-on-One career mentorship sessions

- Ensures timely delivery of LMS & degree

- A career advisor for life

Program Fees for Online MBA in Fintech Management

Starting at ₹ 6,776/month

Program Fee: ₹60,000 - ₹10,20,000

Low Cost EMI Available

Recommended

Usually, several institutions offer the online MBA in Fintech Management program, whose course fees should be different, but they can range from 1 lakh to 9 lakhs; universities may vary. However, these course fees are for the 2 years.

Students can pay the fees throughout the payment cycle:

- The program fee is a one-time fee available

- Semester-wise payment is accessible at several universities

- Students can pay throughout the year

- Take EMI options

Comparison in b/w the Top Universities offering an Online MBA in Fintech Management course fees:

|

Top Universities for Online MBA in Fintech Management Course Fees |

||

|

List of Universities |

Course Fees |

Detailed Fee Structure |

|

INR 1.89 lakhs |

|

|

|

INR 8.40 lakhs |

|

|

|

Amrita Online MBA in Fintech |

INR 2.20 lakhs |

|

Online MBA in Fintech Management Admission Procedure

Below is a common procedure to gain admission to the Online MBA in FinTech Course:

- First, visit the university's official website and register as a new user.

- After that, fill out the application form with your information (contact details, educational certificates, etc.) for the course.

- Upload your documents for verification in the next step. You can attach the digital copies of the required documents.

- Then, submit the application form along with the documents and registration fee.

- Finally, you must submit your academic fee to confirm your acceptance of the seat in the course.

- After completing the verification process, the institution will send you a confirmation email with the important student credentials.

Trusted Information

We provide only authentic information from verified universities to save you from fraud.

Hassle-Free Admission Process

Enroll in your program via a simplified process guided by our expert counselors.

Pay Directly to the University

The guidance & support offered by us is completely free, so you can trust us & pay directly to the university.

Community at the Center

Join our telegram community to share your thoughts with other learners & alumni.

Other Specializations for Online MBA in 2026

Education Loan/EMI Facilities for Online MBA in Fintech Management

The program knows that people who want to work are worried about money, so it helps them by giving them options like EMI services. This makes it easy to get an online MBA in FinTech management without worrying about money immediately. People can lower their school costs with no-cost EMI.

Apply For No Cost EMI

Compare EMI Partners

Is Online MBA in Fintech Management Worth it?

Undoubtedly, getting an online MBA in FinTech management is a smart investment as the program puts professionals in a unique situation at the cutting edge of how finance and technology are coming together, giving them inside information on the newest FinTech advances. The online structure makes it easy for everyone to access, so working people can learn new skills without changing their schedules.

Graduates have a wide range of skills, including financial and technology know-how. This makes them essential in the FinTech sector, which is always changing. Real-life case studies, practical applications, and networking chances with leaders in the field all make learning more fun and help turn academic knowledge into insights that can be used immediately. FinTech is changing businesses worldwide right now, and this school gives people the academic credentials and the real-world skills they need to lead, create, and make a big difference in the changing world of financial technology.

College Vidya Advantages

Job Opportunity after Online MBA in Fintech Management

The fintech sector is a budding arena of opportunities for students and qualified professionals as it combines two of the fastest-growing domains of the economy: finance and technology. So, there are a multitude of career opportunities for graduates in an online MBA in Fintech Management.

*The salary range of the online MBA in Fintech Management should be taken from Glassdoor and Ambition Box.

|

Job Roles after an Online MBA in Fintech Management |

Wages in INR (annually) |

|

Marketing Manager |

4.6 LPA to 33.5 LPA |

|

Risk Manager |

11.5 LPA to 48.5 LPA |

|

Management Consultant |

3 LPA to 33.2 LPA |

|

App Creator |

6.2 LPA to 24.7 LPA |

|

Product Manager |

9.9 LPA to 48.4 LPA |

|

Investment Manager |

3 LPA to 60.4 LPA |

|

Blockchain Specialist |

5 LPA to 25 LPA |

|

Financial Advisor |

1.1 LPA to 50 LPA |

|

Blockchain Developer |

5 LPA to 20.2 LPA |

|

Credit Analyst |

3 LPA to 33.3 LPA |

Top Recruiters for Online MBA in Fintech Management

Many top multinational companies like Accenture, Deloitte, Infosys, TCS, Capgemini, and Intel constantly look for people with proven FinTech Management experience or who are graduates of online MBA in Fintech Management.

*The companies should be taken from the Naukri’s official website, which hires an online MBA in Fintech Management Graduate; read it.

|

Top MNCs hire an online MBA in Fintech Management Graduate |

Salary Packages (yearly) (in INR) |

|

Paytm |

5.2 lakhs to 40 lakhs |

|

NoBroker |

4.3 lakhs to 15.6 lakhs |

|

Taskus |

2.1 lakhs to 17.4 lakhs |

|

Phonepe |

9.1 lakhs to 40 lakhs |

|

IndiaMart |

3 lakhs to 69 lakhs |

|

|

30 lakhs to 70.7 lakhs |

|

Deutsche Bank |

2.6 lakhs to 21 lakhs |

|

Crisil |

4.4 lakhs to 16 lakhs |

|

Iris Software |

4.5 lakhs to 17.4 lakhs |

|

WNS Holdings |

3 lakh to 29 lakhs |

Our students work at

Accenture

Capgemini

Deloitte

Infosys

Paytm

TCS

Let's clear up some doubts about Online MBA in Fintech Management

Yes, as per the approvals from UGC-DEB, an online MBA in Fintech Management is a valid course and will hold equivalent value as a regular offline MBA degree.

The full course duration is 2 years (minimum period of course completion). This course can be completed in a maximum duration of 4 years. There are 4 semesters in this course.

The minimum eligibility criteria to meet for applying to this course is that the candidate should have completed their graduation from a recognized university. Some universities may additionally have a cutoff criteria ranging approximately between 45% to 55% aggregate marks.

The full course fee for this online MBA program in Fintech Management ranges between INR 80,000 to INR 3,00,000 depending upon the chosen university.

Firstly, if you complete the course from a well-accredited university, then your online MBA degree will hold equal value as an offline MBA. This will allow you to explore your job opportunities in top MNCs, fincorps, fintech organizations and technological firms. There are a vast number of job roles to explore as well, ranging from financial risk analysis, wealthtech management, cybersecurity, credit risk analysis and so on.

The online MBA in Fintech Management program covers the topics of Cryptocurrency and blockchain, Retail banking, Business intelligence, Quantitative analysis, Accounting, Capital market analytics, Database management system, E-Commerce, Marketing, Technology management, Cyber Security, Data analysis, Digital marketing, Enterprise resource planning, Fintech risk management, Human Resource Management, Insurtech, Investment banking, Lending and investing, Artificial intelligence in finance, Financial markets and instruments, Security Analysis and Portfolio Management, Financial big data analytics, FinTech Foundations or more.

Fintech Manager/Director, Digital Transformation Officer, Risk Manager in Fintech, Blockchain Consultant, Financial Data Scientist, Chief Technology Officer (CTO) in Fintech, or more career opportunities are available after completing the online MBA in Fintech Management.

The online MBA in Fintech Management curriculum focus on Financial Technologies (Fintech), Blockchain and Cryptocurrencies, Digital Transformation in Finance, Artificial Intelligence in Finance, Financial Risk Management, Regulation and Compliance, Strategy and Leadership in Fintech and more are the focus particularly.

While learning the online MBA in Fintech management course will develop the skills related to leadership skills, tech-savvy, financial acumen, strategy, risk management, innovation and entrepreneurship are more skill will be enhanced.

AACSB, AMBA, or EQUIS or more accreditations are required to have.

View More

Every query is essential.

Our team of experts, or experienced individuals, will answer it within 24 hours.

Popular Calculators

Discover our user-friendly calculators tailored to help you make informed university selection decisions. Our Diverse range of calculators & tools ensures you find the perfect fit for your needs. Explore the options below to get started.

ROI CalculatorCareer Finder (Career Suitability Test)

Explore and Find out your Most Suitable Career Path. Get Started with our Career Finder Tool Now!

Online & Distance MBA

Online & Distance UG Courses

- GenAI & Agentic AI Courses Online

- 1 Year MBA Online

- Leadership & Management

- IIM Online Courses

- IIIT Online Courses

- Data Science & Analytics

- Executive M.Tech for Working Professionals

- AI and Machine Learning

- Generative AI

- UI UX Certificate Program

- Online PG Diploma & Certificate

- Finance

- Marketing

- Human Resource (HR)

- Healthcare

- Operations

- Business Analytics

- Software & Technology

- PG Diploma Applied Statistics

- IIT Courses Online

- Blockchain

- Cloud Computing

- PG Program In Technology Management

- Big Data Engineering

- DevOps

- Quantum Computing

- Digital Transformation and Innovation

- Public Policy Management

- Cyber Security

- Executive Program in Retail Management

- Online Executive Program in Emerging Technologies

- Online Executive PG Diploma in Sports Management

- View All

Online & Distance PG Courses

- Online MBA

- 1 Year MBA Online

- Distance MBA

- Executive MBA for Working Professionals

- Online Global MBA

- Online MCA

- M.Tech

- Online M.Sc

- MS Degree Online

- Online MA

- Online M.Com

- Dual MBA Online

- Online MBA after Diploma

- Online Master of Education (M.Ed)

- Online Global MCA

- Online PGDM

- Distance MCA

- Distance M.Com

- Distance M.Sc

- Distance MA

- Online MBA Plus

- Online Master of Social Work

- Online MBA & Doctorate

- Online M.Ed & Ed.D

- Online Master of Management Studies

- Blended MBA

- View All

Online & Distance Best Colleges for

India has a net of 9.6 Million students that will enroll in online education by the end of 2024. Still, the online education sector in India is unorganized and students face a lot of difficulties in getting information on it. College Vidya aims to tackle the current difficulties of students. College Vidya is India's first online platform that brings you all the online universities at a single platform. College Vidya provides unbiased information about every online course and the university providing this course.

The online portal of College Vidya is aimed to complete information to the students about every aspect of online education without being biased.

College Vidya gives the power to the students to get the best universities in online education. College Vidya's compare feature gives the comparison of every online university on the various parameters such as E-learning system, EMI, Faculties, and fees.

Disclaimer / Terms & Conditions / Refund Policy / Our PolicyThe intend of College Vidya is to provide unbiased precise information & comparative guidance on Universities and its Programs of Study to the Admission Aspirants. The contents of the College vidya Site, such as Texts, Graphics, Images, Blogs, Videos, University Logos, and other materials contained on College vidya Site (collectively, “Content”) are for information purpose only. The content is not intended to be a substitute for in any form on offerings of its Academia Partner. Infringing on intellectual property or associated rights is not intended or deliberately acted upon. The information provided by College Vidya on www.collegevidya.com or any of its mobile or any other applications is for general information purposes only. All information on the site and our mobile application is provided in good faith with accuracy and to the best of our knowledge, however, we make nor representation or warranty of any kind, express or implied, regarding the accuracy, adequacy, validity, reliability, completeness of any information on the Site or our mobile application. College vidya & its fraternity will not be liable for any errors or omissions and damages or losses resultant if any from the usage of its information.More+

© 2026 College Vidya, Inc. All Rights Reserved.

Build with Made in India.